The Federal Assistance Cash-Out Program (FACOP), often associated with the FHA cash-out refinance, is a financial tool that allows homeowners to tap into their home equity by refinancing their existing mortgage. This initiative has gained attention due to its potential benefits and drawbacks, particularly in the context of current economic conditions and the housing market. Understanding the pros and cons of the FACOP refi initiative is crucial for homeowners considering this option, especially those interested in finance, crypto, forex, and money markets.

The FACOP initiative primarily aims to provide financial relief to homeowners by allowing them to access cash for various purposes such as home improvements, debt consolidation, or emergency funds. However, like any financial decision, it comes with its own set of advantages and disadvantages that must be carefully weighed.

| Pros | Cons |

|---|---|

| Access to home equity without a second loan | Higher overall debt burden |

| Lower credit score requirements | Mandatory mortgage insurance premiums |

| Potentially lower interest rates | Increased monthly payments |

| Flexible use of funds | Restrictions on property types |

| Possible tax deductions on interest paid | Risk of foreclosure if unable to repay |

| Predictable fixed monthly payments | Closing costs associated with refinancing |

| Improvement in credit score potential through debt consolidation | Limitations on cash-out amounts based on home value |

| Ability to refinance even with existing FHA loans | Potential for scams targeting unsuspecting borrowers |

Access to Home Equity Without a Second Loan

One significant advantage of the FACOP refi initiative is that it allows homeowners to access their home equity without needing to take out a second mortgage. This means that instead of juggling multiple loans, borrowers can consolidate their debt into a single payment.

- Simplified financial management: Homeowners benefit from managing one mortgage payment rather than multiple loans.

- Immediate cash access: The cash received can be used for immediate needs such as home repairs or paying off high-interest debts.

Higher Overall Debt Burden

While accessing home equity can be beneficial, it also increases the overall debt burden on the homeowner. By refinancing for a larger amount than what is currently owed, borrowers may find themselves in a precarious financial position.

- Increased loan amount: Borrowers may end up owing significantly more than before, which can lead to long-term financial strain.

- Potential for negative equity: If property values decline after refinancing, homeowners might find themselves in a situation where they owe more than their home is worth.

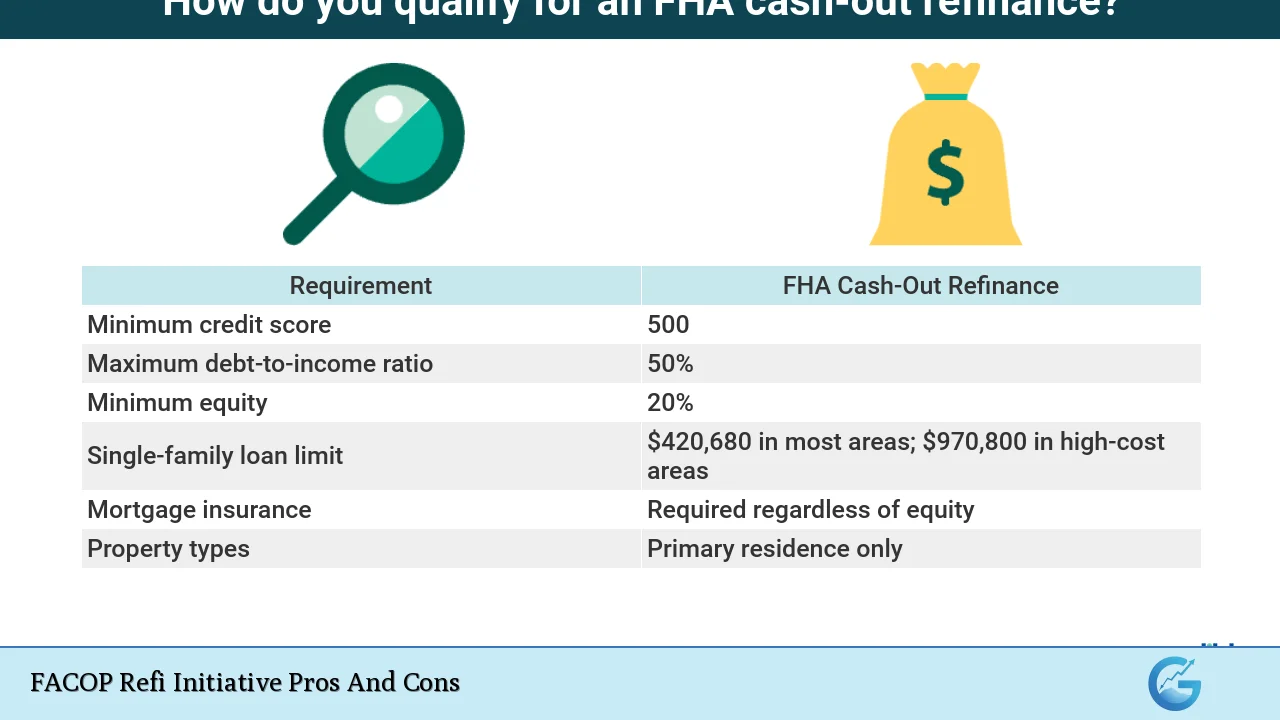

Lower Credit Score Requirements

The FACOP initiative typically has lower credit score requirements compared to conventional loans. This makes it accessible for many homeowners who may not qualify for other financing options.

- Opportunity for more borrowers: Individuals with credit scores as low as 500 may still qualify for refinancing under FHA guidelines.

- Inclusivity: This accessibility can help those who have faced financial challenges regain stability through refinancing.

Mandatory Mortgage Insurance Premiums

A notable disadvantage of the FACOP refi is the requirement for mortgage insurance premiums (MIP). This applies even if the borrower has a good credit score or a significant amount of equity in their home.

- Added costs: Homeowners must pay both upfront and monthly MIP, which can significantly increase the overall cost of borrowing.

- Long-term expense: Even if interest rates are lower, the added insurance costs can make FHA loans more expensive over time compared to conventional loans without MIP.

Potentially Lower Interest Rates

FHA loans often come with lower interest rates compared to traditional financing options. This can make refinancing appealing for many homeowners looking to reduce their monthly payments.

- Cost-effective borrowing: Lower rates mean that homeowners could save money over the life of the loan compared to higher-interest alternatives like personal loans or credit cards.

- Market competitiveness: FHA rates are typically competitive due to government backing, making them an attractive option during periods of rising interest rates.

Increased Monthly Payments

While lower interest rates can be an advantage, they do not negate the fact that taking out a larger loan will likely result in higher monthly payments.

- Budget strain: Homeowners must ensure they can afford these increased payments without compromising their financial stability.

- Long-term commitment: Higher payments extend the duration of debt repayment and could affect future financial planning.

Flexible Use of Funds

One of the most appealing aspects of the FACOP refi initiative is the flexibility it offers regarding how borrowed funds can be used.

- Diverse applications: Homeowners can use cash from refinancing for various purposes including renovations, consolidating debt, or covering unexpected expenses.

- Financial empowerment: This flexibility allows borrowers to make decisions that best suit their financial needs and goals.

Restrictions on Property Types

A significant limitation of the FACOP initiative is that it is primarily available only for primary residences.

- No investment properties: Homeowners cannot use this program for second homes or investment properties, which limits its applicability for some borrowers.

- Focus on primary residence stability: This restriction ensures that funds are directed toward maintaining stable housing rather than speculative investments.

Possible Tax Deductions on Interest Paid

Another advantage is that interest paid on cash-out refinances may be tax-deductible if used for eligible home improvements.

- Tax benefits: Homeowners can potentially reduce their taxable income by deducting mortgage interest on renovations made using cash from their refinance.

- Encouragement for improvements: This tax incentive encourages homeowners to invest back into their properties, potentially increasing value over time.

Risk of Foreclosure If Unable to Repay

With increased borrowing comes increased risk. If homeowners are unable to keep up with their new mortgage payments, they face foreclosure risks.

- Collateral implications: Since the home serves as collateral for the refinance loan, failure to repay could result in losing one’s home.

- Financial repercussions: Foreclosure not only affects housing stability but also severely impacts credit scores and future borrowing ability.

Predictable Fixed Monthly Payments

Refinancing through FACOP often results in fixed-rate mortgages, providing predictability in monthly budgeting.

- Stable payment structure: Homeowners benefit from knowing exactly what their monthly payments will be throughout the life of the loan without worrying about fluctuating rates.

- Easier financial planning: Fixed payments simplify budgeting and long-term financial planning for families and individuals alike.

Closing Costs Associated With Refinancing

While there are many benefits associated with refinancing through FACOP, it’s important to note that closing costs can be substantial.

- Upfront expenses: Borrowers should be prepared for closing costs similar to those incurred when purchasing a home, which can include appraisal fees, title insurance, and lender fees.

- Impact on equity: These costs may reduce the amount of equity available after refinancing since they are typically rolled into the new loan amount or paid upfront at closing.

Improvement in Credit Score Potential Through Debt Consolidation

Using cash from a refinance to pay off high-interest debts can lead to an improved credit score over time.

- Debt reduction benefits: By consolidating debts into one payment at a lower rate, borrowers may improve their credit utilization ratio and overall credit profile.

- Long-term financial health: A better credit score opens up more favorable borrowing options in the future and enhances overall financial health.

Limitations on Cash-Out Amounts Based on Home Value

Homeowners should also consider that there are limits on how much cash they can take out based on their home’s appraised value.

- Equity restrictions: Typically, lenders allow borrowers to access up to 80% of their home’s value minus existing mortgage balances; this limits potential cash-out amounts significantly in some cases.

- Market fluctuations impact: Changes in property values can further restrict available equity over time, affecting future refinancing opportunities.

Potential for Scams Targeting Unsuspecting Borrowers

The popularity of programs like FACOP has unfortunately led to an increase in scams targeting vulnerable homeowners looking for quick cash solutions.

- Caution advised: Borrowers must be vigilant against offers that seem too good to be true and ensure they are dealing with reputable lenders when considering refinancing options.

- Research necessary: Conducting thorough research and seeking advice from trusted financial advisors can help avoid falling victim to fraudulent schemes.

In conclusion, while the FACOP Refi Initiative offers several advantages such as access to home equity without additional loans and potentially lower interest rates, it also comes with significant disadvantages including higher overall debt burdens and mandatory mortgage insurance premiums. Each homeowner’s situation is unique; therefore, careful consideration of both pros and cons is essential before making any decisions regarding refinancing options like FACOP.

Frequently Asked Questions About FACOP Refi Initiative

- What is a FACOP refinance?

A FACOP refinance refers to a Federal Assistance Cash-Out Program that allows homeowners to refinance their existing mortgages while accessing cash based on their home equity. - Who qualifies for a FACOP refinance?

Homeowners with varying credit scores may qualify; FHA guidelines allow individuals with scores as low as 500 under certain conditions. - What are typical uses for funds obtained through FACOP?

The funds can be used flexibly for purposes such as home improvements, debt consolidation, or other personal expenses. - Are there any risks associated with FACOP refinancing?

Yes, risks include increased monthly payments, potential foreclosure if unable to make payments, and additional costs like mortgage insurance premiums. - How does FACOP compare with traditional refinancing options?

FACOP typically offers lower credit requirements but comes with mandatory mortgage insurance costs that might not apply with conventional options. - Can I refinance an investment property through FACOP?

No, FACOP refinancing is limited strictly to primary residences. - What should I do if I suspect a scam related to my refinance?

If you suspect fraud or scams related to your refinance process, report it immediately and consult trusted financial advisors or legal professionals. - Is there a maximum amount I can cash out through FACOP?

The maximum cash-out amount depends on your home’s appraised value; typically lenders allow up to 80% of your home’s value minus existing mortgage balances.