Equity crowdfunding has emerged as a transformative method for startups and small businesses to raise capital by allowing a large number of investors to contribute smaller amounts in exchange for equity in the company. This approach democratizes investment opportunities, enabling non-accredited investors to participate in funding early-stage ventures that were traditionally reserved for wealthy individuals or institutional investors. While equity crowdfunding opens new doors for entrepreneurs and investors alike, it also comes with its own set of advantages and disadvantages. This article delves into the pros and cons of equity crowdfunding, providing a comprehensive overview for those interested in finance, crypto, forex, and money markets.

| Pros | Cons |

|---|---|

| Broader Access to Capital | High Risk of Failure |

| No Repayment Pressure | Share Dilution |

| Engaged Investor Base | Regulatory Compliance Challenges |

| Market Validation | Potential for Fraud |

| Retention of Control | Time-Consuming Process |

| Opportunity for Non-Accredited Investors | Lack of Expert Support |

| Potential for High Returns | Limited Resale Options |

| Diverse Investment Opportunities | Public Disclosure of Financials |

Broader Access to Capital

One of the most significant advantages of equity crowdfunding is the broader access to capital it provides. Startups can reach a vast audience of potential investors beyond traditional sources such as banks or venture capitalists. This increased visibility can lead to higher funding success rates.

- Diverse Investor Pool: Entrepreneurs can attract investments from friends, family, customers, and even strangers who believe in their business idea.

- Flexibility in Funding: Unlike traditional financing methods that may impose strict criteria, equity crowdfunding allows businesses to pitch their ideas to a wide range of investors.

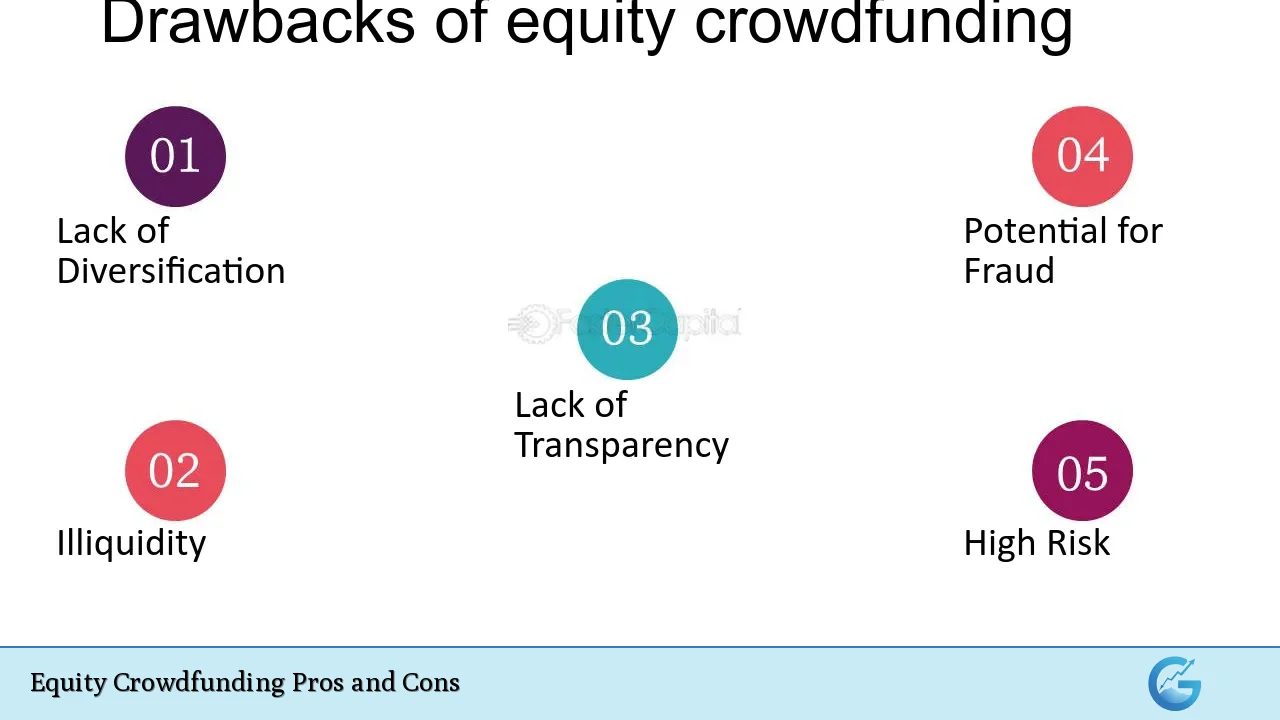

High Risk of Failure

Despite its advantages, equity crowdfunding carries a high risk of failure associated with startup investments. Many startups do not succeed, which can lead to significant financial losses for investors.

- Inherent Business Risks: Startups often face various operational challenges that can hinder their growth and sustainability.

- Investor Losses: Investors may lose their entire investment if the company fails, making it crucial to conduct thorough due diligence before investing.

No Repayment Pressure

Equity crowdfunding allows businesses to raise funds without incurring debt. This means there is no repayment pressure, which can be particularly beneficial for startups still finding their footing.

- Equity Over Debt: Companies offer shares instead of taking loans, alleviating concerns about monthly repayments.

- Focus on Growth: Entrepreneurs can concentrate on scaling their business rather than worrying about servicing debt.

Share Dilution

While raising capital through equity crowdfunding is advantageous, it can lead to share dilution for existing shareholders.

- Ownership Percentage Reduction: Issuing new shares to multiple investors reduces the ownership percentage of current shareholders.

- Potential Conflicts: Increased shareholder numbers may lead to conflicts in decision-making and governance.

Engaged Investor Base

Equity crowdfunding often results in an engaged investor base, where investors are not just passive contributors but active supporters of the business.

- Feedback and Support: Investors may provide valuable insights and connections that can help the startup grow.

- Community Building: A dedicated group of investors can foster a sense of community around the brand, enhancing customer loyalty.

Regulatory Compliance Challenges

Navigating the regulatory landscape can be challenging for startups engaging in equity crowdfunding.

- Complex Regulations: Companies must adhere to various regulations set forth by bodies like the SEC, which can be time-consuming and costly.

- Transparency Requirements: Startups are required to disclose financial information and business plans, which may deter some entrepreneurs from pursuing this funding method.

Market Validation

A successful equity crowdfunding campaign serves as a form of market validation, indicating that there is interest in the product or service being offered.

- Investor Confidence: Attracting investments from multiple individuals demonstrates confidence in the business model.

- Attracting Further Investments: A validated concept may attract additional funding from venture capitalists or angel investors later on.

Potential for Fraud

The rise of equity crowdfunding has also led to an increase in potential fraud risks.

- Scams Targeting Investors: Unscrupulous individuals may exploit the accessibility of crowdfunding platforms to launch fraudulent campaigns.

- Due Diligence Required: Investors must conduct thorough research before committing funds to ensure they are investing in legitimate opportunities.

Retention of Control

Entrepreneurs can maintain greater control over their businesses when using equity crowdfunding compared to traditional financing methods.

- No Board Seats Required: Unlike venture capitalists who often demand board representation, equity crowdfunding allows founders to retain full management control.

- Flexible Equity Offers: Business owners can structure their offers to minimize control loss while still raising necessary funds.

Time-Consuming Process

The process of launching an equity crowdfunding campaign can be quite time-consuming.

- Preparation Time: Entrepreneurs must prepare marketing materials, financial disclosures, and legal documentation before launching their campaigns.

- Campaign Duration: Successful campaigns typically run for several weeks or months, potentially delaying access to funds.

Opportunity for Non-Accredited Investors

Equity crowdfunding opens investment opportunities for non-accredited investors who traditionally lacked access to early-stage investment opportunities.

- Democratization of Investment: Individuals with lower net worths can now invest in promising startups alongside wealthy investors.

- Small Investment Amounts: Many platforms allow investments as low as $100, making it accessible for everyday individuals.

Lack of Expert Support

Investors participating in equity crowdfunding often do not receive the same level of expert support that they might get from traditional investment routes.

- Limited Guidance: Unlike venture capital firms that provide mentorship and resources, crowdfunding platforms typically do not offer extensive support.

- Self-Reliance Required: Investors must rely on their own research and judgment when evaluating potential investments.

Potential for High Returns

Investing through equity crowdfunding offers the potential for significant returns if the company succeeds.

- High Growth Potential: Successful startups can yield substantial returns on investment, sometimes exceeding traditional investment avenues.

- Case Studies of Success: Notable examples include companies like Oculus Rift, which achieved massive valuations after initial crowdfunding rounds.

Limited Resale Options

Investors face challenges when trying to resell their shares obtained through equity crowdfunding.

- Illiquid Investments: Shares purchased through these platforms are often illiquid and cannot be easily sold on secondary markets.

- Long Holding Periods: Investors may have to wait several years for an exit opportunity through acquisitions or public offerings.

Public Disclosure of Financials

Equity crowdfunding requires companies to publicly disclose financial information, which has both pros and cons.

- Transparency Benefits: Providing financial data increases transparency and builds trust with potential investors.

- Competitive Risks: Publicly sharing sensitive information could give competitors insights into business strategies or financial health.

In conclusion, equity crowdfunding represents a revolutionary shift in how startups secure funding while providing everyday investors with opportunities previously reserved for affluent individuals. However, as with any investment strategy, it is essential for both entrepreneurs and investors to carefully weigh the pros and cons. The potential rewards are significant but come with inherent risks that necessitate thorough due diligence and strategic planning. As this funding method continues to evolve, staying informed about its dynamics will be crucial for anyone involved in finance or investment markets.

Frequently Asked Questions About Equity Crowdfunding

- What is equity crowdfunding?

Equity crowdfunding is a method where individuals invest small amounts in exchange for shares in a startup or small business. - Who can participate in equity crowdfunding?

Both accredited and non-accredited investors can participate, making it accessible to a broader audience. - What are the risks associated with investing in equity crowdfunding?

The risks include high failure rates among startups, potential fraud, illiquidity of shares, and share dilution. - How much can I invest through equity crowdfunding?

The amount you can invest depends on your income and net worth; regulations typically limit individual investments based on these factors. - Is there a minimum investment requirement?

Many platforms allow investments starting as low as $100, but this varies by platform. - Can I sell my shares easily after investing?

Selling shares acquired through equity crowdfunding is often challenging due to limited resale options. - How does equity crowdfunding differ from traditional fundraising?

Unlike traditional fundraising methods that typically involve larger sums from fewer investors, equity crowdfunding democratizes access by allowing many small investments. - What should I consider before investing?

You should conduct thorough research on the company’s business model, financial health, market potential, and any associated risks.