A Home Equity Line of Credit (HELOC) is a versatile financial tool that allows homeowners to borrow against the equity they’ve built in their property. This revolving credit line functions similarly to a credit card, offering flexibility in borrowing and repayment. As the housing market continues to evolve, understanding the intricacies of HELOCs becomes crucial for savvy investors and homeowners alike.

| Pros | Cons |

|---|---|

| Lower interest rates compared to credit cards | Variable interest rates can lead to payment fluctuations |

| Flexible borrowing and repayment terms | Risk of foreclosure if payments are not met |

| Potential tax deductions on interest | Temptation to overspend |

| Access to large sums of money | Reduction in home equity |

| Interest charged only on borrowed amount | Possible fees and closing costs |

| Can be used for various purposes | Complex terms and conditions |

Advantages of a Home Equity Line of Credit

Lower Interest Rates

HELOCs typically offer lower interest rates compared to unsecured loans and credit cards.

This is because the loan is secured by your home, reducing the lender’s risk. The interest rates for HELOCs are often tied to the prime rate, which can result in significant savings over time, especially when compared to high-interest credit card debt.

Benefits include:

- Potential for substantial interest savings over time

- Opportunity to consolidate high-interest debts

- More affordable borrowing for large expenses

Flexible Borrowing and Repayment Terms

HELOCs provide a level of flexibility that few other financial products can match. During the draw period, which typically lasts 5 to 10 years, borrowers can:

- Access funds as needed, up to the credit limit

- Make interest-only payments on the borrowed amount

- Repay and reborrow funds multiple times

This flexibility allows homeowners to manage their finances more effectively, adapting to changing circumstances and needs over time.

Potential Tax Deductions

Interest paid on a HELOC may be tax-deductible if the funds are used for home improvements or renovations.

While the Tax Cuts and Jobs Act of 2017 placed some limitations on this benefit, it remains a significant advantage for many homeowners. However, it’s crucial to consult with a tax professional to understand the current regulations and how they apply to your specific situation.

Access to Large Sums of Money

HELOCs often provide access to substantial amounts of credit, depending on the equity in your home. This can be particularly advantageous for:

- Major home renovations

- Funding a business venture

- Covering significant expenses like education costs

The ability to borrow large sums at relatively low interest rates makes HELOCs an attractive option for those needing to finance substantial projects or investments.

Interest Charged Only on Borrowed Amount

Unlike traditional loans where interest accrues on the entire principal from day one, HELOCs only charge interest on the amount you actually borrow. This feature can result in significant savings, especially if you don’t need to use the entire credit line immediately or if you use it for intermittent expenses.

Versatility in Use

HELOCs can be used for a wide range of purposes, offering flexibility that many other financial products lack. Common uses include:

- Home improvements and renovations

- Debt consolidation

- Education expenses

- Emergency funds

- Investment opportunities

This versatility makes HELOCs a valuable tool in a comprehensive financial strategy.

Disadvantages of a Home Equity Line of Credit

Variable Interest Rates

The variable nature of HELOC interest rates can lead to unpredictable payment amounts over time.

While initial rates may be attractive, they can increase significantly based on market conditions. This variability can make budgeting challenging and potentially lead to financial strain if rates rise substantially.

Risks include:

- Difficulty in long-term financial planning

- Potential for dramatically increased monthly payments

- Exposure to market volatility

Risk of Foreclosure

Perhaps the most significant risk associated with HELOCs is the potential for foreclosure. Since your home serves as collateral for the loan, failing to make payments could result in losing your property. This risk underscores the importance of careful financial planning and responsible borrowing when utilizing a HELOC.

Temptation to Overspend

The ease of access to funds through a HELOC can lead to overspending. Some borrowers may view their home equity as “free money,” leading to:

- Accumulation of unnecessary debt

- Using home equity for non-essential purchases

- Difficulty repaying the borrowed amount during the repayment period

It’s crucial to approach a HELOC with discipline and a clear repayment strategy to avoid these pitfalls.

Reduction in Home Equity

Utilizing a HELOC reduces the equity you’ve built in your home. This can be particularly problematic if:

- Property values decline

- You need to sell your home in the near future

- You’re relying on home equity for retirement planning

Careful consideration of long-term financial goals is essential when deciding to tap into home equity.

Possible Fees and Closing Costs

While HELOCs often have lower upfront costs compared to traditional loans, they’re not free. Potential expenses include:

- Application fees

- Annual maintenance fees

- Early termination fees

- Closing costs (which can include appraisal fees, title search fees, and more)

These costs can add up, potentially offsetting some of the interest rate advantages of a HELOC.

Complex Terms and Conditions

HELOCs often come with complex terms and conditions that can be challenging to navigate. Key considerations include:

- Draw period and repayment period structures

- Minimum draw requirements

- Rate caps and floors

- Conversion options from variable to fixed rates

Understanding these nuances is crucial for making informed decisions and avoiding unexpected financial challenges.

In conclusion, Home Equity Lines of Credit offer a powerful financial tool for homeowners, providing access to funds at potentially lower interest rates than other forms of borrowing. However, they also come with significant risks and responsibilities. The decision to pursue a HELOC should be made carefully, considering both short-term needs and long-term financial goals. By understanding the pros and cons thoroughly, homeowners can make informed decisions about whether a HELOC aligns with their financial strategy.

Frequently Asked Questions About Equity Line Of Credit Pros And Cons

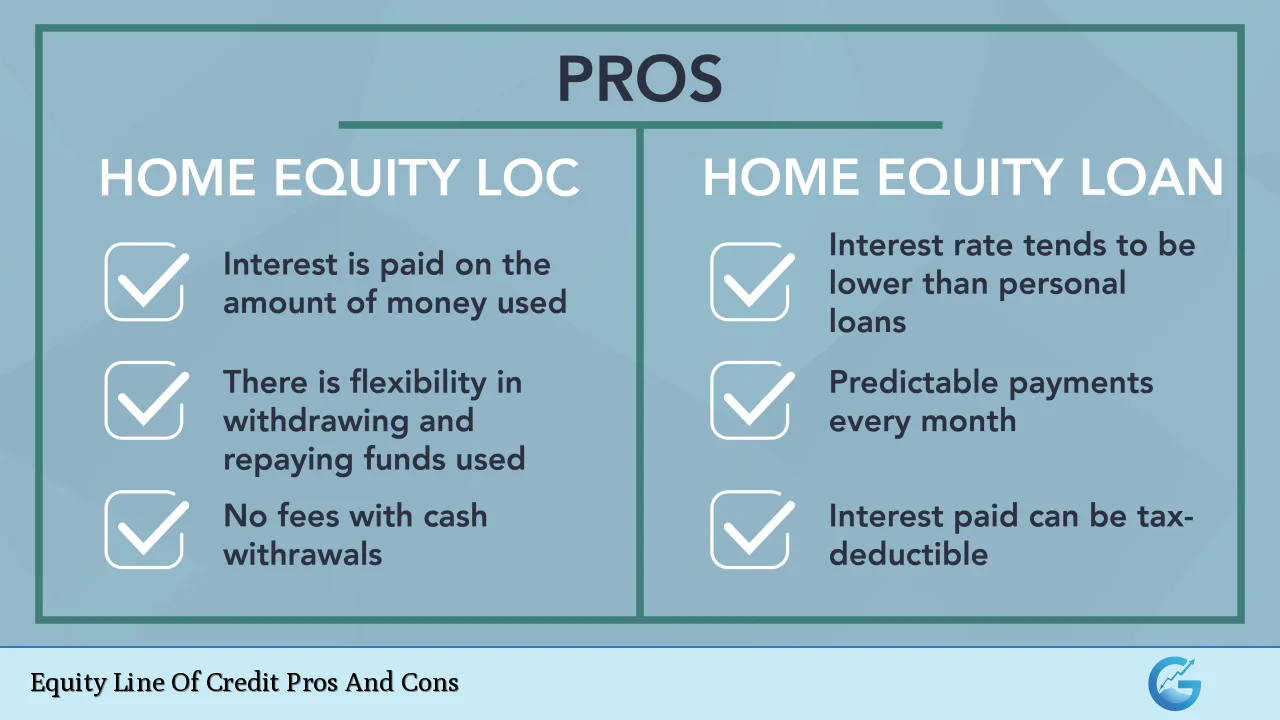

- How does a HELOC differ from a home equity loan?

A HELOC offers revolving credit with variable rates, while a home equity loan provides a lump sum with fixed rates. HELOCs allow for flexible borrowing during the draw period, whereas home equity loans have fixed monthly payments from the start. - Can I use a HELOC for any purpose?

Yes, you can use a HELOC for various purposes, including home improvements, debt consolidation, or education expenses. However, using it for home improvements may offer tax advantages. - What happens if my home value decreases while I have a HELOC?

If your home value decreases, your lender may reduce your credit limit or freeze your HELOC. In extreme cases, they might require immediate repayment of some or all of the outstanding balance. - Are there any alternatives to HELOCs for accessing home equity?

Yes, alternatives include cash-out refinancing, home equity loans, and reverse mortgages for seniors. Each option has its own set of pros and cons to consider based on your financial situation. - How does a HELOC affect my credit score?

A HELOC can impact your credit score in several ways. It may initially lower your score due to the hard inquiry, but responsible use can improve your credit utilization ratio and potentially boost your score over time. - Can I deduct HELOC interest on my taxes?

HELOC interest may be tax-deductible if the funds are used for home improvements. However, recent tax law changes have limited this deduction, so consult a tax professional for current regulations. - What happens at the end of the HELOC draw period?

At the end of the draw period, you enter the repayment period where you can no longer borrow funds. Your payments will include both principal and interest, potentially resulting in higher monthly payments. - Is it possible to refinance a HELOC?

Yes, you can refinance a HELOC by either negotiating with your current lender or finding a new lender offering better terms. This can be particularly beneficial if interest rates have decreased or your financial situation has improved.