Family trusts are a popular estate planning tool that allows individuals to manage and protect their assets while ensuring a smooth transfer of wealth to future generations. They can provide significant benefits, including asset protection and tax advantages, but they also come with certain drawbacks. Understanding the pros and cons of family trusts is essential for anyone considering this option as part of their financial strategy.

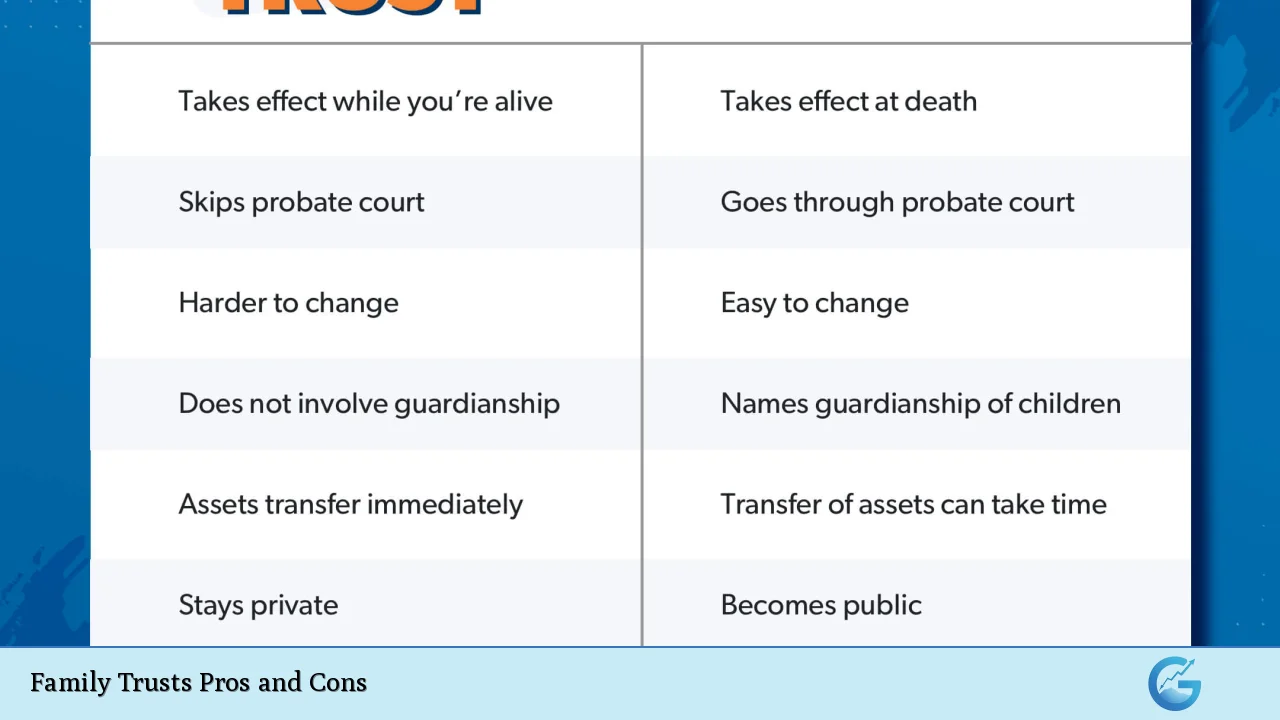

| Pros | Cons |

|---|---|

| Asset protection from creditors | Initial setup and ongoing maintenance costs can be high |

| Avoidance of probate, leading to faster distribution of assets | Loss of direct control over assets placed in the trust |

| Tax benefits through income splitting among beneficiaries | Complex tax implications and potential liabilities |

| Privacy in asset management and distribution | Potential for family disputes over trust management |

| Continuity of asset management in case of incapacity | Rigidity in terms once established, making changes difficult |

| Flexibility in asset distribution according to changing needs | Legal complexities may require professional assistance for setup and management |

Asset Protection from Creditors

One of the most significant advantages of establishing a family trust is the protection it offers against creditors. Assets held within a trust are generally shielded from personal liabilities of the beneficiaries or trustees. This can be particularly beneficial for families with business interests or those concerned about potential lawsuits.

- Creditor Shielding: Assets in a family trust are not directly owned by the beneficiaries, making them less accessible to creditors.

- Business Continuity: For business owners, placing business assets in a trust can protect them from claims arising from personal financial issues.

Avoidance of Probate

Family trusts allow individuals to bypass the probate process, which can be lengthy and costly. This means that beneficiaries can access their inheritance more quickly.

- Faster Access to Assets: With no probate required, beneficiaries receive their assets without delay.

- Cost Savings: Avoiding probate fees can result in significant savings for the estate.

Tax Benefits Through Income Splitting

Family trusts can provide substantial tax advantages by allowing income generated by the trust to be distributed among beneficiaries. This can lead to lower overall tax liabilities.

- Income Allocation: Trustees can allocate income to beneficiaries based on their individual tax rates, potentially reducing the overall tax burden.

- Capital Gains Tax Minimization: Trusts may also benefit from capital gains exemptions when assets are sold.

Privacy in Asset Management

Unlike wills, which become public documents upon death, family trusts remain private. This confidentiality can be crucial for families wishing to keep their financial affairs out of the public eye.

- Confidentiality Maintained: Trust details are not disclosed publicly, protecting family privacy.

- Discretion in Management: The trustee has discretion over how assets are managed and distributed, which can help maintain family harmony.

Continuity of Asset Management

In cases where the trust creator becomes incapacitated, a family trust ensures that asset management continues seamlessly without court intervention.

- Immediate Succession: The appointed trustee can step in immediately to manage the trust’s assets.

- Avoiding Legal Complications: This arrangement helps prevent disputes among family members regarding asset distribution.

Flexibility in Asset Distribution

Family trusts offer flexibility in how assets are distributed among beneficiaries. The terms of the trust can be tailored to meet specific family needs and circumstances.

- Adaptable Provisions: Trusts can include provisions that allow for adjustments based on changing family dynamics or financial situations.

- Tailored Solutions: Families can structure distributions to meet the needs of minors or financially irresponsible beneficiaries.

Initial Setup and Ongoing Maintenance Costs

While family trusts offer many advantages, they also come with significant costs associated with their establishment and maintenance.

- Legal Fees: Setting up a trust often requires hiring legal professionals, which can be expensive.

- Ongoing Administrative Costs: There may be additional costs for tax preparation and compliance with legal requirements.

Loss of Direct Control Over Assets

Once assets are placed into a family trust, the original owner relinquishes direct control over them. This can be a concern for individuals who prefer to manage their own assets actively.

- Trustee Authority: The trustee has full authority over the management and distribution of trust assets.

- Potential Conflicts: If the trustee does not act in accordance with the grantor’s wishes, it could lead to conflicts within the family.

Complex Tax Implications

While there are tax benefits associated with family trusts, they also come with complex tax implications that must be carefully managed.

- Higher Tax Rates on Trust Income: Income retained within the trust may be subject to higher tax rates compared to individual beneficiaries.

- Compliance Requirements: Trusts must adhere to specific tax regulations, which may complicate filing processes.

Potential for Family Disputes

Family trusts can sometimes lead to disputes among beneficiaries, especially if there is a lack of transparency or perceived unfairness in how assets are managed or distributed.

- Trustee Accountability: Beneficiaries may feel entitled to information about trust management and distribution decisions.

- Emotional Strain: Disputes over trust management can create rifts within families, leading to long-lasting emotional distress.

Rigidity Once Established

Once established, making changes to a family trust can be challenging. This rigidity might pose problems if family circumstances change significantly.

- Difficulty Modifying Terms: Altering the terms of a trust often requires legal intervention and may not always be possible.

- Inflexibility with Life Changes: Changes such as divorce or new family members may necessitate adjustments that are not easily accommodated within existing trust structures.

Legal Complexities

The creation and administration of a family trust involve various legal complexities that may require ongoing professional guidance.

- Need for Professional Assistance: Engaging legal professionals is often necessary for both setup and ongoing management.

- Regulatory Compliance: Trusts must comply with local laws governing their operation, which adds another layer of complexity.

In conclusion, while family trusts offer numerous advantages such as asset protection, avoidance of probate, tax benefits, privacy, continuity in asset management, and flexibility in distributions, they also present challenges including high costs, loss of control over assets, complex tax implications, potential for disputes among beneficiaries, rigidity once established, and legal complexities.

Individuals considering establishing a family trust should weigh these pros and cons carefully against their specific financial circumstances and goals. Consulting with financial advisors or estate planning professionals is highly recommended to ensure that a family trust aligns well with one’s overall financial strategy.

Frequently Asked Questions About Family Trusts

- What is a family trust?

A family trust is a legal entity that holds assets on behalf of beneficiaries while providing specific instructions on how those assets should be managed or distributed. - Why should I consider setting up a family trust?

A family trust can help protect your assets from creditors, avoid probate fees, provide tax benefits through income splitting, and maintain privacy regarding your estate. - What are the costs associated with establishing a family trust?

The costs typically include legal fees for setup and ongoing administrative expenses such as tax preparation and compliance. - Can I change my family trust once it’s established?

While some aspects may be flexible depending on its structure (revocable vs irrevocable), changing terms often requires legal assistance. - Who manages the assets within a family trust?

The trustee manages the assets according to the terms set forth in the trust deed; this could be an individual or an organization. - Are there any tax disadvantages associated with family trusts?

Yes, while there are benefits like income splitting, retained income within the trust may face higher taxation rates. - How does a family trust differ from a will?

A will distributes your estate after death through probate; a family trust allows for immediate distribution without probate involvement. - Can I include non-family members as beneficiaries in my family trust?

No; typically only lineal descendants (children) and sometimes spouses are included as beneficiaries.