Credit unions are unique financial institutions that operate on a not-for-profit basis, owned and governed by their members. They provide many of the same services as traditional banks, such as savings and checking accounts, loans, and credit cards. However, they differ significantly in their operational model and member benefits. This article explores the advantages and disadvantages of credit unions, helping potential members make informed decisions about their financial options.

| Pros | Cons |

|---|---|

| Lower borrowing rates and higher deposit yields | Membership requirements can limit access |

| Personalized customer service | Limited branch locations |

| Lower fees compared to traditional banks | Potentially fewer product offerings |

| Member ownership and influence | Less advanced digital banking services |

| Community-focused initiatives | Shared branching may be necessary for access |

| Educational resources for financial literacy | Cross-collateralization risk on loans |

| Insurance on deposits up to $250,000 | May lack competitive rates compared to online banks |

Lower Borrowing Rates and Higher Deposit Yields

One of the most significant advantages of credit unions is their ability to offer lower interest rates on loans and higher yields on savings accounts. Since credit unions are not-for-profit entities, they return profits to their members rather than shareholders. This structure allows them to provide more favorable rates:

- Lower Loan Rates: Credit unions often have lower interest rates for personal loans, auto loans, mortgages, and credit cards.

- Higher Savings Rates: Members can benefit from higher annual percentage yields (APYs) on savings accounts compared to traditional banks.

These benefits can lead to substantial savings over time, particularly for those who borrow frequently or maintain significant savings.

Personalized Customer Service

Credit unions are known for their member-centric approach to banking. Because they are smaller and community-focused, they often provide a level of personalized service that larger banks cannot match:

- Individual Attention: Members typically receive more direct support from staff who understand their financial situations.

- Community Engagement: Many credit unions participate in community events and support local initiatives, fostering a sense of belonging among members.

This personalized service can enhance the overall banking experience, making members feel valued and understood.

Lower Fees Compared to Traditional Banks

Credit unions generally impose fewer fees than traditional banks. Their non-profit status allows them to operate with lower overhead costs, which translates into savings for members:

- Reduced Account Fees: Many credit unions do not charge monthly maintenance fees or require minimum balances.

- Lower Transaction Fees: Members often face fewer fees for services such as ATM withdrawals or overdrafts.

These lower fees can lead to significant savings over the long term, especially for those who frequently use banking services.

Member Ownership and Influence

When you join a credit union, you become a member-owner. This unique structure provides several advantages:

- Voting Rights: Members have a say in key decisions through voting rights in board elections and policy changes.

- Profit Sharing: Any profits made by the credit union are reinvested into the institution or returned to members in the form of dividends or improved services.

This ownership model fosters a sense of community and accountability within the institution.

Community-Focused Initiatives

Credit unions often prioritize community involvement and support local initiatives:

- Local Investments: Many credit unions invest in local businesses and community projects, helping to stimulate economic growth in their areas.

- Financial Education: They frequently offer workshops and resources aimed at improving financial literacy among members.

This community focus not only benefits individual members but also enhances the overall well-being of the communities they serve.

Educational Resources for Financial Literacy

Credit unions place a strong emphasis on educating their members about financial management:

- Workshops and Seminars: Many credit unions offer free workshops covering topics such as budgeting, saving for retirement, and understanding credit scores.

- Personal Finance Tools: Members often have access to tools that help them track spending, set financial goals, and manage debt effectively.

These resources empower members to make informed financial decisions, which can lead to better long-term outcomes.

Insurance on Deposits Up to $250,000

Deposits at federally insured credit unions are protected up to $250,000 per depositor by the National Credit Union Administration (NCUA). This insurance provides peace of mind for members:

- Safety of Funds: Members can feel secure knowing their deposits are protected against potential losses.

- Similar Protection as Banks: This coverage is comparable to the FDIC insurance offered by traditional banks.

This safety net is crucial for individuals looking for secure places to save their money.

Membership Requirements Can Limit Access

Despite their many advantages, credit unions do have some drawbacks. One significant limitation is membership eligibility:

- Specific Criteria: Many credit unions require individuals to meet specific membership criteria based on factors like employment, geographic location, or affiliation with certain organizations.

- Limited Options: If you do not meet these criteria, you may find it challenging to access the services offered by a particular credit union.

This requirement can restrict access for potential members who could benefit from the services provided.

Limited Branch Locations

Credit unions typically have fewer branches than large national banks. This limitation can pose challenges for some members:

- Inconvenience: If you prefer in-person banking or travel frequently, limited branch locations may be inconvenient.

- Shared Branching Networks: While many credit unions participate in shared branching networks that allow members to use other credit union branches nationwide, this may not fully compensate for fewer physical locations.

Members should consider their accessibility needs when choosing a credit union.

Potentially Fewer Product Offerings

While many credit unions offer a variety of financial products similar to traditional banks, they may not provide as extensive a range:

- Limited Specialized Products: Smaller credit unions might lack certain specialized products like wealth management services or investment accounts.

- Basic Offerings: Some may focus primarily on essential services like checking accounts and loans without offering more advanced options.

Individuals seeking comprehensive financial services may find this limitation frustrating.

Less Advanced Digital Banking Services

As smaller institutions, many credit unions may not have the same level of technological advancement as larger banks:

- Basic Online Services: Credit unions might offer basic online banking features but lack advanced functionalities such as sophisticated mobile apps or online account management tools.

- Digital Accessibility Issues: This can be a disadvantage for tech-savvy consumers who rely heavily on digital banking solutions.

Members should evaluate the digital capabilities of a credit union before joining if online banking is important to them.

Shared Branching May Be Necessary for Access

To mitigate limited branch locations, many credit unions participate in shared branching networks:

- Accessing Other Locations: Members can conduct transactions at participating branches across the country; however, this system may require some adjustment.

- Potential Confusion: Navigating shared branching networks can sometimes be confusing for members unfamiliar with how they operate.

Understanding how shared branching works is essential for maximizing access to banking services.

Cross-Collateralization Risk on Loans

Cross-collateralization is a practice where lenders can claim funds from one account if another account becomes delinquent. In the context of credit unions:

- Risk Exposure: If you have multiple accounts (e.g., checking account and loan) with the same credit union and default on one loan, they might withdraw funds from your checking account without your consent.

- Legal Protections Are Different: Unlike banks that require court orders for such actions, this practice can lead to unexpected account issues.

Members should be aware of this risk when managing multiple accounts within a single institution.

May Lack Competitive Rates Compared to Online Banks

While credit unions generally offer competitive rates compared to traditional banks, they may not always match those offered by online-only banks:

- Higher Online Savings Rates: Online banks often have lower overhead costs and can afford to provide higher interest rates on savings accounts.

- Loan Comparisons Needed: Individuals seeking loans should compare rates across various institutions before deciding where to borrow.

It’s essential for potential members to conduct thorough research when considering where to deposit funds or take out loans.

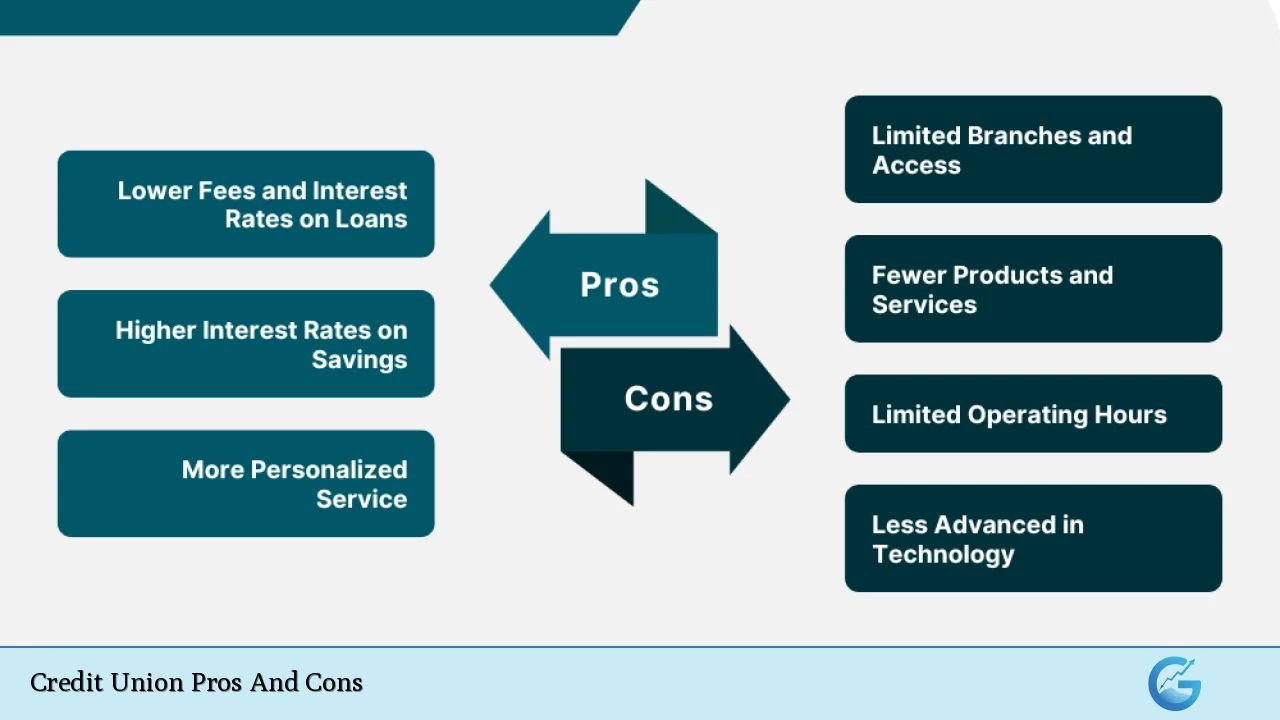

In conclusion, joining a credit union presents numerous advantages such as lower fees, better interest rates on loans and deposits, personalized service, and community involvement. However, potential drawbacks include membership restrictions, limited branch access, fewer product offerings compared to larger banks, less advanced digital services, and risks associated with cross-collateralization.

Ultimately, individuals should weigh these pros and cons carefully against their personal financial needs and preferences before deciding whether a credit union is right for them.

Frequently Asked Questions About Credit Union Pros And Cons

- What is a credit union?

A credit union is a member-owned financial cooperative that provides various banking services similar to those offered by traditional banks but operates on a not-for-profit basis. - How do I become a member of a credit union?

To become a member of a credit union, you must meet specific eligibility criteria set by the institution based on factors like your location or employment. - Are deposits in a credit union insured?

Yes! Deposits at federally insured credit unions are protected up to $250,000 per depositor by the National Credit Union Administration (NCUA). - What are the main advantages of joining a credit union?

The main advantages include lower loan rates, higher interest on deposits, personalized customer service, lower fees compared to banks, and community involvement. - What are some disadvantages of using a credit union?

Disadvantages include membership restrictions that limit access for some individuals, fewer branch locations than large banks, potentially fewer product offerings, less advanced digital banking options. - Can I use ATMs outside my credit union network?

Many credit unions participate in shared ATM networks allowing you to use ATMs without incurring fees; however, availability may vary. - Do all credit unions offer similar products?

No; while most offer basic products like checking accounts and loans, some may lack specialized services found at larger institutions. - Is it better to choose a bank over a credit union?

This depends on individual needs; if low fees and personalized service are priorities then a credit union might be better; however if extensive product offerings or convenience is desired then traditional banks could be more suitable.