Cooperatives are unique business structures that prioritize member ownership and democratic governance. They operate on the principle of mutual benefit, providing services and products to their members while promoting a sense of community and shared responsibility. In recent years, cooperatives have gained traction in various sectors, including finance, agriculture, and technology, particularly with the rise of digital cooperatives and decentralized autonomous organizations (DAOs). This article explores the advantages and disadvantages of cooperatives, offering insights for individuals interested in finance, cryptocurrency, forex, and money markets.

| Pros | Cons |

|---|---|

| Democratic Control | Complex Decision-Making |

| Shared Resources and Costs | Limited Profit Distribution |

| Community Focus | Potential for Inefficiency |

| Access to Capital | Regulatory Challenges |

| Stability and Resilience | Member Apathy |

| Financial Benefits for Members | Difficulty in Attracting Talent |

| Flexibility in Operations | Market Competition Disadvantages |

| Innovation through Collaboration | Vulnerability to Mismanagement |

Democratic Control

One of the most significant advantages of cooperatives is their democratic governance structure. Each member typically has one vote, regardless of their investment size. This ensures that all members have an equal say in decision-making processes.

- Empowerment: Members feel valued and empowered as they can influence the direction of the cooperative.

- Transparency: Democratic control fosters transparency in operations and financial management.

- Accountability: Leaders are accountable to the members, which can lead to more responsible governance.

However, this democratic structure can also lead to complexities:

- Complex Decision-Making: The need for consensus can slow down decision-making processes.

- Potential Conflicts: Differing opinions among members can lead to conflicts that hinder progress.

- Inefficiencies: Lengthy discussions may result in delays in implementing necessary changes.

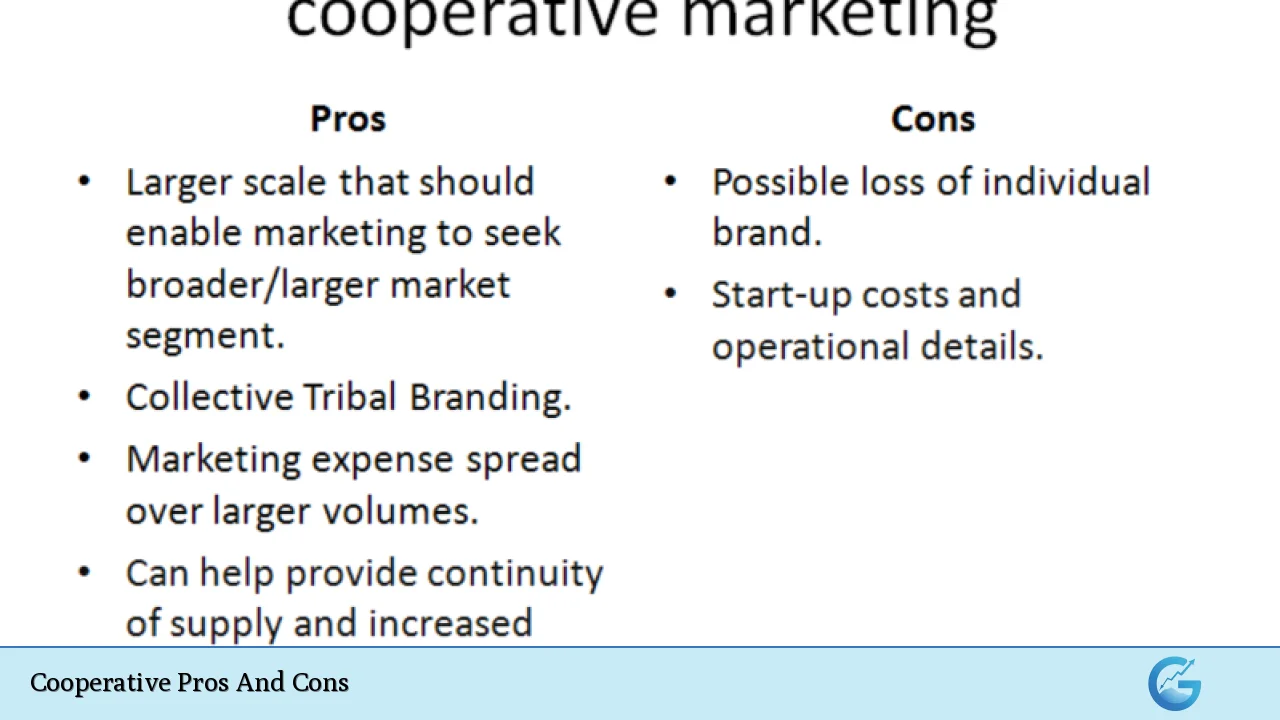

Shared Resources and Costs

Cooperatives allow members to pool resources, leading to significant cost savings.

- Lower Costs: Members can share expenses related to marketing, supplies, and services.

- Economies of Scale: Larger cooperatives can negotiate better deals with suppliers due to increased buying power.

- Access to Services: Smaller businesses benefit from services they might not afford individually.

On the downside:

- Limited Profit Distribution: Profits are often reinvested into the cooperative rather than distributed among members.

- Shared Risks: Members share both profits and losses, which can lead to financial strain during downturns.

- Dependency on Member Participation: The cooperative’s success hinges on active member involvement.

Community Focus

Cooperatives often prioritize community welfare over profit maximization.

- Local Development: They contribute to local economies by supporting local suppliers and creating jobs.

- Social Responsibility: Many cooperatives engage in community service initiatives that enhance their social impact.

- Sustainable Practices: Cooperatives tend to adopt environmentally friendly practices due to their community-oriented nature.

However, this community focus can create challenges:

- Potential for Inefficiency: Prioritizing community goals over profits may lead to inefficiencies in operations.

- Market Limitations: Cooperatives may struggle to compete with larger corporations focused solely on profit.

- Resistance to Change: A strong community focus may hinder innovation or adaptation to market demands.

Access to Capital

Cooperatives can access capital through member contributions and loans.

- Member Investments: Members contribute capital based on their needs, which can be a stable funding source.

- Borrowing Power: Cooperatives often have better borrowing capabilities than individual members due to collective assets.

- Grants and Subsidies: Many cooperatives qualify for government grants aimed at supporting local businesses.

Despite these advantages:

- Regulatory Challenges: Cooperatives may face stringent regulations that complicate capital acquisition.

- Limited Investment Opportunities: Investors may be hesitant due to the cooperative model’s inherent limitations on profit distribution.

- Dependence on Member Contributions: The cooperative’s financial health relies heavily on continuous member participation.

Stability and Resilience

Cooperatives often exhibit stability due to their member-driven nature.

- Long-Term Focus: Cooperatives prioritize long-term sustainability over short-term profits, leading to more stable operations.

- Community Support: Strong ties within the community foster loyalty among members, ensuring consistent support during tough times.

- Crisis Resilience: Cooperatives tend to weather economic downturns better than traditional businesses due to their collective approach.

However:

- Member Apathy: Over time, some members may become disengaged from cooperative activities, weakening its stability.

- Vulnerability to External Shocks: Economic crises affecting the broader market can still impact cooperatives significantly.

- Resistance to Change: A focus on stability may lead some cooperatives to resist necessary changes or innovations.

Financial Benefits for Members

Members of cooperatives often enjoy various financial benefits.

- Lower Fees and Rates: Financial cooperatives like credit unions typically offer lower fees and better interest rates than traditional banks.

- Profit Sharing: Some cooperatives distribute profits back to members based on their usage or investment levels.

- Access to Unique Products: Members may have access to specialized products tailored to their needs.

Nevertheless:

- Difficulty in Attracting Talent: Cooperatives may struggle to offer competitive salaries compared to traditional businesses, making it hard to attract skilled professionals.

- Equity Issues: Not all members may benefit equally from financial products or services offered by the cooperative.

- Limited Growth Potential: Financial benefits might be constrained by the cooperative’s growth limits compared to traditional firms.

Flexibility in Operations

Cooperatives often exhibit flexibility that allows them to adapt quickly.

- Responsive Management: Cooperative management tends to be more responsive due to closer ties with members’ needs.

- Tailored Services: Cooperatives can develop products or services specifically designed for their member base.

However:

- Market Competition Disadvantages: The flexibility of cooperatives may be offset by a lack of resources compared to larger competitors who can invest heavily in innovation.

Innovation through Collaboration

The collaborative nature of cooperatives fosters innovation.

- Shared Knowledge: Members bring diverse skills and knowledge that can lead to innovative solutions.

Yet:

- Vulnerability to Mismanagement: If not properly managed, collaborative efforts can lead to wasted resources or failed projects due to lack of direction or leadership.

In conclusion, while cooperatives offer numerous advantages such as democratic control, shared resources, community focus, access to capital, stability, financial benefits for members, operational flexibility, and innovation through collaboration, they also face significant challenges. These include complex decision-making processes, limited profit distribution, potential inefficiencies, regulatory hurdles, member apathy, difficulties attracting talent, competition disadvantages, and vulnerability to mismanagement.

Understanding these pros and cons is crucial for individuals considering involvement in cooperatives within finance, cryptocurrency, forex markets, or other sectors. As with any business model, careful consideration of both strengths and weaknesses will inform better decision-making for potential investors or participants in cooperative ventures.

Frequently Asked Questions About Cooperative Pros And Cons

- What are the main advantages of cooperatives?

The main advantages include democratic control by members, shared resources leading to cost savings, a strong community focus that supports local development, access to capital through member contributions, stability during economic downturns, financial benefits such as lower fees for members, operational flexibility tailored towards member needs, and fostering innovation through collaboration. - What are some disadvantages associated with cooperatives?

Disadvantages include complex decision-making processes that may slow progress; limited profit distribution which might discourage investment; potential inefficiencies due to a strong community focus; regulatory challenges affecting capital access; vulnerability from member apathy; difficulties attracting skilled talent; competition disadvantages against larger firms; and risks associated with mismanagement. - How do cooperatives differ from traditional businesses?

Cooperatives are owned and controlled by their members who have equal voting rights regardless of investment size. In contrast, traditional businesses are typically owned by shareholders who influence decisions based on their shareholding size. - Can anyone join a cooperative?

No. Membership eligibility varies depending on the type of cooperative. Some may require specific qualifications or affiliations. - How do financial cooperatives benefit their members?

Financial cooperatives provide lower fees and interest rates compared to banks while also offering profit-sharing opportunities based on usage. - Are there specific regulations governing cooperatives?

Yes. Cooperatives must adhere to specific regulations that vary by region but generally include guidelines around governance structures and financial practices. - What role does technology play in modern cooperatives?

Technology enhances collaboration among members through digital platforms. It also facilitates innovations like blockchain applications in digital cooperatives. - How do cooperatives promote sustainability?

Their focus on community welfare often leads them towards sustainable practices that benefit both local economies and the environment.