Credit card modification refers to the process of changing the terms of a credit card account, which can include adjustments to interest rates, fees, payment due dates, and credit limits. This practice can be beneficial for consumers facing financial difficulties or those looking to optimize their credit management strategies. However, it also carries potential drawbacks that can affect a cardholder’s financial health and credit score. Understanding the pros and cons of credit card modification is essential for individuals interested in finance, as it can significantly influence their financial decisions.

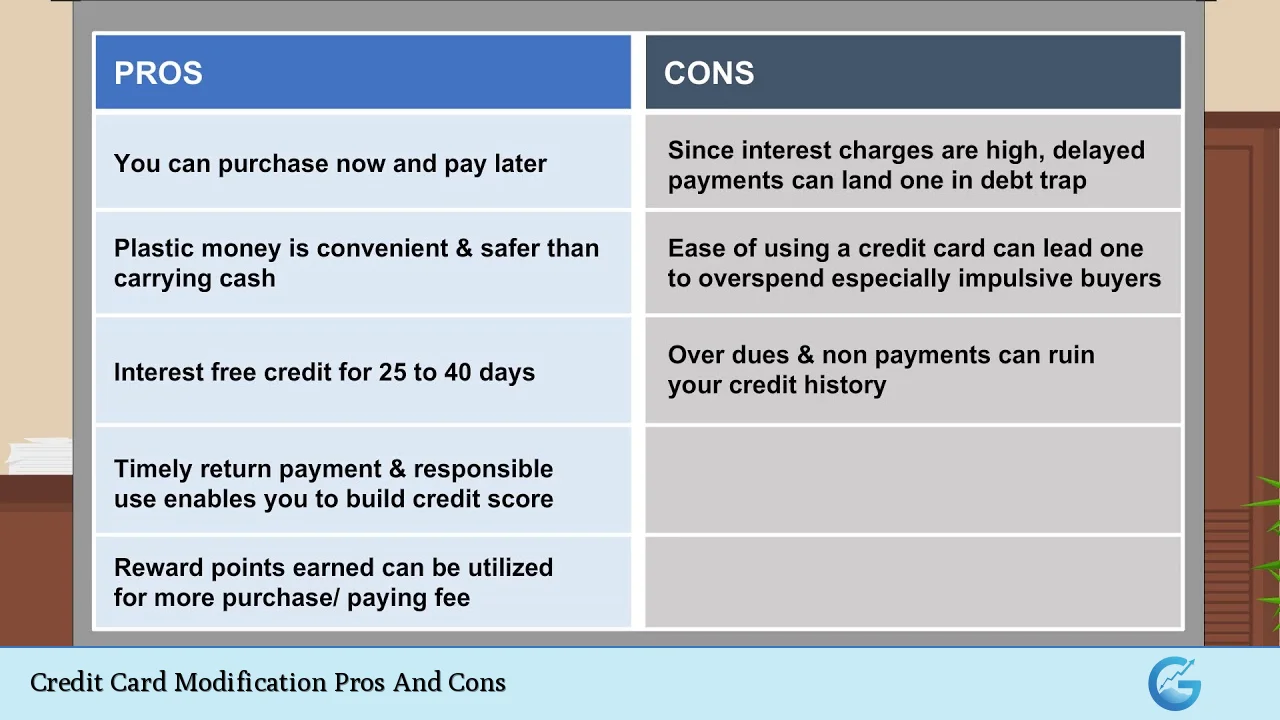

| Pros | Cons |

|---|---|

| Improved cash flow management | Potential negative impact on credit score |

| Access to lower interest rates | Limited options for modification |

| Increased payment flexibility | Risk of increased overall debt |

| Opportunity to avoid default | Complexity in the modification process |

| Enhanced rewards and benefits | Possible fees associated with modifications |

| Better alignment with financial goals | Long-term commitment may be required |

Improved Cash Flow Management

One of the primary advantages of modifying a credit card is the potential for improved cash flow management. By altering payment terms or reducing interest rates, cardholders can ease their monthly financial burdens.

- Lower monthly payments: A modification can lead to reduced monthly payments, making it easier for consumers to manage their budgets.

- Increased spending power: With lower payments, individuals may find they have more disposable income for other expenses.

- Better budgeting: Predictable payments help in planning and managing finances effectively.

Potential Negative Impact on Credit Score

While modifications can provide immediate relief, they may also have adverse effects on a consumer’s credit score.

- Credit inquiries: Applying for modifications often involves hard inquiries on credit reports, which can temporarily lower scores.

- Modification notation: Some lenders report modifications as a form of debt settlement, which can negatively affect credit ratings.

- Long-term implications: A lower credit score can hinder future borrowing opportunities or result in higher interest rates on new loans.

Access to Lower Interest Rates

Another significant advantage is the possibility of securing lower interest rates through modification.

- Reduced interest costs: Lower rates mean less money spent on interest over time, allowing more funds to go toward principal repayment.

- Competitive offers: Consumers may negotiate better terms based on market conditions or competitive offers from other lenders.

- Increased savings: Over time, reduced interest payments can lead to substantial savings that can be redirected toward other financial goals.

Limited Options for Modification

Despite the benefits, there are limitations regarding how much and how often one can modify their credit card terms.

- Lender policies: Not all lenders offer modifications, and those that do may have strict eligibility criteria.

- Frequency restrictions: Some lenders limit how often modifications can occur, making it difficult for consumers needing frequent adjustments.

- Potential denial: Even if a consumer qualifies, lenders may still deny modification requests based on their internal policies or risk assessments.

Increased Payment Flexibility

Modification can lead to increased payment flexibility, allowing consumers to tailor their repayment plans according to their financial situations.

- Customized payment schedules: Cardholders might negotiate due dates that align better with their pay periods.

- Flexible repayment options: Modifications may allow for partial payments or deferred payments during financial hardship periods.

- Ability to manage unexpected expenses: Flexible terms can help consumers navigate unforeseen financial challenges without falling behind.

Risk of Increased Overall Debt

While modifications can provide immediate relief, they might also lead to increased overall debt in the long run.

- Extended repayment periods: Lengthening the term of repayment could result in paying more interest over time.

- Accumulation of fees: Modifications may involve fees that add to the total debt burden if not carefully managed.

- Potential for overspending: Easier access to credit might tempt consumers to spend beyond their means, exacerbating debt issues.

Opportunity to Avoid Default

One of the most compelling reasons for seeking a credit card modification is the opportunity it provides to avoid defaulting on payments.

- Maintaining account status: Modifications help keep accounts in good standing and prevent delinquencies.

- Preventing collections actions: By modifying terms, consumers may avoid aggressive collection efforts from creditors.

- Long-term financial health: Avoiding default helps preserve consumer credit ratings and maintains access to future borrowing opportunities.

Complexity in the Modification Process

The process of modifying a credit card account can be complex and time-consuming.

- Documentation requirements: Lenders often require extensive documentation proving financial hardship or justification for modification requests.

- Lengthy approval processes: The time taken for lenders to review and approve modifications can be frustrating for consumers needing immediate assistance.

- Uncertainty in outcomes: There is no guarantee that a modification request will be approved, leading to potential anxiety for applicants.

Enhanced Rewards and Benefits

Credit card modifications may also enhance rewards programs associated with accounts, providing additional value to consumers.

- Improved rewards structures: Modifications might include better cashback rates or bonus points on specific categories like travel or dining.

- Lower thresholds for rewards redemption: Consumers may find it easier to redeem rewards after modifying their accounts.

- Access to exclusive offers: Modified accounts might grant access to promotional offers unavailable to standard accounts.

Possible Fees Associated with Modifications

While modifications offer many advantages, they may also come with associated costs that consumers should consider carefully.

- Modification fees: Some lenders charge fees for processing modification requests.

- Increased annual fees: Changes in account terms could lead to higher annual fees that offset potential savings from lower interest rates.

- Hidden costs: Consumers should scrutinize any new terms carefully; unexpected fees could diminish the benefits of modification.

Better Alignment with Financial Goals

Finally, modifying a credit card account allows consumers to align their financial products with their broader financial goals more effectively.

- Tailored repayment plans: Modifications enable consumers to create repayment plans that fit within their overall financial strategy.

- Strategic use of credit: Consumers can optimize how they use credit cards as part of a larger investment or savings strategy by adjusting terms accordingly.

- Financial stability focus: Modifying accounts helps prioritize long-term financial health over short-term gains by managing debt responsibly.

Long-Term Commitment May Be Required

A significant disadvantage of modifying a credit card is that it often requires a long-term commitment from the consumer.

- Binding agreements: Once terms are modified, consumers are typically bound by those new agreements until they are fully paid off.

- Limited flexibility post-modification: Consumers may find it challenging to revert back to previous terms if their financial situation changes again after modification.

- Future borrowing implications: Long-term commitments could affect future borrowing capacity or options if not managed properly.

In conclusion, while credit card modification presents numerous advantages such as improved cash flow management and access to lower interest rates, it also carries significant disadvantages including potential impacts on credit scores and increased overall debt. Consumers must weigh these factors carefully before pursuing modifications. Understanding both sides will empower individuals in finance, crypto, forex, and money markets to make informed decisions about their credit management strategies.

Frequently Asked Questions About Credit Card Modification

- What is credit card modification?

A process where cardholders change the terms of their credit card agreements such as interest rates or payment due dates. - How does modifying my credit card benefit me?

It can lower your monthly payments, improve cash flow management, and help avoid default. - Can modifying my credit card hurt my credit score?

Yes, it may lead to hard inquiries and could be reported negatively depending on lender practices. - Are there any fees associated with modifying my credit card?

Some lenders charge fees for processing modifications; it’s essential to review all terms before proceeding. - How often can I modify my credit card?

This depends on your lender’s policies; some limit how frequently you can request changes. - What documentation do I need for a modification?

Lenders typically require proof of financial hardship or other relevant information supporting your request. - Will I always get approved for a modification?

No, approval is not guaranteed; it depends on your lender’s criteria and your current financial situation. - Can I revert back after modifying my terms?

This is usually difficult; once modified, you are generally bound by the new agreement until fully paid off.