The Federal Reserve, often referred to as the Fed, serves as the central bank of the United States and plays a pivotal role in shaping the nation’s monetary policy. Established in 1913, its primary responsibilities include regulating banks, managing the country’s money supply, and ensuring financial stability. The Fed’s actions significantly impact various financial markets, including forex and cryptocurrency, making it a crucial subject for investors and finance enthusiasts. This article will explore the advantages and disadvantages of the Federal Reserve, providing a comprehensive overview for those interested in finance.

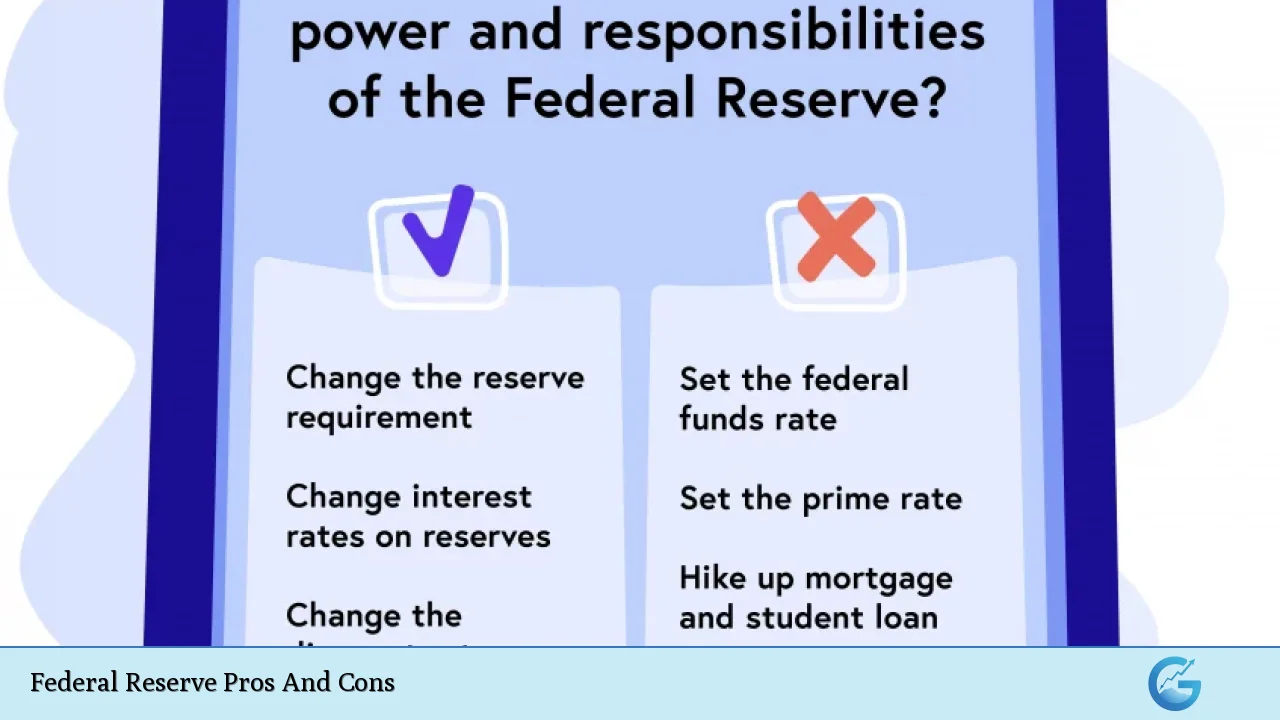

| Pros | Cons |

|---|---|

| Promotes economic stability | Potential for market distortion |

| Acts as a lender of last resort | Lack of transparency in decision-making |

| Controls inflation through monetary policy | Influence of political pressures on policy |

| Regulates financial institutions | Risk of creating asset bubbles |

| Facilitates smooth payment systems | Dependency on central bank interventions |

| Supports employment through economic growth | Long-term consequences of low interest rates |

| Provides research and data for economic analysis | Criticism over its role during financial crises |

Promotes Economic Stability

One of the Federal Reserve’s primary advantages is its ability to promote economic stability. By managing monetary policy, the Fed can influence interest rates and control inflation, which helps maintain consumer confidence and encourages investment.

- Interest Rate Adjustments: The Fed adjusts interest rates based on economic conditions. Lowering rates can stimulate borrowing and spending, while raising them can cool an overheating economy.

- Inflation Control: Through tools like open market operations, the Fed can manage the money supply to keep inflation within target ranges, fostering a stable economic environment.

Acts as a Lender of Last Resort

The Federal Reserve serves as a lender of last resort to banks during times of financial distress. This function is crucial for maintaining liquidity in the banking system.

- Preventing Bank Runs: By providing emergency funding to banks facing liquidity issues, the Fed helps prevent bank runs that could destabilize the financial system.

- Crisis Management: During events like the 2008 financial crisis, the Fed’s intervention was vital in stabilizing major financial institutions, ultimately preventing broader economic collapse.

Controls Inflation Through Monetary Policy

The Fed plays a critical role in controlling inflation through its monetary policy strategies.

- Quantitative Easing: In times of economic downturn, the Fed may implement quantitative easing to inject liquidity into the economy and encourage lending.

- Inflation Targeting: The Fed aims for a specific inflation rate (typically around 2%), using various tools to achieve this goal and ensure long-term price stability.

Regulates Financial Institutions

Another significant advantage of the Federal Reserve is its regulatory oversight over banks and financial institutions.

- Ensuring Safety and Soundness: The Fed establishes regulations that promote safe banking practices, protecting depositors from excessive risk-taking by financial institutions.

- Consumer Protection: Through its regulatory framework, the Fed also works to ensure fair treatment of consumers in financial transactions.

Facilitates Smooth Payment Systems

The Federal Reserve plays an essential role in ensuring that payment systems operate smoothly across the country.

- Payment Processing: The Fed oversees payment systems such as ACH (Automated Clearing House) transfers and checks, facilitating efficient transactions between banks.

- Innovation in Payments: The Fed is also involved in developing new payment technologies that enhance efficiency and security in financial transactions.

Supports Employment Through Economic Growth

By fostering economic growth through its monetary policies, the Federal Reserve indirectly supports job creation.

- Stimulating Growth: Lower interest rates can lead to increased business investment and consumer spending, which in turn drives job creation across various sectors.

- Responding to Economic Changes: The Fed adjusts its policies based on current economic conditions to support maximum employment while keeping inflation in check.

Provides Research and Data for Economic Analysis

The Federal Reserve conducts extensive research on economic trends and provides valuable data that informs policymakers and investors alike.

- Economic Reports: Regular reports from the Fed provide insights into economic conditions, helping investors make informed decisions regarding their investments.

- Educational Resources: The Fed also offers educational programs that enhance public understanding of monetary policy and its implications for the economy.

Potential for Market Distortion

Despite its advantages, there are notable disadvantages associated with the Federal Reserve’s actions that can lead to market distortions.

- Asset Price Inflation: Prolonged low interest rates can inflate asset prices beyond their intrinsic values, leading to potential market corrections when reality sets in.

- Investment Risks: Investors may take excessive risks during periods of low rates, leading to increased volatility in markets such as real estate or equities.

Lack of Transparency in Decision-Making

A common criticism of the Federal Reserve is its perceived lack of transparency regarding its decision-making processes.

- Opaque Policies: Critics argue that many decisions are made without sufficient public understanding or insight into how these decisions are reached.

- Public Trust Issues: This lack of transparency can erode public trust in the institution, leading to skepticism about its motives and effectiveness.

Influence of Political Pressures on Policy

The independence of the Federal Reserve is often challenged by political pressures that may influence monetary policy decisions.

- Political Interference: There are concerns that elected officials may exert pressure on the Fed to adopt policies that align with political agendas rather than sound economic principles.

- Short-Term Focus: Such influences can lead to short-term policy decisions that may not align with long-term economic health or stability.

Risk of Creating Asset Bubbles

The Federal Reserve’s monetary policies can inadvertently contribute to asset bubbles in various markets.

- Low Interest Rates Encouraging Speculation: When interest rates are kept low for extended periods, it encourages speculative investments that may not be sustainable over time.

- Potential Market Crashes: When these bubbles burst, they can result in significant market corrections that negatively impact investors and the broader economy.

Dependency on Central Bank Interventions

Overreliance on Federal Reserve interventions can create a dependency that may hinder natural market adjustments.

- Market Distortions: Continuous intervention can distort market signals, making it difficult for investors to gauge true economic conditions or asset values accurately.

- Long-Term Economic Health Risks: This dependency may lead to challenges when it comes time for markets to adjust naturally without central bank support.

Long-Term Consequences of Low Interest Rates

While low interest rates can stimulate growth, they also carry long-term risks that need consideration.

- Savings Impact: Prolonged low rates can discourage savings among consumers, impacting future investment levels and economic growth potential.

- Pension Fund Strain: Low returns on fixed-income investments can strain pension funds’ ability to meet future obligations, creating long-term fiscal challenges for retirees.

Criticism Over Its Role During Financial Crises

The Federal Reserve has faced criticism regarding its actions during financial crises and whether those actions were appropriate or effective.

- Bailouts vs. Moral Hazard: Critics argue that bailing out failing institutions creates moral hazard by encouraging risky behavior among banks knowing they might be saved from failure again in future crises.

- Effectiveness of Stimulus Measures: Some economists question whether measures like quantitative easing effectively stimulate real economic growth or merely inflate asset prices without addressing underlying issues.

In conclusion, while the Federal Reserve plays an essential role in promoting economic stability and managing monetary policy effectively, it also faces significant criticisms related to market distortions, transparency issues, and potential long-term consequences. Understanding both sides is crucial for investors navigating finance markets today. As we move forward, finding a balance between effective monetary policy and addressing these valid concerns will be vital for maximizing benefits while minimizing drawbacks associated with this influential institution.

Frequently Asked Questions About Federal Reserve Pros And Cons

- What is the primary function of the Federal Reserve?

The primary function of the Federal Reserve is to manage monetary policy by regulating money supply and interest rates to promote maximum employment and stable prices. - How does the Federal Reserve influence inflation?

The Fed influences inflation through tools such as adjusting interest rates and conducting open market operations to control money supply. - What are some criticisms against the Federal Reserve?

Criticisms include lack of transparency in decision-making processes, potential market distortions due to low interest rates, and political pressures influencing policy. - How does the Federal Reserve act as a lender of last resort?

The Fed provides emergency loans to banks facing liquidity issues during financial crises to prevent systemic failures. - What impact does quantitative easing have?

Quantitative easing aims to stimulate economic growth by increasing liquidity but may lead to inflated asset prices if maintained too long. - Why is transparency important for the Federal Reserve?

Transparency helps build public trust and ensures accountability regarding monetary policy decisions affecting the economy. - Can low-interest rates create asset bubbles?

Yes, prolonged low-interest rates can encourage excessive risk-taking among investors leading to inflated asset prices. - What role does research play at the Federal Reserve?

The Fed conducts extensive research on economic trends which informs policymakers and helps guide monetary policy decisions.