Exchange-Traded Funds (ETFs) have gained significant popularity among investors in recent years due to their unique structure and advantages. ETFs are investment funds that are traded on stock exchanges, much like individual stocks. They typically track an index, commodity, or a basket of assets, providing investors with a diversified portfolio. This article explores the pros and cons of ETFs, offering a comprehensive overview for those interested in finance, including traditional markets and emerging sectors like cryptocurrency and forex.

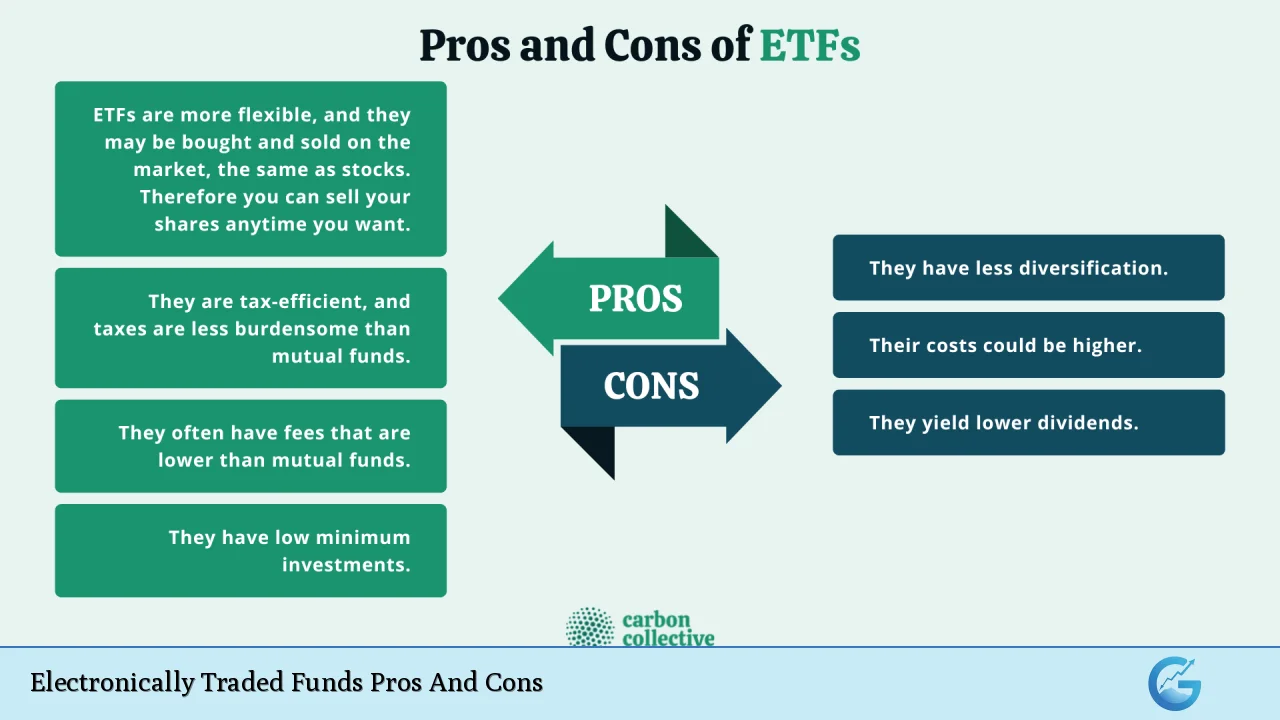

| Pros | Cons |

|---|---|

| Lower Costs | Trading Costs |

| Diversification | Market Risk |

| Liquidity | Tracking Error |

| Flexibility | Limited Access to Private Investments |

| Tax Efficiency | Potential for Overtrading |

| Transparency | Complexity of Certain ETFs |

| Accessibility | Dividend Yields May Be Lower |

| Variety of Investment Options | Price Volatility |

Lower Costs

One of the most significant advantages of ETFs is their lower cost structure compared to traditional mutual funds.

- Expense Ratios: ETFs generally have lower expense ratios because they are often passively managed, meaning they aim to replicate the performance of an index rather than actively selecting securities. This reduces management fees associated with research and trading.

- No Sales Loads: Unlike mutual funds, which may charge sales loads (commissions), ETFs do not have these additional fees, making them more cost-effective for investors.

Trading Costs

While ETFs have lower annual expenses, they are not free from trading costs.

- Brokerage Commissions: Each time an ETF is bought or sold, investors typically incur brokerage commissions. Frequent trading can lead to significant costs that may offset the benefits of lower expense ratios.

- Bid-Ask Spread: The bid-ask spread represents the difference between what buyers are willing to pay and what sellers are asking. Wider spreads can increase trading costs, particularly in less liquid ETFs.

Diversification

ETFs provide instant diversification by holding a basket of securities.

- Risk Mitigation: By investing in an ETF, investors can gain exposure to numerous stocks or bonds within a single transaction. This diversification helps reduce the risk associated with investing in individual securities.

- Access to Various Asset Classes: Investors can find ETFs that track different asset classes including equities, fixed income, commodities, and even real estate.

Market Risk

Despite their diversification benefits, ETFs are still subject to market risks.

- Market Fluctuations: Since ETFs track underlying indexes or assets, they can experience losses during market downturns. Investors should be aware that their investments can decline in value based on overall market conditions.

- Sector-Specific Risks: Some ETFs focus on specific sectors (e.g., technology or energy), which can expose investors to higher volatility if those sectors underperform.

Liquidity

ETFs offer high liquidity compared to traditional mutual funds.

- Intraday Trading: Investors can buy and sell ETF shares throughout the trading day at market prices, providing greater flexibility than mutual funds that only trade at the end of the trading day.

- Ease of Access: The ability to trade ETFs like stocks allows investors to react quickly to market changes.

Tracking Error

Tracking error refers to how closely an ETF’s performance matches its benchmark index.

- Deviation from Benchmark: While most ETFs aim to replicate their underlying index’s performance, various factors such as fees and market fluctuations can lead to discrepancies known as tracking errors.

- Impact on Returns: A significant tracking error can affect long-term investment performance, especially for those relying on precise index tracking.

Flexibility

ETFs provide various trading strategies that enhance investor flexibility.

- Trading Options: Investors can employ various strategies such as short selling or buying options on ETFs, which is not possible with traditional mutual funds.

- Limit Orders: Investors can place limit orders for ETF shares, allowing them to specify the price at which they want to buy or sell.

Limited Access to Private Investments

Unlike some mutual funds, ETFs generally do not invest in private securities.

- Public Market Focus: Most ETFs are limited to publicly traded securities, which may restrict access to potentially lucrative private equity or venture capital investments.

- Diversification Limitations: This limitation could reduce an investor’s ability to diversify fully across both public and private markets.

Tax Efficiency

ETFs are often more tax-efficient than mutual funds.

- Capital Gains Distributions: Because of their unique structure, ETFs typically generate fewer capital gains distributions compared to mutual funds. This is beneficial for investors looking to minimize tax liabilities.

- In-Kind Redemptions: The mechanism by which ETF shares are created and redeemed allows for tax-efficient transactions that help avoid triggering capital gains taxes for existing shareholders.

Potential for Overtrading

The ease of trading ETFs can lead some investors to overtrade.

- Frequent Trading Risks: While intraday trading provides flexibility, it may encourage speculative behavior that undermines long-term investment strategies. Overtrading can lead to increased costs and reduced returns.

- Emotional Decision-Making: Investors might make impulsive decisions based on short-term market movements rather than adhering to a well-thought-out investment plan.

Transparency

ETFs typically offer transparency regarding their holdings.

- Daily Disclosure: Most ETFs disclose their holdings daily, allowing investors to see exactly what assets they own. This level of transparency helps investors make informed decisions about their investments.

- Understanding Portfolio Composition: Knowing the underlying assets enables investors to assess risk more effectively and align their investments with their financial goals.

Complexity of Certain ETFs

While many ETFs are straightforward, some can be complex financial instruments.

- Leveraged and Inverse ETFs: These types of ETFs aim to amplify returns or provide inverse exposure but come with higher risks. They may not be suitable for all investors due to their complexity and volatility.

- Understanding Strategies Required: Investors must thoroughly understand the strategies employed by complex ETFs before investing, as they may not behave as expected in volatile markets.

Accessibility

ETFs offer accessibility for a wide range of investors.

- Low Minimum Investment Requirements: Unlike some mutual funds that require minimum investments, investors can purchase a single share of an ETF at market price.

- Wide Availability: Most brokerage accounts allow access to a broad range of ETFs across different asset classes and strategies.

Dividend Yields May Be Lower

Investors seeking high dividend yields might find some limitations with ETFs.

- Average Yields: While there are dividend-paying ETFs available, their yields may be lower than those obtained by investing directly in high-yielding stocks. This is due to the diversified nature of most ETFs.

- Reinvestment Policies: Dividends from ETF holdings may be reinvested automatically or distributed periodically; however, this could lead to lower immediate cash flows compared to direct stock ownership.

Price Volatility

ETFs can experience price volatility similar to individual stocks.

- Market Sentiment Impact: Prices can fluctuate significantly during market hours based on investor sentiment and broader economic factors.

- Potential for Losses: Investors should be prepared for potential short-term losses due to price volatility when holding ETF shares during turbulent market conditions.

In conclusion, Exchange-Traded Funds (ETFs) present a compelling investment option for individuals looking for diversification, cost-effectiveness, and flexibility in their portfolios. However, it’s essential for investors to weigh these advantages against potential drawbacks such as trading costs, market risks, and complexities associated with certain types of ETFs. Understanding both the strengths and weaknesses will help investors make informed decisions that align with their financial goals and risk tolerance.

Frequently Asked Questions About Electronically Traded Funds Pros And Cons

- What are the main advantages of investing in ETFs?

ETFs offer lower costs compared to mutual funds, provide instant diversification across various asset classes, allow intraday trading for liquidity and flexibility, and are generally more tax-efficient. - What are the primary disadvantages associated with ETFs?

The main disadvantages include trading costs such as commissions and bid-ask spreads, exposure to market risks leading to potential losses during downturns, tracking errors affecting performance consistency, and complexities related to certain types of leveraged or inverse ETFs. - How do trading costs impact ETF investments?

While expense ratios may be low for many ETFs, frequent buying and selling can lead to significant brokerage commissions over time. Additionally, wider bid-ask spreads in less liquid ETFs can further increase overall trading costs. - Are all ETFs suitable for every investor?

No, while many standard ETFs are accessible and suitable for most investors seeking diversification, complex products like leveraged or inverse ETFs carry higher risks and may not be appropriate for all investment strategies. - How does tax efficiency benefit ETF investors?

The unique structure of ETFs typically results in fewer capital gains distributions compared to mutual funds. This tax efficiency helps minimize tax liabilities for shareholders when it comes time for tax reporting. - Can I invest in private companies through an ETF?

No, most traditional ETFs focus on publicly traded securities. Some mutual funds may invest in private equity or venture capital opportunities that are typically unavailable through standard ETF structures. - What should I consider before investing in an ETF?

Investors should evaluate factors such as the ETF’s expense ratio, underlying holdings’ performance history relative to its benchmark index, liquidity levels based on average trading volume, and any potential tracking errors. - How do I choose the right ETF for my investment strategy?

Selecting the right ETF involves understanding your investment goals—whether you seek growth through equities or income through bonds—and considering factors like expense ratios, sector exposure preferences, risk tolerance levels, and overall portfolio diversification needs.