Credit consolidation has become an increasingly popular financial strategy for individuals grappling with multiple debts, particularly high-interest credit card balances. This approach involves combining various debts into a single, more manageable loan or payment plan. While it can offer significant benefits, it’s crucial to understand both the advantages and potential drawbacks before deciding if it’s the right move for your financial situation.

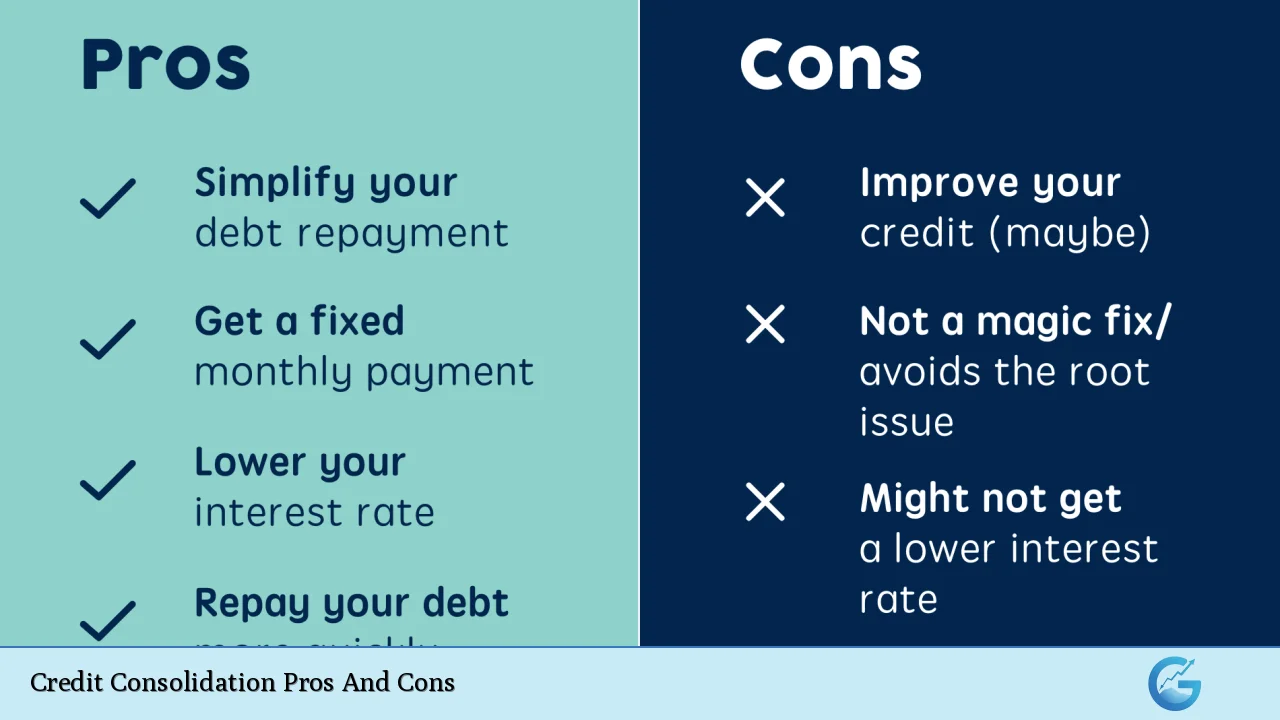

| Pros | Cons |

|---|---|

| Simplified debt management | Potential for higher overall costs |

| Potentially lower interest rates | Risk of accumulating more debt |

| Single monthly payment | Longer repayment terms |

| Improved credit score potential | Collateral risk for secured loans |

| Faster debt repayment | Fees and closing costs |

| Fixed repayment schedule | Potential negative impact on credit score |

Simplified Debt Management

One of the most significant advantages of credit consolidation is the simplification of debt management. Instead of juggling multiple payments with various due dates, you’re left with a single, streamlined obligation.

- Reduced stress from managing multiple accounts

- Lower likelihood of missed payments

- Easier budgeting and financial planning

By consolidating your debts, you can focus on a single payment strategy, potentially improving your overall financial discipline and reducing the mental burden of debt management.

Potentially Lower Interest Rates

Credit consolidation often results in a lower overall interest rate, especially when consolidating high-interest credit card debt.

- Opportunity to secure a fixed, lower interest rate

- Significant savings on interest over time

- Faster progress on paying down the principal balance

For instance, if you’re carrying balances on multiple credit cards with interest rates ranging from 15% to 25%, consolidating into a personal loan with a 10% interest rate could lead to substantial savings. However, it’s crucial to carefully compare the terms and ensure that the new rate is indeed lower than your current weighted average interest rate.

Single Monthly Payment

Consolidation simplifies your financial life by reducing multiple payments to a single, predictable monthly obligation.

- Easier to remember and manage one payment

- Reduced risk of late fees from forgotten payments

- Improved cash flow management

This simplification can be particularly beneficial for those who struggle with organization or have complex financial situations.

Having a single payment can provide a clearer picture of your debt repayment progress and help you stay motivated on your journey to becoming debt-free.

Improved Credit Score Potential

While the initial act of consolidating debt might cause a slight dip in your credit score due to the hard inquiry, the long-term effects can be positive.

- Lower credit utilization ratio

- Improved payment history with consistent, on-time payments

- Potential increase in credit score over time

As you pay down your consolidated debt, you may see your credit utilization ratio decrease, which is a key factor in credit scoring models. Additionally, making regular, on-time payments on your consolidated loan can help build a positive payment history, further boosting your credit score.

Faster Debt Repayment

Consolidation can accelerate your debt repayment process, especially if you secure a lower interest rate.

- More of each payment goes towards the principal

- Potential for setting a fixed repayment term

- Motivation to stick to a repayment plan

With a structured repayment plan, you can see a clear end date to your debt, which can be highly motivating.

This visibility can encourage you to stay committed to your financial goals and avoid taking on additional debt.

Fixed Repayment Schedule

Many debt consolidation options, particularly personal loans, offer fixed repayment schedules.

- Predictable monthly payments

- Easier long-term financial planning

- Protection against interest rate fluctuations

A fixed schedule can provide peace of mind, knowing exactly how much you need to budget each month for debt repayment. This predictability is especially valuable in uncertain economic times or when planning for major life events.

Potential for Higher Overall Costs

Despite the potential for lower interest rates, consolidation can sometimes lead to higher overall costs.

- Extended repayment terms may increase total interest paid

- Fees associated with consolidation loans or balance transfers

- Potential for higher rates if credit score is poor

It’s crucial to calculate the total cost of the consolidated debt over the entire repayment period.

In some cases, even with a lower interest rate, you might end up paying more due to an extended repayment term.

Always compare the total cost of your current debts with the proposed consolidation option.

Risk of Accumulating More Debt

One of the most significant risks of debt consolidation is the potential to accumulate more debt.

- Freed up credit limits on paid-off cards

- False sense of financial relief

- Failure to address underlying spending habits

After consolidating, it can be tempting to use the newly available credit on your paid-off cards.

Without addressing the root causes of debt accumulation, you might find yourself in a worse financial situation than before.

It’s crucial to develop a solid financial plan and potentially close or freeze unused credit accounts to avoid this pitfall.

Longer Repayment Terms

While longer repayment terms can lower monthly payments, they can also extend the time you’re in debt.

- Extended debt burden

- More interest paid over time

- Delayed financial freedom

It’s important to balance the need for manageable monthly payments with the goal of becoming debt-free as quickly as possible. Consider whether you can afford higher monthly payments to shorten the repayment term and reduce the overall interest paid.

Collateral Risk for Secured Loans

Some consolidation options, like home equity loans or home equity lines of credit (HELOCs), require collateral.

- Risk of losing assets if unable to repay

- Turning unsecured debt into secured debt

- Potential for underwater mortgage

Using your home as collateral can be particularly risky, as defaulting on the loan could result in foreclosure.

Carefully consider whether the benefits of a secured consolidation loan outweigh the potential risks to your assets.

Fees and Closing Costs

Many consolidation options come with associated fees that can add to the overall cost of the debt.

- Origination fees for personal loans

- Balance transfer fees for credit cards

- Closing costs for home equity loans or HELOCs

These fees can sometimes negate the benefits of a lower interest rate, especially for smaller debt amounts or shorter repayment terms. Always factor in these costs when comparing consolidation options to ensure you’re getting a good deal.

Potential Negative Impact on Credit Score

While consolidation can potentially improve your credit score in the long run, it may have short-term negative effects.

- Hard inquiries from loan applications

- Closure of old accounts affecting credit history length

- New account lowering average account age

These effects are typically temporary, but they’re worth considering, especially if you’re planning to apply for major credit, like a mortgage, in the near future.

The impact on your credit score should be weighed against the potential long-term benefits of consolidation.

In conclusion, credit consolidation can be a powerful tool for managing debt, but it’s not without its risks and potential drawbacks. It’s essential to carefully consider your financial situation, compare all available options, and potentially consult with a financial advisor before deciding to consolidate your debts. Remember that consolidation is not a magic solution to debt problems; it should be part of a broader strategy to improve your financial health and spending habits.

Frequently Asked Questions About Credit Consolidation Pros And Cons

- What types of debt can be consolidated?

Most unsecured debts can be consolidated, including credit card balances, personal loans, and medical bills. Secured debts like mortgages and car loans typically cannot be included in consolidation. - How does debt consolidation affect my credit score?

Initially, it may cause a slight dip due to hard inquiries and new account openings. However, over time, it can improve your score by lowering credit utilization and establishing a consistent payment history. - Is debt consolidation the same as debt settlement?

No, they are different. Debt consolidation combines multiple debts into one, while debt settlement involves negotiating with creditors to pay less than what you owe, often damaging your credit score significantly. - Can I consolidate my debt if I have bad credit?

It’s possible, but more challenging. You may face higher interest rates or need to explore secured loan options. Credit counseling or debt management plans might be alternatives worth considering. - How long does the debt consolidation process take?

The process can vary, but typically takes 2-4 weeks from application to funding. Balance transfers to new credit cards can be quicker, often completed within a week. - Will debt consolidation stop collection calls?

Yes, if you consolidate and pay off the debts in collections. However, it’s crucial to ensure all debts are included and paid off through the consolidation process. - Can I still use my credit cards after consolidation?

You can, but it’s generally not recommended. Using credit cards while paying off consolidated debt can lead to re-accumulating debt and defeating the purpose of consolidation. - Is it better to get a personal loan or a balance transfer card for consolidation?

It depends on your situation. Personal loans offer fixed rates and terms, while balance transfer cards can offer 0% intro APR periods. Consider the amount of debt, your credit score, and how quickly you can pay off the debt.