Discover Bank is an online financial institution that offers a wide range of banking products including savings accounts, checking accounts, certificates of deposit (CDs), and personal loans. Founded as a credit card company in 1985, Discover has evolved into a comprehensive banking service provider, known for its competitive interest rates and customer service. With no physical branches, Discover operates primarily through its website and mobile app, making it a suitable option for tech-savvy consumers who prefer online banking.

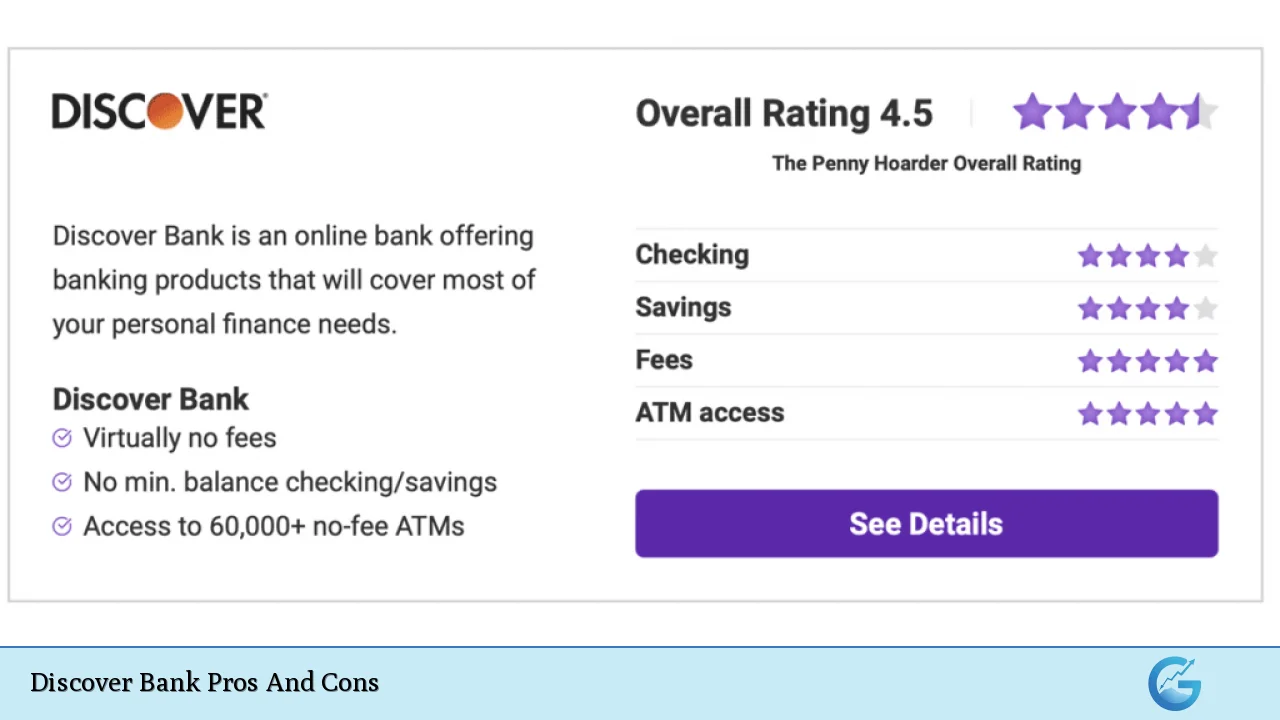

This article examines the pros and cons of Discover Bank to help potential customers make informed decisions about their banking options.

| Pros | Cons |

|---|---|

| No monthly maintenance fees on accounts | Limited physical branch presence |

| Competitive interest rates on savings accounts | Higher outgoing wire transfer fees compared to some competitors |

| Cashback rewards on debit card purchases | No interest on checking accounts |

| 24/7 customer service support | Limited cash deposit options |

| User-friendly mobile app with high ratings | Less widespread acceptance of Discover cards compared to Visa/Mastercard |

| FDIC insurance for deposits up to $250,000 | Limited options for specialty CDs and investment accounts |

No Monthly Maintenance Fees on Accounts

One of the standout features of Discover Bank is that it does not charge monthly maintenance fees for its accounts. This is particularly beneficial for customers who want to avoid unnecessary charges that can eat into their savings.

- Advantage: This fee-free structure allows customers to keep more of their money working for them.

- Consideration: While this is a significant plus, it is essential to note that some traditional banks may offer promotional bonuses or incentives that could be appealing despite the fees.

Competitive Interest Rates on Savings Accounts

Discover Bank offers competitive interest rates on its savings accounts, often exceeding the national average. As of December 2024, the annual percentage yield (APY) for Discover’s savings account stands at 3.75%, which is substantially higher than many brick-and-mortar banks.

- Advantage: Higher interest rates mean your savings can grow faster without any additional effort.

- Consideration: However, while Discover’s rates are competitive, they may not always be the highest available among online-only banks.

Cashback Rewards on Debit Card Purchases

Discover Bank provides a unique feature with its Cashback Debit account, allowing customers to earn 1% cash back on debit card purchases up to $3,000 each month. This feature can add up to significant rewards over time.

- Advantage: This cashback offering is a rare benefit among checking accounts and can incentivize users to use their debit cards more frequently.

- Consideration: Customers should be aware that this program has limits, and those who spend significantly more may not benefit as much.

24/7 Customer Service Support

Discover Bank prides itself on its exceptional customer service, offering 24/7 support through phone and online channels. This level of accessibility can be crucial for customers who may need assistance at odd hours.

- Advantage: Customers report high satisfaction levels with service representatives who are knowledgeable and helpful.

- Consideration: While online support is robust, some users may still prefer face-to-face interactions that are not available with an online-only bank.

User-Friendly Mobile App with High Ratings

The Discover mobile app has received high ratings from users across various platforms. It allows customers to manage their accounts easily, check balances, transfer funds, and deposit checks remotely.

- Advantage: A well-designed app enhances the banking experience by making transactions quick and convenient.

- Consideration: Despite its strengths, some users have noted limitations in transaction search capabilities within the app.

FDIC Insurance for Deposits Up to $250,000

All deposits made at Discover Bank are insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor per account type. This insurance provides peace of mind that your money is safe even in the event of bank failure.

- Advantage: FDIC insurance is a critical safety net for depositors.

- Consideration: Customers should ensure they remain within insured limits when managing multiple accounts.

Limited Physical Branch Presence

One notable disadvantage of Discover Bank is its lack of physical branches. While it operates one branch in Delaware, most transactions must be conducted online or via ATMs.

- Disadvantage: For customers who prefer in-person banking or need services like cash deposits frequently, this can be a significant drawback.

- Consideration: The bank does allow cash deposits at Walmart locations but may not be as convenient as traditional banking options.

Higher Outgoing Wire Transfer Fees Compared to Some Competitors

Discover Bank charges a fee of $30 for outgoing wire transfers, which is higher than many other banks that offer lower or no fees for similar services.

- Disadvantage: This fee can deter customers who frequently need to send money electronically.

- Consideration: Customers should evaluate their expected wire transfer needs before committing to an account with Discover.

No Interest on Checking Accounts

While Discover offers competitive rates on savings products, its checking accounts do not earn interest. This could be a disadvantage for those looking to maximize their earnings across all account types.

- Disadvantage: Customers may feel they miss out on potential earnings by keeping their money in a non-interest-bearing account.

- Consideration: Users might choose to keep larger balances in high-yield savings accounts instead.

Limited Cash Deposit Options

Although Discover allows cash deposits at Walmart locations without fees, it lacks other convenient cash deposit methods available at traditional banks.

- Disadvantage: This limitation could pose challenges for customers who prefer using cash regularly.

- Consideration: Users should assess how often they need to deposit cash before deciding if this bank fits their needs.

Less Widespread Acceptance of Discover Cards Compared to Visa/Mastercard

While Discover cards have made strides in acceptance over the years, they still do not have the same level of ubiquity as Visa or Mastercard.

- Disadvantage: Some merchants may not accept Discover cards, which could inconvenience users who rely solely on them for transactions.

- Consideration: Customers might consider carrying a backup Visa or Mastercard for situations where Discover is not accepted.

Limited Options for Specialty CDs and Investment Accounts

Discover Bank offers standard CDs but lacks more specialized options like variable-rate CDs or brokerage services that other banks might provide.

- Disadvantage: This limitation can restrict customers looking for diverse investment opportunities within their banking institution.

- Consideration: Customers interested in broader investment strategies may need to look elsewhere or use additional financial institutions alongside Discover.

In conclusion, Discover Bank presents several compelling advantages such as no monthly fees, competitive interest rates on savings accounts, cashback rewards on debit purchases, and robust customer service. However, potential customers should weigh these benefits against disadvantages such as limited physical branch access and higher fees for certain services like outgoing wire transfers.

Ultimately, whether Discover Bank is the right choice will depend on individual banking preferences and needs. Those comfortable with online banking and seeking high-yield savings options may find it an excellent fit.

Frequently Asked Questions About Discover Bank Pros And Cons

- What types of accounts does Discover Bank offer?

Discover Bank offers various accounts including checking accounts, high-yield savings accounts, money market accounts, and CDs. - Are there any monthly fees associated with Discover Bank accounts?

No, Discover Bank does not charge monthly maintenance fees on its deposit accounts. - How does Discover’s interest rate compare with traditional banks?

Discover typically offers higher interest rates on savings accounts compared to most traditional brick-and-mortar banks. - Can I deposit cash at Discover Bank?

You can deposit cash at Walmart locations using your Discover debit card without incurring fees. - Is customer service available 24/7 at Discover Bank?

Yes, Discover Bank provides 24/7 customer support via phone and online channels. - Does Discover Bank offer any rewards programs?

Yes, the Cashback Debit account allows you to earn 1% cash back on debit card purchases. - What are the wire transfer fees at Discover Bank?

The bank charges $30 for outgoing wire transfers. - Is my money safe with Discover Bank?

Your deposits are insured by the FDIC up to $250,000 per depositor per account type.