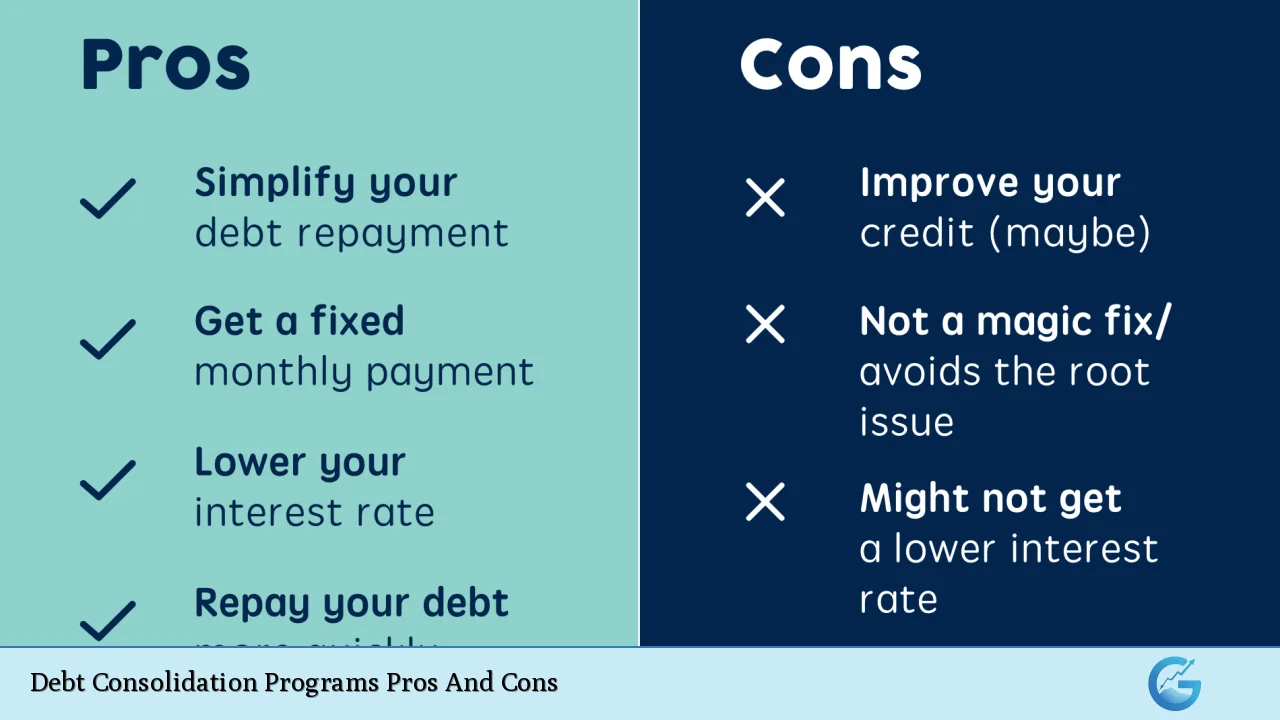

Debt consolidation is a financial strategy that involves combining multiple debts into a single loan or payment. This approach can simplify the repayment process and potentially lower overall interest rates, making it an appealing option for many individuals struggling with debt. However, while debt consolidation can provide immediate relief, it also has its drawbacks. Understanding the pros and cons of debt consolidation programs is crucial for anyone considering this option.

| Pros | Cons |

|---|---|

| Simplifies monthly payments | Potentially higher overall costs |

| May lower interest rates | Risk of accumulating more debt |

| Improves cash flow | Impact on credit score |

| Can help manage past-due accounts | Fees and penalties involved |

| Potential for faster debt repayment | Not a solution for underlying financial issues |

| Access to professional guidance | Eligibility requirements can be strict |

| Helps in building credit over time | Limited to unsecured debts in most cases |

| Reduces stress associated with multiple creditors | May require collateral, risking assets like a home |

Simplifies Monthly Payments

One of the primary advantages of debt consolidation is that it simplifies your monthly payments. Instead of managing several different payments to various creditors, you only have one payment to focus on. This can significantly reduce the likelihood of missing a payment, which can lead to additional fees and damage to your credit score.

- Easier management: With only one payment, budgeting becomes more straightforward.

- Less stress: Fewer bills mean less anxiety about meeting multiple deadlines.

May Lower Interest Rates

Debt consolidation often allows individuals to secure a lower interest rate than what they are currently paying on their existing debts. This is particularly beneficial for those with high-interest credit card debt.

- Cost savings: A lower interest rate means that more of your payment goes toward paying down the principal rather than interest.

- Long-term financial benefits: Over time, this can lead to significant savings, especially if you are consolidating high-interest debts.

Improves Cash Flow

By consolidating debts into a single loan with potentially lower monthly payments, individuals can improve their cash flow. This extra cash can be used for other essential expenses or savings.

- Increased disposable income: With lower payments, you may find it easier to manage daily expenses.

- Opportunity for savings: The money saved from reduced payments can be redirected toward building an emergency fund or investing.

Can Help Manage Past-Due Accounts

Debt consolidation can also assist in bringing past-due accounts current. By consolidating debts, you may be able to negotiate better terms with creditors and avoid collections.

- Restores credit standing: Bringing accounts up to date can improve your credit score over time.

- Negotiation leverage: A consolidated loan may provide you with leverage to negotiate better terms from creditors.

Potential for Faster Debt Repayment

If managed correctly, debt consolidation can lead to faster repayment of debts. By combining debts into a single loan with a structured repayment plan, borrowers may find themselves on a quicker path to financial freedom.

- Structured repayment plans: Many consolidation loans come with fixed terms that encourage timely repayment.

- Motivation to pay off debt: Knowing there’s only one loan can motivate individuals to focus on paying it off quickly.

Access to Professional Guidance

Many debt consolidation programs offer access to financial professionals who can provide guidance throughout the process. This support can be invaluable for those unfamiliar with financial management strategies.

- Expert advice: Financial counselors can help tailor a plan that suits your specific needs and circumstances.

- Accountability: Having a professional involved can encourage better financial habits and discipline.

Helps in Building Credit Over Time

While taking out a new loan may initially impact your credit score, consistent on-time payments on a consolidated loan can help rebuild your credit over time.

- Improved credit utilization ratio: Paying off existing debts reduces your overall credit utilization, positively impacting your score.

- Establishing positive payment history: Regular payments demonstrate reliability to future lenders.

Potentially Higher Overall Costs

Despite the benefits of lower monthly payments and interest rates, consolidating debt could lead to higher overall costs if not managed properly.

- Longer repayment terms: Extending the life of the loan may reduce monthly payments but increase total interest paid over time.

- Fees associated with loans: Many lenders charge origination fees or closing costs that can add up quickly.

Risk of Accumulating More Debt

One significant disadvantage of debt consolidation is the potential risk of accumulating more debt after consolidating existing obligations.

- Access to credit lines: After consolidating, individuals may still have access to previously available credit lines, leading them to incur additional debt.

- Behavioral patterns: If spending habits do not change, individuals may find themselves in a similar or worse financial situation after consolidation.

Impact on Credit Score

While consolidating debts may improve your credit score over time through responsible management, there is often an initial dip when applying for new loans due to hard inquiries on your credit report.

- Short-term impact: New inquiries can temporarily lower your score as lenders assess your creditworthiness.

- Long-term recovery required: It may take time and consistent payments before you see significant improvements in your score.

Fees and Penalties Involved

Debt consolidation often comes with various fees that can diminish the benefits of consolidating in the first place.

- Upfront costs: Many lenders charge fees for processing loans which could offset any savings from lower interest rates.

- Prepayment penalties: Some loans may impose penalties if you pay them off early, which could limit flexibility in managing finances later on.

Not a Solution for Underlying Financial Issues

Consolidating debt does not address the root causes of financial problems. Individuals must still manage their spending habits and create sustainable budgets post-consolidation.

- Behavioral changes required: Without addressing underlying issues such as overspending or lack of budgeting skills, individuals risk falling back into debt after consolidation.

- Financial education needed: It’s crucial for borrowers to educate themselves about managing finances effectively beyond just consolidating debts.

Eligibility Requirements Can Be Strict

Many debt consolidation programs have strict eligibility criteria that may exclude some individuals from participating.

- Credit score requirements: Those with poor credit scores might find it challenging to secure favorable terms or even qualify for certain programs at all.

- Income verification needed: Lenders typically require proof of stable income before approving loans, which could limit options for those unemployed or underemployed.

Limited to Unsecured Debts in Most Cases

Most debt consolidation programs focus primarily on unsecured debts such as credit cards and personal loans. This limitation means that secured debts like mortgages or auto loans might not be eligible for consolidation through these programs.

- Exclusion of certain debts: Borrowers must consider how other secured debts will be managed outside of the consolidation program.

- Potential complexity in managing multiple types of debt: If secured debts remain separate from consolidated ones, it could complicate overall financial management strategies.

May Require Collateral, Risking Assets Like a Home

Some forms of debt consolidation involve securing loans against assets such as homes or vehicles. This practice carries inherent risks if repayments are not met.

- Risk of losing assets: Defaulting on secured loans could result in losing valuable property like homes or cars used as collateral.

- Increased financial pressure: The stakes are higher when personal assets are tied into the repayment structure of consolidated loans.

In conclusion, while debt consolidation programs offer numerous advantages such as simplified payments and potential cost savings, they also come with significant risks and drawbacks that must be carefully considered. Individuals should evaluate their financial situations thoroughly before deciding whether this strategy aligns with their long-term goals. It is essential not only to focus on immediate relief but also on developing sustainable financial habits that will prevent future indebtedness.

Frequently Asked Questions About Debt Consolidation Programs Pros And Cons

- What is debt consolidation?

Debt consolidation is the process of combining multiple debts into one loan or payment plan, typically aimed at reducing interest rates and simplifying repayment. - How does debt consolidation affect my credit score?

Your credit score may initially dip due to hard inquiries; however, consistent on-time payments can improve it over time. - Are there any fees associated with debt consolidation?

Yes, many lenders charge origination fees or closing costs which could offset potential savings from lower interest rates. - Can I consolidate secured debts like mortgages?

No, most debt consolidation programs focus on unsecured debts; secured debts typically remain separate. - What are the eligibility requirements for a debt consolidation program?

Eligibility often includes having a certain level of unsecured debt and meeting specific income and credit score criteria. - Will I still have access to my old credit lines after consolidating?

Yes, unless you take steps to close these accounts; having access could lead you back into further debt. - Is consolidating my debt a guaranteed solution?

No, while it simplifies payments and potentially lowers costs, it does not address underlying financial habits that need improvement. - What should I do if I don’t qualify for a debt consolidation program?

If you don’t qualify, consider alternatives like debt management plans or working with a nonprofit credit counseling service.