In the financial landscape, consumers often find themselves choosing between credit unions and traditional banks. Both institutions provide similar services, such as savings accounts, loans, and checking accounts, but their operational models differ significantly. Understanding the advantages and disadvantages of each can help individuals make informed decisions based on their financial needs and preferences. This article will explore the pros and cons of credit unions versus banks, providing a comprehensive overview for those interested in finance, crypto, forex, and money markets.

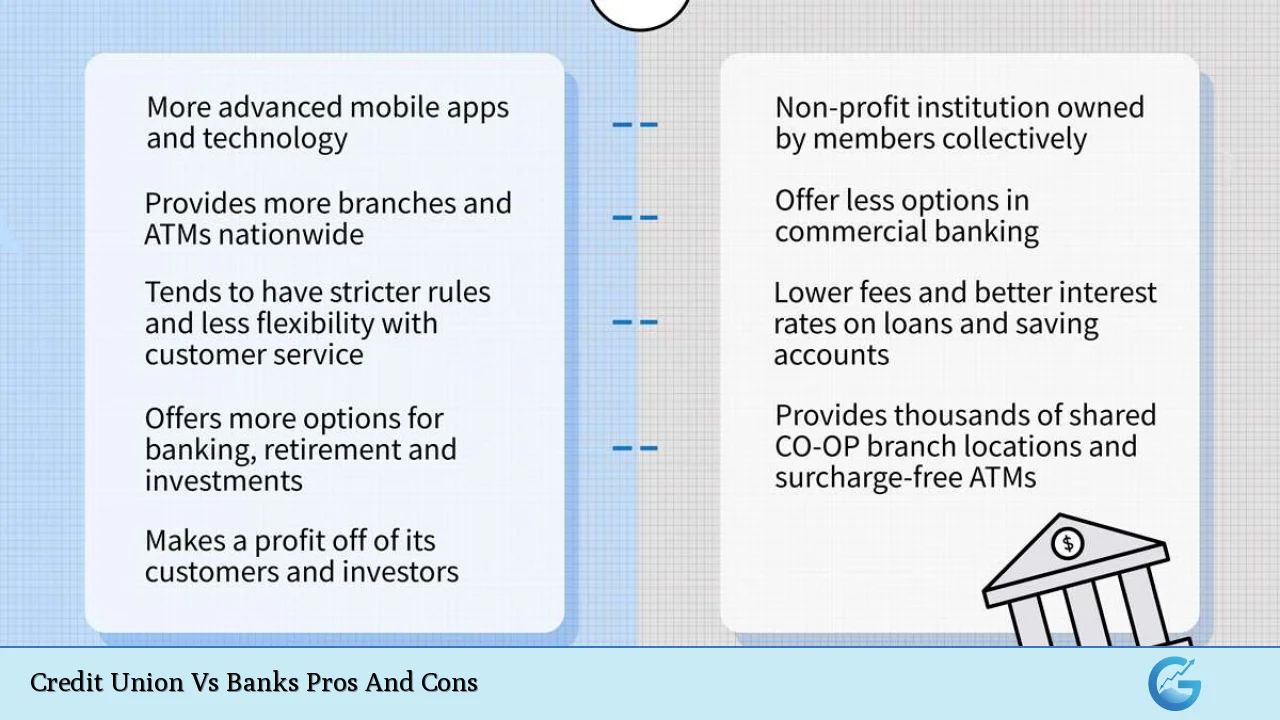

| Pros | Cons |

|---|---|

| Lower fees and better interest rates on loans and deposits. | Membership requirements can limit access. |

| Personalized customer service due to community focus. | Fewer branches and ATMs compared to banks. |

| Not-for-profit model benefits members directly. | Limited product offerings in some cases. |

| Strong emphasis on financial education and literacy. | Potentially slower adoption of new technologies. |

| Community involvement and support for local initiatives. | May lack some advanced banking features available at larger banks. |

Lower Fees and Better Interest Rates

Credit unions generally offer lower fees and better interest rates compared to traditional banks. This advantage stems from their not-for-profit status, allowing them to return profits to their members rather than shareholders.

- Lower Loan Rates: Credit unions typically provide lower interest rates on loans, making them an attractive option for borrowing.

- Higher Savings Yields: Members often enjoy higher returns on savings accounts and certificates of deposit (CDs).

- Reduced Fees: Many credit unions charge fewer fees for account maintenance and transactions, which can lead to significant savings over time.

However, while these financial benefits are compelling, it is essential to consider the potential trade-offs associated with membership.

Membership Requirements

One of the primary disadvantages of credit unions is that they often have specific membership requirements that can restrict access.

- Eligibility Criteria: To join a credit union, individuals must meet certain criteria based on their geographic location, employer affiliation, or membership in a specific organization.

- Limited Access: Those who do not qualify for membership may find themselves unable to take advantage of the benefits offered by credit unions.

This requirement can be a barrier for some consumers who may prefer the open accessibility of traditional banks.

Personalized Customer Service

Credit unions are known for their personalized customer service, which often stems from their community-oriented approach.

- Local Focus: Many credit unions serve specific communities or groups, allowing them to understand their members’ needs better.

- Member-Centric Approach: Credit unions prioritize member satisfaction over profit, leading to a more tailored banking experience.

However, this personalized service can come with its own set of challenges.

Fewer Branches and ATMs

While credit unions provide excellent customer service, they often have fewer physical branches and ATMs compared to larger banks.

- Limited Locations: This can make it challenging for members who prefer in-person banking or need access to ATMs outside their local area.

- Shared Branching Networks: Some credit unions participate in shared branching networks that allow members to use other credit union branches; however, this may not be as convenient as having multiple locations owned by a single institution.

For consumers who prioritize convenience and accessibility, this limitation may be a significant drawback.

Not-for-Profit Model

The not-for-profit model of credit unions allows them to focus on serving their members rather than generating profits for shareholders.

- Direct Benefits: Members benefit directly from the institution’s success through lower rates and fewer fees.

- Community Investment: Credit unions often reinvest in their communities through local initiatives and support programs.

Despite these advantages, there are also some limitations associated with this model.

Limited Product Offerings

Credit unions may offer fewer financial products compared to traditional banks, which can limit options for consumers seeking specific services.

- Basic Services: While most credit unions provide essential banking services like savings accounts and loans, they may not offer more specialized products such as investment accounts or extensive mortgage options.

- Technology Limitations: Some smaller credit unions may lag in adopting the latest banking technologies or online services compared to larger banks that have more resources to invest in innovation.

This limitation can deter individuals looking for comprehensive banking solutions under one roof.

Strong Emphasis on Financial Education

Credit unions typically prioritize financial education as part of their mission to serve their members effectively.

- Educational Resources: Many credit unions offer workshops, seminars, and online resources designed to enhance members’ financial literacy.

- Supportive Environment: The community-focused nature of credit unions fosters an environment where members feel comfortable seeking advice about managing their finances effectively.

However, while this emphasis on education is beneficial, it may not appeal to everyone equally.

Slower Adoption of New Technologies

In comparison to traditional banks, credit unions may adopt new technologies at a slower pace due to limited resources or smaller operational scales.

- Digital Banking Features: While many credit unions have made strides in offering online banking services, they may not always match the advanced features provided by larger banks (such as mobile payment options or sophisticated budgeting tools).

- Tech Support Limitations: Smaller institutions might struggle with providing extensive tech support or troubleshooting assistance compared to larger banks with dedicated IT departments.

Consumers who value cutting-edge technology in banking may find this aspect unappealing when considering a credit union versus a bank.

Community Involvement

Credit unions often engage deeply with their local communities through various initiatives that promote social responsibility and community development.

- Local Support Initiatives: Many credit unions actively participate in charitable events or sponsor local programs that benefit residents directly.

- Member Engagement: This community involvement fosters a sense of belonging among members who appreciate supporting an institution that aligns with their values.

However, while community involvement is a strong point for credit unions, it does not necessarily compensate for all potential drawbacks when compared with traditional banks’ broader reach and resources.

Conclusion

Choosing between a credit union and a bank ultimately depends on individual preferences regarding financial needs, customer service expectations, accessibility requirements, and community values. Credit unions offer numerous advantages such as lower fees, better interest rates on loans and deposits, personalized service, and strong community ties. However, potential disadvantages include membership restrictions, fewer branches/ATMs, limited product offerings, slower technology adoption rates, and varying levels of service quality across different institutions.

As individuals navigate the complexities of personal finance—whether investing in crypto markets or managing traditional assets—understanding these distinctions will empower them to make informed decisions that align with their financial goals.

Frequently Asked Questions About Credit Union Vs Banks

- What is the main difference between a bank and a credit union?

The primary difference lies in ownership; banks are for-profit institutions owned by shareholders while credit unions are non-profit cooperatives owned by their members. - Are my deposits safe in both institutions?

Yes, deposits are federally insured up to $250,000 per depositor at both banks (FDIC) and credit unions (NCUA). - Can anyone join a credit union?

No; membership is typically restricted based on geographic location or affiliation with specific organizations. - Do credit unions offer competitive loan rates?

Yes; generally lower interest rates on loans compared to traditional banks due to their non-profit status. - How do fees compare between banks and credit unions?

Credit unions usually charge lower fees than banks for account maintenance and transactions. - What types of products do credit unions offer?

Credit unions typically offer checking accounts, savings accounts, loans (auto loans, mortgages), but may have fewer investment options than banks. - Is customer service better at credit unions?

Many people find that customer service at credit unions is more personalized due to their community focus. - What should I consider when choosing between a bank or a credit union?

Consider factors like fees, interest rates on savings/loans, accessibility (branches/ATMs), product offerings, and customer service quality.