Donor-Advised Funds (DAFs) have become increasingly popular as a philanthropic vehicle for individuals and families looking to manage their charitable giving. These funds allow donors to contribute assets, receive immediate tax benefits, and recommend grants to charitable organizations over time. However, while DAFs offer numerous advantages, they also come with significant drawbacks. This article explores the pros and cons of DAFs in detail, providing insights for those interested in finance, cryptocurrency, forex, and money markets.

| Pros | Cons |

|---|---|

| Immediate tax deductions for contributions. | Loss of direct control over donated assets. |

| Flexibility in grant-making over time. | Potentially high administrative and management fees. |

| Ability to donate appreciated assets without capital gains tax. | No legal requirement for minimum distributions. |

| Simplified record-keeping for tax purposes. | Funds can remain in the account indefinitely. |

| Opportunity for family involvement in philanthropy. | Perception of “parking” money instead of immediate charitable impact. |

| Privacy options for anonymous giving. | Complexity in understanding fee structures and investment options. |

Immediate Tax Deductions for Contributions

One of the most significant advantages of donor-advised funds is the immediate tax deduction that donors receive upon contributing to the fund.

- Donors can deduct up to 60% of their adjusted gross income (AGI) for cash donations.

- For appreciated assets like stocks or real estate, donors can deduct the fair market value while avoiding capital gains taxes.

This immediate tax benefit can significantly reduce a donor’s taxable income in the year of contribution, making DAFs an attractive option for high-income earners looking to optimize their tax situation.

Flexibility in Grant-Making Over Time

DAFs provide donors with the flexibility to decide when and how much to give to charities over time.

- Donors can contribute funds during high-income years and distribute them later, allowing for strategic planning around their charitable giving.

- This flexibility is particularly beneficial during economic downturns or personal financial challenges, as donors can choose to hold off on distributions until they are ready.

This feature allows donors to align their giving with their philanthropic goals without the pressure of immediate distribution requirements.

Ability to Donate Appreciated Assets Without Capital Gains Tax

Another advantage of DAFs is that they allow donors to contribute appreciated assets without incurring capital gains taxes.

- When donors transfer stocks or other appreciated assets directly into a DAF, they can avoid paying taxes on the gains while still receiving a tax deduction based on the asset’s current market value.

- This strategy not only maximizes the amount available for charitable giving but also enhances overall tax efficiency.

This aspect makes DAFs particularly appealing for individuals who have held investments for a long time and wish to give back without facing significant tax penalties.

Simplified Record-Keeping for Tax Purposes

DAFs simplify the record-keeping process associated with charitable donations.

- Donors receive consolidated statements from the DAF sponsor detailing all contributions and grants made throughout the year.

- This streamlined documentation makes it easier for donors to manage their records during tax season, reducing the burden of tracking individual donations across multiple charities.

The convenience offered by DAFs can be especially beneficial for individuals who engage in regular charitable giving or have complex financial portfolios.

Opportunity for Family Involvement in Philanthropy

DAFs encourage family involvement in charitable activities by allowing family members to participate as advisors.

- This structure fosters a culture of philanthropy within families, enabling them to discuss and decide together on charitable priorities.

- It also provides an opportunity for younger generations to learn about philanthropy and engage in meaningful discussions about social responsibility and community impact.

This aspect not only strengthens family bonds but also ensures that philanthropic values are passed down through generations.

Privacy Options for Anonymous Giving

Donor-advised funds offer donors the option of anonymous giving, which can be appealing for those who prefer not to publicly disclose their charitable contributions.

- Many DAF sponsors allow donors to remain anonymous when making grants, providing a layer of privacy that is not typically available with direct donations.

- This feature can be particularly important for high-profile individuals or those who wish to support sensitive causes without drawing public attention.

The ability to give anonymously enhances the appeal of DAFs as a vehicle for discreet philanthropy.

Loss of Direct Control Over Donated Assets

Despite their advantages, donor-advised funds come with significant disadvantages, including the loss of direct control over donated assets.

- Once contributions are made, donors relinquish legal ownership of the funds, meaning they cannot retrieve or redirect them at will.

- While donors can recommend grants, the final decision rests with the DAF sponsor, which may not always align with the donor’s intentions.

This loss of control can be particularly concerning for individuals who prefer a hands-on approach to their charitable giving.

Potentially High Administrative and Management Fees

DAFs often incur administrative and management fees, which can vary widely depending on the sponsoring organization.

- These fees may include charges for investment management, account maintenance, and transaction costs, potentially eroding the overall value of donations over time.

- Donors should carefully review fee structures before establishing a DAF to ensure that they understand how fees will impact their charitable contributions.

High fees can diminish the effectiveness of a donor’s philanthropic efforts if not managed properly.

No Legal Requirement for Minimum Distributions

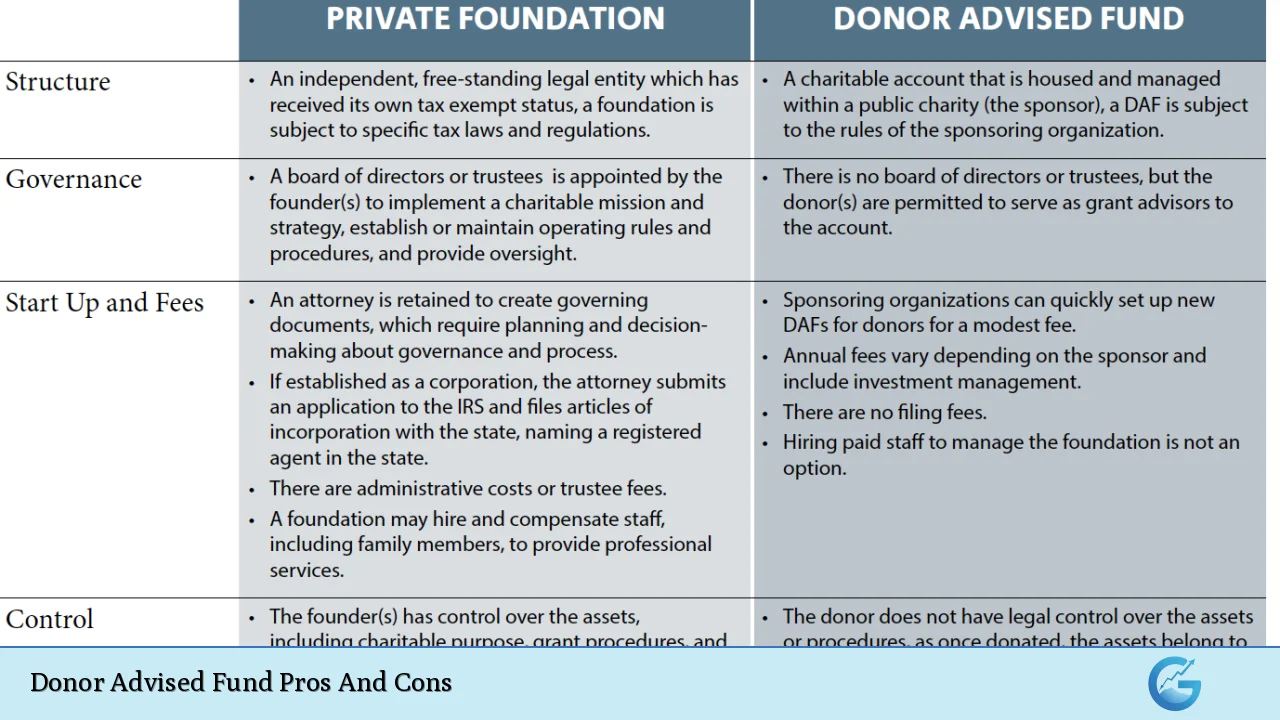

Unlike private foundations, DAFs are not subject to legal requirements regarding minimum distributions.

- This means that funds can remain in a DAF indefinitely without being disbursed to charities, leading some critics to argue that this structure allows wealthy individuals to delay their philanthropic responsibilities.

- The lack of mandatory payout rates has raised concerns about whether DAFs contribute effectively to immediate charitable needs or merely serve as tax shelters.

This feature has sparked debates about the ethical implications of using DAFs as long-term holding accounts rather than active sources of funding for charities.

Funds Can Remain in the Account Indefinitely

Relatedly, there is no deadline by which funds must be disbursed from a DAF.

- This characteristic allows donors to accumulate funds over time but also raises concerns about delayed impact on charitable causes that require immediate funding.

- Critics argue that this practice undermines the purpose of philanthropy by allowing wealthier individuals or families to postpone their contributions indefinitely while enjoying immediate tax benefits.

The potential gap between donation and actual impact poses ethical questions regarding effective altruism and social responsibility within philanthropy.

Perception of “Parking” Money Instead of Immediate Charitable Impact

Many critics argue that DAFs create a perception that wealthy individuals are merely “parking” their money rather than actively engaging in philanthropy.

- Reports indicate that while billions are contributed annually to DAFs, much less is actually distributed as grants each year, leading some stakeholders to question whether these funds genuinely support urgent social needs.

- This criticism highlights concerns about accountability within philanthropic practices and whether current regulations adequately address these issues.

The gap between contributions and actual charitable impact has led some advocates to call for reforms aimed at ensuring more timely distributions from donor-advised funds.

Complexity in Understanding Fee Structures and Investment Options

Lastly, understanding the fee structures and investment options associated with DAFs can be complex.

- Different sponsoring organizations offer various investment strategies, each with its own fee schedule and performance metrics.

- Navigating these options requires careful consideration and research on behalf of donors who want to maximize both their financial returns and philanthropic impact.

The complexity involved may deter some potential donors from utilizing DAFs effectively or lead them into unfavorable arrangements if they do not conduct thorough due diligence.

In conclusion, donor-advised funds present both significant advantages and notable disadvantages. They offer immediate tax benefits, flexibility in grant-making, simplified record keeping, opportunities for family involvement in philanthropy, and privacy options. However, they also entail loss of control over donated assets, potential high fees, no mandatory distribution requirements, indefinite holding periods for funds, perceptions of delayed impact on charities, and complexities related to fee structures.

Individuals considering establishing a donor-advised fund should weigh these factors carefully against their philanthropic goals and financial situations before proceeding. Understanding both sides will empower them to make informed decisions that align with their values while maximizing their charitable impact.

Frequently Asked Questions About Donor Advised Funds

- What is a donor-advised fund?

A donor-advised fund (DAF) is a philanthropic account established at a public charity where donors can contribute assets and recommend grants over time. - How do I benefit from using a donor-advised fund?

You benefit from immediate tax deductions on your contributions while maintaining flexibility regarding when you distribute funds to charities. - Are there any risks associated with donor-advised funds?

The main risks include loss of control over donated assets and potential delays in funding charities due to no required distribution timelines. - Can I donate non-cash assets into a donor-advised fund?

Yes, you can donate appreciated securities or other non-cash assets without incurring capital gains taxes. - What fees should I expect with a donor-advised fund?

Fees vary by sponsoring organization but may include administrative costs and investment management fees; it’s essential to review these before establishing an account. - Is there a minimum contribution requirement?

Many donor-advised funds have minimum contribution requirements ranging from $5,000 up to $25,000 or more depending on the organization. - Can I remain anonymous when making donations through a donor-advised fund?

Yes! Many sponsoring organizations allow you to make anonymous gifts if you prefer not to disclose your identity publicly. - How long can money stay in a donor-advised fund?

Moneys contributed into a donor-advised fund can remain there indefinitely; there are no mandatory payout requirements.