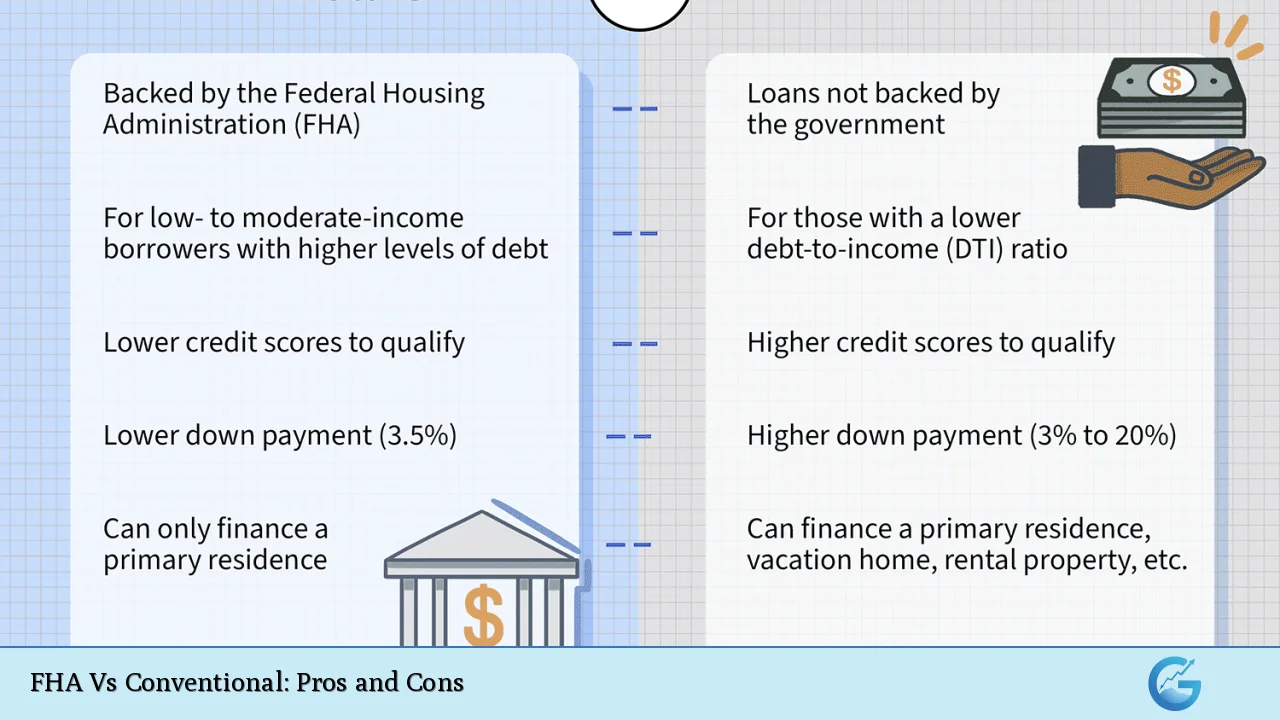

When it comes to financing a home, understanding the differences between FHA (Federal Housing Administration) loans and conventional loans is crucial for potential homebuyers. Each type of mortgage has its own set of advantages and disadvantages that can significantly impact your financial future. This article will explore these pros and cons in detail, helping you make an informed decision based on your unique financial situation.

| Pros | Cons |

|---|---|

| Lower down payment requirements | Higher overall costs due to mortgage insurance |

| Easier credit score qualifications | Mortgage insurance premiums are required for the life of the loan |

| More flexible debt-to-income ratios | Property standards and appraisal requirements can be strict |

| Potentially lower interest rates for lower credit scores | Loan limits may restrict purchasing power in high-cost areas |

| Access to first-time homebuyer programs | Less variety in loan options compared to conventional loans |

| No maximum income limits for eligibility | Limited availability of FHA-approved properties, especially condos |

| FHA loans can be assumable by future buyers | Longer processing times due to government involvement |

| Allows for seller contributions to closing costs | Less favorable terms for those with good credit scores compared to conventional loans |

Lower Down Payment Requirements

One of the most attractive features of FHA loans is the lower down payment requirement. Borrowers can secure an FHA loan with as little as 3.5% down if their credit score is 580 or higher. This is significantly lower than the typical 5% to 20% required for conventional loans, making homeownership more accessible, especially for first-time buyers or those with limited savings.

Easier Credit Score Qualifications

FHA loans are designed to help borrowers who may not qualify for conventional financing due to lower credit scores. While conventional loans often require a minimum score of 620, FHA loans allow scores as low as 500 (with a 10% down payment). This flexibility opens doors for many individuals who might otherwise be denied financing.

More Flexible Debt-to-Income Ratios

FHA loans typically allow for a higher debt-to-income (DTI) ratio compared to conventional loans. Borrowers can qualify with a DTI of up to 50%, while conventional loans usually cap this at 43%. This means that those with existing debts may find it easier to qualify for an FHA loan.

Potentially Lower Interest Rates for Lower Credit Scores

Because FHA loans are backed by the government, they often offer competitive interest rates, even for borrowers with lower credit scores. This can translate into significant savings over the life of the loan, especially when compared to conventional options that may penalize lower scores with higher rates.

Access to First-Time Homebuyer Programs

Many first-time homebuyer programs are tailored specifically for FHA loan applicants. These programs can provide additional financial assistance or incentives that make purchasing a home more feasible for new buyers.

No Maximum Income Limits for Eligibility

Unlike some other loan programs that impose income limits, FHA loans have no such restrictions. This means that even higher-income earners can benefit from the advantages of an FHA loan, provided they meet other eligibility criteria.

FHA Loans Can Be Assumable by Future Buyers

Another unique advantage of FHA loans is that they can be assumed by future buyers if you decide to sell your home. This means that if interest rates rise, your buyer could potentially take over your existing mortgage at a lower rate, making your property more attractive on the market.

Allows for Seller Contributions to Closing Costs

FHA guidelines permit sellers to contribute up to 6% of the purchase price toward closing costs. This can significantly reduce the upfront financial burden on buyers, making it easier to afford a new home.

Higher Overall Costs Due to Mortgage Insurance

Despite their many benefits, FHA loans come with higher overall costs primarily due to mandatory mortgage insurance premiums (MIP). Borrowers must pay both an upfront premium (often rolled into the loan) and ongoing monthly premiums, which can add thousands of dollars over the life of the loan.

Mortgage Insurance Premiums Required for Life of Loan

Unlike conventional loans where private mortgage insurance (PMI) can be canceled once sufficient equity is built up (typically at 20%), FHA MIP lasts for the entire duration of the loan unless you refinance into a conventional mortgage. This can make FHA loans more expensive in the long run.

Property Standards and Appraisal Requirements Can Be Strict

FHA loans require properties to meet certain safety and livability standards. This means that homes must pass an inspection before financing is approved, which can limit options and complicate transactions involving fixer-uppers or older homes that need repairs.

Loan Limits May Restrict Purchasing Power in High-Cost Areas

FHA loan limits vary by location and may not keep pace with rising home prices in high-demand markets. In many areas, these limits are lower than those set for conventional loans, which could restrict buyers from purchasing their desired homes.

Less Variety in Loan Options Compared to Conventional Loans

Conventional mortgages offer a wider range of products, including adjustable-rate mortgages (ARMs), interest-only loans, and various term lengths. In contrast, FHA loans have more standardized offerings, which may not fit every borrower’s needs.

Limited Availability of FHA-Approved Properties

Not all properties qualify for FHA financing; only those meeting specific criteria set by the FHA are eligible. Additionally, there are fewer approved condominiums available under FHA guidelines, which could limit options for buyers interested in this type of housing.

Longer Processing Times Due to Government Involvement

The involvement of government agencies in FHA lending often leads to longer processing times compared to conventional mortgages. The additional paperwork and requirements can delay closing dates and create frustration for eager buyers.

Less Favorable Terms for Those With Good Credit Scores Compared to Conventional Loans

For borrowers with good credit scores (typically above 740), conventional loans often provide better terms than FHA options. These borrowers may qualify for lower interest rates and avoid costly mortgage insurance altogether by putting down at least 20%.

In conclusion, choosing between an FHA loan and a conventional loan involves weighing various factors based on individual circumstances. FHA loans provide significant advantages such as lower down payments and more lenient credit requirements but come with higher long-term costs due to mandatory mortgage insurance. Conversely, conventional loans may offer better overall value for those with strong credit profiles who can afford larger down payments.

Frequently Asked Questions About FHA Vs Conventional

- What is an FHA loan?

An FHA loan is a mortgage insured by the Federal Housing Administration designed to help low- to moderate-income borrowers qualify. - What are the main benefits of an FHA loan?

The main benefits include lower down payment requirements, easier credit qualifications, and flexible debt-to-income ratios. - What are some disadvantages of an FHA loan?

The primary disadvantages include higher overall costs due to mortgage insurance premiums and stricter property standards. - Can I remove mortgage insurance from an FHA loan?

No, unless you refinance into a conventional loan; MIP lasts throughout the life of the loan. - What is a conventional loan?

A conventional loan is not backed by any government agency and typically requires stricter credit qualifications. - When should I consider a conventional loan?

If you have good credit and can afford a larger down payment, a conventional loan might offer better terms. - Are there income limits on FHA loans?

No, there are no maximum income limits on eligibility for FHA loans. - How do I choose between an FHA and a conventional loan?

Your choice should depend on your financial situation, including credit score, down payment capability, and long-term financial goals.

Choosing between an FHA and a conventional mortgage requires careful consideration of your financial situation and long-term goals. By understanding both types of loans’ strengths and weaknesses, you will be better equipped to make a decision that aligns with your needs as you navigate the path toward homeownership.