Equity Indexed Annuities (EIAs) are a hybrid financial product that combines features of both fixed and variable annuities. They offer a unique investment opportunity by providing a minimum guaranteed return while also allowing for potential growth linked to the performance of a stock market index, such as the S&P 500. This blend makes them appealing to investors seeking a balance between security and growth. However, EIAs come with complexities and risks that potential investors must carefully consider.

This article explores the pros and cons of equity indexed annuities, providing a comprehensive overview for those interested in finance, investments, and retirement planning.

| Pros | Cons |

|---|---|

| Potential for higher returns than traditional fixed annuities | Complex structures can be difficult to understand |

| Downside protection against market losses | High fees and commissions can reduce overall returns |

| Tax-deferred growth until withdrawal | Surrender charges can apply for early withdrawals |

| Guaranteed minimum return provides security | Participation rates limit potential gains from market performance |

| No direct exposure to stock market volatility | Potentially lower returns compared to variable annuities during bull markets |

| Flexibility in choosing indexes for growth potential | Limited liquidity due to long-term commitment requirements |

| Can be an effective tool for retirement income planning | May not be suitable for all investor profiles due to complexity and fees |

Potential for Higher Returns Than Traditional Fixed Annuities

One of the most significant advantages of equity indexed annuities is their potential for higher returns compared to traditional fixed annuities.

- Market Linkage: EIAs are tied to the performance of a stock market index, which can yield better returns when the market performs well.

- Interest Rate Cap: While there is typically a cap on the maximum return, the ability to earn more than fixed rates can be attractive during favorable market conditions.

Downside Protection Against Market Losses

Equity indexed annuities offer downside protection, making them appealing for conservative investors.

- Minimum Returns: EIAs guarantee a minimum return, ensuring that investors do not lose their principal even if the linked index performs poorly.

- Market Buffer: This feature can provide peace of mind during volatile market periods, as investors know their capital is protected.

Tax-Deferred Growth Until Withdrawal

Another advantage of EIAs is the tax-deferred growth they offer.

- Tax Benefits: Investors do not pay taxes on earnings until they withdraw funds, allowing their investments to grow without immediate tax implications.

- Retirement Planning: This characteristic makes EIAs suitable for long-term retirement planning, as it can enhance overall savings growth over time.

Guaranteed Minimum Return Provides Security

The guarantee of a minimum return is a key selling point for equity indexed annuities.

- Financial Stability: This feature appeals particularly to risk-averse individuals who prioritize capital preservation alongside growth.

- Predictable Income: For retirees or those nearing retirement, knowing there is a baseline return can help in planning future income needs.

No Direct Exposure to Stock Market Volatility

EIAs allow investors to benefit from stock market gains without directly investing in stocks.

- Reduced Risk: This setup mitigates the risk associated with direct stock investments while still providing opportunities for growth linked to market performance.

- Balanced Approach: Investors can enjoy some market upside while avoiding the full brunt of stock market downturns.

Complexity in Structures Can Be Difficult to Understand

Despite their benefits, equity indexed annuities come with complex structures that can confuse investors.

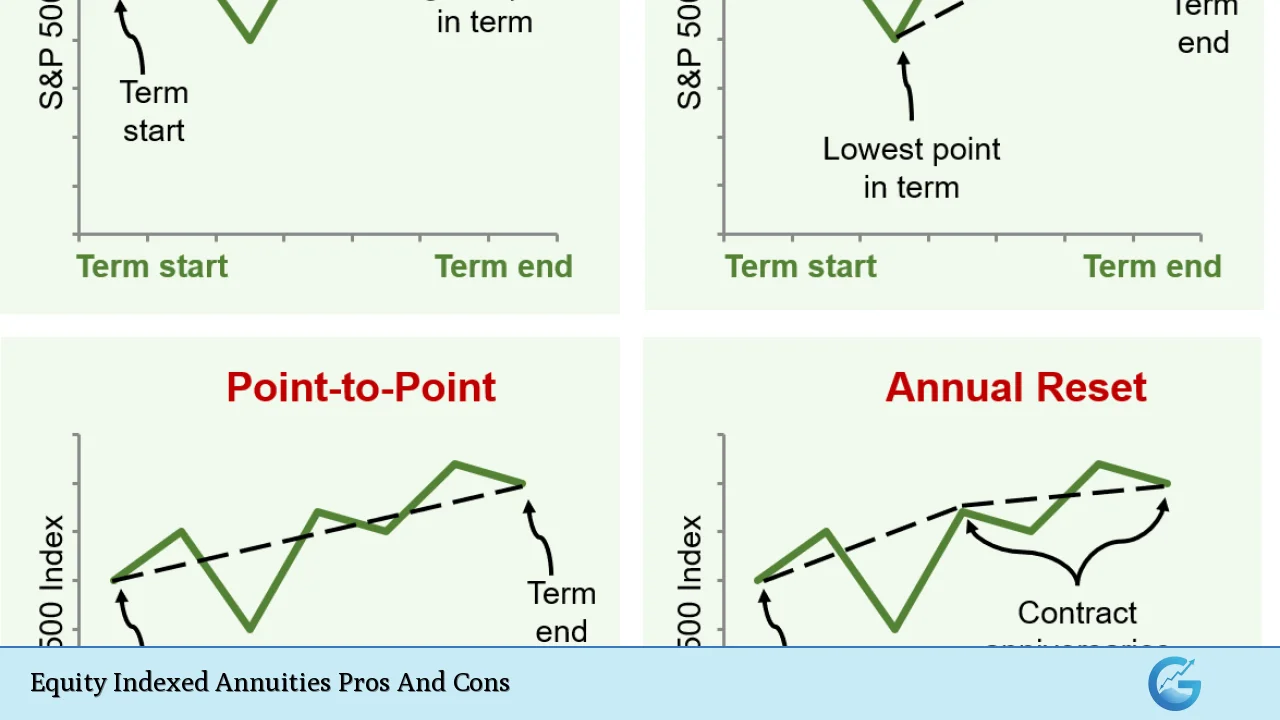

- Variable Terms: The terms related to participation rates, caps, and spreads can vary significantly between products, making comparisons challenging.

- Need for Education: Investors must invest time in understanding these products fully before committing funds, which may deter some potential buyers.

High Fees and Commissions Can Reduce Overall Returns

One of the notable drawbacks of EIAs is their associated costs.

- Commission Structures: High sales commissions and management fees can significantly eat into an investor’s returns over time.

- Lack of Transparency: Often, these fees are not clearly disclosed upfront, leading to surprises when returns are lower than expected due to costs.

Surrender Charges Can Apply for Early Withdrawals

Investors should be aware of surrender charges associated with equity indexed annuities.

- Long Lock-In Periods: If an investor wishes to withdraw funds before a specified period (often 5–10 years), they may incur hefty surrender charges that can reach up to 20% of the investment.

- Penalty Risks: Additionally, withdrawing funds early may also trigger tax penalties if done before age 59½.

Participation Rates Limit Potential Gains from Market Performance

While EIAs provide exposure to market gains, there are limitations on how much investors can benefit from those gains.

- Capped Returns: The participation rate determines how much of the index’s gain will be credited to the annuity. For instance, if an EIA has an 80% participation rate and the index rises by 10%, only 8% would be credited to the investor’s account.

- Potential Underperformance: In strong bull markets, this limitation can lead to lower overall returns compared to direct investments in stocks or variable annuities that do not have such caps.

Potentially Lower Returns Compared To Variable Annuities During Bull Markets

While EIAs offer more security than variable annuities, they may underperform during strong market conditions.

- Growth Limitations: The capped nature of returns means that in booming markets, EIAs might not yield as high returns as variable annuities or direct stock investments.

- Investor Expectations: Investors seeking aggressive growth might find EIAs less appealing compared to other investment vehicles that allow full participation in market gains.

Limited Liquidity Due To Long-Term Commitment Requirements

Equity indexed annuities often require long-term commitments that may limit liquidity for investors.

- Withdrawal Restrictions: Many EIAs impose restrictions on withdrawals during the accumulation phase, making it difficult for investors who may need access to their funds sooner than expected.

- Financial Planning Considerations: This lack of liquidity requires careful financial planning and consideration of future cash flow needs before investing in an EIA.

Can Be an Effective Tool for Retirement Income Planning

Despite their complexities and drawbacks, equity indexed annuities can serve as effective tools for retirement income planning.

- Income Stability: The guaranteed minimum return provides a level of income stability that many retirees seek.

- Diversification Strategy: Including EIAs as part of a diversified retirement portfolio can help balance risk while still allowing for some growth potential linked to market performance.

May Not Be Suitable For All Investor Profiles Due To Complexity And Fees

Finally, it’s essential to recognize that equity indexed annuities may not be suitable for every investor profile due to their complexities and costs.

- Investor Knowledge Level: Individuals unfamiliar with financial products or those who prefer straightforward investments may find EIAs challenging.

- Cost-Benefit Analysis Needed: Potential buyers should conduct thorough research and possibly consult financial advisors before committing funds into these products.

In conclusion, equity indexed annuities present a unique investment opportunity with both advantages and disadvantages. They offer potential higher returns than traditional fixed annuities while providing downside protection and tax-deferred growth. However, their complexity, high fees, and limitations on gains mean they are not suitable for every investor. Understanding these pros and cons is crucial for anyone considering adding EIAs to their investment portfolio.

Frequently Asked Questions About Equity Indexed Annuities

- What is an equity indexed annuity?

An equity indexed annuity is a type of fixed annuity where the interest earned is linked partially to a stock market index’s performance. - What are the main benefits of equity indexed annuities?

The primary benefits include potential higher returns than traditional fixed annuities, downside protection against losses, and tax-deferred growth. - Are there any risks associated with equity indexed annuities?

Yes, risks include high fees and commissions, surrender charges for early withdrawals, and complex structures that may confuse investors. - How do participation rates affect my earnings?

Participation rates determine how much of the index’s gain will be credited; if set at 80%, you would earn 80% of the index’s increase. - Can I access my money easily from an equity indexed annuity?

No, accessing funds early may incur surrender charges and tax penalties; these products typically require long-term commitments. - Who should consider investing in equity indexed annuities?

They may suit conservative investors looking for some growth potential with protection against losses but may not fit aggressive investors seeking high returns. - What happens if I withdraw money from my EIA early?

If you withdraw early, you may face surrender charges and possible tax penalties if under age 59½. - How do I choose an equity indexed annuity?

Selecting an EIA involves comparing different products based on fees, participation rates, caps on earnings, and understanding your financial goals.