Exchange funds, also known as swap funds, are investment vehicles designed to help investors diversify their concentrated stock holdings without triggering immediate capital gains taxes. By pooling the concentrated stock positions of various investors, these funds allow participants to exchange their individual stocks for a diversified collection of assets. This unique structure provides significant tax advantages and risk management opportunities, making exchange funds a compelling option for high-net-worth individuals and accredited investors. However, like any investment strategy, they come with their own set of advantages and disadvantages that potential investors should carefully consider.

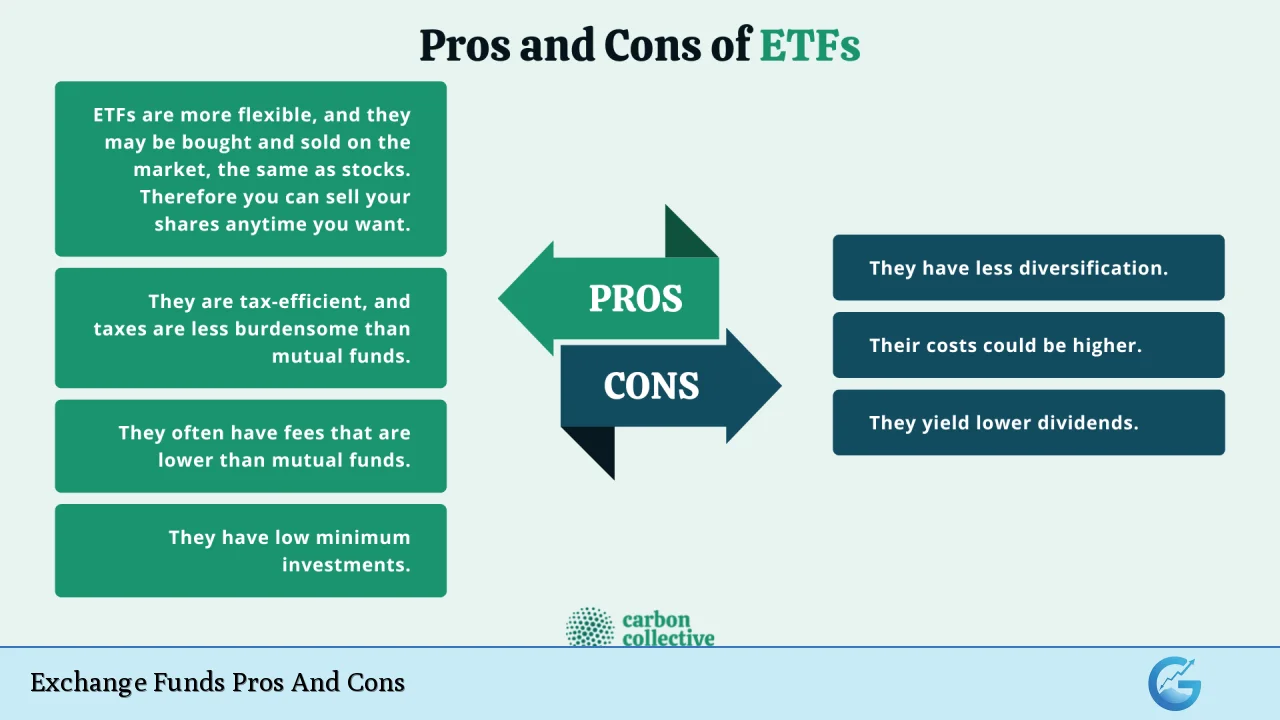

| Pros | Cons |

|---|---|

| Tax deferral on capital gains | Limited liquidity during the holding period |

| Diversification of concentrated holdings | High minimum investment requirements |

| Professional management of assets | Complexity in fund structure and regulations |

| Potential for enhanced portfolio performance | Fees that can reduce overall returns |

| Access to illiquid assets for further diversification | Investment constraints limiting flexibility |

| Step-up in cost basis for heirs | Tax implications upon redemption after holding period |

Tax Deferral on Capital Gains

One of the primary advantages of exchange funds is the ability to defer capital gains taxes. When investors exchange their concentrated stock positions for shares in an exchange fund, they do not trigger a taxable event. This means that they can avoid immediate tax liabilities that would typically arise from selling appreciated stocks. Instead, taxes are deferred until the investor decides to redeem their shares in the fund after a minimum holding period, usually seven years.

- Tax efficiency: Investors can grow their wealth without the drag of immediate taxation.

- Long-term growth potential: By deferring taxes, investments have more time to appreciate.

Limited Liquidity During the Holding Period

While tax deferral is a significant benefit, it comes with a trade-off in terms of liquidity. Exchange funds typically require investors to hold their shares for at least seven years before they can redeem them without penalties. This long commitment can be a disadvantage for those who may need access to their capital sooner.

- Inflexibility: Investors cannot easily access their funds in case of emergencies or changing financial situations.

- Potential penalties: Early redemption may result in receiving back the original concentrated stock rather than diversified shares.

Diversification of Concentrated Holdings

Exchange funds allow investors to diversify their portfolios by exchanging concentrated stock positions for a basket of stocks. This diversification helps mitigate risks associated with having a significant portion of wealth tied up in a single asset or sector.

- Risk reduction: A diversified portfolio is generally less volatile than one concentrated in a few stocks.

- Broader market exposure: Investors gain access to various sectors and industries through the fund’s diversified holdings.

High Minimum Investment Requirements

Participation in exchange funds often comes with high minimum investment thresholds, typically ranging from $500,000 to over $1 million. This requirement can limit access for many retail investors and is primarily designed for accredited investors with substantial net worth.

- Barrier to entry: High minimums restrict participation to wealthy individuals or institutions.

- Limited options: Fewer available funds may cater to lower investment thresholds.

Professional Management of Assets

Exchange funds are managed by professional portfolio managers who oversee the selection and management of the underlying investments. This expertise can enhance portfolio performance over time compared to self-managed investments.

- Expertise: Professional managers bring experience and knowledge that can lead to better investment decisions.

- Time savings: Investors do not need to actively manage their portfolios, allowing them to focus on other priorities.

Complexity in Fund Structure and Regulations

The structure of exchange funds can be complex, often resembling private equity or hedge funds. They are typically set up as limited partnerships or limited liability companies (LLCs), which may require sophisticated understanding from investors regarding their operations and regulations.

- Understanding requirements: Investors need to familiarize themselves with the fund’s structure and tax implications.

- Regulatory concerns: Exchange funds are not registered securities, meaning they lack some protections afforded by public offerings.

Potential for Enhanced Portfolio Performance

By facilitating diversification while deferring taxes, exchange funds can potentially enhance overall portfolio performance. Investors can maintain exposure to high-performing stocks while spreading risk across various assets.

- Long-term growth: The ability to defer taxes allows investments more time to compound growth.

- Market resilience: A diversified portfolio is generally more resilient against market fluctuations than concentrated holdings.

Fees That Can Reduce Overall Returns

Like mutual funds, exchange funds typically charge management fees and other expenses that can eat into overall returns. These fees may be higher than those associated with traditional investment vehicles due to the specialized management involved.

- Cost considerations: Investors should carefully review fee structures before committing capital.

- Impact on returns: High fees can significantly reduce net returns over time.

Access to Illiquid Assets for Further Diversification

Exchange funds often include a portion of illiquid assets such as real estate or commodities within their portfolios. This inclusion provides additional diversification benefits and may enhance returns through exposure to different asset classes.

- Diversification benefits: Illiquid assets often have low correlation with equities, providing stability during market downturns.

- Potential income generation: Real estate investments may generate income that contributes positively to overall fund performance.

Investment Constraints Limiting Flexibility

Investors participating in an exchange fund must adhere to specific investment constraints. These constraints may limit the fund’s ability to rebalance its portfolio aggressively compared to other investment vehicles like ETFs or mutual funds.

- Passive management approach: Exchange funds typically do not sell contributed stocks due to potential adverse tax consequences.

- Lower responsiveness: Limited flexibility may hinder the fund’s ability to adapt quickly to changing market conditions.

Step-Up in Cost Basis for Heirs

One notable advantage of exchange funds is that they provide a step-up in cost basis for heirs upon inheritance. This feature allows beneficiaries to inherit shares at their current market value rather than the original purchase price, potentially reducing future tax liabilities when they sell those shares.

- Tax efficiency for heirs: The step-up in basis minimizes capital gains tax exposure when heirs decide to sell inherited shares.

- Legacy planning benefits: This feature makes exchange funds an appealing option for individuals focused on estate planning strategies.

Tax Implications Upon Redemption After Holding Period

While exchange funds offer significant tax advantages during the holding period, investors should be aware that taxes will eventually be owed upon redemption. When investors redeem their partnership shares after seven years, they will incur capital gains taxes based on the appreciation of the underlying assets since they were initially contributed.

- Future tax liabilities: Investors must plan for potential tax implications when redeeming shares from an exchange fund.

- Long-term strategy considerations: Understanding how taxes will impact overall investment strategy is crucial for effective financial planning.

In conclusion, exchange funds present both compelling advantages and notable disadvantages for investors looking to diversify concentrated stock holdings while deferring capital gains taxes. The ability to achieve instant diversification without immediate tax consequences makes them an attractive option for high-net-worth individuals. However, potential participants must consider factors such as liquidity constraints, high minimum investments, fees, and complexities associated with fund structures before committing capital. As always, it is advisable for investors to consult with financial advisors who can provide tailored advice based on individual circumstances and investment goals.

Frequently Asked Questions About Exchange Funds

- What are exchange funds?

Exchange funds are investment vehicles that allow investors to swap concentrated stock positions for shares in a diversified portfolio without triggering immediate capital gains taxes. - Who can invest in exchange funds?

Typically, only accredited investors with substantial net worth (often over $5 million) are eligible due to high minimum investment requirements. - How long must I hold my investment in an exchange fund?

The minimum holding period is usually seven years before investors can redeem shares without penalties. - What are the tax implications when redeeming shares from an exchange fund?

Upon redemption after the holding period, investors will incur capital gains taxes based on any appreciation since contributing their original stocks. - Can I access my money if needed before seven years?

No; early redemption typically results in receiving back your original concentrated stock instead of diversified shares. - What fees are associated with exchange funds?

Exchange funds charge management fees similar to mutual funds; these fees can vary widely based on fund structure and management quality. - What happens if I pass away while holding an exchange fund?

The cost basis of your shares steps up at your death, minimizing future capital gains taxes owed by your heirs when they sell inherited shares. - Are there risks involved with investing in exchange funds?

Yes; risks include limited liquidity, high fees, complexity in structure, and potential future tax liabilities upon redemption.