Direct deposit has become a prevalent method for receiving payments, especially in the realms of payroll, government benefits, and other financial transactions. This electronic funds transfer system allows individuals to receive their earnings directly into their bank accounts without the need for physical checks. While direct deposit offers numerous advantages, it also comes with certain drawbacks that users should consider. This article delves into the pros and cons of direct deposit, providing a comprehensive overview to help individuals make informed decisions regarding their payment preferences.

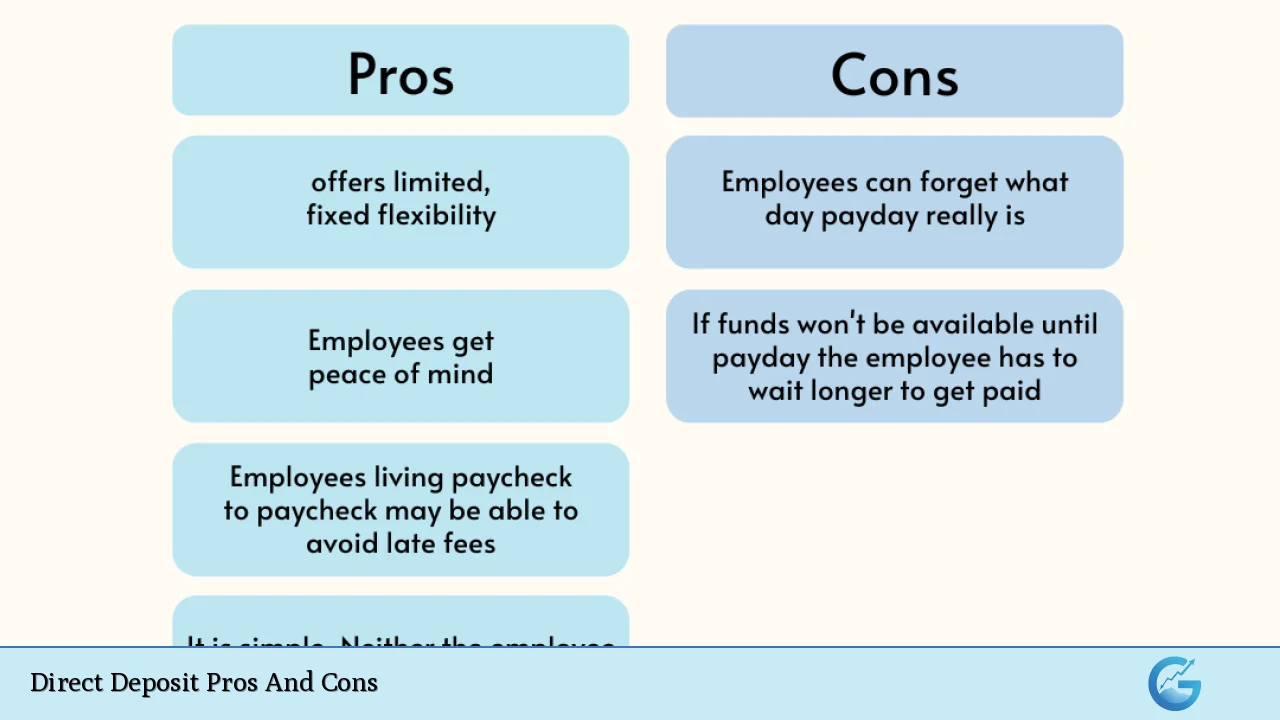

| Pros | Cons |

|---|---|

| Convenience and Time-Saving | Dependency on Banking Systems |

| Enhanced Security | Potential for Errors |

| Immediate Access to Funds | Cybersecurity Risks |

| Cost-Effectiveness | Lack of Control Over Payment Timing |

| Easier Record Keeping | Bank Fees and Charges |

| Environmentally Friendly | Requires Bank Account Access |

Convenience and Time-Saving

One of the most significant advantages of direct deposit is its convenience.

- No Physical Trips: Recipients do not need to visit a bank to deposit checks, saving time and effort.

- Automatic Payments: Payments are deposited automatically on scheduled dates, ensuring that individuals receive their funds without manual intervention.

This ease of use makes direct deposit particularly appealing for employees who may have busy schedules or those who live far from banking facilities.

Enhanced Security

Direct deposit is generally considered a safer option compared to traditional paper checks.

- Reduced Risk of Theft: Since funds are transferred electronically, there is no physical check that can be lost or stolen.

- Confidential Transactions: Direct deposits are processed through secure banking systems, minimizing the risk of fraud associated with paper checks.

This security feature is particularly important in today’s digital age, where identity theft and financial fraud are prevalent concerns.

Immediate Access to Funds

With direct deposit, individuals often have immediate access to their funds on payday.

- No Waiting Period: Unlike paper checks that may take time to clear, direct deposits are typically available as soon as they are processed.

- Early Availability: Some banks even credit accounts before the official payday, allowing users to access their money sooner.

This immediacy can be crucial for individuals who rely on timely payments for their financial obligations.

Cost-Effectiveness

Direct deposit can be more cost-effective than traditional payment methods.

- Lower Transaction Costs: Many banks offer free direct deposit services, whereas paper checks incur costs related to printing and mailing.

- Reduced Administrative Costs: Employers save on expenses associated with check processing and distribution.

For businesses, implementing direct deposit can lead to significant savings over time.

Easier Record Keeping

Direct deposits simplify financial record-keeping for both employers and employees.

- Digital Records: Each transaction is automatically recorded in bank statements, making it easy to track payments without maintaining physical copies of checks.

- Simplified Audits: For businesses, having a clear digital trail of payments can streamline audits and financial reviews.

This transparency enhances accountability and reduces the likelihood of discrepancies in financial records.

Environmentally Friendly

By eliminating the need for paper checks, direct deposit contributes to environmental sustainability.

- Reduced Paper Waste: Fewer checks mean less paper used in banking processes, which can have a positive impact on forest conservation efforts.

- Lower Carbon Footprint: With fewer physical transactions requiring transportation, direct deposit can help reduce overall carbon emissions associated with banking activities.

This eco-friendly aspect appeals to environmentally conscious consumers and businesses alike.

Dependency on Banking Systems

Despite its many advantages, direct deposit does rely heavily on banking systems.

- Banking Errors: If there are issues with the bank’s processing systems or if an employee’s account information is incorrect, payments may be delayed or misdirected.

- Limited Access During Outages: In cases of bank outages or technical difficulties, individuals may not have access to their funds when needed.

This dependency can create challenges for users who may not have alternative means of accessing their money during such events.

Potential for Errors

While rare, errors in direct deposits can occur due to human or technical mistakes.

- Data Entry Mistakes: Incorrect account numbers or routing information can lead to misdirected funds.

- Payroll Errors: Employers must ensure accurate payroll processing; otherwise, employees may receive incorrect amounts or miss payments altogether.

It is essential for both employers and employees to regularly verify transaction details to mitigate these risks.

Cybersecurity Risks

As with any online financial transaction system, direct deposit carries cybersecurity risks.

- Hacking Threats: Cybercriminals may attempt to exploit vulnerabilities in banking systems to access sensitive information or redirect funds.

- Phishing Scams: Users must remain vigilant against phishing attempts that seek personal banking information under false pretenses.

Employers and employees should prioritize cybersecurity measures such as strong passwords and two-factor authentication to safeguard their accounts.

Lack of Control Over Payment Timing

Another disadvantage of direct deposit is the potential lack of control over when payments are received.

- Scheduled Payments Only: Payments are processed on predetermined schedules; if an employer fails to initiate a payment on time, employees may experience delays.

- Inflexible Payment Options: Unlike cash transactions where timing can be adjusted easily, direct deposits follow strict timelines that may not accommodate urgent needs for funds.

Individuals relying on immediate access to cash might find this limitation frustrating during emergencies or unexpected expenses.

Bank Fees and Charges

While many banks offer free direct deposit services, some may impose fees that could affect users negatively.

- Setup Fees: Businesses may incur initial costs when establishing a direct deposit system.

- Monthly Maintenance Fees: Some banks charge ongoing fees for maintaining accounts that could diminish the overall savings associated with using direct deposits.

Users should carefully review the terms associated with their banking services before committing to ensure they understand any potential costs involved.

Requires Bank Account Access

Finally, one notable drawback of direct deposit is that it requires recipients to have a bank account.

- Exclusion for Unbanked Individuals: Those without bank accounts cannot utilize direct deposit unless they opt for alternative solutions like prepaid debit cards.

- Account Maintenance Requirements: Users must also manage their bank accounts actively; failure to do so could result in overdraft fees or account closures.

This requirement can limit accessibility for certain populations who may prefer cash transactions or lack access to traditional banking services.

In conclusion, while direct deposit offers numerous benefits such as convenience, security, immediate access to funds, cost-effectiveness, easier record keeping, and environmental sustainability, it also presents challenges like dependency on banking systems, potential errors, cybersecurity risks, lack of control over payment timing, possible bank fees, and the necessity of having a bank account. Understanding these pros and cons is crucial for individuals considering this payment method. By weighing these factors carefully against personal preferences and circumstances, users can make informed decisions about whether direct deposit aligns with their financial needs.

Frequently Asked Questions About Direct Deposit

- What is direct deposit?

Direct deposit is an electronic transfer method where funds are deposited directly into an individual’s bank account without the need for physical checks. - How does direct deposit work?

Employers send payment instructions through an Automated Clearing House (ACH), which processes the transactions between banks. - Is direct deposit safe?

Yes, direct deposits are generally considered safe due to secure banking protocols; however, users should remain vigilant against cybersecurity threats. - Can I use direct deposit if I don’t have a bank account?

No, you need a bank account to receive payments via direct deposit unless you use alternative methods like prepaid debit cards. - What happens if there’s an error in my direct deposit?

If there’s an error such as incorrect account details or payroll mistakes, you should contact your employer or bank immediately for resolution. - Are there fees associated with direct deposit?

Some banks charge setup or maintenance fees; it’s essential to check your bank’s policies before enrolling in direct deposit. - Can I change my bank account for my direct deposit?

You can change your bank account by providing your new account details through your employer’s payroll department. - How quickly will I receive my funds via direct deposit?

Funds are usually available by 9 AM on payday; some banks may credit accounts earlier depending on their policies.