The Federal Assistance Cash-Out Plan (FACOP) is a financial program designed to allow homeowners to tap into their home equity through cash-out refinancing. This initiative is particularly beneficial for those who may not qualify for conventional loans due to lower credit scores or higher debt-to-income ratios. However, while FACOP presents several advantages, it also comes with notable drawbacks that potential borrowers should consider carefully. This article explores the pros and cons of the FACOP initiative in detail, aiming to provide a comprehensive understanding for individuals interested in finance, cryptocurrency, forex, and money markets.

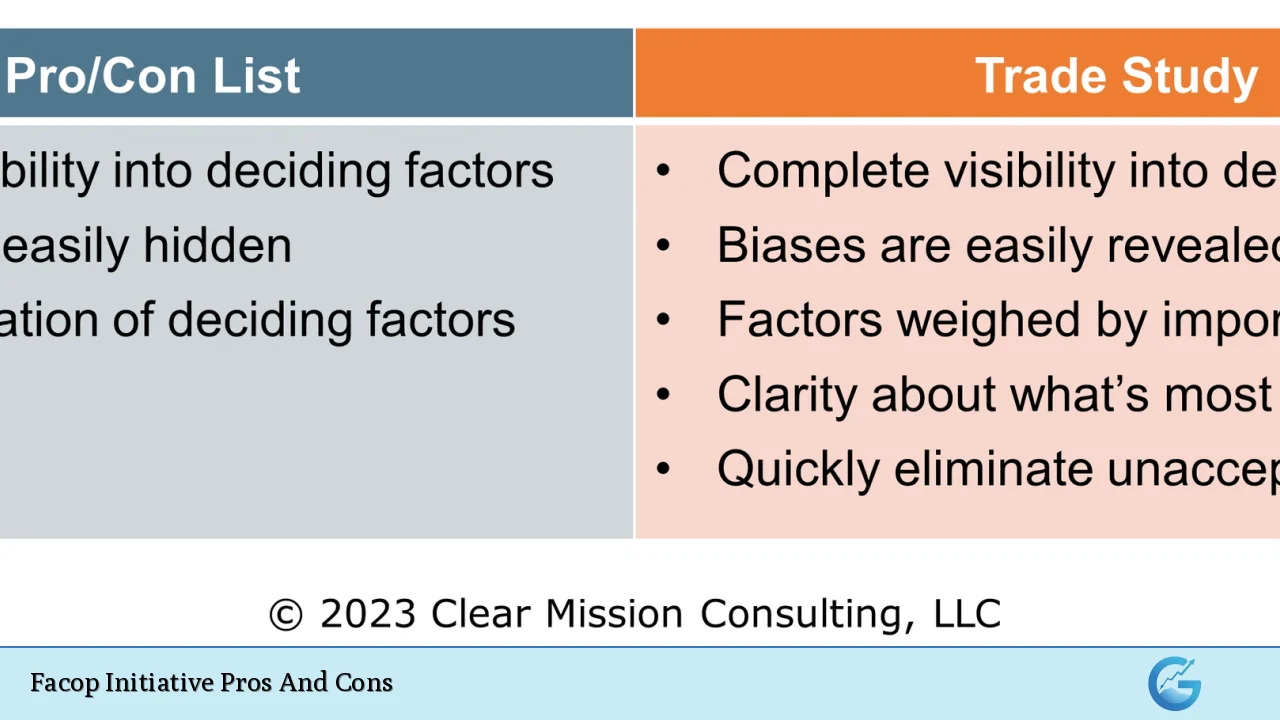

| Pros | Cons |

|---|---|

| Access to home equity | Higher mortgage insurance costs |

| Lower credit score requirements | Increased overall debt burden |

| Potentially lower interest rates | Higher monthly payments |

| Flexible use of funds | Property limitations |

| Avoiding additional loans | Risk of foreclosure if payments are missed |

| Tax deductibility on home improvement funds | Scams and misinformation regarding the program |

Access to Home Equity

One of the primary advantages of the FACOP initiative is that it allows homeowners to access their home equity. This can be particularly useful for individuals looking to fund significant expenses such as home renovations, education costs, or debt consolidation.

- Immediate cash access: Homeowners can receive cash at closing, which can be utilized for various purposes.

- Leverage existing assets: Home equity can be a powerful financial tool, enabling homeowners to invest in opportunities that may yield returns exceeding the cost of borrowing.

Lower Credit Score Requirements

The FACOP initiative is designed to assist borrowers who may not meet the stringent requirements of conventional loans.

- Accessibility: Borrowers with credit scores as low as 500 may qualify, making homeownership and refinancing more accessible to a broader audience.

- Support for financially vulnerable populations: This aspect is particularly beneficial for first-time homebuyers or those recovering from financial setbacks.

Potentially Lower Interest Rates

FHA loans, including those under the FACOP initiative, often come with lower interest rates compared to traditional financing options.

- Cost savings: Lower interest rates can lead to significant savings over the life of the loan, particularly for larger amounts borrowed.

- Long-term benefits: Refinancing at a lower rate can improve overall financial health by reducing monthly payments and total interest paid.

Flexible Use of Funds

Another significant advantage of the FACOP initiative is the flexibility it offers regarding how borrowed funds can be utilized.

- Wide range of applications: Homeowners can use cash-out funds for anything from home improvements to paying off high-interest debts or covering educational expenses.

- No restrictions on usage: Unlike some loan products that limit how funds can be spent, FACOP allows homeowners to make decisions based on their unique financial situations.

Avoiding Additional Loans

A cash-out refinance through FACOP allows homeowners to access needed funds without taking on additional debt.

- Single mortgage payment: Instead of juggling multiple loans, borrowers consolidate their debt into one mortgage payment, simplifying financial management.

- Streamlined process: This approach can reduce paperwork and administrative burdens associated with managing separate loans.

Tax Deductibility on Home Improvement Funds

Funds obtained through a cash-out refinance may be tax-deductible if used for qualified improvements on the property.

- Tax benefits: Homeowners can potentially deduct interest on loans used for home improvements, providing further financial incentives for utilizing this option.

Higher Mortgage Insurance Costs

While there are many benefits to the FACOP initiative, one significant disadvantage is the requirement for mortgage insurance premiums (MIP).

- Upfront and ongoing costs: FHA loans require an upfront MIP of 1.75% of the loan amount and an annual premium that must be paid monthly. These costs can add up significantly over time.

- Increased overall loan cost: The additional insurance premiums can make FHA loans more expensive than conventional options in the long run.

Increased Overall Debt Burden

Opting for a cash-out refinance increases the total amount owed on the mortgage.

- Raising debt levels: For example, if a homeowner refinances for more than their existing mortgage balance, they are increasing their overall debt load. This could lead to financial strain if not managed properly.

- Potentially negative impact on credit score: Higher debt levels can affect credit scores negatively, especially if payments are missed or late.

Higher Monthly Payments

With a larger loan amount comes higher monthly payments, which can impact budgeting and financial planning.

- Strain on finances: Increased monthly obligations may put pressure on household budgets and limit disposable income available for other expenses.

- Long-term planning considerations: Homeowners need to carefully evaluate how increased payments will fit into their long-term financial goals and strategies.

Property Limitations

FACOP funds can only be accessed through refinancing primary residences; investment properties or second homes do not qualify.

- Limited applicability: This restriction may limit options for investors or those looking to leverage equity from multiple properties.

- Need for alternative financing options: Borrowers seeking cash-out refinancing on non-primary residences must explore other financing avenues like conventional loans or HELOCs (Home Equity Lines of Credit).

Risk of Foreclosure if Payments Are Missed

As with any mortgage product, failure to make timely payments could lead to foreclosure risks.

- Collateral risk: The home serves as collateral for the loan; thus, missing payments could result in losing one’s home if default occurs.

- Importance of financial planning: Homeowners must have a solid repayment plan in place before committing to a cash-out refinance under the FACOP initiative.

Scams and Misinformation Regarding the Program

The rising popularity of FACOP has also led to an increase in scams targeting unsuspecting homeowners.

- Beware of fraudulent offers: Many online scams promise easy cash access through FACOP but are designed to steal personal information or charge hidden fees.

- Need for vigilance and research: Borrowers should only work with FHA-approved lenders and remain cautious about unsolicited offers that seem too good to be true.

In conclusion, while the Federal Assistance Cash-Out Plan (FACOP) offers several advantages such as access to home equity, lower credit score requirements, and flexible use of funds, it also presents notable disadvantages including higher mortgage insurance costs and increased overall debt. Homeowners considering this option should weigh these factors carefully against their individual financial situations and long-term goals. Understanding both sides will empower them to make informed decisions regarding their financial futures.

Frequently Asked Questions About Facop Initiative Pros And Cons

- What is the FACOP initiative?

The FACOP initiative stands for Federal Assistance Cash-Out Plan, allowing homeowners to refinance their mortgages and access cash from their home equity. - Who qualifies for FACOP?

Borrowers with credit scores as low as 500 may qualify; however, they must meet other FHA requirements related to income and property type. - What are common uses for cash obtained through FACOP?

Funds can be used for various purposes including home renovations, debt consolidation, education expenses, or emergency costs. - Are there risks associated with FACOP?

Yes, risks include higher mortgage insurance costs, increased monthly payments, and potential foreclosure if payments are missed. - Can I use FACOP for investment properties?

No, FACOP is limited to primary residences; investment properties do not qualify. - How does FACOP compare with traditional refinancing?

FACOP typically has lower credit requirements but may involve higher overall costs due to mortgage insurance premiums. - What should I do if I suspect a scam related to FACOP?

If you suspect fraudulent activity or scams related to FACOP offers, report them immediately to authorities like the Federal Trade Commission (FTC). - Is it possible to lose my home with a FACOP loan?

Yes, failing to make timely payments could result in foreclosure since your home serves as collateral.