Convertible term life insurance is a unique financial product that combines the benefits of term life insurance with the flexibility of converting to a permanent policy. This type of insurance offers individuals a way to secure coverage for a specific period while providing the option to transition to a more permanent solution without undergoing additional medical underwriting. As with any financial product, it is essential to understand both the advantages and disadvantages before making a decision.

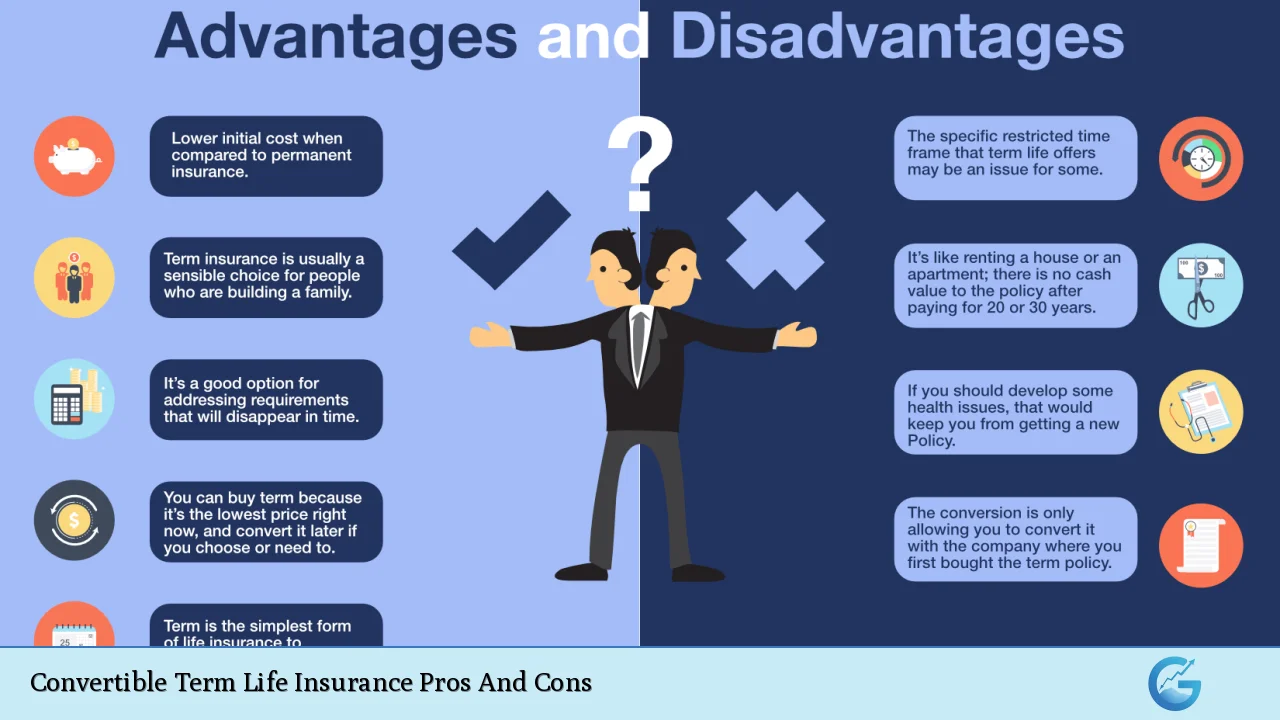

Pros and Cons Overview

| Pros | Cons |

|---|---|

| Flexibility to convert to permanent insurance without a medical exam. | Higher premiums compared to standard term policies. |

| No need for new medical underwriting at conversion. | Limited conversion period may apply. |

| Provides lifelong coverage once converted. | Complexity in understanding terms and conditions. |

| Potential for cash value accumulation in permanent policies. | May not be necessary for those needing short-term coverage. |

| Peace of mind knowing you can secure coverage despite health changes. | Conversion options may be limited to specific types of permanent policies. |

Flexibility to Convert

One of the most significant advantages of convertible term life insurance is its flexibility. Policyholders have the option to convert their term policy into a permanent policy, such as whole or universal life insurance, without needing a new medical exam. This feature is particularly beneficial for individuals whose health may have declined since they first purchased their term policy.

- No Medical Underwriting: The ability to convert without undergoing medical underwriting means that even if your health deteriorates, you can still maintain life insurance coverage.

- Adaptability: This flexibility allows policyholders to adjust their insurance needs as their financial situation changes over time.

No Need for New Medical Underwriting

Convertible term policies eliminate the need for new medical evaluations when converting to a permanent policy. This aspect is crucial for individuals who may develop health issues that could otherwise disqualify them from obtaining life insurance.

- Security Against Health Changes: If you are diagnosed with a chronic condition or experience other health changes, you can still convert your policy without worrying about increased premiums or denial of coverage.

- Peace of Mind: Knowing that you have the option to secure lifelong coverage regardless of your health status provides significant peace of mind.

Lifelong Coverage Once Converted

When you convert your term policy into a permanent one, you gain lifelong coverage. This transition is vital for individuals who want assurance that their beneficiaries will receive financial support regardless of when they pass away.

- Enduring Protection: Permanent policies provide lifelong protection, which is especially important for those with dependents who rely on their income.

- Financial Security: The assurance that your loved ones will be financially protected can alleviate stress and provide confidence in your long-term planning.

Potential for Cash Value Accumulation

Permanent life insurance policies often include a cash value component that accumulates over time. This feature can serve as an additional financial resource.

- Tax-Deferred Growth: The cash value grows tax-deferred, which can be beneficial for long-term financial planning.

- Access to Funds: Policyholders can borrow against the cash value or withdraw funds if needed, providing financial flexibility in times of need.

Peace of Mind with Coverage Security

The combination of flexibility and lifelong coverage offers significant peace of mind. Knowing that you can adapt your insurance as your needs change allows you to focus on other aspects of your financial planning.

- Long-Term Financial Planning: Convertible term life insurance aligns well with long-term financial goals, ensuring that you are covered even as circumstances evolve.

- Protection for Loved Ones: Ultimately, this type of insurance provides security not just for the policyholder but also for their beneficiaries, ensuring they are cared for financially after the policyholder’s death.

Higher Premiums Compared to Standard Term Policies

One notable disadvantage of convertible term life insurance is that it typically comes with higher premiums than standard term policies. This increase reflects the added benefits and flexibility provided by the convertibility feature.

- Cost Considerations: While the initial cost may be manageable, it’s essential to consider how these higher premiums fit into your overall budget and financial plan.

- Value Assessment: Individuals must weigh whether the benefits of having convertible options justify the additional cost compared to traditional term life policies.

Limited Conversion Period

Convertible term policies often have specific limitations on when conversion can occur. These restrictions can vary by insurer and policy type.

- Time Constraints: Many policies require conversion within a certain timeframe or before reaching a specific age, which may not align with every individual’s needs.

- Planning Ahead: It’s crucial to understand these limitations when purchasing a convertible term policy so that you can plan accordingly and avoid missing out on this valuable option.

Complexity in Understanding Terms and Conditions

The terms and conditions associated with convertible term life insurance can sometimes be complex. Understanding these details is essential for making informed decisions about your coverage options.

- Navigating Policy Details: Policyholders must carefully review their contracts to understand conversion rights, premiums, and any limitations associated with their policies.

- Potential Confusion: The complexity may lead some individuals to overlook critical details that could affect their coverage later on.

May Not Be Necessary for Short-Term Coverage Needs

For individuals who only require life insurance coverage for a specific period—such as covering a mortgage or raising children—a standard term policy might suffice without the added costs associated with convertibility.

- Cost-Efficiency: If there’s no intention or need to convert to permanent coverage, opting for a standard term policy could be more cost-effective in the long run.

- Assessing Needs: It’s essential to evaluate whether convertible options are genuinely necessary based on individual circumstances and future plans.

Limited Conversion Options

While convertible term life insurance provides flexibility in converting policies, there may be limitations regarding what types of permanent policies you can convert into.

- Specific Policy Types: Some insurers may restrict conversions only to certain types of permanent policies, limiting choices for policyholders seeking different forms of coverage.

- Rider Limitations: Additionally, there may be restrictions on adding riders or features when converting, which could impact overall protection and benefits received from the new policy.

In conclusion, convertible term life insurance offers a blend of short-term affordability and long-term security. It provides valuable options for those who anticipate changes in their health or financial situation over time. However, potential buyers should carefully weigh the pros and cons—particularly regarding costs and conversion limitations—against their individual needs and goals.

Frequently Asked Questions About Convertible Term Life Insurance

- What is convertible term life insurance?

Convertible term life insurance allows policyholders to convert their term policy into a permanent one without needing new medical underwriting. - What are the main advantages?

The primary advantages include flexibility in converting policies, no need for new medical exams, lifelong coverage once converted, potential cash value accumulation, and peace of mind regarding health changes. - What are the disadvantages?

The main disadvantages include higher premiums compared to standard term policies, limited conversion periods, complexity in understanding terms, potential unnecessary costs for short-term needs, and limited options during conversion. - How does conversion affect premiums?

Upon conversion, premiums typically increase because permanent policies are generally more expensive than term policies due to lifetime coverage and cash value components. - Can I convert my policy at any time?

No, most convertible term policies have specific timeframes during which conversion must occur; it’s essential to check your policy’s terms. - Is there an age limit for conversion?

Yes, many policies impose age limits on when conversions can happen; understanding these limits is crucial when purchasing a convertible term policy. - What happens if I don’t convert my policy?

If you do not convert your policy before it expires or reaches its limit, you will lose coverage unless you purchase another form of insurance. - Is convertible term life insurance suitable for everyone?

No, it’s best suited for individuals who anticipate needing long-term coverage but want affordable initial premiums; those needing only short-term protection may prefer standard term policies.

This comprehensive overview provides insights into convertible term life insurance’s advantages and disadvantages while addressing common questions potential buyers might have.