Credit Karma is a popular financial technology platform that provides users with free access to their credit scores, credit reports, and various financial tools aimed at helping individuals manage their finances. Launched in 2007, it has grown significantly, offering services such as credit monitoring, personalized recommendations for financial products, and insights into credit health. However, like any service, it comes with its own set of advantages and disadvantages. This article will explore the pros and cons of using Credit Karma, providing a comprehensive overview for those interested in finance and personal money management.

| Pros | Cons |

|---|---|

| Free access to credit scores and reports from TransUnion and Equifax. | Does not provide Experian credit scores or reports. |

| User-friendly interface and mobile app for easy access. | Limited customer support options; no live chat or phone support. |

| Personalized financial product recommendations based on user profiles. | Frequent advertisements can be intrusive and overwhelming. |

| Credit monitoring alerts for changes in credit score or report. | Inaccuracies in credit reporting can occur, leading to confusion. |

| No fees associated with using the service. | May not be as comprehensive as paid services that include all three bureaus. |

| Educational resources to help users understand credit scores. | Some users report dissatisfaction with the accuracy of score predictions. |

| Offers tools for budgeting and tracking expenses. | Lacks advanced budgeting features found in dedicated personal finance apps. |

Free Access to Credit Scores and Reports

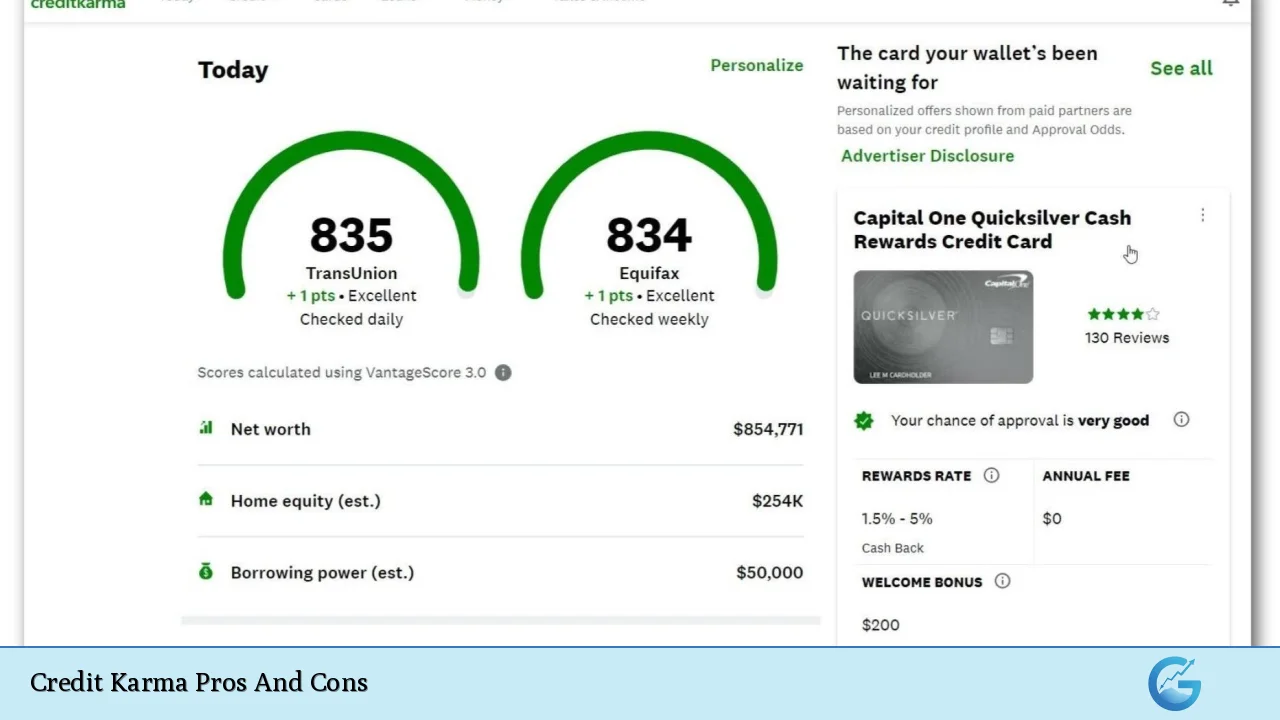

One of the main attractions of Credit Karma is its provision of free access to users’ credit scores and reports from two major credit bureaus: TransUnion and Equifax. This feature allows individuals to monitor their credit health without incurring any costs.

- Advantage: Users can track their credit scores regularly, which is essential for maintaining good financial health.

- Disadvantage: The absence of Experian data means users do not get a complete picture of their credit standing.

User-Friendly Interface

Credit Karma’s platform is designed with user experience in mind. Both the website and mobile app are intuitive, making it easy for users to navigate through their financial information.

- Advantage: The straightforward design allows even those who are not tech-savvy to access their credit information effortlessly.

- Disadvantage: Some users have reported that updates or changes can take time to reflect on the platform, leading to potential confusion.

Personalized Financial Product Recommendations

Credit Karma uses algorithms to provide tailored recommendations for loans, credit cards, and other financial products based on individual user profiles.

- Advantage: This personalized approach can help users find suitable financial products that match their needs.

- Disadvantage: The recommendations can sometimes feel overly aggressive or intrusive, as users may receive numerous notifications about offers that may not be relevant.

Credit Monitoring Alerts

The service offers real-time alerts whenever there are changes in a user’s credit report or score. This feature is particularly useful for those looking to improve their credit standing or protect against identity theft.

- Advantage: Immediate notifications allow users to respond quickly to any potential issues affecting their credit.

- Disadvantage: Users have reported inaccuracies in these alerts, which can lead to unnecessary worry or confusion about their actual credit status.

No Fees Associated with Using the Service

Credit Karma does not charge users any fees for accessing its services, making it an attractive option for those looking to monitor their finances without added costs.

- Advantage: Free services are appealing in a market where many competitors charge monthly fees for similar offerings.

- Disadvantage: While free services are beneficial, they might lack some features or depth provided by paid services that cover all three major bureaus.

Educational Resources

Credit Karma provides a variety of educational resources aimed at helping users understand how credit works and how they can improve their scores.

- Advantage: These resources empower users with knowledge about managing their finances effectively.

- Disadvantage: Some users may find the information too basic or not detailed enough for more advanced financial needs.

Tools for Budgeting and Expense Tracking

In addition to credit monitoring, Credit Karma offers tools that help users budget and track their spending habits.

- Advantage: These tools can assist individuals in managing their finances better by providing insights into spending patterns.

- Disadvantage: Compared to dedicated budgeting apps, Credit Karma’s features may feel limited or less robust.

Limited Customer Support Options

A significant drawback of Credit Karma is its lack of comprehensive customer support options. Users primarily rely on an online help center for assistance.

- Advantage: The online help center contains a wealth of information that can address common issues.

- Disadvantage: The absence of live chat or phone support means that resolving complex issues can be frustrating and time-consuming for users who prefer direct communication.

Inaccuracies in Credit Reporting

While Credit Karma aims to provide accurate information, some users have reported discrepancies between what they see on Credit Karma and what lenders see when they check their reports.

- Advantage: Users can dispute inaccuracies directly through the platform, which facilitates corrections.

- Disadvantage: Inaccuracies can lead to misunderstandings about one’s actual creditworthiness, potentially affecting loan applications or other financial decisions.

Conclusion

Credit Karma offers a range of valuable tools for individuals looking to monitor their credit health without incurring costs. Its user-friendly interface, personalized recommendations, and educational resources make it an appealing choice for many consumers. However, potential drawbacks such as limited customer support options, inaccuracies in reporting, and intrusive marketing practices should also be considered. Ultimately, whether Credit Karma is the right choice depends on individual needs and preferences in managing personal finances.

Frequently Asked Questions About Credit Karma

- Is Credit Karma really free?

Yes, Credit Karma provides its services free of charge without hidden fees. - Can I trust the accuracy of my Credit Karma score?

While many find it reliable, discrepancies may occur compared to lender reports due to different scoring models used by bureaus. - Does Credit Karma monitor all three major credit bureaus?

No, Credit Karma only provides data from TransUnion and Equifax; Experian data is not included. - What should I do if I find an error on my report?

You can dispute inaccuracies directly through Credit Karma’s platform by following the dispute process outlined there. - How often does Credit Karma update my score?

Your score is updated frequently based on new information from the bureaus; however, delays may occur in reflecting recent changes. - Can I improve my score using Credit Karma?

Yes, by utilizing the educational resources and monitoring tools provided by Credit Karma, you can take steps toward improving your score. - What types of financial products does Credit Karma recommend?

The platform recommends various products such as loans, credit cards, and savings accounts tailored to your profile. - Is my personal information safe with Credit Karma?

Credit Karma employs encryption measures; however, like any online service, there are inherent risks associated with data security.