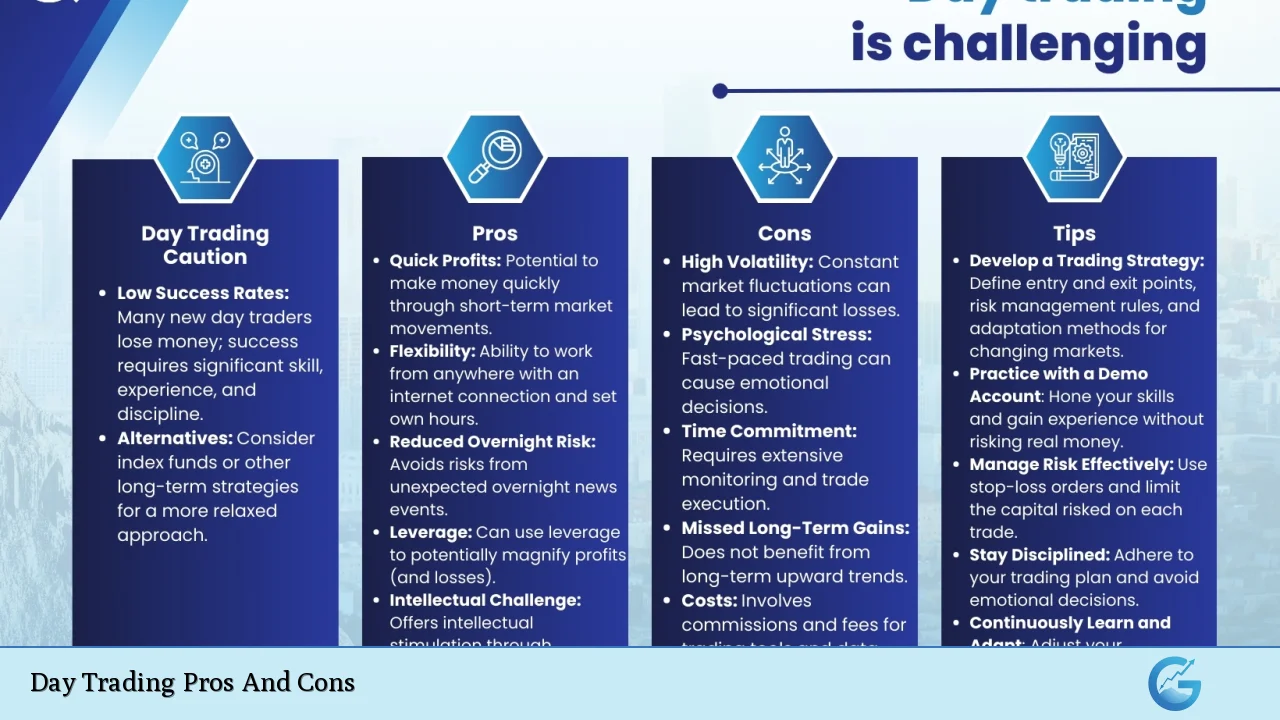

Day trading, the practice of buying and selling financial instruments within the same trading day, has gained significant popularity in recent years. With the rise of online trading platforms and increased access to financial markets, many individuals are drawn to the allure of quick profits. However, this approach to trading is not without its risks and challenges. This article will explore the pros and cons of day trading, providing a comprehensive overview for those interested in finance, cryptocurrencies, forex, and money markets.

| Pros | Cons |

|---|---|

| Potential for High Profits | High Risk of Losses |

| Independence and Flexibility | Time-Intensive and Stressful |

| Rapid Decision-Making Opportunities | Emotional and Psychological Toll |

| No Overnight Risk | High Transaction Costs |

| Immediate Feedback on Performance | Lack of Long-Term Growth Potential |

| Access to Advanced Trading Tools | Requires Significant Knowledge and Experience |

| Ability to Exploit Market Volatility | Regulatory Restrictions and Requirements |

| Potential for Compounding Returns Quickly | Market Manipulation Risks |

Potential for High Profits

One of the most attractive aspects of day trading is the potential for substantial profits. Skilled day traders can capitalize on small price fluctuations throughout the day, making multiple trades that can lead to significant earnings.

- Quick Returns: Day traders aim to make profits from short-term price movements, often resulting in faster returns compared to traditional investing.

- Leverage: Many brokers offer margin accounts that allow traders to borrow money to increase their buying power, potentially amplifying profits.

High Risk of Losses

While the potential for high profits exists, day trading also carries a significant risk of losses.

- Volatility: Financial markets can be unpredictable, with prices fluctuating rapidly due to various factors such as economic data releases or geopolitical events.

- Losses Can Exceed Initial Investment: Particularly when using leverage, traders may face losses that exceed their initial investment, leading to substantial financial setbacks.

Independence and Flexibility

Day trading offers individuals the freedom to set their own schedules and work from virtually anywhere with an internet connection.

- Work-Life Balance: Traders can choose when they want to trade, allowing for a better work-life balance compared to traditional jobs.

- No Boss: The independence from a corporate structure appeals to many individuals who prefer self-directed work environments.

Time-Intensive and Stressful

Despite its flexibility, day trading can be highly demanding in terms of time and mental energy.

- Constant Monitoring Required: Successful day traders often spend hours watching market movements and analyzing data.

- Burnout Risk: The pressure to make quick decisions can lead to stress and burnout over time.

Rapid Decision-Making Opportunities

Day trading requires quick thinking and rapid decision-making skills.

- Immediate Results: Traders receive immediate feedback on their trades, allowing them to learn quickly from both successes and failures.

- Skill Development: Over time, traders can develop sharper analytical skills that enhance their ability to make informed decisions under pressure.

Emotional and Psychological Toll

The psychological aspects of day trading can be challenging for many individuals.

- Emotional Rollercoaster: The highs of winning trades can be followed by the lows of losing trades, leading to emotional instability.

- Impulsive Decisions: Emotional reactions can lead traders to make impulsive decisions that negatively impact their performance.

No Overnight Risk

Day traders close all positions before the market closes each day, eliminating overnight risk from sudden market changes.

- Protection from External Events: This strategy protects traders from adverse news or events that could affect stock prices overnight.

High Transaction Costs

Frequent buying and selling can lead to substantial transaction costs that eat into profits.

- Commissions and Fees: Each trade incurs costs in the form of commissions or fees charged by brokers, which can accumulate quickly with active trading strategies.

- Impact on Profitability: High transaction costs may significantly reduce overall profitability, especially for those with smaller capital bases.

Immediate Feedback on Performance

Day traders receive immediate results from their trades, which provides valuable learning opportunities.

- Performance Tracking: Traders can quickly assess what strategies are working or failing, allowing for rapid adjustments in tactics.

Lack of Long-Term Growth Potential

Day trading often does not take advantage of long-term market trends that benefit traditional investors.

- Missed Opportunities: By focusing solely on short-term price movements, day traders may miss out on significant long-term gains associated with holding investments over time.

Access to Advanced Trading Tools

Many online platforms provide sophisticated tools that enhance a trader’s ability to analyze markets effectively.

- Charting Software: Access to advanced charting tools helps traders identify trends and patterns more efficiently.

- Algorithmic Trading Options: Some platforms allow users to implement algorithmic trading strategies that automate trades based on pre-set criteria.

Requires Significant Knowledge and Experience

Successful day trading is not simply about luck; it requires a deep understanding of market dynamics.

- Educational Investment: Traders must invest time in learning about technical analysis, market indicators, and economic factors influencing prices.

- Continuous Learning Curve: The financial markets are constantly evolving; thus, ongoing education is essential for long-term success in day trading.

Ability to Exploit Market Volatility

Day traders thrive on volatility as it creates opportunities for profit through rapid price changes.

- Short Selling Opportunities: Traders can profit not only from rising prices but also from falling prices by short selling stocks or other securities.

- Market Events Leverage: Day traders often capitalize on earnings announcements or economic reports that lead to increased volatility in stock prices.

Regulatory Restrictions and Requirements

In the U.S., day traders must adhere to specific regulations set by financial authorities such as FINRA.

- Pattern Day Trader Rule: If a trader executes four or more day trades within five business days using a margin account, they are classified as a pattern day trader. This designation requires maintaining a minimum equity balance of $25,000 in their account at all times.

- Regulatory Compliance Costs: Navigating these regulations may require additional resources or consultation with financial professionals, adding complexity to the trading process.

Market Manipulation Risks

The potential for market manipulation exists within day trading environments due to high-frequency trading practices employed by some participants.

- Unfair Advantages: Professional traders with advanced algorithms may manipulate prices in ways that disadvantage retail investors attempting to trade profitably.

- Increased Scrutiny: Regulatory bodies monitor suspicious trading activity closely; however, individual retail traders may still find themselves at a disadvantage against institutional players with more resources at their disposal.

In conclusion, while day trading offers several advantages such as high profit potential and flexibility, it also presents significant risks including high transaction costs and emotional stress. Individuals considering entering this fast-paced world must weigh these pros and cons carefully. Understanding the complexities involved is crucial for anyone looking to engage in this form of investing successfully.

Frequently Asked Questions About Day Trading Pros And Cons

- What are the primary benefits of day trading?

The main benefits include potential high profits from short-term trades, independence in scheduling trades, immediate feedback on performance, and the ability to exploit market volatility. - What risks are associated with day trading?

The risks include high potential losses due to market volatility, significant transaction costs eroding profits, emotional stress from rapid decision-making demands, and regulatory restrictions like the pattern day trader rule. - Is it possible for beginners to succeed in day trading?

While some beginners may find success with proper education and strategy development, statistics show that a majority of day traders do not achieve consistent profitability. - How much capital is needed to start day trading?

A minimum capital requirement of $25,000 is necessary for those classified as pattern day traders in the U.S., but starting with more capital may provide better leverage against losses. - Can I make a living from day trading?

While some individuals do make a living through day trading, it requires extensive knowledge, experience, discipline, and often significant initial capital investment. - What tools do successful day traders use?

Successful day traders utilize advanced charting software, real-time market data feeds, risk management tools like stop-loss orders, and sometimes algorithmic trading systems. - How does emotional stress impact day trading performance?

The psychological toll from losses or rapid decision-making can lead to impulsive actions that negatively affect overall performance. - What should I consider before starting day trading?

You should consider your risk tolerance level, availability of time for monitoring markets closely, educational investment needed for success, and whether you can handle potential financial losses.