Conventional mortgages are a popular choice among homebuyers, particularly in the United States. Unlike government-backed loans, such as FHA or VA loans, conventional mortgages are offered by private lenders and are not insured or guaranteed by a government agency. This distinction gives conventional loans unique advantages and disadvantages that potential borrowers should carefully consider. Understanding these factors is crucial for making informed financial decisions, especially for those interested in finance, cryptocurrency, forex, and money markets.

In this article, we will explore the pros and cons of conventional mortgages in detail, providing a comprehensive overview of their strengths and weaknesses.

| Pros | Cons |

|---|---|

| Flexible loan terms and options | Stricter qualification requirements |

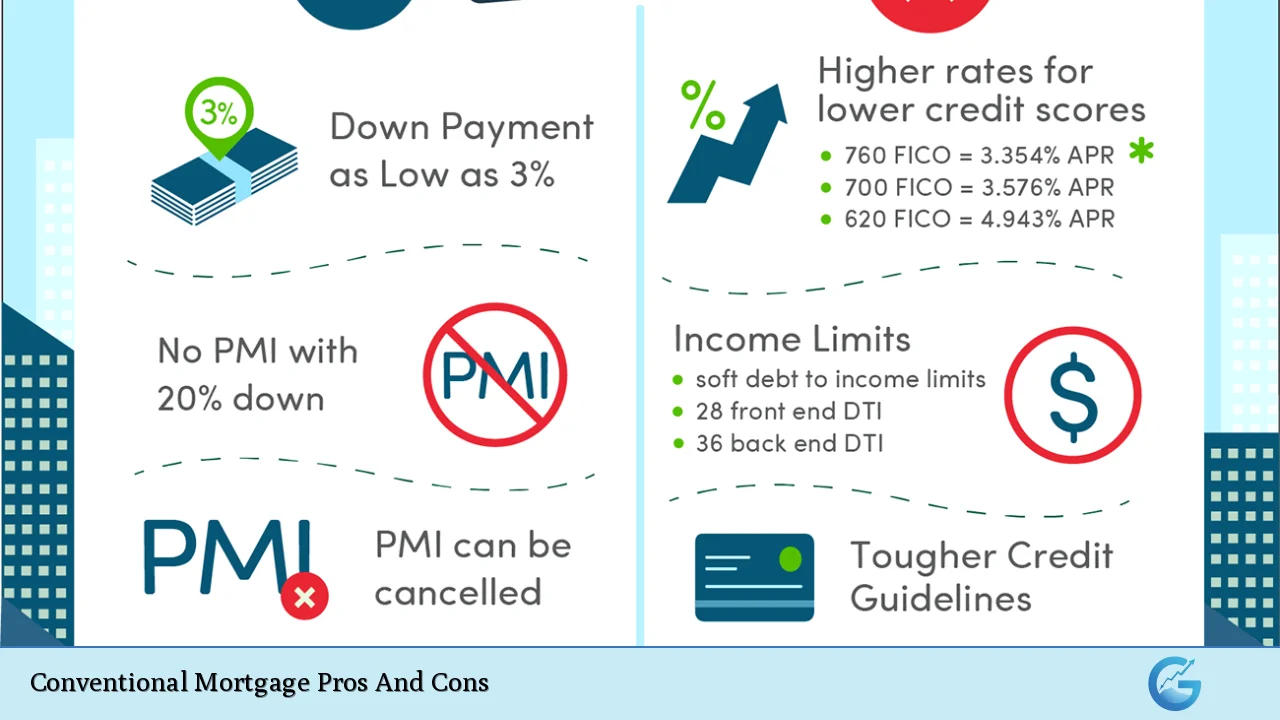

| No mortgage insurance with 20% down payment | Private mortgage insurance (PMI) required with less than 20% down |

| Potentially lower overall costs | Higher interest rates for lower credit scores |

| Faster closing process | Limited options for low-income borrowers |

| Access to various property types | Higher closing costs compared to some government loans |

Flexible Loan Terms and Options

One of the significant advantages of conventional mortgages is their flexibility in terms of loan options. Borrowers can choose from various loan types, including fixed-rate and adjustable-rate mortgages (ARMs), which cater to different financial situations and preferences.

- Fixed-Rate Mortgages: These loans have a consistent interest rate throughout the loan term, typically ranging from 15 to 30 years. This predictability in monthly payments can be beneficial for budgeting.

- Adjustable-Rate Mortgages (ARMs): ARMs offer lower initial interest rates that can adjust periodically based on market conditions. This option may be attractive to those who plan to sell or refinance before the rates increase.

Stricter Qualification Requirements

While conventional loans offer flexibility, they come with more stringent qualification criteria compared to government-backed loans.

- Credit Score: Most lenders require a minimum credit score of 620, though higher scores (740+) can secure better rates. Those with lower scores may find it challenging to qualify.

- Debt-to-Income Ratio: Conventional loans typically require a maximum debt-to-income (DTI) ratio of 43%. This means that your total monthly debt payments should not exceed 43% of your gross monthly income.

No Mortgage Insurance with 20% Down Payment

A significant advantage of conventional mortgages is the ability to avoid private mortgage insurance (PMI) if the borrower makes a down payment of at least 20%.

- Cost Savings: By putting down 20%, borrowers can save on the additional monthly cost associated with PMI, which is usually required for down payments less than this threshold.

- Equity Growth: With no PMI, homeowners can build equity faster, making it easier to refinance or sell the property later.

Private Mortgage Insurance (PMI) Required with Less Than 20% Down

On the flip side, if a borrower opts for a down payment less than 20%, they will be required to pay PMI.

- Increased Monthly Payments: PMI adds an extra expense to monthly mortgage payments, which can strain budgets—especially for first-time homebuyers who may already be managing tight finances.

- Duration of PMI: Although PMI can be canceled once the homeowner reaches 20% equity in their home, it still represents an added cost during the initial years of homeownership.

Potentially Lower Overall Costs

Conventional loans often have lower overall costs compared to government-backed options due to fewer fees and potentially better interest rates for qualified borrowers.

- Lower Fees: Many conventional loans do not come with upfront funding fees that are common in FHA loans. This can lead to significant savings over time.

- Competitive Interest Rates: Borrowers with strong credit profiles may qualify for lower interest rates than those available through government programs.

Higher Interest Rates for Lower Credit Scores

While conventional loans can offer competitive rates for those with good credit, borrowers with lower credit scores may face higher interest rates.

- Risk Premium: Lenders view lower credit scores as higher risk, leading them to charge more in interest to compensate for potential defaults. This can make homeownership more expensive over time.

- Comparison with Government Loans: In some cases, FHA loans might offer better rates for borrowers with lower credit scores due to their backing by the federal government.

Faster Closing Process

Another notable advantage of conventional mortgages is their typically faster closing process compared to government-backed loans.

- Less Red Tape: With fewer regulatory requirements and paperwork involved, borrowers often experience quicker approvals and closings. This speed can be particularly beneficial in competitive real estate markets where timing is crucial.

Limited Options for Low-Income Borrowers

Despite their advantages, conventional loans may not be suitable for all borrowers—particularly those with limited financial resources.

- Accessibility Issues: Low-income individuals or first-time homebuyers may find it challenging to meet the strict qualification criteria and down payment requirements associated with conventional mortgages.

- Alternative Options: Government-backed loans like FHA or VA loans provide more accessible options for those who may struggle with conventional lending standards.

Access to Various Property Types

Conventional mortgages offer flexibility regarding the types of properties that can be financed.

- Investment Properties: Unlike some government-backed loans that restrict purchases to primary residences only, conventional loans allow financing for second homes and investment properties as well.

- Diverse Property Types: Borrowers can use conventional loans for single-family homes, condos, townhouses, and even multi-unit properties (up to four units), providing greater investment opportunities.

Higher Closing Costs Compared to Some Government Loans

While closing costs on conventional mortgages are generally lower than on some other loan types, they can still be higher than those associated with government-backed options like FHA or VA loans.

- Upfront Costs: Borrowers must be prepared for various fees at closing—such as appraisal fees, origination fees, and title insurance—that can add up quickly.

- Limited Flexibility: Unlike some government programs that allow rolling closing costs into the loan amount or provide assistance options, conventional loans typically require these costs to be paid upfront.

In summary, while conventional mortgages present numerous advantages such as flexible terms and potentially lower overall costs without mandatory PMI at higher down payments, they also come with significant disadvantages including stricter qualification requirements and additional costs associated with low down payments.

Frequently Asked Questions About Conventional Mortgages

- What is a conventional mortgage?

A conventional mortgage is a home loan provided by private lenders that is not insured or guaranteed by a government agency. - What are the minimum credit score requirements?

The typical minimum credit score required for a conventional mortgage is 620; however, better rates are available for scores above 740. - Can I avoid PMI?

You can avoid private mortgage insurance if you make a down payment of at least 20% on your home purchase. - Are there any restrictions on property types?

No; conventional mortgages can be used for various property types including single-family homes, condos, townhouses, and investment properties. - How long does it take to close on a conventional mortgage?

The closing process is generally faster than government-backed loans due to less paperwork and regulatory red tape. - What happens if my credit score is low?

If your credit score is low (below 620), you may face higher interest rates or difficulty qualifying for a conventional mortgage. - Are there any benefits of choosing an ARM over a fixed-rate mortgage?

An adjustable-rate mortgage (ARM) typically offers lower initial interest rates which could result in lower monthly payments initially. - What are typical closing costs associated with a conventional mortgage?

Closing costs generally include appraisal fees, origination fees, title insurance, and other related expenses that vary by lender.

In conclusion, understanding the pros and cons of conventional mortgages is essential for anyone considering homeownership. While they offer flexibility and potentially lower costs compared to other loan types, they also require careful consideration of eligibility criteria and financial implications. As always, potential borrowers should assess their individual circumstances and consult financial professionals when navigating these important decisions.