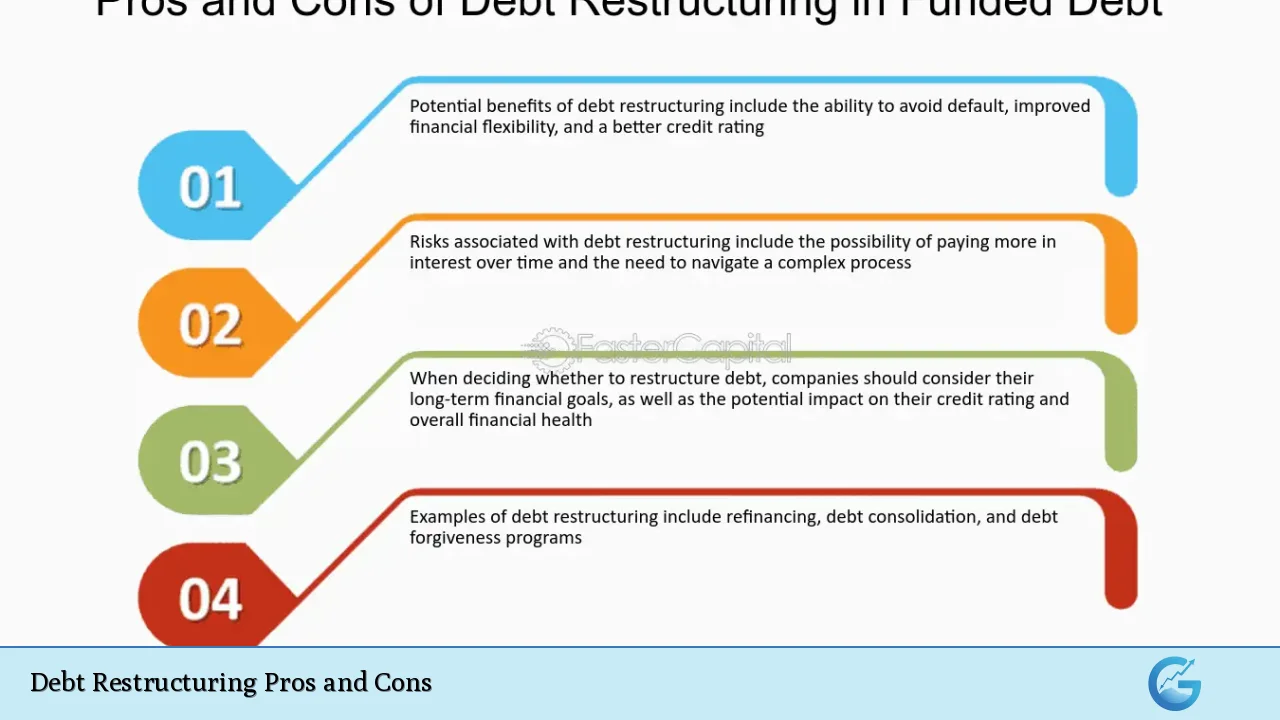

Debt restructuring is a financial strategy employed by individuals or businesses facing significant financial challenges. It involves renegotiating the terms of existing debt obligations to make them more manageable, thereby avoiding default or bankruptcy. This process can take various forms, including extending repayment periods, reducing interest rates, or even forgiving a portion of the debt. While debt restructuring can provide immediate relief and pave the way for recovery, it also comes with its own set of challenges and potential drawbacks. Understanding the pros and cons of debt restructuring is crucial for anyone involved in finance, whether as an investor, a business owner, or an individual managing personal finances.

| Pros | Cons |

|---|---|

| Avoids bankruptcy and legal proceedings | Negative impact on credit score |

| Improves cash flow through lower payments | Potential for higher overall interest costs |

| Negotiates more favorable terms with creditors | May incur additional fees for restructuring services |

| Provides legal protection from creditors | Not all creditors may agree to the new terms |

| Can enhance financial stability in the long run | Complex and time-consuming process |

| May preserve jobs and business operations | Risk of not meeting restructured payment terms |

| Allows for a fresh start financially | Potential tax implications on forgiven debt |

| Can improve future borrowing prospects if managed well | Requires strong negotiation skills and leverage |

Avoids Bankruptcy and Legal Proceedings

One of the most significant advantages of debt restructuring is that it can help individuals or businesses avoid the dire consequences of bankruptcy.

- Legal Protection: During the restructuring process, debtors often gain legal protections that prevent creditors from pursuing collection actions.

- Preservation of Assets: This approach can protect valuable assets from being liquidated to satisfy debts.

- Continuity of Operations: For businesses, avoiding bankruptcy means they can continue operations, preserving jobs and maintaining relationships with customers and suppliers.

Improves Cash Flow Through Lower Payments

Debt restructuring typically results in lower monthly payments, which can significantly improve cash flow.

- Extended Repayment Periods: By extending the repayment period, borrowers can reduce their monthly obligations, making it easier to manage their finances.

- Reduced Interest Rates: Negotiating lower interest rates can further alleviate financial pressure, allowing borrowers to allocate funds to other essential areas.

Negotiates More Favorable Terms with Creditors

The restructuring process allows borrowers to negotiate directly with creditors for better terms.

- Customized Solutions: Borrowers can tailor solutions that fit their specific financial situation, such as adjusting payment schedules or negotiating principal reductions.

- Mutual Benefit: Creditors may prefer restructuring over bankruptcy since it allows them to recover some amount rather than potentially losing everything in a bankruptcy proceeding.

Provides Legal Protection from Creditors

Debt restructuring offers legal safeguards that are not typically available once a borrower defaults.

- Automatic Stay: Many jurisdictions provide an automatic stay on collections during the restructuring process, giving borrowers time to negotiate without harassment from creditors.

- Court Supervision: In some cases, court involvement may oversee the restructuring process, ensuring fairness and adherence to legal standards.

Can Enhance Financial Stability in the Long Run

Successfully navigating through debt restructuring can lead to improved financial health over time.

- Better Debt Management: By reworking existing debts into manageable payments, borrowers can stabilize their finances and avoid future defaults.

- Rebuilding Credit: If managed properly post-restructuring, borrowers may gradually rebuild their credit scores, enhancing future borrowing opportunities.

Negative Impact on Credit Score

While debt restructuring can provide immediate relief, it often negatively affects credit scores.

- Short-Term Damage: The act of restructuring itself may be reported to credit bureaus as a negative mark, impacting credit ratings temporarily.

- Long-Term Effects: Although borrowers may recover over time, initial damage can make obtaining new credit more challenging until scores improve.

Potential for Higher Overall Interest Costs

Despite lower initial payments, debt restructuring can lead to higher total costs over time.

- Extended Terms Mean More Interest Paid: Longer repayment periods may result in paying more interest overall compared to original loan terms.

- Higher Rates Post-Recovery: If a borrower’s credit score suffers significantly due to restructuring, future loans may come with higher interest rates due to perceived risk by lenders.

May Incur Additional Fees for Restructuring Services

Engaging in debt restructuring often involves costs that borrowers should consider carefully.

- Professional Fees: Hiring financial advisors or legal experts to assist with negotiations can add significant expenses to the process.

- Administrative Costs: Some lenders may charge fees for processing changes to loan agreements or other administrative tasks associated with restructuring.

Not All Creditors May Agree to the New Terms

A potential drawback is that not all creditors are obligated to accept restructured terms.

- Creditor Resistance: Some creditors may refuse to negotiate favorable terms if they believe they can recover more through other means.

- Unequal Treatment Among Creditors: Different creditors may have varying responses to restructuring proposals, leading to complications if some agree while others do not.

Complex and Time-Consuming Process

The debt restructuring process is often intricate and requires careful planning and execution.

- Lengthy Negotiations: Reaching an agreement with all parties involved can take considerable time and effort.

- Documentation Requirements: Borrowers must prepare extensive documentation detailing their financial situation, which can be burdensome and stressful.

Risk of Not Meeting Restructured Payment Terms

After successfully negotiating new terms, there remains a risk that borrowers may not be able to meet them.

- Continued Financial Strain: If underlying financial issues are not resolved, borrowers could find themselves unable to keep up with restructured payments as well.

- Potential for Further Default: Failing to meet new obligations could lead back into default or even bankruptcy if conditions worsen again.

Potential Tax Implications on Forgiven Debt

If any portion of the debt is forgiven during restructuring, it may have tax consequences for the borrower.

- Taxable Income: The IRS may treat forgiven debt as taxable income, leading to unexpected tax liabilities that could further complicate financial recovery efforts.

- Planning Required: Borrowers should consult tax professionals when considering debt forgiveness as part of their restructuring strategy to understand potential impacts fully.

Requires Strong Negotiation Skills and Leverage

Successful debt restructuring often hinges on effective negotiation skills and leverage against creditors.

- Knowledgeable Representation Needed: Borrowers who lack experience in negotiations may benefit from hiring professionals who understand creditor dynamics and negotiation tactics.

- Positioning for Success: Borrowers must present a compelling case showing why restructuring benefits both parties; without this leverage, negotiations could fail or yield unfavorable results.

In conclusion, debt restructuring presents both significant advantages and notable disadvantages. While it offers a pathway out of financial distress by improving cash flow and providing legal protections against creditors, it also carries risks such as negative impacts on credit scores and potential long-term costs. Individuals and businesses considering this option should weigh these factors carefully against their unique circumstances. Engaging with financial advisors or legal experts can provide valuable insights into making informed decisions regarding debt management strategies.

Frequently Asked Questions About Debt Restructuring

- What is debt restructuring?

Debt restructuring involves modifying existing loan agreements to make them more manageable for borrowers facing financial difficulties. - How does debt restructuring affect my credit score?

The process typically has a negative impact on your credit score initially but can lead to improvements over time if managed well. - Can all types of debts be restructured?

Most debts can be restructured; however, acceptance depends on creditor policies and willingness. - What are common methods of debt restructuring?

Common methods include extending repayment periods, reducing interest rates, or negotiating partial forgiveness of debts. - Is professional help necessary for debt restructuring?

While not mandatory, professional assistance can enhance negotiation outcomes and ensure compliance with legal requirements. - What happens if I cannot meet restructured payment terms?

If you fail to meet new obligations, you risk defaulting again or potentially facing bankruptcy. - Are there any fees associated with debt restructuring?

Yes, there may be fees for professional services or administrative costs charged by lenders during the process. - Can I restructure my debts multiple times?

This depends on individual circumstances; however, frequent restructurings might indicate ongoing financial instability.