When it comes to financing a home, choosing the right mortgage type is crucial. Two of the most popular options are Conventional loans and FHA (Federal Housing Administration) loans. Each has its own set of advantages and disadvantages, making them suitable for different financial situations and borrower profiles. Understanding these pros and cons can help potential homebuyers make informed decisions that align with their financial goals.

| Pros | Cons |

|---|---|

| Lower credit score requirements for FHA loans. | FHA loans require mortgage insurance premiums for the life of the loan. |

| Lower down payment options available for both loan types. | Conventional loans may require a higher down payment to avoid PMI. |

| FHA loans allow higher debt-to-income ratios. | Conventional loans typically have stricter credit score requirements. |

| Conventional loans can eliminate PMI once 20% equity is reached. | FHA loans have lower borrowing limits compared to conventional loans. |

| More flexible property standards for conventional loans. | FHA loans require an FHA-approved appraisal, which can delay the process. |

Lower Credit Score Requirements

One of the most significant advantages of FHA loans is their lower credit score requirements. Borrowers can qualify with a credit score as low as 580 with a 3.5% down payment, or even 500 with a 10% down payment. This flexibility makes FHA loans particularly appealing to first-time homebuyers or those with less-than-perfect credit histories.

In contrast, conventional loans generally require a minimum credit score of 620. This higher threshold can make it challenging for some borrowers to secure financing, especially if they have had previous financial difficulties.

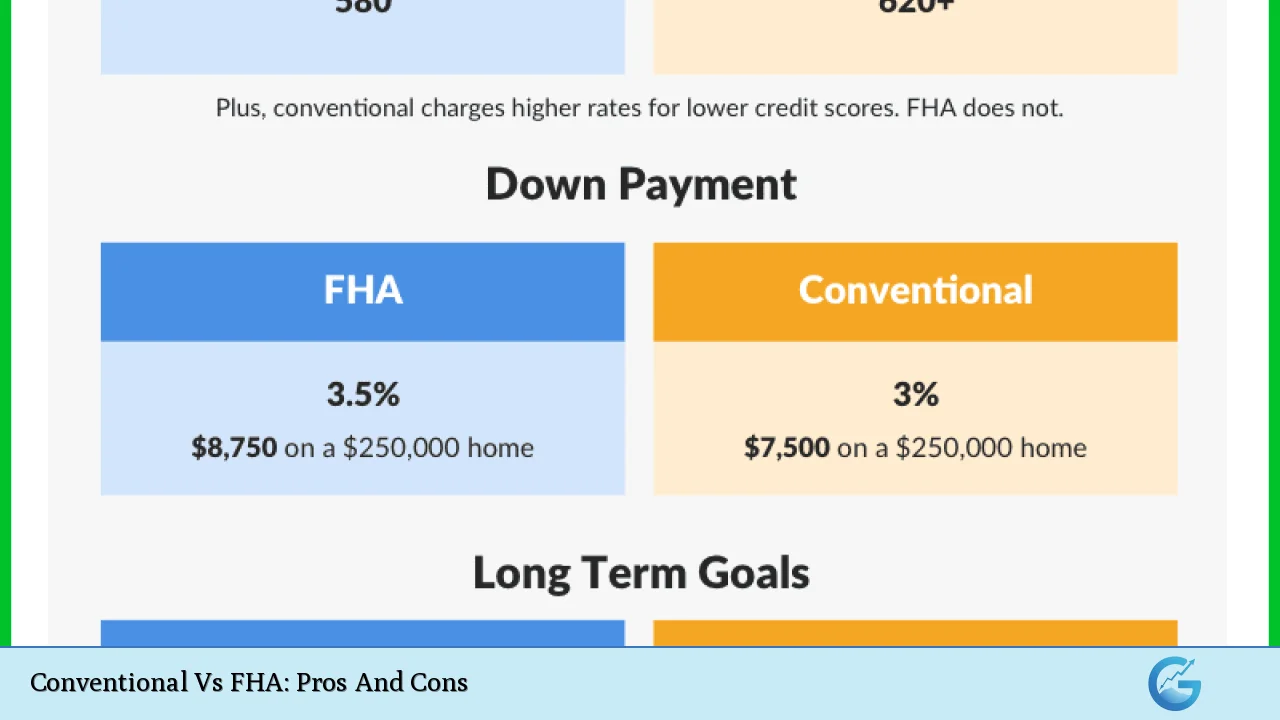

Down Payment Options

Both loan types provide low down payment options, making homeownership more accessible. FHA loans allow for down payments as low as 3.5%, while conventional loans can be obtained with as little as 3% down in some cases.

However, borrowers should be aware that conventional loans often require a larger down payment—typically around 20%—to avoid private mortgage insurance (PMI), which adds to monthly costs. This requirement can be a barrier for many potential homeowners.

Debt-to-Income Ratios

FHA loans also offer higher debt-to-income (DTI) ratios, allowing borrowers to have a DTI of up to 50% in some cases, which means they can allocate a larger portion of their income towards housing costs. This flexibility can be beneficial for those who may have other significant debts.

Conversely, conventional loans typically cap DTI ratios at 43%. This stricter limit may exclude some borrowers who have higher monthly obligations but still possess the means to manage their mortgage payments.

Mortgage Insurance

A critical distinction between these two loan types lies in how they handle mortgage insurance. With conventional loans, if you put down less than 20%, you will need to pay PMI; however, this insurance can be canceled once you reach 20% equity in your home. This feature allows homeowners to reduce their monthly payments over time.

On the other hand, FHA loans require mortgage insurance premiums (MIP) for the life of the loan, regardless of equity status. This ongoing cost can significantly affect total mortgage expenses over time, making FHA loans potentially more expensive in the long run.

Borrowing Limits

When it comes to borrowing limits, conventional loans generally allow for higher amounts compared to FHA loans. The maximum loan limit for FHA varies by location but is often lower than that of conventional mortgages. In high-cost areas, conventional loan limits can exceed $726,200, while FHA limits might max out at around $472,030 or slightly higher.

This difference means that buyers looking at more expensive properties may find conventional financing more suitable for their needs.

Property Standards and Appraisals

Another aspect to consider is property standards and appraisal processes. Conventional loans tend to have more flexible property standards, allowing borrowers to purchase various types of homes, including investment properties and vacation homes.

In contrast, FHA loans are restricted to primary residences only and require an FHA-approved appraisal that may uncover issues needing resolution before approval. This requirement can lead to delays in closing and additional costs if repairs are necessary.

Closing Thoughts

Choosing between an FHA loan and a conventional loan ultimately depends on individual financial circumstances and goals. While FHA loans offer lower barriers to entry with flexible credit requirements and down payments, they come with lifelong mortgage insurance costs that can add up over time. Conversely, conventional loans may provide long-term savings through cancellable PMI and higher borrowing limits but require stronger financial profiles upfront.

Potential homebuyers should carefully evaluate their financial situations, consider future plans regarding home equity and resale value, and consult with mortgage professionals to determine which option aligns best with their needs.

Frequently Asked Questions About Conventional Vs FHA Loans

- What is the main difference between FHA and conventional loans?

The primary difference lies in credit score requirements and mortgage insurance terms; FHA allows lower scores but requires MIP for the life of the loan. - Are there any income limits on FHA loans?

No, there are no maximum income limits on FHA loans; however, lenders may impose their own restrictions based on risk assessment. - Can I refinance from an FHA loan to a conventional loan?

Yes, many homeowners choose to refinance from an FHA loan to a conventional loan once they build enough equity or improve their credit scores. - Which type of loan is better for first-time homebuyers?

FHA loans are often better suited for first-time buyers due to their lower credit requirements and down payment options. - How does PMI work with conventional loans?

Pmi is required if your down payment is less than 20%, but it can be canceled once you reach 20% equity in your home. - Are there any restrictions on property types with these loans?

Yes, FHA loans only apply to primary residences while conventional loans can be used for various property types including investment properties. - What are typical interest rates for each loan type?

Interest rates vary based on market conditions but generally tend to be lower for FHA loans due to government backing. - If I have bad credit, should I go for an FHA loan?

If your credit score is below 620, an FHA loan may be your best option due to its more lenient requirements.

In conclusion, understanding the pros and cons of both Conventional and FHA loan options is essential for making informed financial decisions when purchasing a home. Each type offers unique benefits tailored to different borrower needs and situations.