In the world of personal finance, choosing the right financial institution is crucial for managing your money effectively. Two primary options stand out: credit unions and banks. While both offer similar services, they operate under different models, each with its own set of advantages and disadvantages. This comprehensive guide will delve into the pros and cons of credit unions versus banks, helping you make an informed decision about where to entrust your finances.

| Pros | Cons |

|---|---|

| Higher interest rates on savings | Limited accessibility |

| Lower fees | Fewer product offerings |

| Personalized customer service | Membership requirements |

| Lower loan rates | Less advanced technology |

| Member-owned structure | Smaller network of ATMs and branches |

| Focus on financial education | Limited business services |

| Community involvement | Potential for merger or acquisition |

| Voting rights for members | Less name recognition |

Advantages of Credit Unions

Higher Interest Rates on Savings

Credit unions typically offer higher interest rates on savings accounts, certificates of deposit (CDs), and money market accounts compared to traditional banks. This advantage stems from their not-for-profit status, which allows them to return profits to members in the form of better rates. For instance, while a large national bank might offer a 0.01% annual percentage yield (APY) on a standard savings account, a credit union could provide rates as high as 1% or more.

- Savings accounts with competitive APYs

- Higher rates on CDs and money market accounts

- Compound interest benefits over time

Lower Fees

One of the most significant advantages of credit unions is their tendency to charge lower fees compared to banks. This can result in substantial savings for members over time, particularly for those who frequently use services that typically incur fees at banks. Credit unions often offer:

- Free checking accounts with no minimum balance requirements

- Lower overdraft fees

- Reduced or waived ATM fees

- No or low monthly maintenance fees

Personalized Customer Service

Credit unions are known for their personalized approach to customer service. The smaller size and community focus of credit unions often translate to a more intimate banking experience, where staff members may know customers by name and understand their unique financial situations. This personalized service can be particularly beneficial when:

- Applying for loans or mortgages

- Seeking financial advice

- Resolving account issues

- Discussing long-term financial planning

Lower Loan Rates

Credit unions typically offer lower interest rates on various types of loans, including:

- Auto loans

- Personal loans

- Mortgages

- Home equity lines of credit (HELOCs)

These lower rates can result in significant savings over the life of a loan, making credit unions an attractive option for borrowers. For example, a 1% difference in interest rate on a 30-year mortgage for a $300,000 home could save a borrower over $60,000 over the life of the loan.

Member-Owned Structure

Credit unions operate under a unique member-owned structure, where account holders are considered partial owners of the institution. This structure results in:

- Alignment of interests between the credit union and its members

- Profits reinvested into better rates and services

- Democratic decision-making processes

The member-owned structure ensures that the credit union’s primary focus is on serving its members rather than maximizing profits for external shareholders.

Focus on Financial Education

Many credit unions place a strong emphasis on financial education for their members. This focus can include:

- Free financial literacy workshops

- Online resources and tools for budgeting and financial planning

- One-on-one financial counseling sessions

- Youth-focused programs to teach money management skills

By providing these educational resources, credit unions help their members make more informed financial decisions and improve their overall financial well-being.

Community Involvement

Credit unions often have strong ties to their local communities, which can manifest in various ways:

- Sponsorship of local events and organizations

- Volunteer programs for employees and members

- Tailored products and services to meet specific community needs

- Support for local businesses and economic development initiatives

This community focus can create a sense of belonging and purpose for members who value local engagement and support.

Voting Rights for Members

As member-owned institutions, credit unions typically grant voting rights to their members. This democratic structure allows members to:

- Elect board members

- Participate in annual meetings

- Have a say in major decisions affecting the credit union

These voting rights give members a level of control and influence over their financial institution that is not typically available with traditional banks.

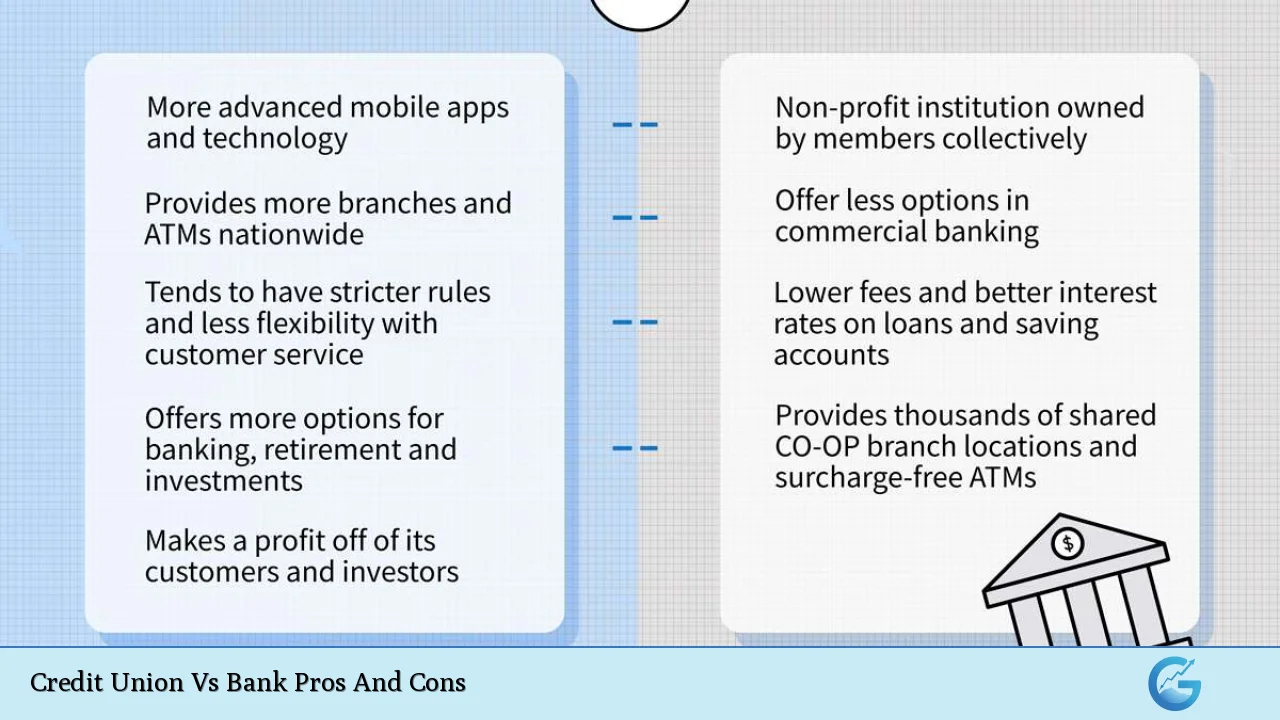

Disadvantages of Credit Unions

Limited Accessibility

One of the primary drawbacks of credit unions is their limited accessibility compared to large national banks. This limitation can manifest in several ways:

- Fewer physical branch locations

- Restricted service areas, often limited to specific regions or communities

- Potential challenges when traveling or relocating

For individuals who frequently travel or move, the limited accessibility of credit unions can be a significant inconvenience, potentially leading to difficulties in accessing funds or conducting in-person banking activities.

Fewer Product Offerings

While credit unions offer most basic financial products, they often have a more limited range of offerings compared to large banks. This can include:

- Fewer options for specialized accounts or investment products

- Limited variety in credit card offerings

- Fewer choices for business banking services

Individuals or businesses with complex financial needs may find the product range of credit unions insufficient to meet all their requirements.

Membership Requirements

Unlike banks, which are open to anyone, credit unions typically have membership requirements. These can be based on:

- Geographic location

- Employer

- Professional or trade associations

- Family connections to existing members

While many credit unions have expanded their membership criteria, these requirements can still be a barrier for some individuals who do not meet the specific eligibility criteria.

Less Advanced Technology

Credit unions, especially smaller ones, may lag behind large banks in terms of technological offerings. This can include:

- Less sophisticated online and mobile banking platforms

- Fewer features in mobile apps

- Limited integration with financial technology (fintech) services

For tech-savvy consumers who prioritize cutting-edge digital banking experiences, the technology gap can be a significant drawback of credit unions.

Smaller Network of ATMs and Branches

Compared to national banks, credit unions typically have a smaller network of ATMs and branches. This can result in:

- Fewer options for fee-free ATM withdrawals

- Increased reliance on ATM surcharge reimbursement programs

- Potential difficulties in accessing in-person services when traveling

While many credit unions participate in shared branching networks to mitigate this issue, the overall reach of these networks is still generally smaller than that of large national banks.

Limited Business Services

Credit unions often have more limited offerings for business banking compared to commercial banks. This can include:

- Fewer options for business loans and lines of credit

- Limited merchant services

- Less robust cash management tools

For small business owners or entrepreneurs with complex banking needs, the limited business services of credit unions may be insufficient.

Potential for Merger or Acquisition

Smaller credit unions may be more susceptible to mergers or acquisitions, which can lead to:

- Changes in policies and procedures

- Potential loss of personalized service

- Alterations to product offerings and rates

While mergers can sometimes result in improved services and expanded reach, they can also disrupt the member experience and potentially alter the community-focused nature of the credit union.

Less Name Recognition

Credit unions often have less brand recognition compared to large national banks. This can result in:

- Reduced confidence among some consumers

- Potential challenges when using credit union-issued cards or checks outside the local area

- Less extensive marketing and advertising presence

For individuals who value the perceived stability and reputation of well-known financial institutions, the lower name recognition of credit unions may be a drawback.

In conclusion, the choice between a credit union and a bank ultimately depends on individual financial needs, preferences, and circumstances. Credit unions offer significant advantages in terms of personalized service, competitive rates, and community focus, but they also come with limitations in accessibility, technology, and product range. Conversely, banks provide wider accessibility and more extensive services but may fall short in personalized attention and competitive rates. By carefully weighing these pros and cons, consumers can make an informed decision that best aligns with their financial goals and lifestyle.

Frequently Asked Questions About Credit Union Vs Bank Pros And Cons

- Are credit unions safer than banks?

Credit unions are generally as safe as banks. Both are insured by federal agencies: the National Credit Union Administration (NCUA) for credit unions and the Federal Deposit Insurance Corporation (FDIC) for banks, typically up to $250,000 per depositor. - Can I join multiple credit unions?

Yes, you can join multiple credit unions as long as you meet their respective membership requirements. This can be beneficial for accessing different products or services offered by various credit unions. - Do credit unions offer better mortgage rates than banks?

Credit unions often offer lower mortgage rates compared to banks due to their not-for-profit status. However, it’s essential to compare rates from multiple lenders, as individual offers can vary based on various factors. - Are credit unions a good option for small businesses?

Credit unions can be a good option for small businesses, especially those seeking personalized service and potentially lower fees. However, larger businesses with complex banking needs might find the services of commercial banks more comprehensive. - Can I use my credit union account when traveling internationally?

Many credit unions offer international services, including foreign ATM access and travel cards. However, their international reach may be more limited compared to large banks, so it’s important to check with your credit union before traveling. - Do credit unions offer investment services like banks do?

Many credit unions offer investment services, including retirement accounts and financial planning. However, the range of investment products may be more limited compared to large banks or dedicated investment firms. - Are credit union credit cards better than bank credit cards?

Credit union credit cards often feature lower interest rates and fees compared to bank-issued cards. However, they may offer fewer rewards programs or premium benefits found with some bank credit cards. - How do I choose between a credit union and a bank?

Consider factors such as your financial needs, the importance of personalized service, the range of products required, and your eligibility for credit union membership. Compare specific offerings, rates, and fees from both types of institutions before making a decision.