Empower Retirement, formerly known as Great-West Financial, has become one of the largest retirement services providers in the United States. As a comprehensive retirement plan administrator, Empower offers a wide range of services for both employers and employees. However, like any financial service provider, it comes with its own set of advantages and disadvantages. This article will delve into the pros and cons of Empower Retirement, providing a detailed analysis for those considering or currently using their services.

| Pros | Cons |

|---|---|

| Comprehensive retirement planning tools | High account minimums for premium services |

| Access to financial advisors | Relatively high management fees |

| Wide range of investment options | Potential for frequent solicitation |

| Strong focus on retirement education | Complex fee structure |

| Robust mobile app and online platform | Limited availability of certain features |

| Tax optimization strategies | Potential for overwhelm with too many options |

Advantages of Empower Retirement

Comprehensive Retirement Planning Tools

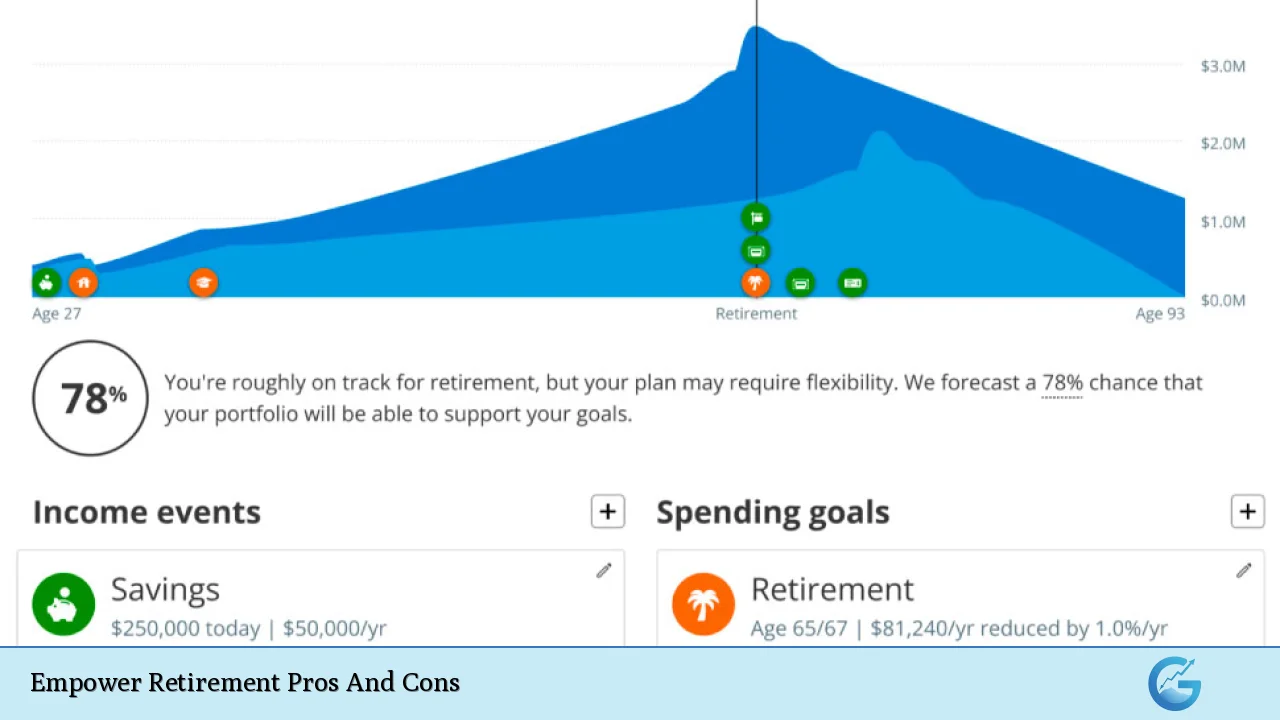

Empower Retirement stands out for its extensive suite of retirement planning tools, which are designed to help users visualize and plan for their financial future. These tools include:

- Retirement Income Planner: Helps users estimate how much they need to save for retirement

- Investment Checkup: Analyzes current investments and suggests improvements

- Fee Analyzer: Identifies hidden fees in retirement accounts

- Budgeting Tool: Assists in creating and maintaining a budget aligned with retirement goals

These tools are particularly beneficial for those who want to take a hands-on approach to their retirement planning. They provide clear, actionable insights that can help users make informed decisions about their financial future.

Access to Financial Advisors

One of the most significant advantages of Empower Retirement is the access it provides to financial advisors. This feature is especially valuable for those who prefer personalized guidance in their retirement planning. The level of access varies depending on the account tier:

- Investment Services ($100K-$200K): Access to a team of financial advisors

- Wealth Management ($200K-$1M): Two dedicated financial advisors

- Private Client ($1M+): Two dedicated advisors plus priority access to specialists

Having access to professional financial advice can be crucial in navigating complex retirement scenarios, tax implications, and investment strategies. This human touch sets Empower apart from purely robo-advisor platforms.

Wide Range of Investment Options

Empower Retirement offers a diverse array of investment options, catering to various risk tolerances and investment strategies. These options include:

- Mutual funds

- Exchange-traded funds (ETFs)

- Individual stocks (for higher-tier accounts)

- Target-date funds

- Socially responsible investing options

This variety allows investors to create well-diversified portfolios tailored to their specific needs and goals. The platform’s “Smart Weighting” approach, which equally weights equity sectors, aims to provide better risk-adjusted returns compared to traditional market-cap weighted strategies.

Strong Focus on Retirement Education

Empower Retirement places a significant emphasis on educating its users about retirement planning and investing. This focus on education is evident through:

- Webinars and online workshops

- Comprehensive articles and guides on retirement topics

- Interactive tools to help users understand complex financial concepts

- Personalized recommendations based on individual financial situations

By providing these educational resources, Empower empowers its users to make more informed decisions about their retirement savings and investments.

Robust Mobile App and Online Platform

In today’s digital age, having a user-friendly mobile app and online platform is crucial. Empower Retirement delivers on this front with:

- An intuitive mobile app for on-the-go account management

- A comprehensive online dashboard providing a holistic view of finances

- Easy-to-use tools for adjusting contributions, rebalancing portfolios, and tracking progress

- Seamless integration with other financial accounts for a complete financial picture

The platform’s ability to aggregate data from various financial accounts provides users with a comprehensive view of their financial health, making it easier to track progress towards retirement goals.

Tax Optimization Strategies

For higher-tier accounts, Empower Retirement offers sophisticated tax optimization strategies. These include:

- Tax-loss harvesting

- Asset location optimization

- Tax-efficient withdrawal strategies in retirement

These strategies can potentially lead to significant tax savings over time, especially for high-net-worth individuals. The platform’s ability to consider tax implications across various account types (e.g., 401(k), IRA, taxable accounts) can lead to more efficient overall portfolio management.

Disadvantages of Empower Retirement

High Account Minimums for Premium Services

While Empower offers free tools for all users, access to its more premium services comes with high account minimums:

- Investment Services: $100,000 minimum

- Wealth Management: $200,000 minimum

- Private Client: $1,000,000 minimum

These high minimums can be a significant barrier for many investors, especially those early in their careers or with more modest savings. This limitation means that a large portion of potential users may not be able to access the full range of Empower’s services.

Relatively High Management Fees

Compared to some competitors, particularly robo-advisors, Empower’s management fees are on the higher side:

- 0.89% for the first $1 million

- 0.79% for $1-3 million

- 0.69% for $3-5 million

- 0.59% for $5-10 million

- 0.49% for amounts over $10 million

While these fees include access to financial advisors, they can still significantly impact returns over time, especially for accounts with lower balances. Investors should carefully consider whether the additional services provided justify the higher fees compared to lower-cost alternatives.

Potential for Frequent Solicitation

Some users have reported frequent contact from Empower representatives, which can be perceived as excessive solicitation. This may include:

- Regular calls or emails promoting additional services

- Encouragement to increase contributions or change investment strategies

- Invitations to webinars or events

While some users may appreciate this level of engagement, others might find it intrusive or feel pressured to make changes to their accounts.

Complex Fee Structure

Beyond the management fees, Empower’s fee structure can be complex and potentially confusing for some users. Additional fees may include:

- Underlying fund expenses

- Trading costs

- Fees for specific services or transactions

This complexity can make it challenging for users to fully understand the total cost of using Empower’s services, potentially leading to unexpected expenses.

Limited Availability of Certain Features

Some of Empower’s more advanced features and services are only available to higher-tier accounts. This tiered approach means that:

- Lower-balance accounts may not have access to individual stock investing

- Certain tax optimization strategies are only available at higher account levels

- Access to specialized advisors is limited to top-tier accounts

This limitation can be frustrating for users who want access to specific features but don’t meet the account balance requirements.

Potential for Overwhelm with Too Many Options

While the wide range of investment options and tools can be an advantage, it can also be a double-edged sword. Some users, particularly those less experienced with investing, might find the array of choices overwhelming. This could lead to:

- Analysis paralysis when making investment decisions

- Difficulty in understanding which tools or strategies are most appropriate for their situation

- Potential for making suboptimal choices due to information overload

Without proper guidance, the wealth of options and information provided by Empower could potentially lead to decision fatigue or poor investment choices.

In conclusion, Empower Retirement offers a comprehensive suite of retirement planning tools and services, backed by access to human advisors and a wide range of investment options. Its strong focus on education and user-friendly platforms make it an attractive option for those seeking a hands-on approach to retirement planning. However, the high account minimums, relatively high fees, and complex fee structure may make it less suitable for some investors. As with any financial decision, it’s crucial to carefully weigh these pros and cons against your personal financial situation and goals before deciding if Empower Retirement is the right choice for you.

Frequently Asked Questions About Empower Retirement Pros And Cons

- What makes Empower Retirement stand out from other retirement service providers?

Empower stands out for its comprehensive retirement planning tools, access to human financial advisors, and wide range of investment options. Its “Smart Weighting” approach to portfolio construction also sets it apart from traditional market-cap weighted strategies. - Are Empower Retirement’s fees competitive?

Empower’s fees are generally higher than those of robo-advisors and some other retirement service providers. However, the fees include access to human advisors and more personalized services, which may justify the cost for some investors. - What are the minimum account balances required for Empower’s services?

Empower’s premium services have high minimums: $100,000 for Investment Services, $200,000 for Wealth Management, and $1,000,000 for Private Client services. However, some tools are available for free to all users. - Does Empower Retirement offer any unique tax optimization strategies?

Yes, for higher-tier accounts, Empower offers tax-loss harvesting, asset location optimization, and tax-efficient withdrawal strategies. These can potentially lead to significant tax savings over time. - How user-friendly is Empower Retirement’s platform?

Empower offers a robust mobile app and online platform that are generally considered user-friendly. They provide comprehensive dashboards, easy-to-use tools, and the ability to aggregate data from various financial accounts. - What educational resources does Empower Retirement provide?

Empower offers a strong focus on education through webinars, online workshops, comprehensive articles, guides on retirement topics, and interactive tools to help users understand complex financial concepts. - Can I invest in individual stocks with Empower Retirement?

Individual stock investing is available, but typically only for higher-tier accounts (Wealth Management and above). Lower-tier accounts are generally limited to mutual funds and ETFs. - Is Empower Retirement suitable for beginners?

While Empower offers educational resources that can benefit beginners, its complex fee structure and wide range of options might be overwhelming for some novice investors. It may be more suitable for those with some investing experience or those willing to work closely with a financial advisor.