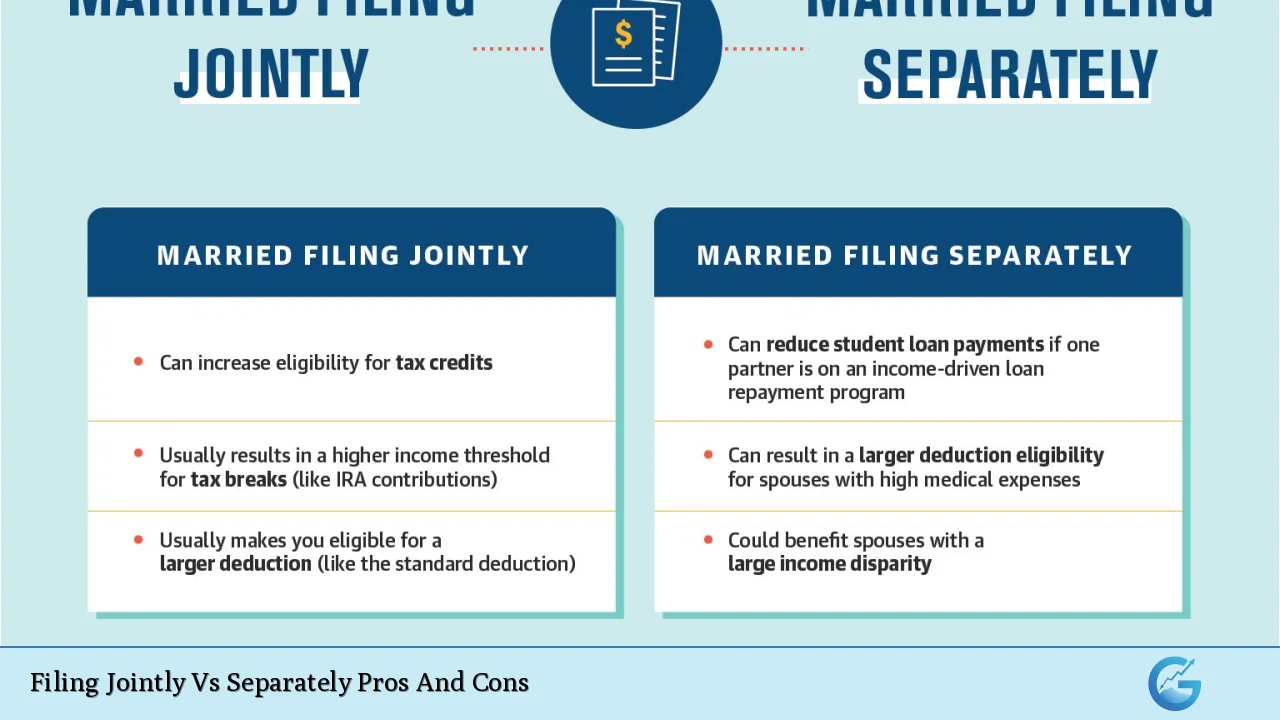

Deciding how to file taxes as a married couple is an important financial decision that can significantly impact your tax liability and overall financial situation. Married couples in the United States have two primary options: Married Filing Jointly (MFJ) and Married Filing Separately (MFS). Each option comes with its own set of advantages and disadvantages, making it crucial for couples to understand the implications of their choice. This article will explore the pros and cons of filing jointly versus separately, providing a comprehensive overview to help couples make informed decisions.

| Pros | Cons |

|---|---|

| Access to a wider range of tax credits and deductions | Both spouses are jointly liable for any tax owed |

| Higher standard deduction | Potentially higher tax rates if income is unequal |

| Simplified tax preparation process | Loss of certain tax benefits when filing separately |

| Lower overall tax liability for most couples | Limited ability to deduct certain expenses |

| Eligibility for various education credits | Higher income thresholds for some deductions when filing separately |

| Opportunity to offset income with spouse’s losses | Complexities in itemizing deductions if one spouse does not itemize |

| Better access to retirement account contributions and deductions | May complicate financial independence goals |

| Easier to qualify for tax breaks like the Earned Income Tax Credit (EITC) | Potential issues if one spouse has significant debt or tax problems |

Access to a Wider Range of Tax Credits and Deductions

One of the most significant advantages of filing jointly is that couples can access a broader array of tax credits and deductions. These include:

- Child Tax Credit: Eligible couples can claim a higher credit when filing jointly.

- Earned Income Tax Credit: This credit is generally not available for those who file separately.

- Education Credits: Couples filing jointly can take advantage of credits like the American Opportunity Tax Credit and Lifetime Learning Credit.

Filing separately often results in losing access to these valuable credits, which can lead to a higher overall tax bill.

Higher Standard Deduction

Married couples who file jointly benefit from a higher standard deduction compared to those who file separately. For example, in 2024, the standard deduction for MFJ is $29,200, while MFS filers only receive $14,600 each. This significant difference can reduce taxable income substantially, leading to lower tax liabilities.

Simplified Tax Preparation Process

Filing jointly typically simplifies the tax preparation process. Couples only need to complete one tax return instead of two, which can save time and reduce the likelihood of errors. This streamlined approach is particularly beneficial for those who may not be well-versed in tax laws or who prefer not to deal with complex calculations.

Lower Overall Tax Liability for Most Couples

For most married couples, filing jointly results in a lower overall tax liability. The IRS has structured tax brackets favorably for joint filers, often resulting in lower effective tax rates compared to filing separately. This is especially true if one spouse earns significantly more than the other, as joint filing allows for income averaging that can minimize taxes owed.

Eligibility for Various Education Credits

Couples who file jointly are more likely to qualify for education-related tax benefits. These include:

- American Opportunity Tax Credit: Available only to those who file jointly.

- Lifetime Learning Credit: Also restricted to joint filers.

These credits can substantially reduce the cost of education and are often unavailable or limited for those who choose to file separately.

Opportunity to Offset Income with Spouse’s Losses

When filing jointly, couples can offset their combined income with any losses incurred by either spouse. This means that if one spouse has significant investment losses or business expenses, these can be used to reduce the overall taxable income of both spouses, potentially lowering their tax burden.

Better Access to Retirement Account Contributions and Deductions

Filing jointly often provides better access to retirement account contributions. For instance:

- Couples filing together may be able to contribute more towards IRAs without facing income limits that apply when filing separately.

- Joint filers also have higher eligibility thresholds for certain retirement-related deductions.

This advantage is particularly important for couples planning for long-term financial security through retirement accounts.

Both Spouses Are Jointly Liable for Any Tax Owed

While there are many benefits to filing jointly, it’s essential to understand that both spouses are equally responsible for any taxes owed. This means that if one spouse makes errors or fails to report income accurately, both partners could face penalties or additional taxes owed. This shared liability can be a concern, especially if there are discrepancies in financial management between partners.

Potentially Higher Tax Rates If Income Is Unequal

In cases where there is a significant disparity in earnings between spouses, filing jointly may push the couple into a higher tax bracket than if they filed separately. This situation arises because combined incomes can exceed thresholds that trigger higher rates, leading to an increased overall tax burden.

Loss of Certain Tax Benefits When Filing Separately

Couples who choose to file separately may lose out on several key benefits available only through joint filing. These include:

- Child and Dependent Care Credit: Not available if filing separately.

- Earned Income Tax Credit: Completely inaccessible under MFS status.

This loss of benefits can make separate filings less advantageous financially.

Limited Ability to Deduct Certain Expenses

Filing separately also imposes limitations on deducting specific expenses. For instance:

- Medical expenses must exceed 7.5% of adjusted gross income (AGI) before they can be deducted.

- If one spouse has high medical bills but low income, filing separately might seem beneficial; however, this approach could limit overall deductible amounts due to AGI calculations based on individual incomes.

Higher Income Thresholds for Some Deductions When Filing Separately

Certain deductions have stricter income thresholds when spouses file separately. For example:

- The ability to deduct contributions made towards IRAs diminishes significantly under MFS status.

- Similarly, capital loss deductions are limited compared to those available under MFJ status.

These restrictions can lead couples who file separately to miss out on valuable deductions that could otherwise reduce their taxable income.

Complexities in Itemizing Deductions If One Spouse Does Not Itemize

When one spouse itemizes deductions while the other opts for the standard deduction under separate filings, it complicates the process significantly. Both spouses must either itemize or take the standard deduction together; mixed approaches are not allowed. This requirement may lead some couples into a situation where they cannot maximize their potential deductions effectively.

May Complicate Financial Independence Goals

While some couples may prefer maintaining financial independence by filing separately, this choice can complicate overall financial planning. Separate filings create barriers in terms of sharing resources and maximizing joint benefits available only through MFJ status. Couples should weigh whether independence outweighs potential savings from joint filings before making their decision.

Potential Issues If One Spouse Has Significant Debt or Tax Problems

If one spouse has significant debt or previous tax issues, filing jointly could expose both partners’ finances during audits or collections. In such cases, opting for separate filings may protect one spouse from being liable for the other’s debts or penalties incurred due to past mistakes. However, this protection comes at the cost of losing many joint benefits that could otherwise provide financial relief.

In conclusion, choosing between Married Filing Jointly and Married Filing Separately involves careful consideration of both advantages and disadvantages tailored specifically toward each couple’s unique financial circumstances. While joint filing offers numerous benefits such as broader access to credits and lower overall taxes for most couples, separate filings provide essential protections in specific situations where liability concerns arise or when significant discrepancies exist between spouses’ incomes.

Frequently Asked Questions About Filing Jointly Vs Separately Pros And Cons

- What are the main advantages of filing jointly?

The main advantages include access to a wider range of tax credits and deductions, a higher standard deduction amount, and potentially lower overall tax liability. - What disadvantages should I consider when deciding?

The main disadvantages include shared liability for taxes owed and potential higher rates if there is a significant income disparity between spouses. - Can I still claim education credits if I file separately?

No, education credits like the American Opportunity Tax Credit are generally not available when filing separately. - How does my choice affect my retirement contributions?

Filing jointly usually allows higher contribution limits without facing strict income thresholds compared to separate filings. - If I have high medical expenses, should I consider filing separately?

Yes, if one spouse has substantial medical expenses relative to their income, it might make sense to file separately. - What happens if only one spouse has debt?

If one spouse has significant debt or tax issues, filing separately may protect the other from being liable. - Is it always better to file jointly?

No; while many couples benefit from joint filings due to lower taxes and increased credits, specific circumstances may warrant separate filings. - Should I consult a professional before deciding?

Yes; consulting with a tax professional can provide personalized advice tailored specifically toward your financial situation.

Understanding these factors will empower married couples as they navigate their options during tax season while ensuring they make informed decisions aligned with their financial goals.