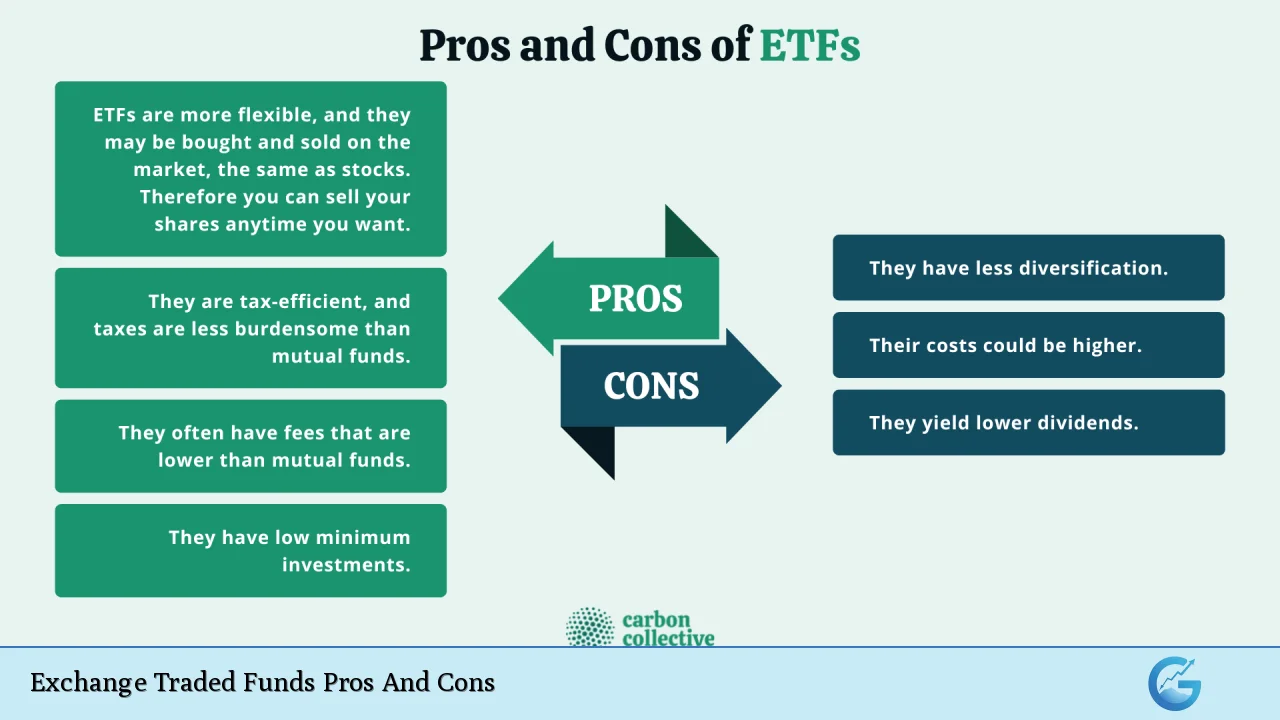

Exchange-Traded Funds (ETFs) have gained immense popularity among investors due to their unique structure and benefits. They are investment funds that trade on stock exchanges, much like individual stocks, allowing investors to buy and sell shares throughout the trading day. ETFs can track a wide variety of assets, including stocks, bonds, commodities, or even specific market indices. This flexibility makes them an attractive option for both novice and experienced investors. However, like any investment vehicle, ETFs come with their own set of advantages and disadvantages. This article will explore the pros and cons of investing in ETFs in detail.

| Pros | Cons |

|---|---|

| Lower Costs | Trading Costs |

| Diversification | Bid-Ask Spreads |

| Liquidity | Market Impact |

| Tax Efficiency | Tracking Errors |

| Transparency | Limited Access to Private Investments |

| Flexibility in Trading | Potential for Over-Concentration |

| Variety of Options | Complexity of Some Products |

| No Minimum Investment Requirement | Regulatory Risks |

Lower Costs

One of the most significant advantages of ETFs is their lower cost structure compared to traditional mutual funds.

- Expense Ratios: ETFs typically have lower expense ratios because they are often passively managed, aiming to replicate the performance of an index rather than actively selecting securities.

- No Sales Loads: Unlike mutual funds that may charge sales loads or commissions when shares are purchased, ETFs generally do not have these fees.

- Cost Efficiency: Over time, these lower costs can lead to higher net returns for investors.

Diversification

ETFs provide an easy way to achieve diversification within a portfolio.

- Broad Market Exposure: By purchasing a single ETF, investors can gain exposure to a wide array of securities across various sectors and asset classes.

- Risk Mitigation: This diversification helps mitigate risk since the performance of different securities can offset each other.

- Thematic Investments: Investors can also access specific themes or sectors that might be difficult or expensive to replicate individually.

Liquidity

ETFs are traded on major exchanges, which enhances their liquidity.

- Real-Time Trading: Investors can buy and sell shares throughout the trading day at market prices, providing flexibility that mutual funds do not offer.

- Quick Transactions: This liquidity allows investors to react swiftly to market changes, which is particularly advantageous during volatile periods.

Tax Efficiency

ETFs are generally more tax-efficient than mutual funds.

- Fewer Capital Gains Distributions: Due to their unique structure, ETFs typically incur fewer capital gains distributions, which can be a significant tax advantage for investors.

- In-Kind Redemptions: The process of in-kind redemptions allows ETFs to minimize taxable events when investors redeem shares.

Transparency

ETFs offer a high level of transparency regarding their holdings.

- Daily Disclosure: Most ETFs publish their net asset value (NAV) daily along with the list of assets held in the fund.

- Investment Clarity: This transparency allows investors to know exactly what they are investing in and how it aligns with their investment strategy.

Flexibility in Trading

Investors enjoy greater flexibility when trading ETFs compared to mutual funds.

- Order Types: Investors can use various order types such as market orders, limit orders, and stop-loss orders when buying or selling ETFs.

- Access During Market Hours: Unlike mutual funds that only transact at the end of the trading day, ETFs can be traded at any point during market hours based on current market conditions.

Variety of Options

The ETF market offers a diverse range of products catering to different investment strategies and goals.

- Asset Classes and Strategies: Investors can select from equity ETFs, bond ETFs, commodity ETFs, sector-specific funds, and more.

- Innovative Products: There are also leveraged and inverse ETFs designed for sophisticated strategies aimed at capitalizing on short-term market movements.

No Minimum Investment Requirement

Many ETFs do not have minimum investment requirements, making them accessible to a broader range of investors.

- Affordable Entry Point: Investors can buy as little as one share of an ETF without needing substantial capital upfront.

Trading Costs

While ETFs have lower expense ratios, they are not free from costs associated with trading them.

- Brokerage Commissions: Each time an investor buys or sells an ETF, they typically incur brokerage commissions. Frequent trading can lead to significant cumulative costs over time.

- Impact on Returns: For active traders or those employing dollar-cost averaging strategies, these costs can erode the overall cost advantage that lower expense ratios provide.

Bid-Ask Spreads

The bid-ask spread is another consideration for ETF investors that can affect overall profitability.

- Wider Spreads in Less Liquid Funds: For ETFs with lower trading volumes or that invest in less liquid markets, the bid-ask spread may be wider, increasing transaction costs for buyers and sellers alike.

- Impact on Trading Strategy: This spread can particularly impact short-term traders who rely on precise entry and exit points for profitability.

Market Impact

Market conditions can significantly influence ETF pricing relative to its NAV.

- Premiums and Discounts: During periods of high volatility or low liquidity, an ETF may trade at a premium (above NAV) or discount (below NAV), leading to potential inefficiencies for buyers and sellers alike.

- Investor Awareness Required: Understanding these dynamics is crucial for making informed trading decisions and avoiding unexpected losses.

Tracking Errors

Tracking error refers to how closely an ETF follows its benchmark index’s performance.

- Performance Deviation: A significant tracking error means that the ETF’s returns may deviate from those of its benchmark index over time. This is particularly important for index-tracking funds where consistency is expected.

- Investor Consideration: Investors should evaluate both expense ratios and tracking errors when assessing potential ETF investments for long-term performance expectations.

Limited Access to Private Investments

ETFs primarily focus on publicly traded securities and may not provide access to private equity or venture capital investments.

- Missed Opportunities: This limitation restricts investors from diversifying into potentially high-return private markets that mutual funds might access through active management strategies.

Potential for Over-Concentration

While diversification is a key advantage of ETFs, some investors may still face concentration risks depending on their choices.

- Sector-Specific Funds Risk: Investing heavily in sector-specific or thematic ETFs may lead to over-concentration in certain industries or asset classes, increasing volatility and risk exposure if those sectors underperform.

Complexity of Some Products

The growing variety of ETF products includes complex structures that may confuse some investors.

- Synthetic vs. Physical ETFs: Understanding the difference between synthetic ETFs (which use derivatives) and physical ETFs (which hold underlying assets) is crucial as synthetic structures carry additional risks related to counterparty defaults.

Regulatory Risks

As financial markets evolve, regulatory changes could impact ETF operations and investor protections.

- Compliance Changes: Changes in regulations governing how ETFs operate could affect fees, transparency requirements, or even product availability in certain markets.

In conclusion, Exchange-Traded Funds (ETFs) present a compelling investment option due to their numerous advantages such as lower costs, diversification benefits, liquidity, tax efficiency, transparency, flexibility in trading options, variety of products available, and accessibility without minimum investment requirements. However, they also come with potential drawbacks including trading costs, bid-ask spreads, market impact issues, tracking errors, limited access to private investments, concentration risks associated with sector-specific funds, complexity in some products, and regulatory risks.

Investors should carefully weigh these pros and cons based on their individual financial goals and risk tolerance before incorporating ETFs into their portfolios.

Frequently Asked Questions About Exchange Traded Funds Pros And Cons

- What are exchange-traded funds (ETFs)?

ETFs are investment funds that trade on stock exchanges like individual stocks. They typically track various assets such as stocks or bonds. - What are the main advantages of investing in ETFs?

The main advantages include lower costs compared to mutual funds, diversification across many securities with a single purchase, high liquidity allowing real-time trading during market hours. - What are some common disadvantages associated with ETFs?

Common disadvantages include trading costs incurred through brokerage commissions and bid-ask spreads which can affect profitability. - How do taxes work with ETFs?

ETFs generally have fewer capital gains distributions than mutual funds due to their unique structure which allows for tax-efficient management. - Can I invest in private companies through ETFs?

No; most ETFs focus on publicly traded securities and do not provide access to private equity investments. - Are all ETFs created equal?

No; there are various types of ETFs including physical and synthetic options which carry different risks and complexities. - How does liquidity benefit ETF investors?

The liquidity allows investors to buy or sell shares throughout the day at market prices rather than waiting until after market close like mutual funds. - What should I consider before investing in an ETF?

You should consider factors like expense ratios versus potential tracking errors as well as your own risk tolerance and investment goals.