A credit freeze, also known as a security freeze, is a powerful tool that allows consumers to restrict access to their credit reports. This can help prevent identity thieves from opening new accounts in your name, providing a layer of protection against fraud. While freezing your credit can offer significant advantages, it also comes with its own set of challenges. Understanding the pros and cons of a credit freeze is essential for anyone concerned about identity theft, especially in today’s digital age where data breaches are increasingly common.

| Pros | Cons |

|---|---|

| Protects against identity theft by preventing new accounts from being opened in your name. | Inconvenient when applying for new credit, as you must temporarily lift the freeze. |

| Free to implement and manage across all three major credit bureaus. | Requires contacting each bureau individually to freeze or unfreeze your credit. |

| No impact on your credit score. | Does not protect against fraud on existing accounts. |

| Offers peace of mind if your personal information has been compromised. | May lead to delays in obtaining new credit due to the need to unfreeze. |

| Prevents creditors from accessing your credit report for marketing purposes. | Can create a false sense of security if not combined with other protective measures. |

Protects Against Identity Theft

One of the most significant advantages of a credit freeze is its effectiveness in protecting against identity theft. By restricting access to your credit report, a freeze prevents unauthorized individuals from opening new accounts in your name. This is particularly crucial for individuals who have been victims of identity theft or those whose personal information has been exposed in data breaches.

- Identity Theft Protection: A credit freeze significantly reduces the risk of someone using your personal information to open fraudulent accounts.

- Immediate Action: If you suspect that your information has been compromised, placing a freeze can be done quickly and easily through the three major credit bureaus: Equifax, Experian, and TransUnion.

Free to Implement and Manage

Another appealing aspect of a credit freeze is that it is free. Under U.S. law, consumers can freeze and unfreeze their credit reports without incurring any fees. This accessibility makes it an attractive option for those looking to enhance their security.

- No Cost: Freezing your credit does not involve any charges, making it an economically viable option for consumers.

- Legal Requirement: As of September 2018, all three major credit bureaus must comply with requests for freezes at no cost.

No Impact on Your Credit Score

A common misconception about credit freezes is that they negatively affect your credit score. However, this is not the case; freezing your credit does not impact your score in any way.

- Score Stability: Your credit score remains unchanged while your accounts are frozen, allowing you to maintain your financial standing.

- Credit Report Access: Only existing creditors or certain government agencies can access your report during a freeze, ensuring that legitimate inquiries do not affect your score.

Offers Peace of Mind

For many individuals, the peace of mind that comes with knowing their financial information is secure is invaluable. A credit freeze serves as a proactive measure against potential fraud.

- Security Assurance: Knowing that no one can open new accounts without your consent can alleviate anxiety related to identity theft.

- Proactive Defense: Keeping a freeze in place can be particularly beneficial for high-risk individuals or those who have previously experienced fraud.

Prevents Creditors from Accessing Your Credit Report for Marketing Purposes

A lesser-known benefit of freezing your credit is that it prevents creditors from accessing your report for marketing purposes. This means you may receive fewer unsolicited offers for loans and credit cards.

- Reduced Spam Offers: By limiting access to your information, you can reduce the volume of unwanted promotional material.

- Control Over Your Information: This gives you greater control over who can see your financial data and how it is used.

Inconvenient When Applying for New Credit

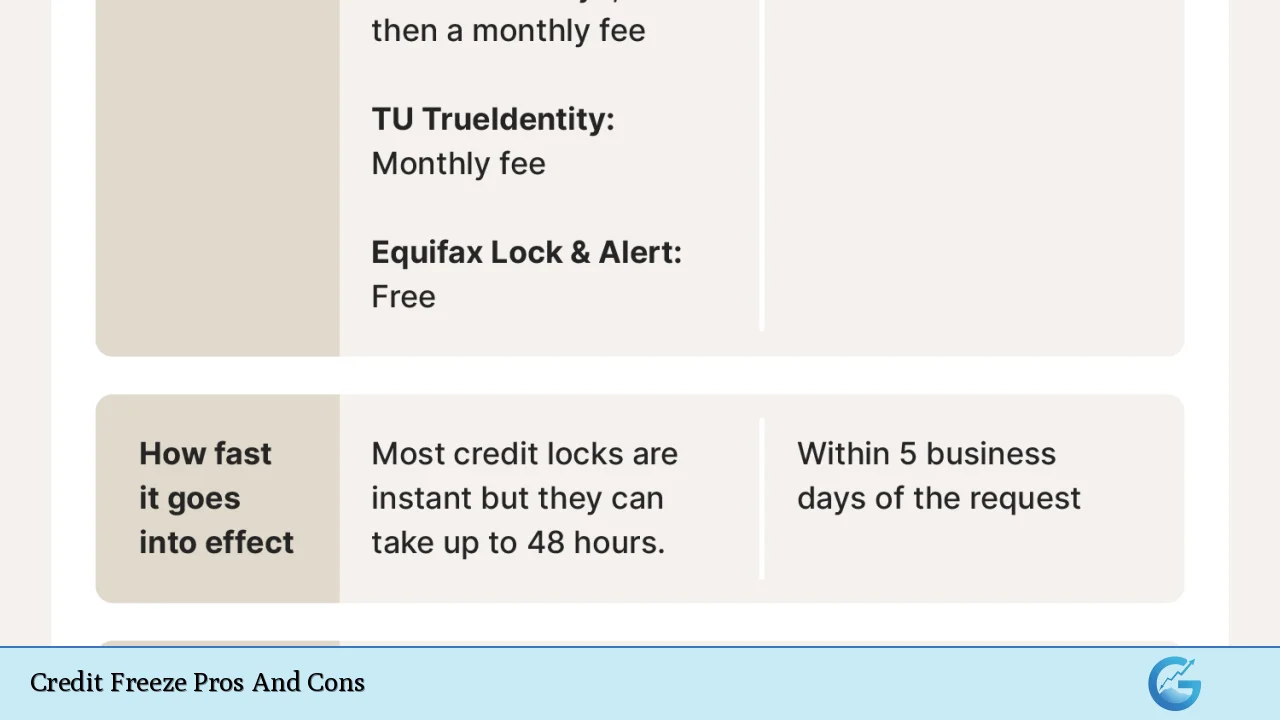

Despite its benefits, one major disadvantage of a credit freeze is the inconvenience it poses when applying for new lines of credit. If you wish to open a new account, you must temporarily lift the freeze.

- Extra Steps Required: You will need to contact each bureau individually to unfreeze your credit before applying for new loans or cards.

- Time Delay: Depending on how you choose to lift the freeze (online or by phone), there may be delays in processing requests.

Requires Contacting Each Bureau Individually

Managing a credit freeze involves interacting with all three major credit bureaus separately. This can be cumbersome and time-consuming.

- Multiple Contacts Needed: Each bureau has its own process for freezing and unfreezing accounts, requiring separate requests.

- Potential Confusion: Navigating different websites and policies may lead to confusion or errors during implementation.

Does Not Protect Against Fraud on Existing Accounts

While a credit freeze prevents new accounts from being opened in your name, it does not protect against fraud involving existing accounts.

- Ongoing Monitoring Needed: Consumers must remain vigilant about their current accounts and regularly check statements for unauthorized transactions.

- Limited Scope: A freeze does not stop thieves from using stolen account information if they already have access.

May Lead to Delays in Obtaining New Credit

When you need to apply for new financing or a loan, having to unfreeze your account can introduce delays into the process.

- Application Delays: If you forget to lift the freeze before applying, it could lead to missed opportunities or longer wait times for approval.

- Planning Required: Consumers must plan ahead and remember to manage their freezes proactively when considering new purchases or loans.

Can Create a False Sense of Security

While a credit freeze provides substantial protection against certain types of fraud, it can also lead individuals to feel overly secure about their financial safety.

- Complacency Risk: Relying solely on a freeze may cause some individuals to neglect other important security measures like monitoring existing accounts or changing passwords regularly.

- Not Foolproof: Identity thieves may still exploit other vulnerabilities unrelated to new account openings if they have access to sensitive information like Social Security numbers or bank details.

In conclusion, freezing your credit offers significant advantages in terms of protecting against identity theft and enhancing financial security. However, it also presents several drawbacks that consumers should consider carefully. Balancing these pros and cons will help individuals make informed decisions about whether a credit freeze aligns with their financial strategies and security needs.

Frequently Asked Questions About Credit Freeze

- What is a credit freeze?

A credit freeze restricts access to your credit report so that no one can open new accounts in your name without lifting the freeze first. - How do I place a credit freeze?

You can place a freeze by contacting each of the three major credit bureaus online, by phone, or by mail. - Is there a fee for freezing my credit?

No, freezing and unfreezing your credit is free under U.S. law. - How long does it take to lift a freeze?

If requested online or by phone, the bureaus must lift the freeze within one hour; requests made by mail may take up to three days. - Will freezing my credit affect my score?

No, freezing your credit does not impact your credit score at all. - Can I still use my existing accounts while my credit is frozen?

Yes, freezing your credit does not affect existing accounts; however, you should monitor them regularly for unauthorized transactions. - What if I forget my PIN when unfreezing my account?

You will need to follow the recovery process set by each bureau if you forget your PIN; this usually involves answering security questions. - Should I keep my credit frozen permanently?

This depends on individual circumstances; if you’re at high risk for identity theft or do not plan on applying for new loans soon, keeping it frozen might be wise.