Debt settlement programs are designed to help individuals manage and reduce their debt burdens by negotiating with creditors to accept less than the full amount owed. These programs can be a viable option for those struggling with unmanageable debt, particularly unsecured debts like credit cards. However, like any financial strategy, they come with their own set of advantages and disadvantages. Understanding these can help individuals make informed decisions about their financial futures.

| Pros | Cons |

|---|---|

| Reduces total debt owed | Negative impact on credit score |

| Speeds up the repayment process | Potential for increased debt due to fees |

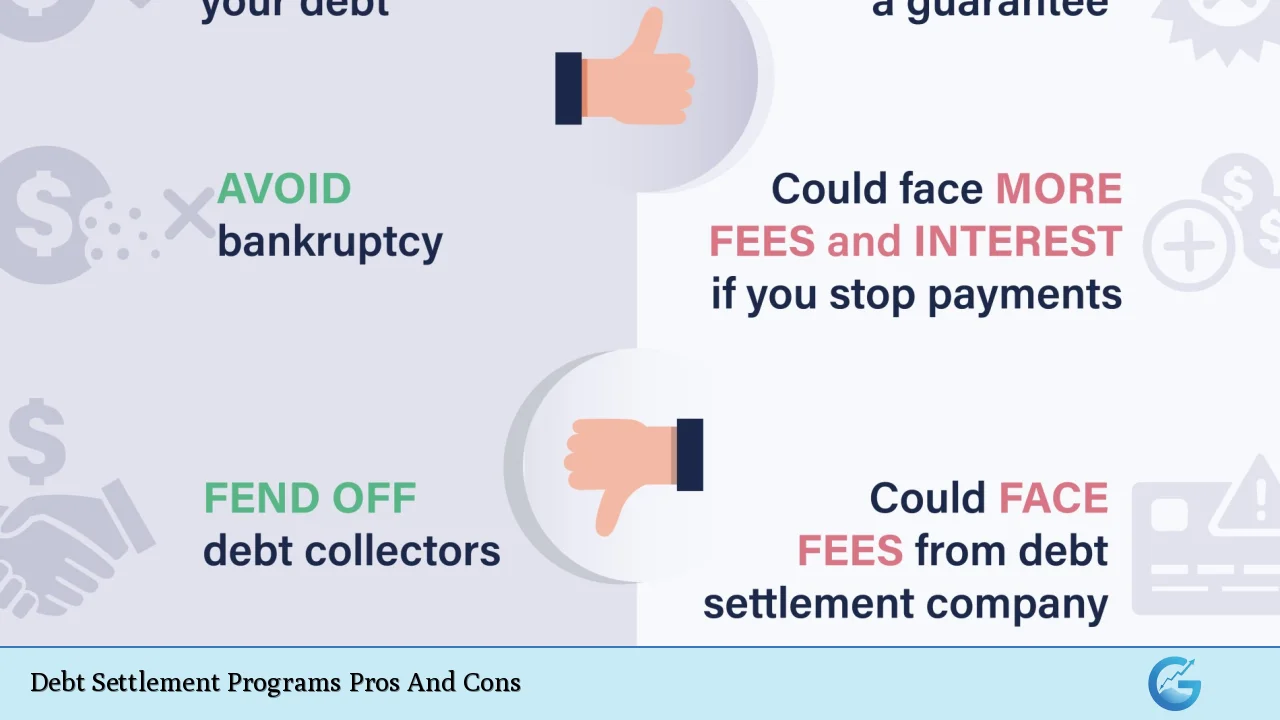

| Avoids bankruptcy | No guarantee of settlement success |

| Simplifies repayment process | Possible tax implications on forgiven debt |

| Provides relief from creditor harassment | Risk of scams and untrustworthy companies |

Reduces Total Debt Owed

One of the primary advantages of debt settlement is the potential to significantly reduce the total amount owed.

- Negotiation Power: Debt settlement companies negotiate with creditors to accept a lump-sum payment that is less than the total amount due. This can lead to substantial savings.

- Financial Relief: For many, this reduction can provide immediate financial relief, allowing them to redirect funds toward other essential expenses.

- Less Stress: Knowing that the debt is settled can alleviate the psychological burden associated with overwhelming financial obligations.

Speeds Up the Repayment Process

Debt settlement can expedite the repayment timeline compared to traditional repayment plans.

- Lump-Sum Payments: Often, debtors can settle their debts in a shorter timeframe by making a single lump-sum payment rather than stretching payments over several years.

- Quick Resolution: Many programs promise resolution within 24 to 48 months, which is significantly shorter than typical debt management plans that may last five years or longer.

Avoids Bankruptcy

For individuals facing severe financial distress, debt settlement offers an alternative to declaring bankruptcy.

- Preserves Credit Options: While debt settlement does affect credit scores, it may still be preferable to bankruptcy, which has more severe long-term consequences on one’s credit report.

- Employment Opportunities: Certain professions may disqualify candidates who have filed for bankruptcy, making debt settlement a more favorable option for maintaining employment prospects.

Simplifies Repayment Process

Debt settlement can streamline the management of multiple debts into a more manageable format.

- Consolidation of Payments: Instead of juggling various creditors and payment schedules, debtors may only need to focus on one negotiated amount.

- Less Administrative Hassle: This simplification reduces the time and effort needed to manage finances, allowing individuals to focus on rebuilding their financial health.

Provides Relief from Creditor Harassment

Once enrolled in a debt settlement program, individuals often experience a decrease in creditor harassment.

- Reduced Communication: Many companies handle communication with creditors on behalf of their clients, allowing individuals to avoid direct confrontations and stress related to collection efforts.

- Peace of Mind: This relief can contribute positively to mental health during a challenging financial period.

Negative Impact on Credit Score

One significant drawback of debt settlement is its adverse effect on credit scores.

- Settled Accounts Reporting: When debts are settled for less than what is owed, they are often reported as “settled” rather than “paid in full,” which can negatively impact credit ratings for up to seven years.

- Future Borrowing Difficulties: A lower credit score can hinder future borrowing opportunities, including loans for homes or cars, as well as affect rental applications and insurance premiums.

Potential for Increased Debt Due to Fees

While settling debts might reduce the overall amount owed, the process itself can incur additional costs.

- Service Fees: Many debt settlement companies charge fees that can range from 15% to 25% of the total enrolled debt. These fees are often deducted from savings intended for settlements.

- Accumulation of Late Fees: During negotiations, stopping payments can lead to accumulating late fees and interest charges, potentially increasing overall debt before settlements are reached.

No Guarantee of Settlement Success

There is no assurance that all debts will be successfully negotiated through a settlement program.

- Creditor Cooperation: Some creditors may refuse to negotiate or may not agree to settle at all, leaving individuals still responsible for their original debts.

- Uncertain Outcomes: This uncertainty can lead individuals back into financial distress if settlements do not materialize as planned.

Possible Tax Implications on Forgiven Debt

Another consideration when entering a debt settlement program is the potential tax consequences associated with forgiven amounts.

- Taxable Income: The IRS treats forgiven debt as taxable income. If $10,000 in debt is forgiven, you may owe taxes on that amount as if it were income received.

- Financial Planning Required: Individuals must be prepared for this potential tax liability when calculating their overall financial situation post-settlement.

Risk of Scams and Untrustworthy Companies

The rise in demand for debt relief solutions has unfortunately led to an increase in fraudulent companies promising unrealistic results.

- Research Needed: It is crucial for individuals seeking help to thoroughly research potential companies and verify their legitimacy through reviews and regulatory compliance.

- Avoiding Scams: Consumers should be wary of any company demanding upfront fees or making guarantees regarding specific outcomes without assessing individual circumstances first.

In conclusion, while debt settlement programs offer several advantages such as reducing total debt owed and expediting repayment processes, they also come with significant risks including negative impacts on credit scores and potential tax liabilities. Individuals considering this option should weigh these pros and cons carefully against their unique financial situations and seek reputable advice before proceeding.

Frequently Asked Questions About Debt Settlement Programs Pros And Cons

- What are some benefits of using a debt settlement program?

The main benefits include reducing total debts owed, speeding up repayment timelines, avoiding bankruptcy, simplifying payments, and alleviating creditor harassment. - What are the downsides of debt settlement?

The downsides include negative impacts on credit scores, potential accumulation of additional fees and interest charges during negotiations, no guaranteed success in settlements, tax implications on forgiven amounts, and risks associated with fraudulent companies. - How does debt settlement affect my credit score?

Debt settlements typically result in accounts being marked as “settled” rather than “paid in full,” which negatively affects your credit score for several years. - Are all types of debts eligible for settlement?

No, typically only unsecured debts like credit cards and personal loans qualify; secured debts like mortgages or car loans cannot be settled. - What should I look for in a reputable debt settlement company?

Look for companies that have positive reviews from previous clients, transparent fee structures without upfront costs, and compliance with state regulations. - Can I negotiate my own settlements?

Yes, individuals can negotiate directly with creditors; however, many find it beneficial to work with experienced professionals who understand negotiation tactics. - How long does it take to see results from a debt settlement program?

Most programs promise resolutions within 24 to 48 months depending on individual circumstances and creditor cooperation. - Will I have to pay taxes on settled debts?

Yes, forgiven debts may be considered taxable income by the IRS; it’s advisable to consult a tax professional regarding potential liabilities.