The Federal Reserve System, often referred to as “the Fed,” serves as the central bank of the United States. Established in 1913, it plays a crucial role in the nation’s monetary policy, financial stability, and economic growth. The Fed’s primary objectives include promoting maximum employment, stable prices, and moderate long-term interest rates. However, its operations and policies have sparked considerable debate among economists, policymakers, and the public. This article explores the pros and cons of the Federal Reserve System, providing a detailed analysis for those interested in finance, cryptocurrency, forex, and money markets.

| Pros | Cons |

|---|---|

| Stability of prices and interest rates | Potential for inflation and asset bubbles |

| Facilitates economic growth through monetary policy | Risk of mismanagement and lack of transparency |

| Supports financial system stability | Perception of being too powerful and unaccountable |

| Enhances consumer protection | Can lead to moral hazard among banks |

| Provides a framework for crisis management | Criticism over its response to past crises |

Stability of Prices and Interest Rates

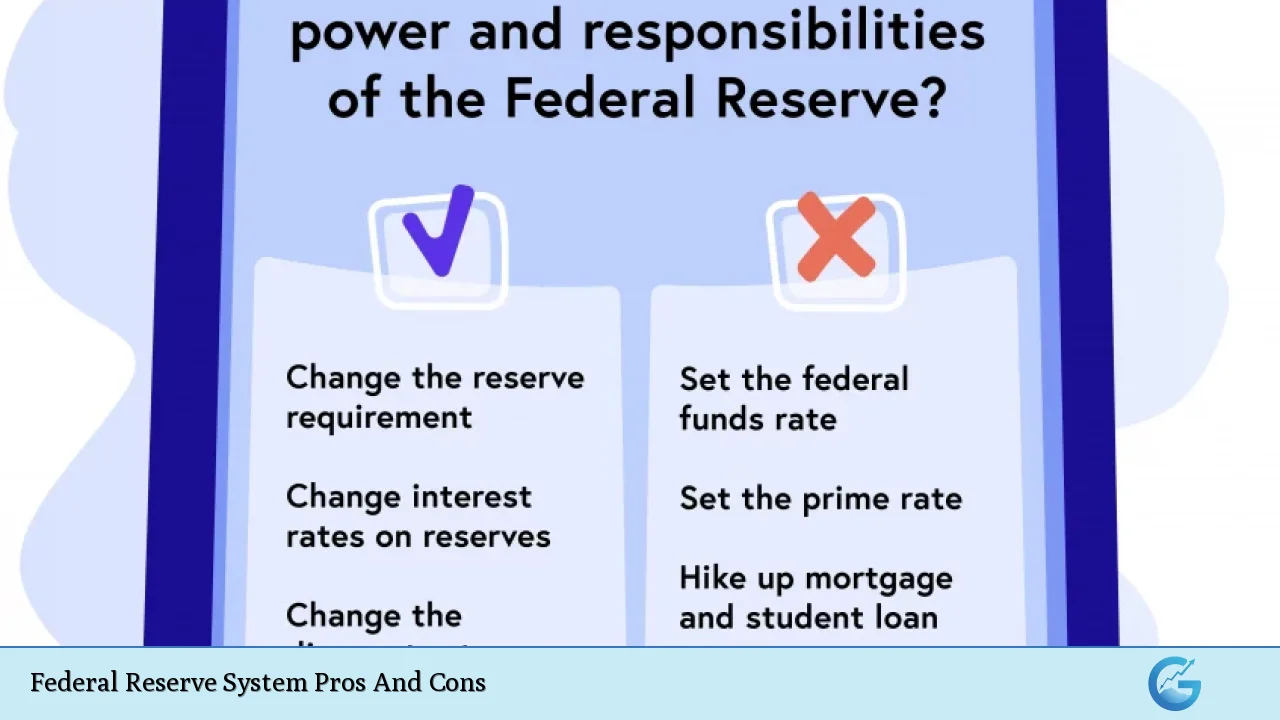

The Federal Reserve’s ability to maintain stable prices and interest rates is one of its most significant advantages. By using tools such as open market operations, discount rates, and reserve requirements, the Fed can influence the money supply and interest rates.

- Price Stability: The Fed aims to keep inflation in check, which helps maintain purchasing power for consumers and businesses.

- Interest Rate Management: By adjusting interest rates, the Fed can stimulate economic activity during downturns or cool down an overheating economy.

However, achieving this stability is not without challenges.

Potential for Inflation and Asset Bubbles

While the Fed’s policies aim to stabilize prices, they can also lead to unintended consequences such as inflation or asset bubbles.

- Inflation Risks: If the Fed injects too much money into the economy or keeps interest rates too low for too long, it can lead to rising prices across various sectors.

- Asset Bubbles: Low-interest rates may encourage excessive risk-taking among investors, potentially leading to inflated asset prices that could eventually collapse.

Facilitates Economic Growth Through Monetary Policy

The Federal Reserve plays a vital role in fostering economic growth through its monetary policy decisions.

- Stimulus Measures: During economic downturns, the Fed can lower interest rates or implement quantitative easing to encourage borrowing and spending.

- Support for Employment: By promoting conditions conducive to job creation, the Fed helps reduce unemployment rates.

Despite these benefits, there are concerns about how effectively these measures are implemented.

Risk of Mismanagement and Lack of Transparency

Critics argue that the Federal Reserve’s decision-making process lacks transparency and accountability.

- Decision-Making Process: The closed-door nature of many Fed meetings can lead to suspicion about its motives and strategies.

- Policy Missteps: Historical instances of poor decision-making have led to significant economic downturns (e.g., the Great Depression).

Supports Financial System Stability

The Federal Reserve contributes to the stability of the financial system through regulatory oversight and crisis management.

- Bank Supervision: The Fed monitors banks to ensure they operate safely and soundly, reducing systemic risk.

- Crisis Management: In times of financial distress, such as during the 2008 financial crisis, the Fed has acted quickly to provide liquidity and support struggling institutions.

However, this role also comes with criticisms regarding its effectiveness during crises.

Perception of Being Too Powerful and Unaccountable

The concentration of power within the Federal Reserve raises concerns about its influence over the economy.

- Independence vs. Accountability: While independence is crucial for effective monetary policy, it can lead to perceptions that the Fed operates without sufficient oversight from elected officials.

- Political Pressure: There are fears that political pressures could influence monetary policy decisions in ways that are not beneficial for long-term economic health.

Enhances Consumer Protection

The Federal Reserve plays a significant role in consumer protection through regulations aimed at safeguarding consumers’ rights.

- Regulatory Frameworks: The Fed enforces laws related to consumer credit protection and fair lending practices.

- Financial Education Initiatives: By promoting financial literacy programs, the Fed helps consumers make informed decisions about their finances.

Yet, there are potential downsides associated with these protections.

Can Lead to Moral Hazard Among Banks

While consumer protection is essential, it can sometimes create moral hazard issues within financial institutions.

- Risky Behavior: If banks believe they will be bailed out during crises due to their “too big to fail” status, they may engage in riskier lending practices.

- Dependency on Support: Continuous reliance on Fed interventions may undermine banks’ incentives to manage risks effectively.

Provides a Framework for Crisis Management

The Federal Reserve’s ability to respond swiftly during economic crises is a critical advantage that has been demonstrated in various situations.

- Emergency Lending Facilities: The establishment of facilities like the Term Auction Facility during financial crises allows banks access to liquidity when needed most.

- Coordination with Other Agencies: The Fed often collaborates with other governmental agencies to address systemic risks effectively.

However, criticisms remain regarding how well these frameworks have performed historically.

Criticism Over Its Response to Past Crises

Despite its capabilities in crisis management, the Federal Reserve has faced scrutiny regarding its responses during critical periods in history.

- Slow Response Times: Critics argue that the Fed was slow to act during pivotal moments like the Great Depression or the 2008 financial crisis.

- Ineffective Measures: Some policies implemented during crises have been criticized for not adequately addressing underlying issues or leading to prolonged economic pain.

In conclusion, while the Federal Reserve System provides several advantages such as price stability, economic growth facilitation, and financial system support, it also faces significant challenges including potential inflation risks, perceptions of excessive power, and historical mismanagement. Understanding these pros and cons is essential for individuals interested in finance markets as they navigate investment decisions influenced by monetary policy dynamics.

Frequently Asked Questions About Federal Reserve System Pros And Cons

- What is the primary function of the Federal Reserve?

The primary function of the Federal Reserve is to conduct national monetary policy aimed at promoting maximum employment and stable prices. - How does the Federal Reserve influence interest rates?

The Federal Reserve influences interest rates primarily through open market operations where it buys or sells government securities. - What are some criticisms of the Federal Reserve?

Criticisms include concerns over its lack of transparency, potential for mismanagement, and perceptions that it operates without sufficient oversight. - How does the Federal Reserve support financial stability?

The Fed supports financial stability by supervising banks and providing emergency liquidity during times of crisis. - What risks does low-interest rate policy pose?

A prolonged low-interest rate environment can lead to inflationary pressures and encourage excessive risk-taking by investors. - What role does consumer protection play in the Federal Reserve’s responsibilities?

The Federal Reserve enforces laws related to consumer credit protection and promotes financial literacy initiatives. - How does public perception affect the Federal Reserve’s operations?

The perception that the Fed operates independently can lead to concerns about accountability and potential political influences on its decisions. - Can you explain moral hazard in relation to banks?

Moral hazard occurs when banks engage in risky behavior because they believe they will be bailed out by government interventions if they face financial distress.