Equity financing is a method through which companies raise capital by selling shares of their stock to investors. This approach allows businesses to access funds without incurring debt, making it an attractive option for startups and established firms alike. However, equity financing comes with its own set of advantages and disadvantages that can significantly impact a company’s operations and financial health. Understanding these pros and cons is essential for entrepreneurs, investors, and financial professionals navigating the complexities of funding in today’s dynamic markets.

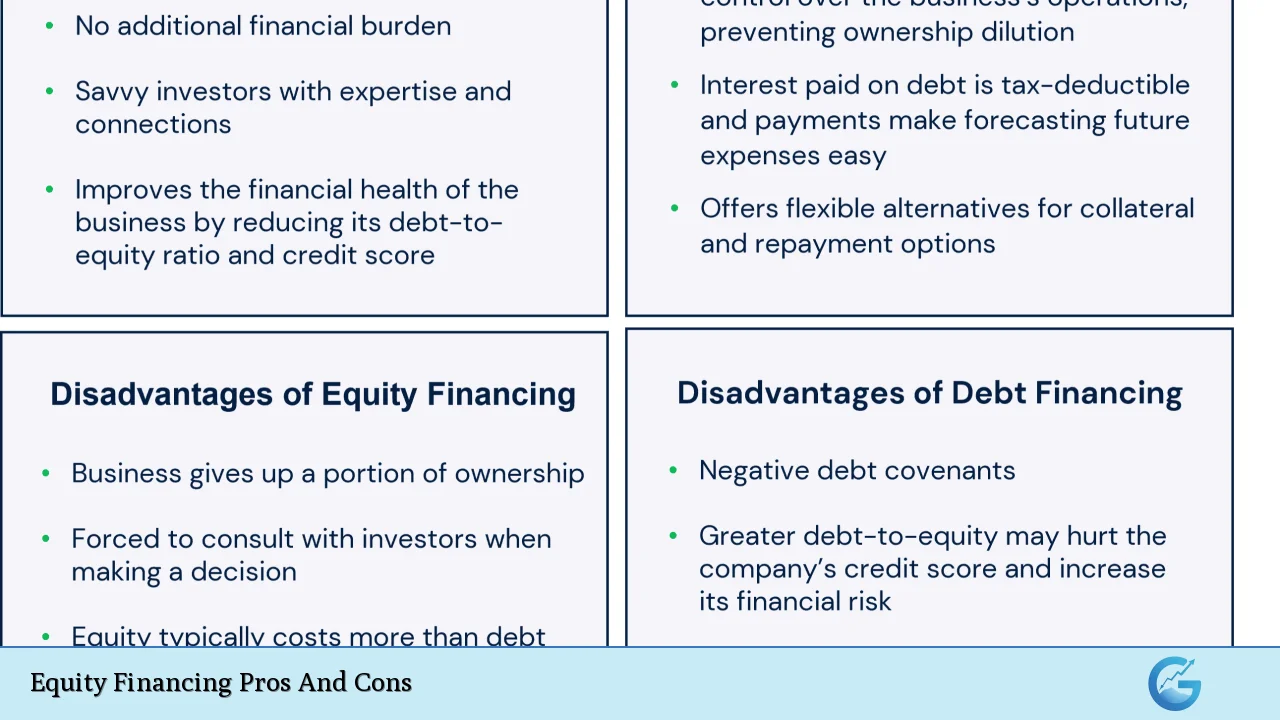

| Pros | Cons |

|---|---|

| No repayment obligation | Dilution of ownership |

| Access to additional capital | Loss of control over business decisions |

| No collateral required | Higher overall cost of capital |

| Potential for valuable investor expertise | Time-consuming fundraising process |

| Improved cash flow management | No tax benefits on dividends |

No Repayment Obligation

One of the most significant advantages of equity financing is that it does not require any repayment. Unlike loans, which necessitate regular payments regardless of a company’s financial situation, equity financing allows businesses to retain their cash flow for operational needs and growth initiatives. This feature is particularly beneficial for startups that may not yet generate consistent revenue.

- Cash Flow Management: Companies can allocate funds towards expansion, research and development, or marketing without the burden of monthly loan payments.

- Financial Flexibility: The absence of debt obligations provides greater flexibility in managing financial resources, especially during challenging economic periods.

Dilution of Ownership

While equity financing offers numerous benefits, one major drawback is the dilution of ownership. When a company sells shares to raise capital, existing owners must relinquish a portion of their stake in the business.

- Reduced Control: Founders may find themselves with less decision-making power as new shareholders gain influence over company operations.

- Potential Conflicts: Diverging interests between original owners and new investors can lead to conflicts regarding the company’s strategic direction.

Access to Additional Capital

Equity financing opens doors to substantial capital that might not be accessible through traditional lending channels. This is especially true for startups or companies lacking sufficient credit history or assets.

- Funding for Growth: Companies can secure large sums necessary for expansion projects or entering new markets without the constraints of collateral requirements.

- Diverse Investor Pool: Equity financing allows businesses to tap into various investor types, including venture capitalists and angel investors who are often willing to invest in high-risk ventures.

Loss of Control Over Business Decisions

Another significant disadvantage of equity financing is the loss of control over business decisions. As new investors come on board, they often expect a say in how the company is run.

- Investor Influence: Major shareholders may demand a voice in strategic decisions, potentially leading to slower decision-making processes.

- Board Representation: Investors might require representation on the board of directors, further complicating governance dynamics within the company.

No Collateral Required

Equity financing does not require businesses to pledge assets as collateral, making it an appealing option for many entrepreneurs. This characteristic is particularly advantageous for startups that may not have substantial assets to secure loans.

- Lower Financial Risk: Entrepreneurs can raise funds based on their business ideas and growth potential rather than their current asset base.

- Encouragement for Innovation: The lack of collateral requirements encourages innovative ventures that might otherwise struggle to secure funding through traditional means.

Higher Overall Cost of Capital

Despite its advantages, equity financing typically comes with a higher overall cost compared to debt financing. Investors expect a higher return on their investment due to the increased risk associated with equity stakes.

- Long-Term Financial Impact: The requirement for higher returns can lead to significant financial obligations in the long run, particularly if the company becomes highly profitable.

- Dividend Expectations: Profits must be shared with shareholders in the form of dividends, reducing the amount available for reinvestment back into the company.

Potential for Valuable Investor Expertise

Equity investors often bring more than just capital; they can provide valuable expertise and connections that can help propel a business forward.

- Networking Opportunities: Investors frequently have extensive networks that can open doors to new partnerships and markets.

- Mentorship: Many venture capitalists and angel investors are seasoned entrepreneurs themselves and can offer guidance based on their experiences.

Time-Consuming Fundraising Process

Securing equity financing can be a lengthy and complex process compared to obtaining debt financing.

- Extensive Due Diligence: Companies must undergo rigorous evaluation processes by potential investors, which can take considerable time and resources.

- Negotiation Challenges: The need for negotiations over terms, valuations, and shareholder rights can prolong the fundraising timeline significantly.

Improved Cash Flow Management

Equity financing enhances cash flow management by freeing up resources that would otherwise be allocated toward debt repayment.

- Focus on Growth Initiatives: Companies can prioritize growth strategies without the pressure of meeting fixed repayment schedules.

- Buffer Against Economic Downturns: With no immediate repayment obligations, businesses are better positioned to weather economic challenges without sacrificing operational integrity.

No Tax Benefits on Dividends

Unlike interest payments on debt—which are tax-deductible—dividends paid to shareholders do not offer similar tax advantages.

- Higher Effective Cost: This lack of tax benefits increases the overall cost associated with equity financing compared to debt options.

- Impact on Profit Distribution: Companies might find themselves paying out more in taxes when distributing profits as dividends rather than retaining them for reinvestment.

In conclusion, equity financing presents both significant opportunities and notable challenges for businesses seeking growth capital. While it provides essential funding without repayment obligations and access to valuable expertise, it also requires careful consideration regarding ownership dilution and potential loss of control. Entrepreneurs must weigh these factors against their specific circumstances and long-term goals before deciding whether equity financing is the right path forward.

Frequently Asked Questions About Equity Financing

- What is equity financing?

Equity financing involves raising capital by selling shares in a company, allowing investors to gain ownership stakes in exchange for their investment. - What are the main advantages of equity financing?

The primary advantages include no repayment obligation, access to substantial capital without collateral requirements, and potential support from experienced investors. - What are some disadvantages associated with equity financing?

Disadvantages include dilution of ownership, loss of control over business decisions, higher overall cost compared to debt financing, and no tax benefits on dividends. - How does equity financing impact cash flow?

Equity financing improves cash flow management by eliminating repayment obligations associated with loans, allowing companies to reinvest profits into growth initiatives. - Can startups benefit from equity financing?

Yes, startups often benefit from equity financing as it provides access to necessary funds without requiring established credit histories or collateral. - What types of investors participate in equity financing?

Investors can include venture capitalists, angel investors, institutional investors, or even crowdfunding platforms depending on the stage and needs of the business. - Is there a risk involved in equity financing?

Yes, there are risks such as losing control over business decisions and having to share profits with shareholders through dividends. - How does one go about securing equity financing?

The process typically involves preparing a solid business plan, pitching to potential investors, negotiating terms, and undergoing due diligence.