Dividend-paying whole life insurance is a unique financial product that combines the benefits of permanent life insurance with the potential for dividends based on the insurer’s performance. This type of policy not only provides lifelong coverage but also accumulates cash value over time, which can be accessed during the policyholder’s lifetime. As such, it has become a popular choice among those looking to secure their financial future while also providing for their loved ones. However, like any financial instrument, it comes with its own set of advantages and disadvantages that potential buyers should carefully consider.

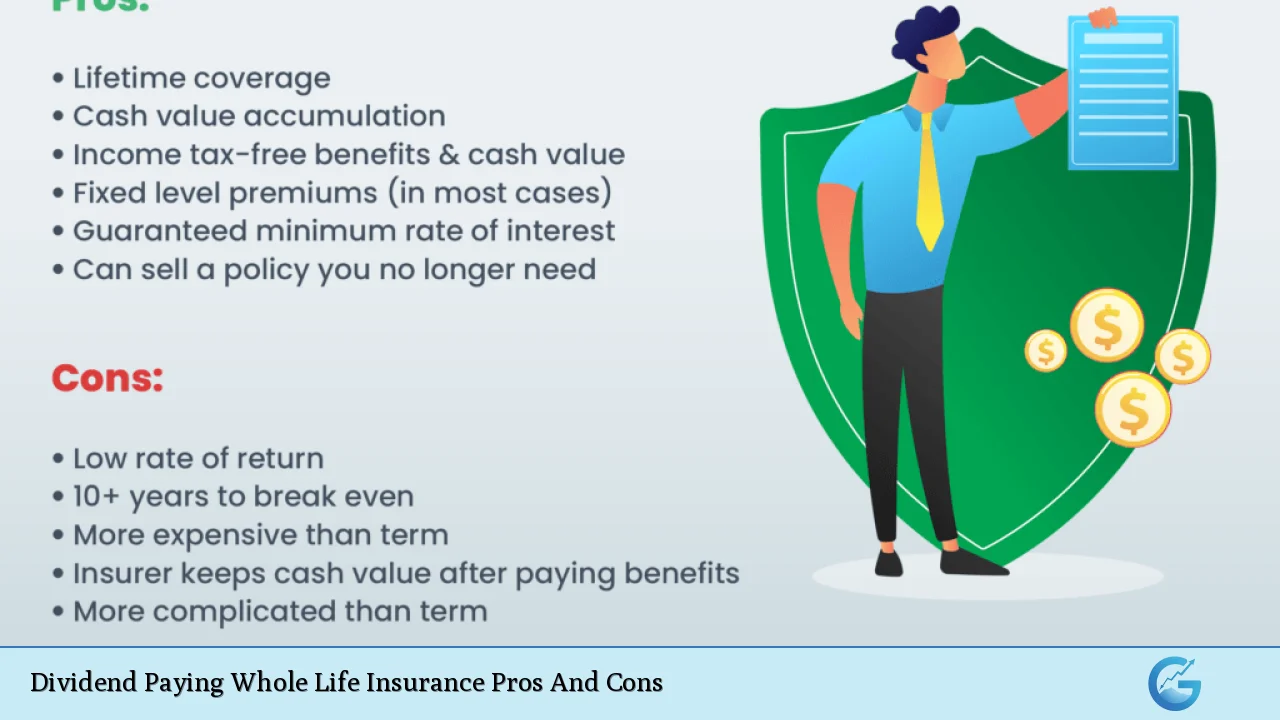

| Pros | Cons |

|---|---|

| Guaranteed lifelong coverage | Higher premiums compared to term insurance |

| Cash value accumulation that grows tax-deferred | Complexity in understanding dividends and policy mechanics |

| Potential for dividends based on company performance | Dividends are not guaranteed and may fluctuate |

| Tax advantages on dividends received | Potentially lower returns compared to other investment vehicles |

| Ability to borrow against cash value | Loans against cash value reduce death benefit if not repaid |

| Flexibility in using dividends (premium payments, additional coverage) | Long-term commitment required; may not be suitable for short-term needs |

| Estate planning benefits and legacy building | May require professional guidance for optimal use |

| Participating policies can offer lower net costs in the long run due to dividends | Potential for policy lapse if premiums are not maintained |

Guaranteed Lifelong Coverage

One of the most significant advantages of dividend-paying whole life insurance is the guaranteed lifelong coverage it provides. As long as premiums are paid, the policy remains in force, ensuring that beneficiaries receive a predetermined death benefit upon the policyholder’s passing. This feature offers peace of mind, knowing that loved ones will be financially protected regardless of when the policyholder dies.

- Stability: The fixed premium payments mean that costs do not increase over time.

- Financial security: This assurance is particularly appealing to those with dependents or significant financial obligations.

Cash Value Accumulation That Grows Tax-Deferred

Another major benefit is the cash value accumulation within the policy. A portion of each premium payment contributes to a cash value account that grows over time at a guaranteed rate set by the insurance company.

- Liquidity: Policyholders can borrow against this cash value if needed, providing a source of funds during emergencies or for other financial needs.

- Tax-deferred growth: The cash value grows without being subject to income tax until withdrawn, making it an attractive savings component.

Potential for Dividends Based on Company Performance

Dividend-paying whole life insurance policies offer the potential for dividends, which are essentially a share of the insurer’s profits distributed to policyholders. These dividends can be used in several ways:

- Reinvestment: Policyholders can choose to reinvest dividends into the policy to purchase additional coverage or increase cash value.

- Income stream: Alternatively, dividends can be taken as cash, providing an additional income stream during retirement or other life stages.

Tax Advantages on Dividends Received

Dividends received from participating policies are generally considered a return of premium and are not subject to income tax until they exceed the total amount paid into the policy. This tax treatment makes dividend-paying whole life insurance an attractive option for those looking to minimize their tax liabilities while building wealth.

- Tax-free income: This feature allows policyholders to access funds without incurring immediate tax consequences.

Ability to Borrow Against Cash Value

The ability to borrow against the accumulated cash value is another advantage. Policyholders can take loans against their policies without having to undergo credit checks or prove income.

- Flexible financing: This feature provides financial flexibility, allowing individuals to access funds when needed without disrupting their overall financial strategy.

- No repayment requirement: Loans do not require repayment during the policyholder’s lifetime; however, any outstanding loan balance will reduce the death benefit paid out to beneficiaries.

Flexibility in Using Dividends

Policyholders have options regarding how they use their dividends. They can apply them toward premium payments, accumulate them within the policy, or use them to purchase additional coverage.

- Customization: This flexibility allows individuals to tailor their policies according to their changing financial needs and goals.

Estate Planning Benefits and Legacy Building

Dividend-paying whole life insurance serves as an effective tool for estate planning. The death benefit is typically tax-free and can provide heirs with a substantial inheritance.

- Wealth transfer: This aspect makes it an excellent choice for individuals looking to leave a legacy or provide for future generations.

Participating Policies Can Offer Lower Net Costs in the Long Run

While dividend-paying whole life policies tend to have higher initial premiums compared to non-participating policies, they can potentially result in lower net costs over time due to dividends received.

- Long-term savings: If managed correctly, these policies may yield better overall returns when considering both cash value growth and dividend payouts.

Higher Premiums Compared to Term Insurance

One of the primary drawbacks of dividend-paying whole life insurance is its higher cost relative to term life insurance.

- Budget considerations: The increased premiums may strain budgets, especially for younger individuals or families just starting out financially.

- Affordability: For those who only need temporary coverage or have limited budgets, term insurance may be a more suitable option.

Complexity in Understanding Dividends and Policy Mechanics

The mechanics behind dividend-paying whole life insurance can be complex and difficult for some individuals to understand fully.

- Need for education: Policyholders must grasp how dividends are calculated and how they impact overall policy performance, which may require professional guidance.

- Confusion around options: Understanding how best to utilize dividends (e.g., reinvestment vs. taking as cash) can also pose challenges.

Dividends Are Not Guaranteed and May Fluctuate

While many mutual companies have a strong history of paying dividends consistently, these payments are not guaranteed and can fluctuate based on company performance and economic conditions.

- Financial risk: This uncertainty means that policyholders cannot rely on receiving dividends every year, which could impact long-term financial planning.

Potentially Lower Returns Compared to Other Investment Vehicles

Investing in dividend-paying whole life insurance may yield lower returns compared to other investment options like stocks or mutual funds over time.

- Opportunity cost: Individuals might miss out on potentially higher growth opportunities available through more aggressive investment strategies.

Loans Against Cash Value Reduce Death Benefit If Not Repaid

While borrowing against cash value provides flexibility, it also comes with risks. If loans are not repaid during the policyholder’s lifetime, they will reduce the death benefit available to beneficiaries.

- Impact on legacy: This reduction could significantly affect what heirs receive upon death if substantial loans remain unpaid.

Long-Term Commitment Required; May Not Be Suitable for Short-Term Needs

Dividend-paying whole life insurance is designed as a long-term financial product.

- Commitment level: Individuals must commit to paying premiums over many years, which may not align with short-term financial goals or needs.

- Inflexibility: Those seeking temporary solutions may find these policies unsuitable due to their long-term nature and associated costs.

May Require Professional Guidance for Optimal Use

Navigating the complexities of dividend-paying whole life insurance often necessitates professional advice from licensed agents or financial advisors.

- Expertise needed: Understanding how best to structure policies, utilize dividends effectively, and integrate them into broader financial plans requires expertise beyond basic knowledge.

Potential for Policy Lapse If Premiums Are Not Maintained

If premium payments are missed or insufficient funds are available, there is a risk that the policy could lapse.

- Loss of coverage: A lapsed policy means losing both coverage and any accumulated cash value, which could have significant implications for beneficiaries relying on that death benefit.

In conclusion, dividend-paying whole life insurance presents both substantial advantages and notable disadvantages. It offers lifelong protection with potential cash value growth and tax benefits but comes with higher costs and complexities that require careful consideration. Individuals interested in this type of insurance should evaluate their financial goals thoroughly and consider consulting with professionals who specialize in this area before making decisions about their coverage options.

Frequently Asked Questions About Dividend Paying Whole Life Insurance

- What is dividend-paying whole life insurance?

This type of insurance provides lifelong coverage while allowing policyholders to earn dividends based on the insurer’s performance. - Are dividends from whole life insurance taxable?

No, dividends are generally considered a return of premium and are not subject to income tax until they exceed total premiums paid. - Can I borrow against my whole life insurance?

Yes, you can borrow against the accumulated cash value without needing credit checks. - What happens if I stop paying premiums?

If premiums are not maintained, your policy could lapse, resulting in loss of coverage and accumulated cash value. - How do I use my dividends?

You can take them as cash, apply them toward premiums, or reinvest them into additional coverage. - Is this type of insurance suitable for everyone?

No; it is most beneficial for those seeking permanent coverage and who can afford higher premiums. - What are some alternatives to dividend-paying whole life insurance?

Alternatives include term life insurance or other forms of permanent insurance without dividend features. - How do I choose an insurer for this type of policy?

Select an insurer with a strong track record of paying dividends consistently over many years.