In the world of personal finance, the choice between using a debit card or a credit card is a decision that can significantly impact one’s financial health and spending habits. Both types of cards offer unique advantages and come with their own set of drawbacks. This comprehensive analysis will delve into the pros and cons of debit cards versus credit cards, providing valuable insights for individuals looking to make informed decisions about their payment methods.

| Pros | Cons |

|---|---|

| Direct access to funds | Limited fraud protection |

| No interest charges | No credit building |

| Budgeting tool | Potential overdraft fees |

| Widely accepted | No rewards programs |

| ATM access | Limited dispute resolution |

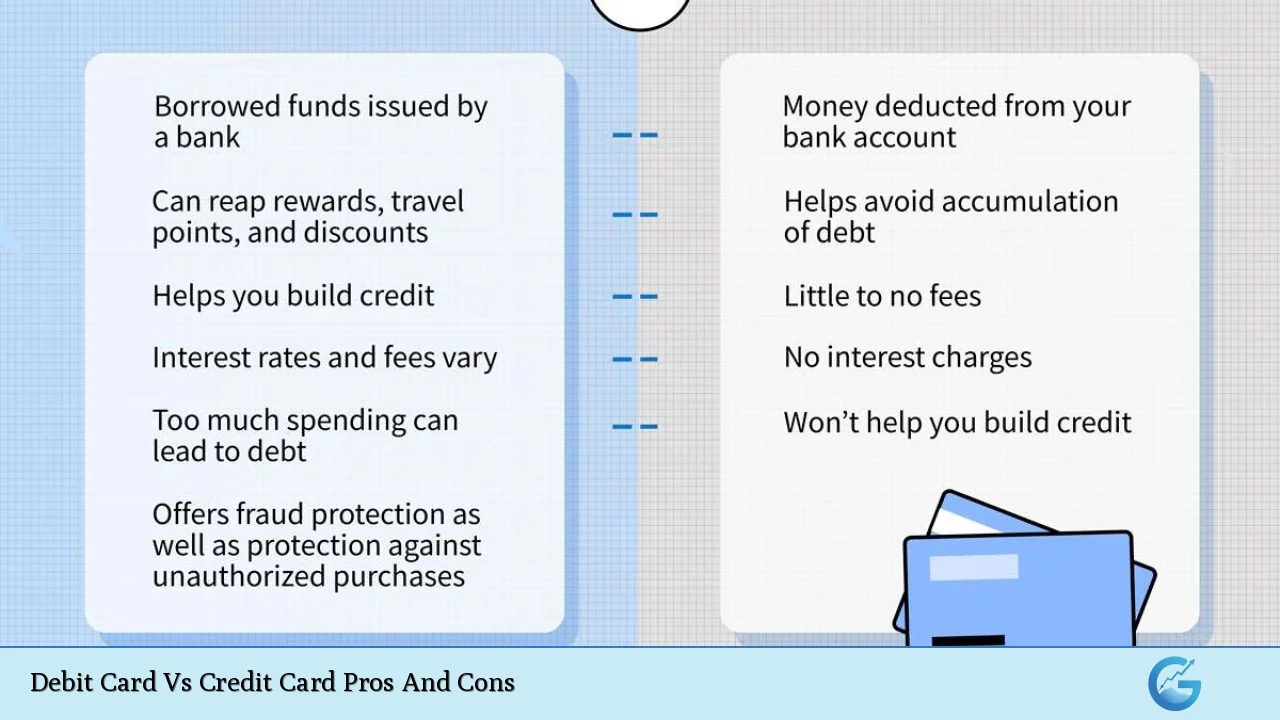

Advantages of Debit Cards

Debit cards offer several benefits that make them an attractive option for many consumers:

- Direct access to funds: Debit cards are linked directly to your checking account, allowing you to spend only the money you actually have.

- No interest charges: Unlike credit cards, debit card purchases do not accrue interest, as you’re using your own money.

- Budgeting tool: Debit cards can help you stick to a budget by limiting your spending to available funds.

- Widely accepted: Most merchants that accept credit cards also accept debit cards.

- ATM access: Debit cards typically allow free cash withdrawals from your bank’s ATMs.

Disadvantages of Debit Cards

Despite their benefits, debit cards also come with some drawbacks:

- Limited fraud protection: While banks offer some protection, it may not be as comprehensive as credit card fraud protection.

- No credit building: Debit card usage does not contribute to building or improving your credit score.

- Potential overdraft fees: If you spend more than your account balance, you may incur costly overdraft fees.

- No rewards programs: Most debit cards do not offer cashback, points, or other rewards for spending.

- Limited dispute resolution: Resolving disputes for debit card purchases can be more challenging than with credit cards.

Advantages of Credit Cards

Credit cards offer a range of benefits that can be particularly appealing to certain consumers:

- Build credit history: Responsible credit card use can help improve your credit score over time.

- Rewards programs: Many credit cards offer cashback, points, or miles for purchases.

- Fraud protection: Credit cards typically offer robust fraud protection and zero liability for unauthorized charges.

- Purchase protection: Some credit cards offer extended warranties or insurance on purchases.

- Grace period: Most credit cards offer a grace period between purchase and payment due date, allowing for short-term, interest-free borrowing.

Disadvantages of Credit Cards

Credit cards also come with potential pitfalls that users should be aware of:

- High interest rates: If you carry a balance, credit cards can charge significant interest, often exceeding 20% APR.

- Potential for debt: The ability to spend beyond your means can lead to accumulating debt.

- Annual fees: Some credit cards, especially those with premium rewards, charge annual fees.

- Impact on credit score: Misuse of credit cards can negatively affect your credit score.

- Complex terms and conditions: Credit card agreements often include complex terms that can be difficult to understand.

Debit Cards in the Context of Personal Finance

Debit cards play a crucial role in personal finance management. They serve as a direct link to your checking account, allowing for real-time tracking of expenses and helping to prevent overspending. This feature is particularly beneficial for those who are trying to adhere to a strict budget or are working to improve their financial discipline.

In the realm of forex and international transactions, debit cards can offer advantages. Many banks now provide debit cards with low or no foreign transaction fees, making them an attractive option for travelers or those who frequently make international purchases. However, it’s important to note that exchange rates applied to debit card transactions may not always be as favorable as those available through specialized forex services.

For investors in the crypto market, some debit cards now offer the ability to spend cryptocurrency balances directly. These crypto-linked debit cards convert digital assets to fiat currency at the point of sale, providing a bridge between the crypto and traditional financial worlds.

Credit Cards: A Tool for Financial Growth

Credit cards, when used responsibly, can be powerful tools for financial growth and management. The ability to build credit history through regular use and timely payments can have far-reaching implications for an individual’s financial future. A strong credit score can lead to more favorable terms on mortgages, auto loans, and other financial products.

In the context of investing and money markets, credit cards can offer unique advantages. Some cards provide investment rewards, allowing users to earn stocks or contribute to investment accounts with their spending. This feature can be particularly appealing to those looking to grow their investment portfolio passively.

For forex traders and international investors, certain credit cards offer no foreign transaction fees and competitive exchange rates, potentially saving significant amounts on cross-border transactions. Additionally, the purchase protection and extended warranties offered by many credit cards can be valuable for those making large purchases of trading equipment or technology.

The Role of Debit and Credit Cards in Modern Finance

As the financial landscape continues to evolve, both debit and credit cards are adapting to new technologies and consumer needs. The rise of contactless payments and mobile wallets has made both types of cards more convenient than ever. Many debit and credit cards now offer features like virtual card numbers for enhanced security in online transactions, a crucial consideration in an era of increasing cyber threats.

In the realm of cryptocurrency, some credit card issuers have begun offering crypto rewards, allowing users to earn digital assets on their spending. This intersection of traditional finance and cryptocurrency represents an exciting frontier for tech-savvy consumers and investors.

It’s important to note that the choice between debit and credit cards is not mutually exclusive. Many financial experts recommend a balanced approach, using debit cards for everyday expenses and budgeting, while strategically employing credit cards for their rewards, protections, and credit-building benefits.

For those involved in trading or investing, maintaining a mix of both card types can provide flexibility and security. Debit cards can be used for immediate expenses and withdrawals, while credit cards can offer a buffer for larger trades or unexpected market movements.

In conclusion, both debit and credit cards have their place in a well-rounded financial strategy. The key is to understand the pros and cons of each, use them responsibly, and align their usage with your personal financial goals and risk tolerance. As with any financial tool, education and disciplined use are crucial to maximizing benefits while minimizing potential drawbacks.

Frequently Asked Questions About Debit Card Vs Credit Card Pros And Cons

- Which is safer to use online, a debit card or a credit card?

Credit cards generally offer better protection for online purchases. They typically have stronger fraud protection policies and don’t directly access your bank account. - Can using a credit card help improve my credit score?

Yes, responsible use of a credit card can help improve your credit score. Consistently making on-time payments and maintaining a low credit utilization ratio can positively impact your credit history. - Are there any debit cards that offer rewards similar to credit cards?

Some banks offer rewards debit cards, but they are less common and typically offer lower rewards rates compared to credit cards. Examples include cashback on purchases or points for debit transactions. - What should I do if my debit card is lost or stolen?

Immediately contact your bank to report the loss and freeze the card. Most banks have 24/7 hotlines for this purpose. Review your recent transactions and report any unauthorized charges. - Is it possible to build credit using a debit card?

Generally, debit card usage does not impact your credit score. However, some banks offer credit-builder programs linked to debit cards, which may help establish credit history. - How do overdraft fees work with debit cards?

Overdraft fees are charged when you spend more than the available balance in your account. These fees can be substantial, often around $30-$35 per transaction. Many banks offer overdraft protection services to help avoid these fees. - Can I use my credit card for cash advances, and are there any drawbacks?

Yes, you can use a credit card for cash advances, but it’s generally not recommended. Cash advances often come with high fees and interest rates that start accruing immediately, with no grace period. - How do foreign transaction fees compare between debit and credit cards?

Foreign transaction fees can vary widely between cards. Some credit cards, especially travel-focused ones, offer no foreign transaction fees. Debit cards from major banks often charge around 1-3% for foreign transactions, but some online banks offer fee-free international use.