The use of debit cards has become increasingly popular as consumers seek convenient and efficient ways to manage their finances. Unlike credit cards, which allow users to borrow money up to a certain limit, debit cards draw directly from the user’s bank account. This fundamental difference shapes the advantages and disadvantages associated with debit card usage. Understanding these pros and cons is essential for individuals looking to make informed financial decisions, especially in the context of budgeting, spending habits, and overall financial health.

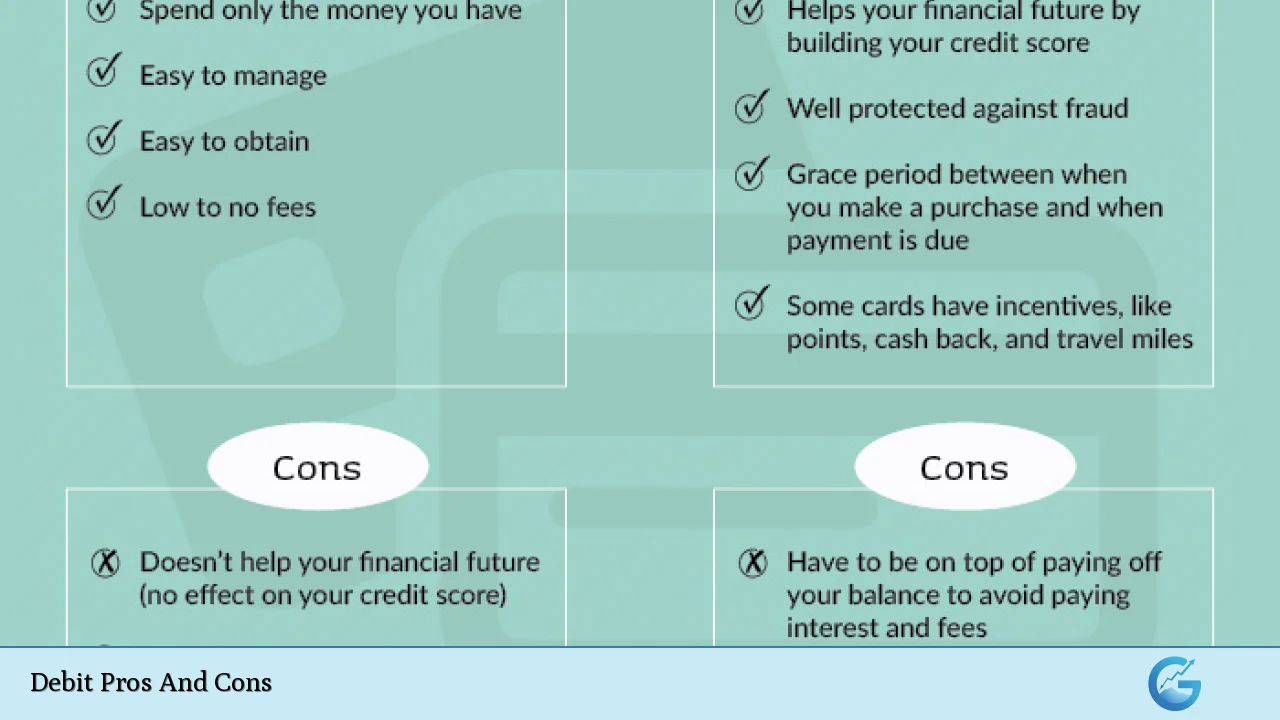

| Pros | Cons |

|---|---|

| No debt accumulation | Limited fraud protection |

| No interest charges | No credit score boost |

| Easy access to cash | Overdraft fees |

| Encourages responsible spending | No rewards programs |

| Widely accepted | Less protection for refunds |

| Immediate transaction processing | Potential for fees on ATM withdrawals |

| Convenient budgeting tool | Lack of grace periods for payments |

| Easier qualification compared to credit cards | Spending limitations due to account balance |

No Debt Accumulation

One of the primary advantages of using a debit card is that it allows you to spend only the money you have in your bank account. This feature significantly reduces the risk of accumulating debt, as users cannot overspend beyond their available balance.

- Budget Control: Since debit cards draw directly from your checking account, they encourage users to maintain better control over their spending habits.

- Financial Discipline: This pay-as-you-go approach can help prevent impulsive purchases that often lead to financial strain.

Limited Fraud Protection

While debit cards do offer some level of fraud protection, it is generally less comprehensive than that provided by credit cards. If a debit card is lost or stolen, unauthorized transactions can lead to immediate financial loss.

- Immediate Impact: Fraudulent charges can directly deplete your bank account, which may take time to resolve through your bank’s investigation process.

- Less Robust Recovery Options: Unlike credit cards, which often have zero liability policies for fraudulent charges, debit card users may find it more challenging to recover lost funds.

No Interest Charges

Another significant benefit of debit cards is that they do not incur interest charges. Since you are using your own money, you avoid the high-interest rates associated with credit card balances.

- Cost Savings: This can lead to substantial savings over time, especially for individuals who might otherwise carry a balance on a credit card.

- Transparent Costs: Users are only responsible for what they spend without worrying about accruing interest on unpaid balances.

No Credit Score Boost

A notable disadvantage of using debit cards is that they do not contribute positively to your credit score.

- Credit Building: For individuals looking to improve their credit history, relying solely on debit cards will not aid in achieving this goal.

- Potential Negative Impact: Conversely, negative activities related to overdrafts or insufficient funds can adversely affect your overall financial profile.

Easy Access to Cash

Debit cards provide convenient access to cash through ATMs, allowing users to withdraw funds as needed without incurring high fees associated with cash advances on credit cards.

- ATM Usage: Most banks offer fee-free withdrawals at their ATMs, making it easy to access cash without additional costs.

- Quick Transactions: The ability to quickly obtain cash makes debit cards particularly useful for everyday purchases or emergencies.

Overdraft Fees

Despite their advantages, debit cards can also lead to unexpected costs if users spend more than their available balance.

- Overdraft Charges: Many banks impose hefty fees for overdrafts, which can accumulate quickly if not monitored closely.

- Financial Strain: These charges can create financial stress and may negate some benefits of using a debit card for budgeting purposes.

Encourages Responsible Spending

Debit cards inherently encourage responsible spending habits by limiting expenditures to available funds.

- Budgeting Tool: Users are more likely to think critically about their purchases when they know they cannot exceed their current balance.

- Financial Awareness: This awareness can foster better financial habits over time, particularly among young adults or those new to managing their finances.

No Rewards Programs

Unlike many credit cards that offer rewards such as cashback or travel points, most debit cards lack similar incentives.

- Missed Benefits: Users miss out on potential perks that could enhance their purchasing power or provide additional value.

- Limited Offers: While some banks do offer limited rewards programs for debit card usage, these are typically not as lucrative as those associated with credit cards.

Widely Accepted

Debit cards are generally accepted at most retailers and online platforms, making them a versatile payment option.

- Global Use: They can be used internationally where major networks like Visa or Mastercard are accepted.

- Convenience: This widespread acceptance ensures that users can easily make purchases without needing cash.

Less Protection for Refunds

When it comes to disputes over transactions or refunds, debit card users may face challenges compared to credit card holders.

- Dispute Resolution: The process for disputing charges or obtaining refunds can be more complicated with debit cards.

- Risky Purchases: Using a debit card for significant purchases may expose consumers to greater risk if products are faulty or services are not delivered as promised.

Immediate Transaction Processing

Transactions made with debit cards are typically processed immediately, providing real-time updates on account balances.

- Instantaneous Feedback: Users can see the impact of their spending right away, which aids in maintaining budgetary control.

- Avoiding Surprises: This immediacy helps prevent the unpleasant surprise of overdraft fees due to unaccounted transactions.

Potential for Fees on ATM Withdrawals

While many banks offer free ATM withdrawals within their network, using ATMs outside this network can incur fees.

- Cost Awareness: Users should be aware of potential charges when withdrawing cash from non-affiliated ATMs.

- Fee Structures Vary: It’s essential for consumers to understand their bank’s fee structure regarding ATM usage.

Convenient Budgeting Tool

Debit cards serve as an excellent tool for budgeting since they limit spending based on available funds in the user’s account.

- Financial Planning Aid: They help individuals stick to budgets by preventing overspending and encouraging mindful purchasing behavior.

- Tracking Expenses Easily: Many banks provide online banking tools that allow users to track spending patterns effectively through their debit card transactions.

Lack of Grace Periods for Payments

Unlike credit cards that often come with grace periods before interest accrues on unpaid balances, debit card transactions deduct funds immediately from the user’s account.

- No Delay in Payment Processing: This means there is no opportunity for users to delay payments without incurring immediate consequences.

- Increased Financial Pressure: For those who struggle with tracking expenses closely, this lack of grace period can create additional financial pressure.

Spending Limitations Due to Account Balance

The most significant limitation of using a debit card is that spending is strictly tied to the available balance in the linked bank account.

- Pre-set Limits: Banks often impose daily withdrawal limits which may restrict access during emergencies or larger purchases.

- Financial Flexibility Issues: This limitation can be a drawback when unexpected expenses arise and immediate access to additional funds is necessary.

In conclusion, while debit cards offer numerous advantages such as ease of use, budget control, and no debt accumulation, they also come with significant drawbacks including limited fraud protection and no rewards programs. Understanding these pros and cons is crucial for individuals looking to navigate their financial landscape effectively. By weighing these factors carefully against personal financial goals and habits, consumers can make informed decisions about whether a debit card aligns with their needs in managing finances effectively in today’s complex economic environment.

Frequently Asked Questions About Debit Pros And Cons

- What are the main advantages of using a debit card?

The main advantages include no debt accumulation since you spend only what you have in your account and no interest charges associated with purchases. - What are the risks associated with using a debit card?

The primary risks include limited fraud protection compared to credit cards and potential overdraft fees if you exceed your available balance. - Can using a debit card help with budgeting?

Yes, because it limits spending strictly based on available funds in your bank account, encouraging responsible financial management. - Do debit cards offer rewards like credit cards?

No, most debit cards do not offer rewards programs comparable to those offered by many credit cards. - How does using a debit card affect my credit score?

Using a debit card does not impact your credit score since it does not involve borrowing money. - Are there any fees associated with using a debit card?

Yes, there may be fees related to overdrafts or ATM withdrawals outside your bank’s network. - Is it safe to use a debit card online?

While many banks implement security measures like two-factor authentication, using a debit card online poses risks since it is directly linked to your bank account. - What should I consider before choosing between a debit and credit card?

You should consider factors such as your spending habits, need for rewards programs, desire for building credit history, and how comfortable you are managing potential risks associated with each type of card.