When it comes to financing a home, understanding the differences between FHA (Federal Housing Administration) loans and conventional loans is crucial for potential homeowners. Each type of mortgage has its own set of advantages and disadvantages, making them suitable for different financial situations and goals. This article will delve into the pros and cons of FHA and conventional loans, providing a comprehensive overview to help you make an informed decision.

| Pros | Cons |

|---|---|

| Lower minimum credit score requirements | Higher overall costs due to mortgage insurance |

| Lower down payment options | Strict property standards and appraisal requirements |

| More flexible debt-to-income ratios | Limited loan choices and amounts |

| Potentially favorable interest rates for lower credit scores | No option to remove mortgage insurance without refinancing |

| Government backing reduces lender risk | Less flexibility in property types eligible for financing |

Lower Minimum Credit Score Requirements

One of the most significant advantages of FHA loans is their lenient credit score requirements.

- FHA Loans: Borrowers can qualify with a credit score as low as 580 with a 3.5% down payment, or even 500 with a higher down payment of 10%.

- Conventional Loans: Typically require a minimum credit score of 620, which can be a barrier for many first-time homebuyers or those with less-than-perfect credit.

This flexibility makes FHA loans particularly appealing to individuals who may have had past financial difficulties or limited credit history.

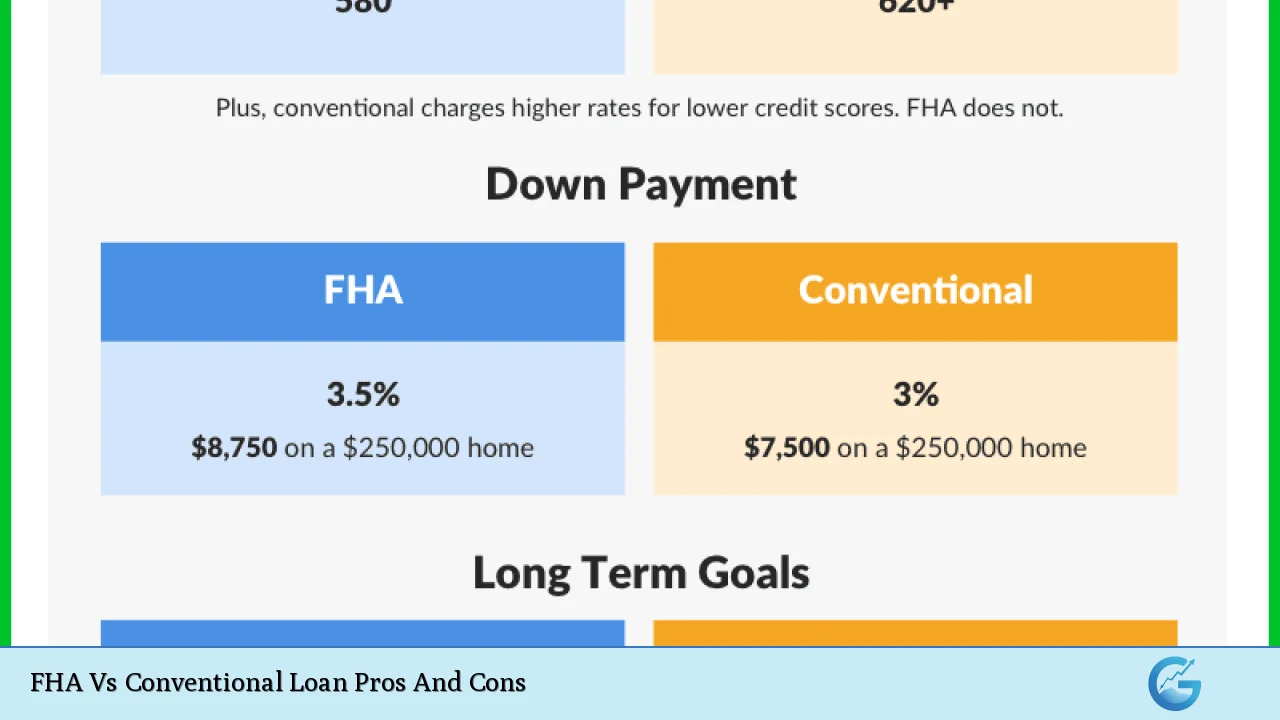

Lower Down Payment Options

FHA loans allow for lower down payments compared to conventional loans, making homeownership more accessible.

- FHA Loans: Require as little as 3.5% down, which translates to $7,000 on a $200,000 home.

- Conventional Loans: While some programs allow for down payments as low as 3%, standard expectations are typically around 5% to 20%.

This lower barrier to entry can significantly benefit first-time buyers or those who may not have substantial savings.

More Flexible Debt-to-Income Ratios

Debt-to-income (DTI) ratios are critical in determining loan eligibility.

- FHA Loans: Allow DTI ratios up to 50% in some cases, which means borrowers can have higher levels of existing debt relative to their income.

- Conventional Loans: Generally cap DTI ratios at 43%.

This increased flexibility can help borrowers with existing debts qualify for a mortgage they might otherwise be denied.

Potentially Favorable Interest Rates for Lower Credit Scores

FHA loans often provide competitive interest rates, especially for those with lower credit scores.

- Interest Rates: FHA loan rates are generally consistent across borrowers regardless of credit scores, making them attractive for those who may not qualify for the best rates through conventional loans.

However, while the interest rates might be lower initially, the long-term costs associated with mortgage insurance can offset these savings.

Government Backing Reduces Lender Risk

FHA loans are backed by the federal government, which reduces the risk for lenders.

- Lender Assurance: This backing allows lenders to offer more favorable terms and conditions, such as lower down payments and less stringent credit requirements.

Conversely, conventional loans do not have this government backing, leading lenders to impose stricter requirements.

Higher Overall Costs Due to Mortgage Insurance

Despite their advantages, FHA loans come with significant costs that can make them more expensive over time.

- Mortgage Insurance Premiums (MIP): FHA loans require both an upfront premium (typically 1.75% of the loan amount) and monthly premiums that last for the life of the loan unless refinanced.

This requirement can add thousands of dollars to the total cost of the loan compared to conventional options where private mortgage insurance (PMI) can be removed once the borrower reaches 20% equity in their home.

Strict Property Standards and Appraisal Requirements

FHA loans come with stringent property standards that must be met before approval.

- Property Condition: Homes financed through FHA must meet specific safety and livability standards. This requirement can limit your options if you’re considering fixer-upper properties or homes that don’t meet these standards.

In contrast, conventional loans tend to have more flexible appraisal standards, allowing buyers greater freedom in their property choices.

Limited Loan Choices and Amounts

FHA loans have caps on how much you can borrow based on location and property type.

- Loan Limits: These limits vary by county; in many areas, they are lower than conventional loan limits. For instance, while FHA limits might cap at around $472,030 in some regions, conventional loans can go up to $726,200 or more depending on local housing markets.

This limitation can restrict buyers looking at higher-priced homes in competitive markets.

No Option to Remove Mortgage Insurance Without Refinancing

One major drawback of FHA loans is that mortgage insurance cannot be removed without refinancing.

- Permanent MIP: Borrowers are required to pay MIP for the life of the loan if they put less than 10% down. This contrasts sharply with conventional loans where PMI can be canceled once certain equity thresholds are met.

This ongoing cost can significantly affect long-term financial planning for homeowners using FHA financing.

Less Flexibility in Property Types Eligible for Financing

FHA loans are primarily designed for primary residences and have strict guidelines regarding property types.

- Eligible Properties: Only certain types of properties qualify for FHA financing, which excludes many investment properties or vacation homes. Conventional loans offer broader options that may include second homes or investment properties without stringent restrictions.

This limitation may deter potential buyers interested in purchasing non-primary residences or multifamily units under an FHA loan program.

In conclusion, both FHA and conventional loans offer unique benefits and drawbacks that cater to different financial situations.

While FHA loans provide accessibility through lower credit scores and down payments, they come with higher overall costs due to mandatory mortgage insurance and stricter property requirements. Conversely, conventional loans may offer more favorable terms for those with good credit but require larger down payments and stricter financial qualifications.

Ultimately, prospective homeowners should carefully assess their financial situation and long-term goals when choosing between these two types of mortgages.

Frequently Asked Questions About FHA Vs Conventional Loan Pros And Cons

- What is the main difference between FHA and conventional loans?

The primary difference lies in their backing; FHA loans are insured by the government while conventional loans are not. This leads to different qualification criteria. - Are FHA loans only for first-time homebuyers?

No, while they are popular among first-time buyers due to their lenient requirements, anyone can apply for an FHA loan. - Can I refinance an FHA loan?

Yes, borrowers can refinance an FHA loan into another FHA loan or into a conventional loan when they build sufficient equity. - What happens if I default on my FHA loan?

If you default on an FHA loan, the lender will claim insurance from the government which covers their losses. - Is mortgage insurance cheaper on FHA or conventional loans?

Generally, PMI on conventional loans can be canceled once you reach 20% equity; whereas MIP on FHA loans lasts for the life of the loan unless refinanced. - How does my credit score affect my interest rate?

A higher credit score typically results in lower interest rates; this is especially true for conventional loans. - What is the maximum DTI ratio allowed for each type of loan?

The maximum DTI ratio is typically 50% for FHA loans compared to 43% for conventional loans. - Can I use an FHA loan for investment properties?

No, FHA loans are intended only for primary residences; investment properties generally require a conventional loan.