Dividend-paying whole life insurance is a type of permanent life insurance that not only provides lifelong coverage but also has the potential to pay dividends to policyholders. These dividends are typically a share of the insurer’s profits, and they can enhance the policy’s cash value and death benefit. As with any financial product, understanding the advantages and disadvantages is crucial for making an informed decision. This article will explore the key pros and cons of dividend-paying whole life insurance, providing insights for individuals interested in finance, investments, and long-term financial planning.

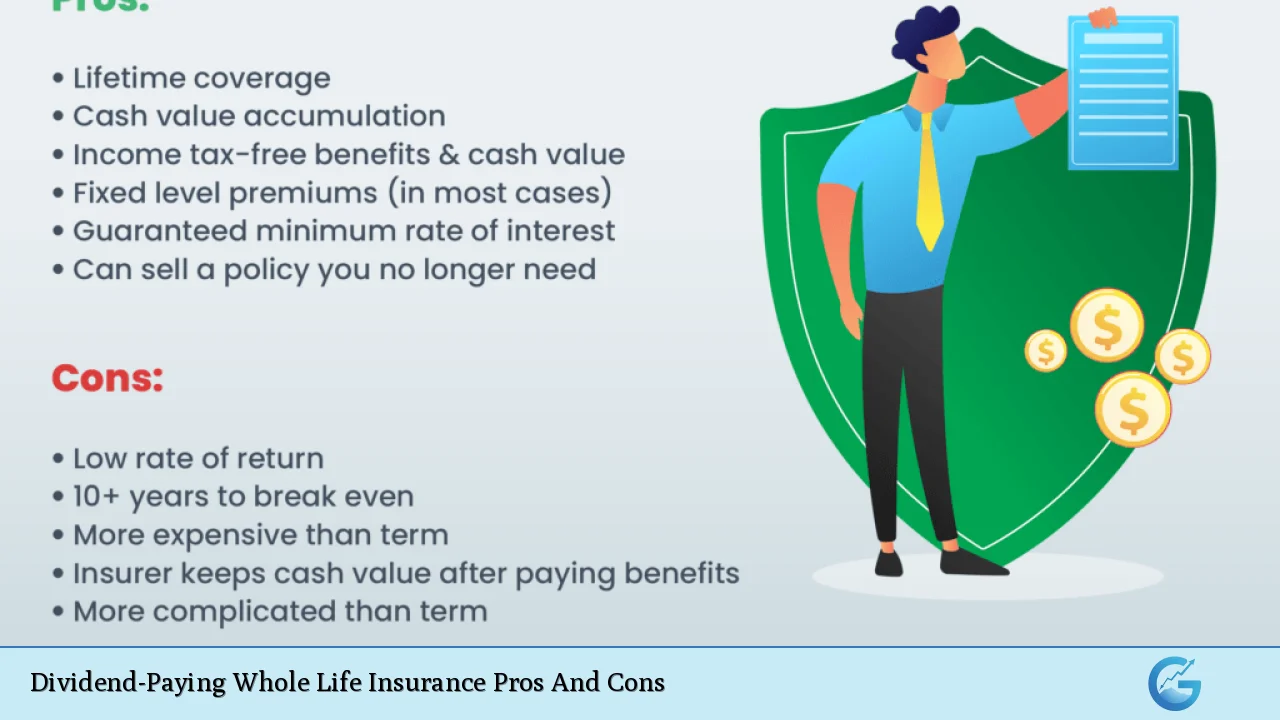

| Pros | Cons |

|---|---|

| Provides lifelong coverage with fixed premiums. | Higher premiums compared to term insurance. |

| Potential for cash value accumulation. | Dividends are not guaranteed. |

| Policyholders can receive dividends as cash or reinvest them. | Complexity in understanding how dividends are calculated. |

| Tax advantages on dividends received. | Lower returns compared to other investment vehicles. |

| Ability to purchase additional coverage using dividends. | Long-term commitment required to maintain the policy. |

Provides Lifelong Coverage with Fixed Premiums

One of the primary advantages of dividend-paying whole life insurance is that it offers lifelong coverage. As long as premiums are paid, the policy remains in force, ensuring that beneficiaries receive a death benefit upon the policyholder’s passing. This feature provides peace of mind, knowing that loved ones will be financially protected regardless of when death occurs.

- Fixed Premiums: The premiums for whole life insurance remain constant throughout the policyholder’s life, which can aid in budgeting and financial planning.

- Guaranteed Death Benefit: The death benefit is guaranteed, meaning it will not decrease as long as premiums are paid.

Higher Premiums Compared to Term Insurance

While dividend-paying whole life insurance offers numerous benefits, it comes at a cost. The premiums for these policies are generally much higher than those for term life insurance.

- Cost Considerations: Individuals must weigh the higher initial costs against the potential long-term benefits of cash value accumulation and dividends.

- Affordability: Higher premiums may make it difficult for some individuals to maintain their policies over time, especially if their financial situation changes.

Potential for Cash Value Accumulation

Another significant advantage is the cash value accumulation feature inherent in whole life insurance policies. This cash value grows over time and can be accessed by the policyholder.

- Tax-Deferred Growth: The cash value grows tax-deferred, allowing for potential savings on taxes until funds are withdrawn.

- Access to Funds: Policyholders can borrow against their cash value or withdraw funds if needed, providing financial flexibility during emergencies or significant expenses.

Dividends Are Not Guaranteed

A critical disadvantage of dividend-paying whole life insurance is that dividends are not guaranteed. They depend on the insurer’s financial performance and other factors.

- Variable Returns: While many reputable insurers have a history of paying dividends consistently, there is no assurance that this will continue indefinitely.

- Financial Health Dependency: The ability to pay dividends relies heavily on the insurer’s overall profitability and operational efficiency.

Policyholders Can Receive Dividends as Cash or Reinvest Them

Dividends from participating policies provide flexibility in how they can be utilized. Policyholders have several options regarding their dividends:

- Cash Payments: Dividends can be taken as cash, providing an additional income stream that can be used for various expenses or investments.

- Premium Reduction: Policyholders may choose to apply dividends toward premium payments, effectively lowering their out-of-pocket costs.

- Reinvestment Options: Dividends can also be reinvested into purchasing additional paid-up insurance, which increases both the cash value and death benefit over time.

Complexity in Understanding How Dividends Are Calculated

The calculation of dividends can be complex and may deter some potential policyholders from pursuing dividend-paying whole life insurance.

- Understanding Factors: Various factors influence dividend calculations, including investment performance, mortality rates, and administrative costs.

- Need for Financial Literacy: Individuals must have a good understanding of these factors or seek advice from knowledgeable professionals to make informed decisions about their policies.

Tax Advantages on Dividends Received

One of the appealing aspects of dividend-paying whole life insurance is its favorable tax treatment.

- Tax-Free Dividends: Dividends received by policyholders are generally not subject to income tax, which can lead to significant savings over time.

- Tax-Deferred Growth: The cash value growth within the policy is also tax-deferred until withdrawals are made, allowing for strategic long-term financial planning.

Lower Returns Compared to Other Investment Vehicles

While dividend-paying whole life insurance offers some investment-like features through cash value accumulation and dividends, it often yields lower returns compared to other investment options such as stocks or mutual funds.

- Investment Performance: The returns from participating policies may not keep pace with inflation or outperform traditional investment avenues over time.

- Opportunity Cost: Funds allocated toward higher premium payments could potentially generate greater wealth if invested elsewhere with higher growth potential.

Ability to Purchase Additional Coverage Using Dividends

The ability to use dividends to purchase additional paid-up coverage is a unique feature of dividend-paying whole life insurance policies.

- Increased Death Benefit: This allows policyholders to increase their death benefit without undergoing additional medical underwriting or incurring significantly higher costs associated with new policies.

- Compounding Effect: Reinvesting dividends into additional coverage enhances both cash value and death benefit over time through compounding growth.

Long-Term Commitment Required to Maintain the Policy

Dividend-paying whole life insurance requires a long-term commitment from policyholders.

- Premium Payment Obligation: Failure to pay premiums can result in policy lapse, leading to loss of coverage and potential forfeiture of accumulated cash value.

- Financial Planning Necessity: Individuals must consider their long-term financial stability before committing to such policies due to their complexity and cost structure.

In conclusion, dividend-paying whole life insurance presents both significant advantages and notable disadvantages. It provides lifelong coverage with fixed premiums, potential cash value accumulation, and tax benefits while allowing policyholders flexibility in managing dividends. However, individuals must also contend with higher premium costs, non-guaranteed dividends, complexity in understanding how these products work, and lower returns compared to other investment options.

Ultimately, whether dividend-paying whole life insurance is suitable depends on individual financial goals, risk tolerance, and overall investment strategy. It is advisable for prospective buyers to conduct thorough research or consult with financial advisors before making decisions regarding this type of insurance product.

Frequently Asked Questions About Dividend-Paying Whole Life Insurance

- What is dividend-paying whole life insurance?

Dividend-paying whole life insurance is a permanent life insurance product that offers lifelong coverage while potentially paying out dividends based on the insurer’s profitability. - How do I receive dividends from my policy?

You can receive dividends as cash payments, apply them towards premium payments, or reinvest them into additional paid-up coverage. - Are dividends guaranteed?

No, dividends are not guaranteed; they depend on the financial performance of the insurance company. - What happens if I stop paying premiums?

If you stop paying premiums, your policy may lapse, resulting in loss of coverage and potentially forfeiting accumulated cash value. - Can I borrow against my policy’s cash value?

Yes, you can borrow against your policy’s cash value; however, any outstanding loans will reduce your death benefit upon passing. - Are there tax implications for receiving dividends?

No, dividends received from a participating whole life policy are generally not subject to income tax. - How does this type of insurance compare with term life?

Unlike term life insurance which provides coverage for a specific period only, dividend-paying whole life offers lifelong protection along with potential cash value growth. - Is it advisable to invest in dividend-paying whole life insurance?

This depends on your individual financial goals; it’s essential to assess your needs and possibly consult a financial advisor before investing.