The Federal Assistance Cash-Out Program (FACOP) is a refinancing option that allows homeowners to leverage their home equity for various financial needs. This program is particularly appealing to those who may not qualify for traditional refinancing options due to credit score limitations or other financial constraints. However, like any financial product, it comes with its own set of advantages and disadvantages. This article will explore the pros and cons of FACOP refinancing in detail, providing a comprehensive overview for potential borrowers.

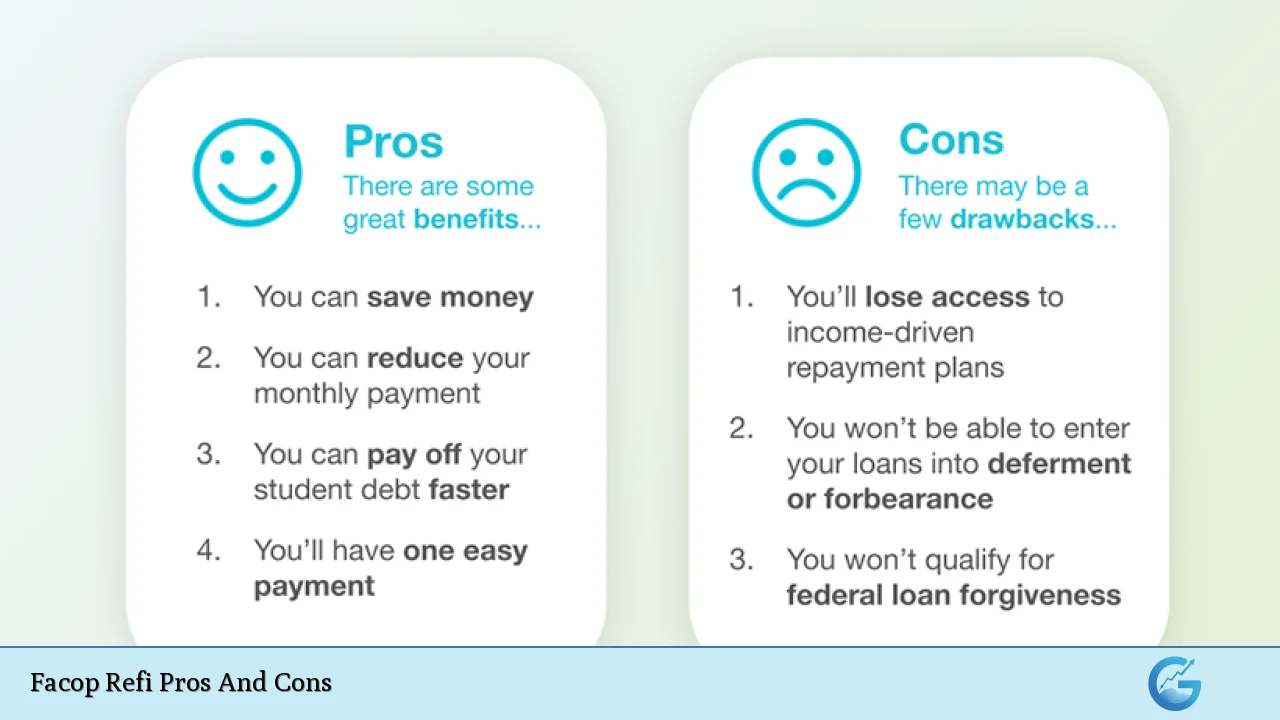

| Pros | Cons |

|---|---|

| Access to home equity for cash needs | Increased overall debt burden |

| Lower credit score requirements | Higher mortgage insurance premiums |

| Potentially lower interest rates | Property limitations (primary residence only) |

| Flexibility in fund usage | Longer repayment terms may lead to more interest paid |

| Opportunity for debt consolidation | Risk of foreclosure if payments are missed |

| Tax-deductible interest on home improvements | Closing costs can be significant |

Access to Home Equity for Cash Needs

One of the primary advantages of the FACOP refinance is the ability to access significant cash by tapping into your home equity. Homeowners can use this cash for various purposes:

- Home renovations: Funding improvements that can increase property value.

- Debt consolidation: Paying off high-interest debts, such as credit cards.

- Education expenses: Covering tuition or other educational costs.

- Emergency funds: Providing cash for unexpected expenses.

This flexibility makes FACOP an attractive option for homeowners looking to manage their finances more effectively.

Lower Credit Score Requirements

FACOP refinancing is particularly beneficial for individuals with lower credit scores. Unlike conventional loans, which often require higher credit ratings, FHA loans (which FACOP falls under) allow borrowers with scores as low as 500 to qualify. This inclusivity enables many homeowners who might otherwise be denied refinancing options to take advantage of the benefits of cash-out refinancing.

Potentially Lower Interest Rates

Another significant advantage of FACOP refinancing is the potential for lower interest rates compared to other forms of borrowing, such as personal loans or credit cards. Since FHA loans are backed by the government, lenders face less risk, which often translates into better rates for borrowers. This can lead to substantial savings over time, especially if the funds are used to pay off higher-interest debts.

Flexibility in Fund Usage

The funds obtained through a FACOP refinance can be used for nearly any purpose, providing homeowners with considerable flexibility. This is unlike some other loan types that restrict usage strictly to home improvements or specific expenses. Borrowers can choose how best to utilize their cash based on their individual financial situations and goals.

Opportunity for Debt Consolidation

Using a FACOP refinance to consolidate debt can be a powerful financial strategy. By rolling high-interest debts into a single mortgage payment, homeowners can simplify their finances and potentially lower their monthly payments. This approach not only reduces the number of payments but can also improve overall financial health if managed correctly.

Increased Overall Debt Burden

Despite its advantages, one of the most significant disadvantages of FACOP refinancing is that it increases the overall debt burden on the homeowner. When you refinance for more than what you owe on your current mortgage, you are essentially taking on additional debt. For instance, if your current mortgage balance is $150,000 and you refinance for $180,000, you are adding $30,000 to your debt load.

- Long-term implications: This increased debt can have long-term implications on financial stability and future borrowing capacity.

- Potential financial strain: Homeowners need to ensure they have a solid plan in place to manage this additional debt effectively.

Higher Mortgage Insurance Premiums

Another downside of FACOP refinancing is the requirement to pay mortgage insurance premiums (MIP). FHA loans require both upfront and ongoing MIP payments:

- Upfront MIP: Typically 1.75% of the new loan amount.

- Annual MIP: Approximately 0.55% paid monthly.

These additional costs can make FHA loans more expensive than conventional loans in the long run, particularly if the borrower has a high loan-to-value ratio.

Property Limitations (Primary Residence Only)

FACOP refinancing is restricted to primary residences only. Homeowners looking to refinance investment properties or second homes will need to explore other options. This limitation can be a significant drawback for those who wish to leverage equity in non-primary residences.

Longer Repayment Terms May Lead to More Interest Paid

While extending repayment terms can lower monthly payments, it often results in paying more interest over the life of the loan. Homeowners should carefully consider how extending their mortgage term will impact their overall financial situation:

- Total interest cost: A longer repayment period means more interest paid over time.

- Budgeting considerations: Homeowners should ensure they can manage their budget effectively with potentially higher long-term costs.

Risk of Foreclosure If Payments Are Missed

As with any mortgage product, there is a risk associated with missing payments on a FACOP refinance. If a borrower fails to keep up with their mortgage payments:

- Foreclosure risk: The home serves as collateral for the loan, meaning failure to repay could lead to losing one’s home.

- Financial security: Homeowners must assess their job security and income stability before committing to this type of refinancing.

Closing Costs Can Be Significant

FACOP refinancing involves closing costs similar to those incurred when obtaining an original mortgage. These costs can include:

- Appraisal fees

- Title insurance

- Loan origination fees

While these costs are often rolled into the new loan amount, they still reduce the amount of cash received at closing and should be factored into any decision-making process regarding refinancing.

In conclusion, while FACOP refinancing offers several compelling advantages such as access to cash, lower credit score requirements, and flexibility in fund usage, it also presents notable disadvantages including increased debt burden and higher insurance premiums. Homeowners must weigh these factors carefully against their individual financial situations and long-term goals before proceeding with this option.

Frequently Asked Questions About Facop Refi Pros And Cons

- What is FACOP?

The Federal Assistance Cash-Out Program (FACOP) allows homeowners to refinance their existing mortgages and access cash from their home equity. - Who qualifies for FACOP?

This program typically requires at least 20% equity in the home and has more lenient credit score requirements compared to conventional loans. - What are common uses for cash obtained through FACOP?

The funds can be used for various purposes including home renovations, debt consolidation, education expenses, or emergency funds. - Are there risks associated with FACOP?

Yes, risks include increased overall debt burden and potential foreclosure if mortgage payments are missed. - What fees are associated with FACOP?

Borrowers may incur closing costs similar to those of obtaining an original mortgage, including appraisal fees and title insurance. - Can I use FACOP for investment properties?

No, FACOP refinancing is limited to primary residences only. - How does FACOP compare with conventional refinancing?

FACOP typically offers lower credit score requirements but comes with higher mortgage insurance premiums compared to conventional options. - Can I deduct interest from my taxes when using FACOP?

If funds from the refinance are used for qualified home improvements, interest may be tax-deductible.