Equity financing is a method by which companies raise capital by selling shares of their stock to investors. This approach can be particularly appealing for startups and growing businesses that may not have access to traditional forms of financing, such as bank loans. By offering equity, companies can attract investment without incurring debt, which can be a significant advantage in the early stages of growth. However, this method also comes with its own set of challenges and drawbacks. Understanding the pros and cons of equity financing is crucial for entrepreneurs and investors alike.

| Pros | Cons |

|---|---|

| No repayment obligation | Ownership dilution |

| Access to substantial capital | Potential conflicts with investors |

| No collateral required | Pressure for dividends |

| Shared financial risk | Lengthy fundraising process |

| Expertise and connections from investors | No tax benefits on dividends |

| Enhanced company credibility | Loss of control over business decisions |

No Repayment Obligation

One of the most significant advantages of equity financing is that it does not require regular repayments. Unlike loans, which typically necessitate monthly payments regardless of business performance, equity financing allows companies to use their cash flow for operational needs and growth opportunities. This flexibility can be particularly beneficial for startups that may not yet have stable revenue streams.

- Cash Flow Management: Companies can allocate funds towards research, development, marketing, and other critical areas without the burden of debt repayment.

- Financial Stability: The absence of repayment obligations reduces financial stress during challenging economic conditions.

Access to Substantial Capital

Equity financing can provide access to larger amounts of capital than might be available through traditional lending sources. This is especially advantageous for businesses looking to undertake significant projects or expansions.

- Funding Growth: Companies can pursue ambitious growth strategies without being limited by their current assets or creditworthiness.

- Diverse Investor Pool: Equity financing opens doors to various types of investors, including angel investors, venture capitalists, and crowdfunding platforms.

No Collateral Required

Unlike debt financing, equity financing does not require collateral. This means that personal or business assets are not at risk when raising funds through equity.

- Lower Risk for Founders: Entrepreneurs can secure funding based on their business plans and growth potential rather than their current asset base.

- Encourages Innovation: The lack of collateral requirements allows more startups and small businesses to access necessary funds without jeopardizing personal assets.

Shared Financial Risk

When a company raises funds through equity financing, it shares the financial risks associated with its operations with its investors. This shared risk can provide a safety net for business owners.

- Support During Downturns: If the company faces difficulties, the financial burden is not solely on the original owners.

- Collaborative Decision-Making: Investors often bring valuable insights and support that can lead to better strategic decisions.

Expertise and Connections from Investors

Investors often bring more than just capital; they can provide valuable expertise and connections that help businesses navigate challenges and seize opportunities.

- Strategic Guidance: Experienced investors can offer insights into market entry strategies, operational efficiencies, and product development.

- Networking Opportunities: Investors typically have extensive networks that can facilitate introductions to potential clients, suppliers, and partners.

Enhanced Company Credibility

Securing investment from reputable investors enhances a company’s credibility in the marketplace. This validation can attract additional partners and customers.

- Market Confidence: A history of attracting equity financing signals strong growth potential to future investors and stakeholders.

- Attracting Talent: Increased credibility can help attract top talent who want to work for a reputable organization.

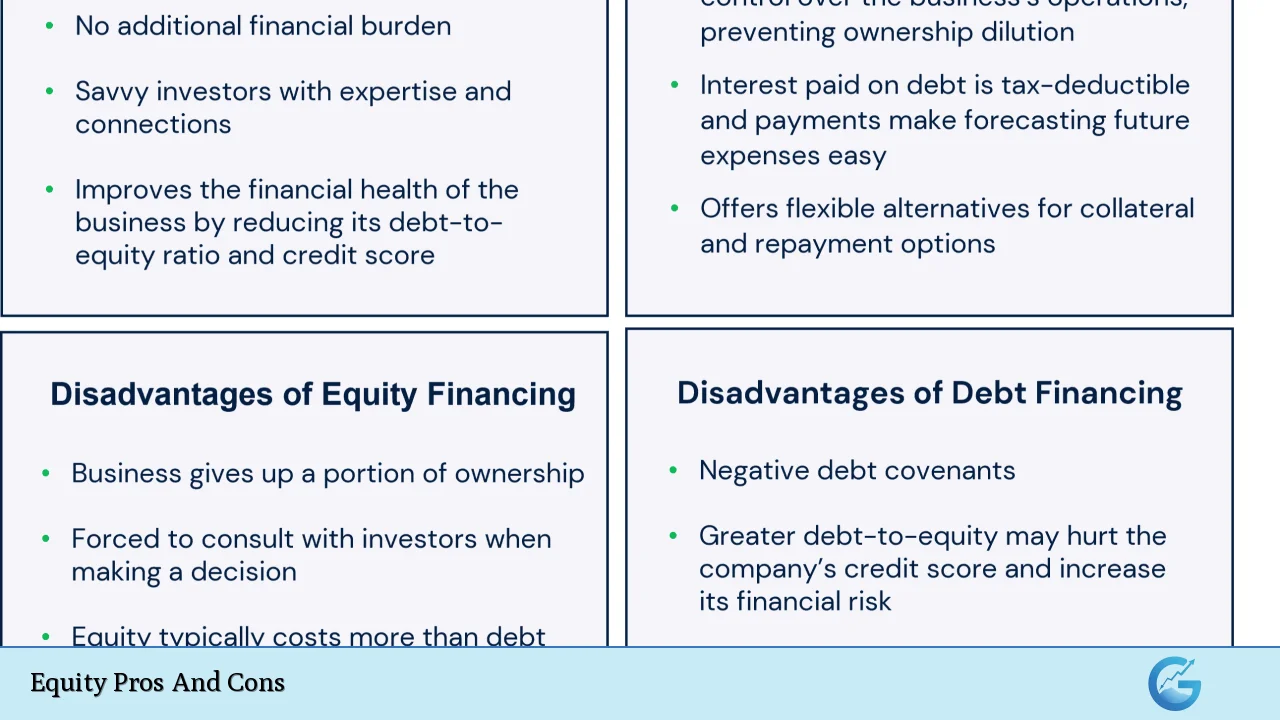

Ownership Dilution

A major disadvantage of equity financing is ownership dilution. When a company sells shares, existing owners must share control with new investors.

- Reduced Decision-Making Power: Founders may find their autonomy compromised as they must consult with shareholders on important business decisions.

- Potential Conflicts: Investors may have different priorities or visions for the company, leading to conflicts in strategic direction.

Potential Conflicts with Investors

The introduction of outside investors can lead to potential conflicts regarding business strategy and operations.

- Diverging Interests: Investors may focus on short-term profits while founders might prioritize long-term growth.

- Decision-Making Delays: The need for consensus among multiple stakeholders can slow down critical decision-making processes.

Pressure for Dividends

Investors often expect returns on their investments in the form of dividends. This expectation can create additional financial obligations for the company.

- Impact on Cash Flow: Regular dividend payments can strain resources during downturns or when profits are low.

- Operational Trade-offs: Companies may have to make difficult decisions about cutting costs in other areas to meet dividend expectations.

Lengthy Fundraising Process

Raising equity capital can be a time-consuming process that requires extensive preparation and negotiation.

- Time Investment: Identifying suitable investors and securing commitments can take months or even longer.

- Due Diligence Requirements: Investors typically conduct thorough due diligence before committing funds, adding complexity to the fundraising process.

No Tax Benefits on Dividends

Unlike interest payments on debt, dividends paid to shareholders are not tax-deductible. This lack of tax benefits makes equity financing potentially more expensive in the long run.

- Higher Overall Cost: Companies may face higher effective costs when distributing profits as dividends compared to interest payments on loans.

- Investor Expectations: The need to provide attractive returns may pressure companies into paying dividends even when it might not be financially prudent.

Loss of Control Over Business Decisions

With new investors comes a loss of control over business operations. Founders must now consider the opinions and interests of shareholders when making decisions.

- Slower Decision-Making Processes: The necessity for consensus among multiple parties can hinder agility in responding to market changes.

- Strategic Misalignment: Differences in vision between founders and investors can lead to strategic misalignment that affects overall company direction.

In conclusion, equity financing presents both significant advantages and notable disadvantages. For many businesses, especially startups seeking rapid growth without incurring debt, equity financing offers essential benefits like access to capital and shared risk. However, it also involves complexities such as ownership dilution and potential conflicts with investors that must be carefully managed. Entrepreneurs should weigh these factors against their specific circumstances when considering equity as a funding option.

Frequently Asked Questions About Equity Pros And Cons

- What is equity financing?

Equity financing involves raising capital by selling shares in a company, allowing businesses to gain investment without incurring debt. - What are the main advantages of equity financing?

The main advantages include no repayment obligation, access to substantial capital, no collateral requirements, shared financial risk, expertise from investors, and enhanced credibility. - What are common disadvantages associated with equity financing?

Common disadvantages include ownership dilution, potential conflicts with investors, pressure for dividend payments, lengthy fundraising processes, lack of tax benefits on dividends, and loss of control over business decisions. - How does ownership dilution affect founders?

Ownership dilution reduces founders’ control over decision-making processes as they must share authority with new shareholders. - Can equity financing lead to conflicts between founders and investors?

Yes, differing priorities between founders focused on long-term growth and investors seeking short-term returns can create conflicts. - What is the impact of dividend payments on cash flow?

Dividend payments can strain a company’s cash flow during downturns or periods of low profitability. - Why is the fundraising process considered lengthy?

The fundraising process involves identifying suitable investors, conducting due diligence, negotiating terms, and securing commitments which can take considerable time. - Are there tax advantages associated with equity financing?

No, unlike interest payments on debt which are tax-deductible, dividends paid out are not tax-deductible expenses.