Escrow accounts serve as a financial safeguard in various transactions, ensuring that funds are held securely until all conditions of an agreement are met. This mechanism is widely used in real estate, online sales, and even in the cryptocurrency space, providing a layer of trust between parties. While escrow accounts offer significant advantages, they also come with certain drawbacks that potential users should consider. This article explores the pros and cons of using escrow accounts, aiming to provide a comprehensive understanding for individuals interested in finance, crypto, forex, and money markets.

| Pros | Cons |

|---|---|

| Ensures funds are available and conditions are met before release. | Escrow services can be expensive. |

| Provides reassurance that funds or assets are handled properly. | The process can be complex and time-consuming. |

| Helps resolve disputes with a neutral third party holding funds. | May cause delays in completing transactions. |

| Managed by professionals ensuring compliance with terms. | Reliance on the escrow agent’s efficiency and trustworthiness. |

| Provides legal protection for all parties involved. | Limited ability to change terms once set. |

| All transactions and terms are clear and documented. | Involves significant paperwork and documentation. |

| Lowers the risk of fraud or deceit in financial transactions. | Risk of miscommunication between parties and the escrow agent. |

Ensures Funds Are Available and Conditions Are Met Before Release

One of the primary advantages of using an escrow account is that it guarantees that funds will only be released when all agreed-upon conditions are fulfilled. This is particularly crucial in high-stakes transactions such as real estate deals or large online purchases.

- Security: Escrow accounts protect both buyers and sellers by ensuring that neither party can access the funds until all contractual obligations are met.

- Trust: This arrangement fosters trust between parties who may not know each other well, as it provides assurance that funds are secure.

Provides Reassurance That Funds or Assets Are Handled Properly

Escrow accounts offer peace of mind by ensuring that funds or assets are managed by a neutral third party. This is especially important in complex transactions where large sums of money are involved.

- Professional Management: Escrow agents are typically experienced professionals who understand the legalities involved, which helps ensure compliance with all terms.

- Transparency: All parties have visibility into the transaction process, which can help prevent misunderstandings.

Helps Resolve Disputes with a Neutral Third Party Holding Funds

In cases where disputes arise between buyers and sellers, having an escrow agent can help facilitate resolution. The agent acts as a mediator who can help clarify issues based on the terms set forth in the escrow agreement.

- Dispute Resolution: If there is a disagreement about whether conditions have been met, the escrow agent can help determine the appropriate course of action.

- Documentation: The escrow process involves detailed documentation, which can serve as evidence if disputes escalate to legal action.

Managed by Professionals Ensuring Compliance with Terms

Escrow accounts are typically managed by licensed professionals who understand regulatory requirements and best practices. This professional oversight adds another layer of security to financial transactions.

- Expertise: Escrow agents bring expertise that can help navigate complex transactions smoothly.

- Regulatory Compliance: Professional management ensures adherence to relevant laws and regulations, reducing legal risks for all parties involved.

Provides Legal Protection for All Parties Involved

Using an escrow account can provide legal protections for both buyers and sellers. The structured nature of these agreements helps enforce compliance with contract terms.

- Contractual Obligations: Escrow agreements clearly outline the responsibilities of each party, which can be legally enforced if necessary.

- Reduced Risk: By ensuring that funds are only released when conditions are met, escrow accounts mitigate risks associated with fraud or non-compliance.

All Transactions and Terms Are Clear and Documented

The use of an escrow account necessitates clear documentation of all transaction terms. This clarity helps prevent misunderstandings and ensures that all parties are on the same page.

- Written Agreements: All conditions for fund release must be documented, which provides a reference point for all parties.

- Accountability: Clear documentation holds each party accountable for their obligations under the agreement.

Lowers the Risk of Fraud or Deceit in Financial Transactions

Escrow accounts significantly reduce the risk of fraud by holding funds securely until all conditions are satisfied. This is particularly important in online transactions where buyers may be concerned about scams.

- Trustworthy Transactions: Buyers feel more secure knowing their money is protected until they receive what they paid for.

- Fraud Prevention: The presence of an escrow account deters fraudulent behavior since both parties know there is a neutral third party involved.

Escrow Services Can Be Expensive

Despite their advantages, one major drawback of escrow services is their cost. Fees can vary significantly depending on the nature of the transaction and the service provider.

- Service Fees: Escrow services typically charge fees based on the amount being held in escrow or a flat rate for their services.

- Budget Considerations: For smaller transactions, these fees may represent a significant percentage of the total amount involved.

The Process Can Be Complex and Time-Consuming

Setting up an escrow account involves several steps that can complicate transactions. From drafting agreements to waiting for fund releases, this process may take longer than expected.

- Multiple Steps: The process often requires multiple documents to be signed by all parties involved.

- Time Delays: Depending on how quickly each party responds to requests from the escrow agent, delays can occur that may frustrate those involved in time-sensitive transactions.

May Cause Delays in Completing Transactions

The structured nature of escrow processes means that transactions may take longer to complete than if they were conducted directly between buyers and sellers without intermediaries.

- Waiting Periods: Funds cannot be released until all conditions have been verified as met, which may lead to delays.

- Impact on Negotiations: Extended timelines can affect negotiations and lead to frustration among parties eager to finalize deals.

Reliance on the Escrow Agent’s Efficiency and Trustworthiness

The effectiveness of an escrow account largely depends on the reliability and efficiency of the escrow agent managing it. If an agent is inefficient or untrustworthy, it can lead to significant issues.

- Agent Selection: Choosing a reputable escrow agent is crucial; poor choices can result in mishandling funds or delays.

- Trust Issues: If any party doubts the integrity of the escrow agent, it could undermine confidence in the entire transaction process.

Limited Ability to Change Terms Once Set

Once an escrow agreement is established, modifying its terms can be challenging. This rigidity may not suit all situations or parties’ needs.

- Inflexibility: Changes often require consensus from all parties involved, which may not always be possible.

- Potential Conflicts: If circumstances change after an agreement has been made, rigid terms could lead to conflicts between parties.

Involves Significant Paperwork and Documentation

The use of an escrow account necessitates extensive paperwork. While this documentation provides clarity and security, it can also be burdensome.

- Administrative Burden: Parties must prepare various documents detailing transaction terms, which can slow down processes.

- Record Keeping: Maintaining accurate records becomes essential but may require additional effort from all parties involved.

Risk of Miscommunication Between Parties and the Escrow Agent

Effective communication is vital when using an escrow account; however, miscommunication can lead to misunderstandings about terms or conditions required for fund release.

- Clarifying Expectations: All parties must clearly articulate their expectations to avoid confusion later on.

- Potential Disputes: Miscommunication could result in disputes over whether conditions have been met or how funds should be handled.

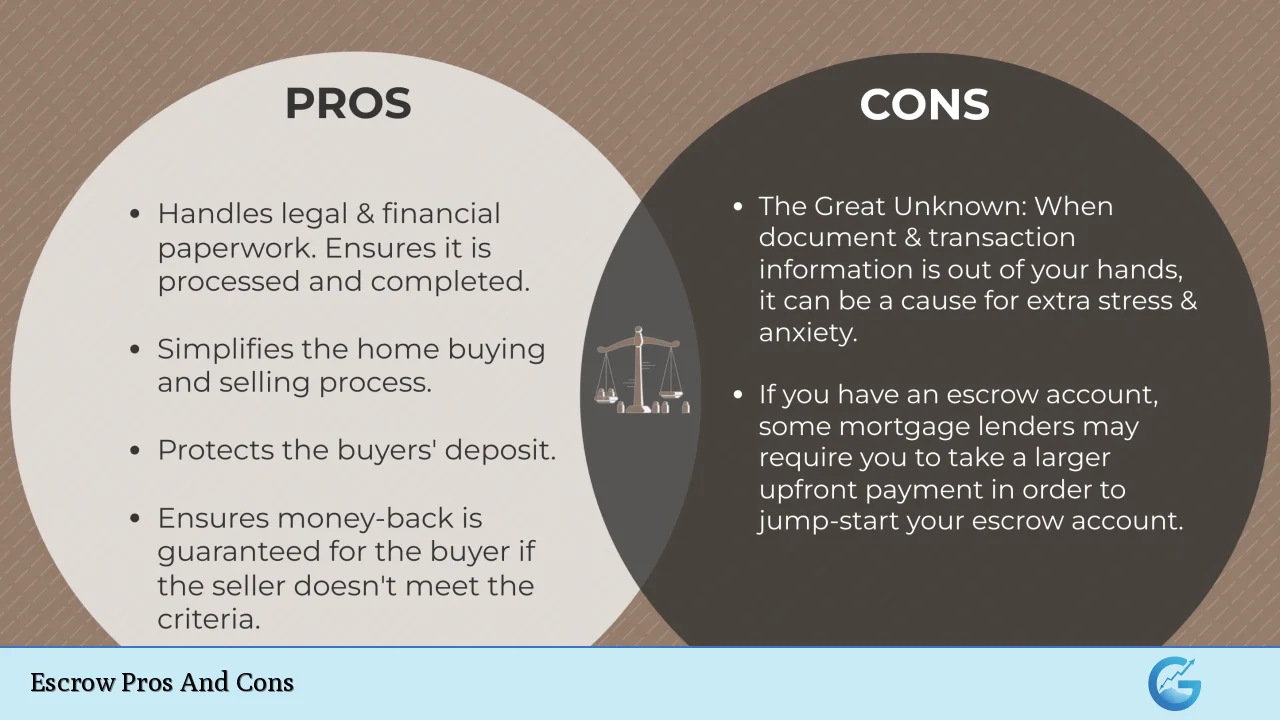

In conclusion, while escrow accounts provide numerous advantages such as security, trust-building, legal protection, and fraud reduction, they also come with notable disadvantages including costs, complexity, potential delays, reliance on agents’ efficiency, inflexibility regarding terms changes, extensive paperwork requirements, and communication risks. Individuals engaging in financial transactions—especially those involving large sums—should weigh these pros and cons carefully before deciding whether to utilize an escrow service.

Frequently Asked Questions About Escrow Pros And Cons

- What is an escrow account?

An escrow account is a financial arrangement where a third party holds funds until specific conditions outlined in a contract are fulfilled. - Why should I use an escrow service?

Using an escrow service provides security for both buyers and sellers by ensuring that funds are only released when contractual obligations are met. - What are common uses for escrow accounts?

Escrow accounts are commonly used in real estate transactions, online sales involving high-value items, mergers and acquisitions, and cryptocurrency trades. - Are there fees associated with using an escrow service?

Yes, most escrow services charge fees based on transaction amounts or flat rates; these fees vary depending on service providers. - Can I change terms once they’re set in an escrow agreement?

No; changing terms after setting them requires mutual consent from all parties involved in the agreement. - What happens if there’s a dispute during an escrow transaction?

If disputes arise during an escrow transaction, the neutral third-party agent helps mediate based on documented terms until resolution is reached. - How does using an escrow account mitigate fraud?

By holding funds securely until all agreed-upon conditions are met before releasing them; this reduces opportunities for fraudulent activities. - Is using an escrow service time-consuming?

The process can be complex and may involve waiting periods due to verification steps before fund release; thus it might take longer than direct transactions.