Cooperative businesses, commonly referred to as co-ops, are unique organizational structures that emphasize collective ownership and democratic governance. They are established to serve the mutual interests of their members, who are also the users of the cooperative’s services. This model is prevalent across various sectors, including agriculture, retail, and housing, and it offers a distinct alternative to traditional business structures. Understanding the advantages and disadvantages of cooperatives is essential for investors and individuals interested in finance, crypto, forex, and money markets, as these factors can significantly influence investment decisions and business strategies.

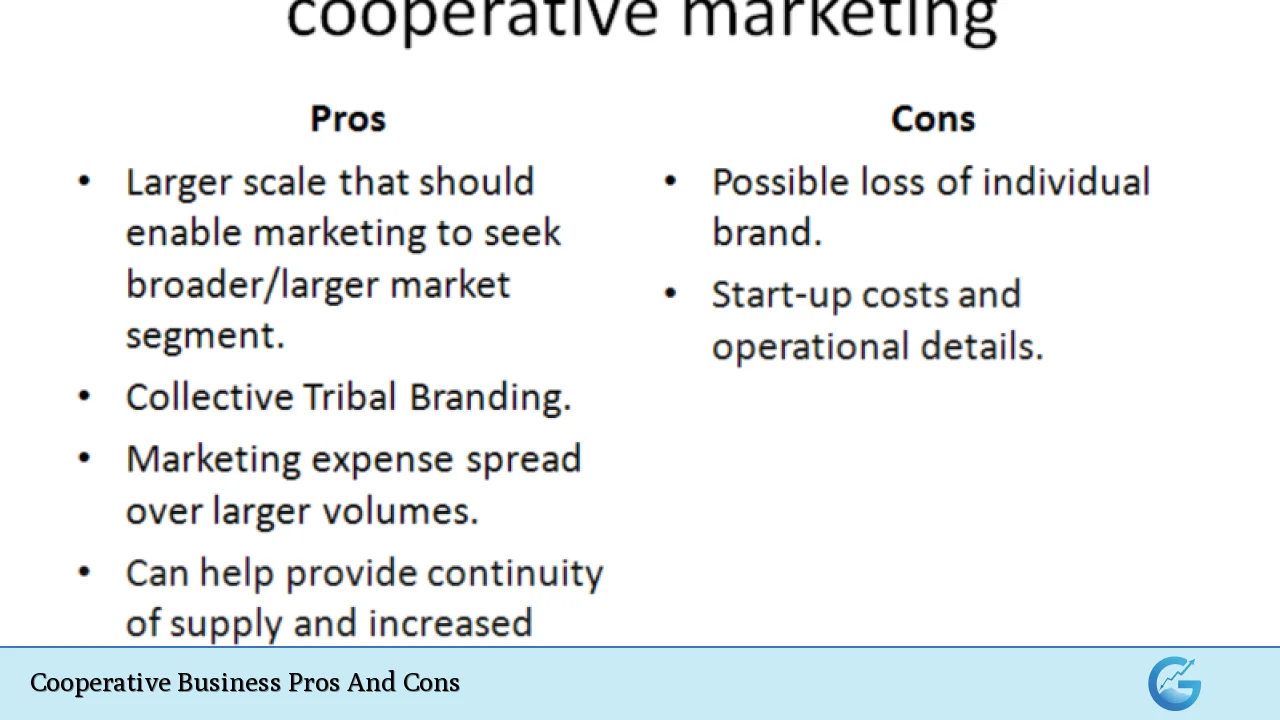

| Pros | Cons |

|---|---|

| Democratic control by members | Slower decision-making processes |

| Shared profits among members | Limited access to capital |

| Strong community focus and loyalty | Potential for internal conflicts among members |

| Lower operational costs through resource sharing | Less operational control for individual members |

| Limited liability for members | Inefficient management due to lack of professional expertise |

| Tax advantages in some regions | Regulatory challenges and excessive state oversight |

| Flexibility in profit distribution options | Lack of secrecy in business operations |

| Encourages local economic development | Higher member turnover can affect stability |

Democratic Control by Members

One of the most significant advantages of cooperative businesses is their democratic governance structure. Each member typically has one vote regardless of their financial contribution, ensuring that all voices are heard in decision-making processes. This democratic control fosters a sense of ownership and accountability among members.

- Equal participation: Every member has an equal say in the cooperative’s operations.

- Transparency: Decisions are made openly, promoting trust among members.

- Empowerment: Members feel empowered to influence the direction of the business.

Slower Decision-Making Processes

While democratic control is beneficial, it can also lead to slower decision-making. Reaching a consensus among many members can be time-consuming, particularly in larger cooperatives.

- Time-consuming discussions: Achieving agreement may require extensive meetings.

- Delayed responses: The cooperative may struggle to respond quickly to market changes.

- Potential for indecision: Conflicts among members can lead to paralysis in decision-making.

Shared Profits Among Members

Cooperatives operate on the principle of profit-sharing. Any surplus generated by the cooperative is distributed back to the members based on their usage or participation.

- Equitable distribution: Profits are shared fairly among all members.

- Incentivizes participation: Members are motivated to engage actively with the cooperative.

- Fosters loyalty: Sharing profits helps build a strong community bond among members.

Limited Access to Capital

A notable disadvantage of cooperatives is their limited access to capital compared to traditional businesses. Cooperatives cannot issue shares on public markets or attract large investors easily.

- Funding challenges: Reliance on member contributions can restrict growth opportunities.

- Difficulty securing loans: Financial institutions may view cooperatives as higher-risk borrowers.

- Limited investment potential: The inability to attract significant outside investment can hinder expansion efforts.

Strong Community Focus and Loyalty

Cooperatives often have a strong emphasis on serving their local communities. This focus not only enhances member loyalty but also contributes positively to local economic development.

- Community engagement: Co-ops often address specific community needs or issues.

- Support for local economies: By prioritizing local sourcing and employment, co-ops stimulate regional growth.

- Building trust: A strong community focus fosters trust between the cooperative and its members.

Potential for Internal Conflicts Among Members

Despite their collaborative nature, cooperatives can experience internal conflicts. Disagreements over management decisions or profit distribution can arise among members.

- Diverse opinions: Varied interests among members can lead to disputes.

- Management challenges: Conflicts may distract from effective management and operational efficiency.

- Risk of factionalism: Over time, factions may form within the cooperative, undermining its unity.

Lower Operational Costs Through Resource Sharing

Cooperatives benefit from shared resources, which can lead to lower operational costs. By pooling resources such as purchasing power or marketing efforts, co-op members can achieve economies of scale.

- Cost savings: Members can access goods and services at lower prices.

- Shared services: Co-ops often provide essential services collectively rather than individually.

- Increased competitiveness: Smaller businesses within a cooperative can compete more effectively against larger firms.

Less Operational Control for Individual Members

While cooperatives promote collective decision-making, this structure can limit individual members’ control over specific operational aspects of the business.

- Shared marketing strategies: Individual branding efforts may be diluted within a cooperative framework.

- Fixed pricing structures: Pricing decisions made collectively may not align with individual business goals.

- Reduced autonomy: Members may feel constrained by group decisions that do not reflect their preferences.

Limited Liability for Members

Cooperatives generally offer limited liability protection to their members. This means that individuals are not personally responsible for the cooperative’s debts beyond their investment in it.

- Financial security: Members’ personal assets are protected from business liabilities.

- Encourages participation: The limited risk associated with membership can attract more participants.

- Stability during downturns: Limited liability helps maintain member confidence during financial challenges.

Inefficient Management Due to Lack of Professional Expertise

Cooperatives often struggle with management efficiency due to a lack of specialized skills among member-managers. This challenge can hinder effective operation and growth.

- Limited managerial expertise: Many co-op leaders may lack formal training in business management.

- Difficulty attracting talent: The inability to offer competitive salaries makes it hard to hire skilled professionals.

- Potential for mismanagement: Ineffective management practices can lead to operational inefficiencies.

Tax Advantages in Some Regions

In certain jurisdictions, cooperatives enjoy tax benefits that traditional businesses do not receive. These advantages can enhance profitability and sustainability.

- Tax exemptions or reductions: Some regions provide favorable tax treatment for cooperatives.

- Government support programs: Co-operatives might qualify for grants or subsidies aimed at promoting community-based businesses.

- Reinvestment opportunities: Tax savings can be reinvested into the cooperative for growth initiatives.

Regulatory Challenges and Excessive State Oversight

Cooperatives often face stringent regulations that govern their formation and operation. While these regulations aim to protect member interests, they can also impose burdensome requirements.

- Complex compliance requirements: Navigating regulatory frameworks can be time-consuming and costly.

- State intervention risks autonomy: Excessive oversight may undermine the cooperative’s self-governance principles.

- Potential legal challenges: Non-compliance with regulations could lead to legal repercussions or fines.

Flexibility in Profit Distribution Options

Cooperatives have unique flexibility regarding how they distribute profits among members. This adaptability allows them to align profit-sharing with member needs effectively.

- Diverse profit-sharing models: Co-operatives can tailor profit distribution based on usage or other criteria.

- Community reinvestment options: Surplus funds can be used for community projects rather than solely distributed as profits.

- Encourages long-term investment in co-op goals: Flexible distribution models promote sustained commitment from members.

Lack of Secrecy in Business Operations

The open nature of cooperatives often leads to a lack of confidentiality regarding business operations. This transparency can be both an advantage and a disadvantage.

- Transparency fosters trust: Open operations build confidence among members regarding management practices.

- Risk of sensitive information exposure: Business strategies may become public knowledge, potentially harming competitive advantage.

- Challenges in maintaining competitive edge: Lack of secrecy may hinder innovation efforts due to fear of idea theft by competitors.

Higher Member Turnover Can Affect Stability

Cooperatives may experience higher turnover rates compared to traditional businesses due to various factors such as dissatisfaction or lack of engagement among members.

- Instability in leadership roles: Frequent changes in membership can disrupt continuity in management and operations.

- Loss of institutional knowledge: High turnover may result in valuable insights being lost when experienced members leave.

- Challenges in maintaining culture and values: A shifting membership base can dilute the cooperative’s foundational principles over time.

In conclusion, while cooperative businesses offer numerous advantages such as democratic governance, shared profits, and lower operational costs through resource sharing, they also face significant challenges including slower decision-making processes, limited access to capital, and potential internal conflicts. Understanding these pros and cons is crucial for anyone considering investing in or establishing a cooperative business model. By weighing these factors carefully, potential investors and entrepreneurs can make informed decisions that align with their financial goals and community values.

Frequently Asked Questions About Cooperative Business Pros And Cons

- What is a cooperative business?

A cooperative business is an organization owned and operated by its members who share profits and decision-making responsibilities. - What are some key advantages of cooperatives?

Key advantages include democratic control by members, shared profits based on usage, lower operational costs through resource sharing, and limited liability. - What are common disadvantages associated with cooperatives?

Common disadvantages include slower decision-making processes, limited access to capital for growth, potential internal conflicts among members, and inefficient management due to lack of expertise. - How do cooperatives support local communities?

Cooperatives often prioritize local sourcing and employment opportunities which contribute positively to regional economic development. - Can anyone join a cooperative?

Yes, most cooperatives have open membership policies that do not discriminate based on gender, race, or social status. - What types of businesses commonly use the cooperative model?

The cooperative model is commonly used in sectors such as agriculture (e.g., farmer co-operatives), retail (e.g., food co-operatives), housing (e.g., housing co-operatives), and services (e.g., credit unions). - Are there tax benefits associated with forming a cooperative?

In some regions, cooperatives enjoy tax exemptions or reductions that traditional businesses do not receive. - How does profit distribution work in cooperatives?

Profits generated by cooperatives are typically distributed back to members based on their level of participation or usage rather than investment size.