Declaring bankruptcy is a significant financial decision that can offer relief to individuals and businesses overwhelmed by debt. It is a legal process that allows debtors to eliminate or repay their debts under the protection of the bankruptcy court. While bankruptcy can provide a fresh start, it also comes with serious implications that can affect one’s financial future. This article explores the advantages and disadvantages of declaring bankruptcy, providing a comprehensive overview for those interested in finance, including aspects relevant to the money markets, crypto, and forex sectors.

| Pros | Cons |

|---|---|

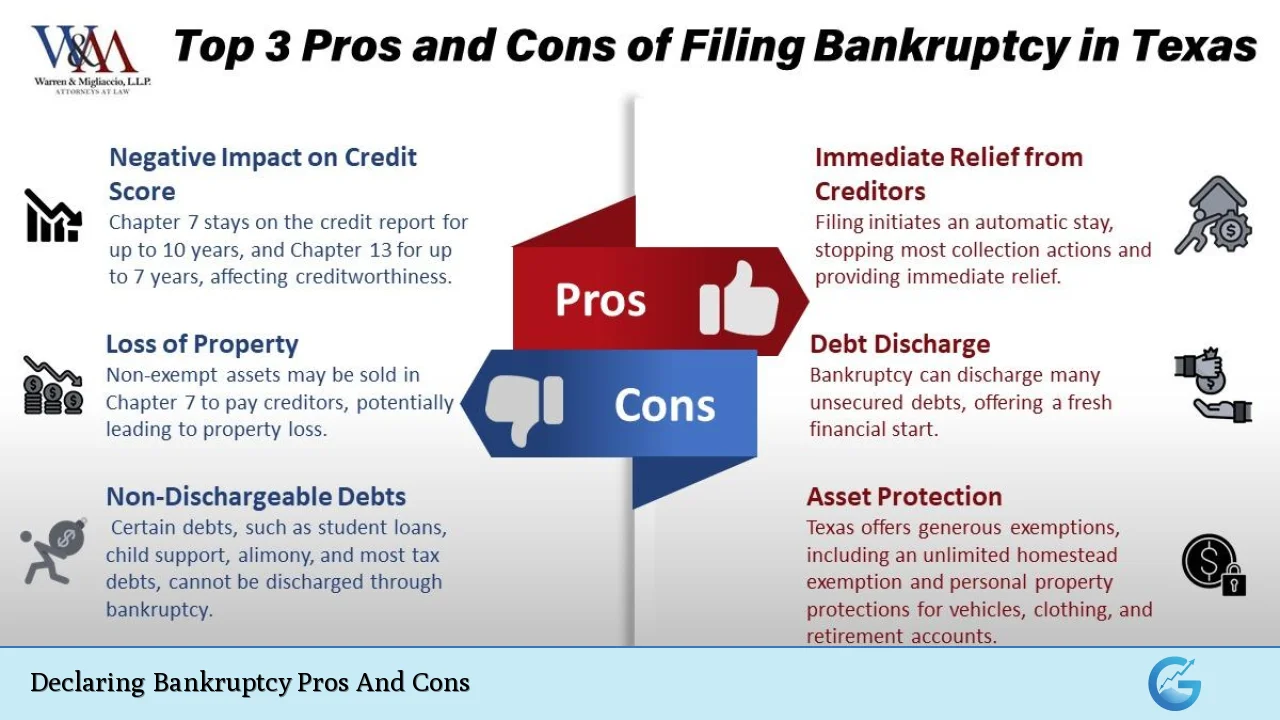

| Provides debt relief and a fresh start. | Can severely impact credit rating. |

| Stops collection efforts and legal actions. | May result in loss of assets. |

| Offers protection from creditors. | Not all debts are dischargeable. |

| Can lead to a structured repayment plan (Chapter 13). | Public record of bankruptcy can affect employment opportunities. |

| Potentially allows for the retention of certain assets. | Emotional and social stigma attached to bankruptcy. |

Provides Debt Relief and a Fresh Start

One of the primary advantages of declaring bankruptcy is the opportunity it provides for debt relief.

- Discharge of Debts: Most unsecured debts, such as credit card balances, personal loans, and medical bills, can be eliminated.

- Fresh Financial Start: After bankruptcy, individuals can rebuild their financial lives without the burden of overwhelming debt.

- Types of Bankruptcy: Different chapters (e.g., Chapter 7 or Chapter 13) offer various paths to debt relief based on individual circumstances.

This fresh start can be particularly beneficial for individuals who have faced unexpected financial hardships such as job loss or medical emergencies.

Stops Collection Efforts and Legal Actions

Filing for bankruptcy immediately triggers an automatic stay, which halts all collection activities from creditors.

- Protection from Harassment: Debtors are protected from aggressive collection calls, lawsuits, and wage garnishments.

- Legal Shield: This protection allows individuals to focus on their financial recovery without the stress of constant creditor pressure.

- Temporary Relief: The stay remains in effect until the bankruptcy case is resolved, providing crucial breathing room for debtors.

This aspect of bankruptcy can alleviate significant emotional stress associated with financial difficulties.

Offers Protection from Creditors

Bankruptcy provides a legal framework that protects individuals from creditors during the bankruptcy process.

- Court Oversight: The bankruptcy court oversees the proceedings, ensuring fair treatment for both debtors and creditors.

- Equitable Distribution: In cases where assets are liquidated, the court ensures that proceeds are distributed equitably among creditors according to legal priorities.

- Trustee Involvement: A court-appointed trustee manages the case, representing the interests of both parties throughout the process.

This structured approach helps maintain order during what can be a chaotic time for those facing financial distress.

Can Lead to a Structured Repayment Plan (Chapter 13)

For those who file under Chapter 13 bankruptcy, there is an opportunity to create a structured repayment plan that allows them to pay back debts over time while retaining their assets.

- Flexible Payment Terms: Debtors can propose a repayment plan that fits their budget over three to five years.

- Asset Retention: Unlike Chapter 7, Chapter 13 allows individuals to keep their property while making payments according to their plan.

- Potential Debt Reduction: In some cases, unsecured debts may be paid at reduced amounts based on what the debtor can afford.

This option is particularly appealing for individuals who wish to avoid losing their homes or other significant assets while still addressing their debts.

Potentially Allows for the Retention of Certain Assets

While some types of bankruptcy involve liquidating assets to pay creditors, others allow for asset retention under specific conditions.

- Exemptions Available: Many states have laws that protect certain assets from being sold in bankruptcy proceedings. This includes essential household items and sometimes vehicles.

- Strategic Planning: Individuals can often plan their filings strategically to maximize asset retention while still achieving debt relief.

- State Variations: The specifics of what can be retained vary by state, making it essential for individuals to understand local laws when considering bankruptcy.

This aspect makes bankruptcy more appealing for those worried about losing essential property during financial recovery efforts.

Can Severely Impact Credit Rating

Despite its benefits, declaring bankruptcy has significant drawbacks, particularly concerning credit ratings.

- Long-Term Impact: A bankruptcy filing remains on an individual’s credit report for up to ten years, which can hinder future borrowing opportunities.

- Higher Interest Rates: Individuals may face higher interest rates on loans due to perceived risk by lenders after declaring bankruptcy.

- Difficulty Obtaining Credit: Securing new credit cards or loans may become challenging as lenders view bankruptcies unfavorably.

The long-term effects on creditworthiness necessitate careful consideration before proceeding with a bankruptcy filing.

May Result in Loss of Assets

One of the most significant disadvantages of declaring bankruptcy is the potential loss of valuable assets.

- Liquidation Process: In Chapter 7 bankruptcies, non-exempt assets may be sold off by a trustee to repay creditors. This could include homes or investments if they exceed exemption limits.

- Emotional Toll: Losing personal property can have an emotional impact on individuals and families already struggling financially.

- Asset Evaluation: The evaluation process used by trustees may result in unexpected losses if individuals are not fully aware of what constitutes exempt versus non-exempt property.

This risk highlights why individuals should seek professional advice before filing for bankruptcy.

Not All Debts Are Dischargeable

Bankruptcy does not eliminate all types of debt, which is a crucial consideration when evaluating this option.

- Non-dischargeable Debts: Certain obligations like child support, alimony, student loans (in most cases), and some tax debts cannot be discharged through bankruptcy proceedings.

- Secured Debts Remain: Mortgages and car loans are typically secured debts that must be paid unless the asset is surrendered or repossessed voluntarily.

- Partial Discharge Possibility: In some cases under Chapter 13, only portions of unsecured debts may be discharged based on repayment plans approved by the court.

Understanding these limitations is vital for anyone considering bankruptcy as a solution to their financial issues.

Public Record of Bankruptcy Can Affect Employment Opportunities

Declaring bankruptcy becomes part of public record and may have implications beyond just financial aspects.

- Employment Risks: Some employers may view a history of bankruptcy unfavorably, particularly if the job involves handling money or trust funds.

- Professional Licenses Impacted: Certain professions may have licensing requirements that are affected by a personal bankruptcy filing.

- Social Stigma: The stigma associated with declaring bankruptcy might influence personal relationships and social standing within communities or industries.

These factors underscore the importance of considering not only financial but also social implications before proceeding with a bankruptcy declaration.

Emotional and Social Stigma Attached to Bankruptcy

The decision to declare bankruptcy often carries an emotional burden due to societal perceptions surrounding financial failure.

- Feelings of Shame or Failure: Many individuals experience feelings of shame or embarrassment when filing for bankruptcy due to societal expectations about financial responsibility.

- Impact on Relationships: Personal relationships may suffer as friends or family react negatively or misunderstand the necessity behind such a decision.

- Support Systems Needed: Individuals going through this process may benefit from counseling or support groups that address both emotional and practical aspects related to financial recovery.

Recognizing these emotional challenges is essential when navigating through the complexities surrounding bankruptcies.

In conclusion, declaring bankruptcy presents both significant advantages and notable disadvantages. While it offers much-needed relief from overwhelming debt and provides legal protections against creditors, it also carries lasting consequences such as damaged credit ratings and potential loss of assets. Individuals must weigh these factors carefully against their unique circumstances before deciding whether this path is right for them. Consulting with financial advisors or legal professionals can provide valuable insights tailored to individual needs in navigating this complex decision-making process.

Frequently Asked Questions About Declaring Bankruptcy

- What types of debts can be discharged in bankruptcy?

Most unsecured debts like credit cards and medical bills can be discharged; however, secured debts like mortgages typically cannot be wiped out without surrendering the property. - How long does a bankruptcy stay on my credit report?

A Chapter 7 bankruptcy remains on your credit report for up to ten years, while Chapter 13 typically stays for seven years. - Can I keep my home if I file for bankruptcy?

This depends on whether you file Chapter 7 or Chapter 13; in many cases under Chapter 13 you can keep your home while repaying your debts. - Will filing for bankruptcy stop foreclosure?

Yes, filing will temporarily halt foreclosure proceedings; however, you must continue making mortgage payments after filing if you wish to keep your home. - Do I need an attorney to file for bankruptcy?

While it’s possible to file without one, hiring an attorney is recommended due to the complexities involved in the process. - What happens after I file for bankruptcy?

Your case will be assigned a trustee who will manage your case; you will also attend a meeting with creditors where you will discuss your finances. - Can I file for bankruptcy more than once?

You can file multiple times; however, there are waiting periods between filings depending on which chapter you filed previously. - How does filing for bankruptcy affect my employment?

A history of filing may impact job prospects in certain fields where financial responsibility is critical; however, it varies by employer.