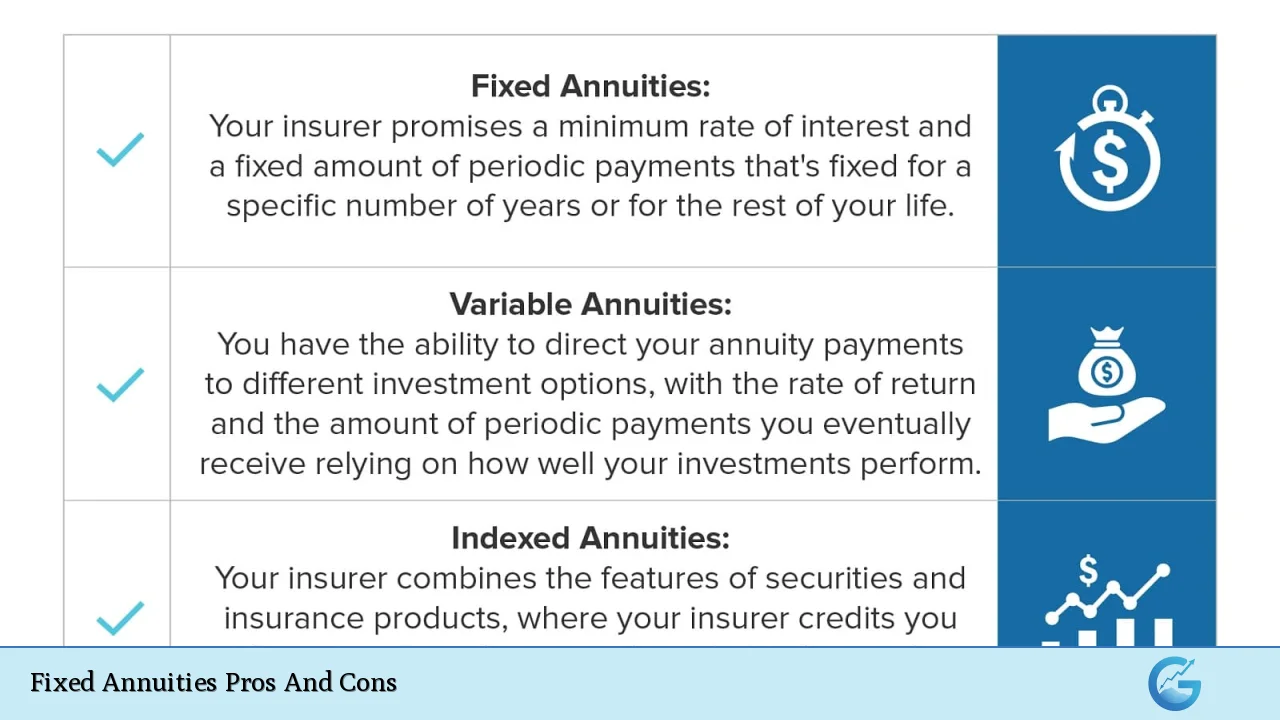

Fixed annuities are financial products that offer a guaranteed stream of income during retirement. They are contracts between an individual and an insurance company, where the individual pays a lump sum or series of payments in exchange for regular payouts at a later date. These products have gained popularity among investors seeking stability and predictable returns in their retirement planning. However, like any financial instrument, fixed annuities come with their own set of advantages and disadvantages that potential investors should carefully consider.

| Pros | Cons |

|---|---|

| Guaranteed Income | Limited Returns |

| Tax-Deferred Growth | Lack of Liquidity |

| Principal Protection | Inflation Risk |

| Predictable Returns | Opportunity Cost |

| No Market Risk | Complexity of Contracts |

| Death Benefit | Surrender Charges |

| Low Investment Minimums | Credit Risk |

| Simplicity | Loss of Control Over Principal |

Advantages of Fixed Annuities

Guaranteed Income

Fixed annuities provide a reliable stream of income that can last for a specified period or even for the entirety of an individual’s lifetime.

This feature is particularly attractive for retirees who want to ensure they have a stable financial foundation in their golden years. The guaranteed income can help cover essential expenses and provide peace of mind, knowing that a portion of one’s retirement income is secure regardless of market conditions.

- Predictable monthly, quarterly, or annual payments

- Option for lifetime income or a specified period

- Helps in budgeting and financial planning for retirement

Tax-Deferred Growth

One of the most significant advantages of fixed annuities is their tax-deferred growth potential.

The earnings within a fixed annuity grow tax-free until withdrawals begin, allowing for more substantial compound growth over time.

This tax advantage can be particularly beneficial for individuals in higher tax brackets or those looking to defer taxes until retirement when they may be in a lower tax bracket.

- Earnings compound without annual tax implications

- Potential for higher overall returns due to tax deferral

- Flexibility in timing withdrawals for tax planning purposes

Principal Protection

Fixed annuities offer a level of security that many other investment vehicles cannot match.

The principal invested in a fixed annuity is typically guaranteed by the insurance company, protecting it from market downturns.

This feature is especially appealing to risk-averse investors or those nearing retirement who cannot afford to lose their savings due to market volatility.

- Protection against market losses

- Guaranteed minimum interest rate

- Peace of mind for conservative investors

Predictable Returns

Unlike variable annuities or market-linked investments, fixed annuities offer a predetermined rate of return.

This predictability allows investors to accurately forecast their future income and plan their retirement finances with greater certainty.

The interest rate is typically guaranteed for a specific period, after which it may be adjusted based on prevailing market conditions, but often with a guaranteed minimum rate.

- Known interest rate for the initial guarantee period

- Ability to project future income accurately

- Reduced anxiety about market fluctuations

No Market Risk

Fixed annuities are not directly tied to stock market performance, which means they are insulated from market volatility.

This lack of market risk can be particularly attractive during times of economic uncertainty or for investors with a low risk tolerance.

While this also means potentially missing out on higher returns during bull markets, it provides stability and consistency that many retirees value.

- Protection from stock market crashes

- Steady growth regardless of economic conditions

- Suitable for risk-averse investors

Death Benefit

Many fixed annuities come with a death benefit feature, which can provide financial protection for the annuitant’s beneficiaries.

If the annuity owner dies before receiving all the guaranteed payments, the remaining value or a specified death benefit can be passed on to designated beneficiaries.

This feature can be an important aspect of estate planning and ensuring that loved ones are financially secure.

- Potential to leave a financial legacy

- Options for different payout structures to beneficiaries

- Can complement other estate planning tools

Low Investment Minimums

Fixed annuities often have lower investment minimums compared to other retirement products or investment vehicles.

This accessibility allows a broader range of investors to participate and start building their retirement income strategy, even with modest initial investments.

Some insurance companies offer fixed annuities with minimums as low as $1,000 to $5,000, making them an option for those just starting to save for retirement.

- More accessible to a wider range of investors

- Ability to start small and add contributions over time

- Flexibility in investment amounts

Simplicity

Compared to more complex financial products, fixed annuities are relatively straightforward and easy to understand.

The simplicity of fixed annuities can be appealing to investors who prefer a “set it and forget it” approach to retirement planning.

There’s no need to actively manage investments or make ongoing decisions about asset allocation, which can be a relief for those who don’t want to closely monitor their retirement accounts.

- Clear terms and conditions

- No need for active management

- Reduced stress and time commitment for financial planning

Disadvantages of Fixed Annuities

Limited Returns

While the guaranteed nature of fixed annuities provides security, it also means that returns are typically lower compared to other investment options.

In a bull market or during periods of high inflation, the fixed returns may not keep pace with the broader economy or other investment vehicles.

This limitation can result in opportunity costs and potentially lower overall wealth accumulation over the long term.

- Lower potential for capital appreciation

- May underperform compared to stock market investments

- Difficulty in beating inflation over extended periods

Lack of Liquidity

Fixed annuities are designed as long-term investments, and accessing funds before the agreed-upon time can be challenging and costly.

Most fixed annuities impose surrender charges for early withdrawals, which can significantly reduce the value of the investment if accessed prematurely.

This lack of liquidity can be problematic if unexpected expenses arise or if the investor’s financial situation changes.

- Limited access to funds without penalties

- Typically high surrender charges in early years

- Potential tax implications for early withdrawals

Inflation Risk

One of the most significant drawbacks of fixed annuities is their vulnerability to inflation.

As the cost of living increases over time, the fixed payments from an annuity may lose purchasing power, potentially leaving retirees with insufficient income in later years.

While some annuities offer inflation-adjusted options, these typically come at a higher cost or with lower initial payments.

- Fixed payments may not keep up with rising costs

- Reduced standard of living over time

- Limited options for increasing payouts to match inflation

Opportunity Cost

By locking funds into a fixed annuity, investors may miss out on potentially higher returns from other investment opportunities.

The conservative nature of fixed annuities means forgoing the possibility of substantial gains that could be achieved through more aggressive investment strategies.

This opportunity cost can be significant over long periods, especially for younger investors with a higher risk tolerance.

- Potential for lower overall returns compared to diversified portfolios

- Missing out on market rallies and economic booms

- Limited ability to adjust strategy based on changing market conditions

Complexity of Contracts

While fixed annuities are simpler than some financial products, the contracts can still be complex and filled with technical jargon.

Understanding all the terms, conditions, and potential scenarios outlined in an annuity contract can be challenging for many investors, potentially leading to misunderstandings or unexpected limitations.

It’s crucial to thoroughly review and comprehend the contract, often with the help of a financial advisor, before committing to a fixed annuity.

- Difficult to compare different annuity products

- Potential for hidden fees or unfavorable terms

- Need for professional guidance to fully understand the contract

Surrender Charges

Most fixed annuities come with surrender charges, which are fees imposed if the annuity owner withdraws more than a specified amount or terminates the contract early.

These charges can be substantial, often starting at 7-10% of the withdrawal amount and declining over several years.

Surrender charges can significantly impact the overall return on investment if the annuity needs to be accessed or terminated prematurely.

- High fees for early withdrawals or contract termination

- Declining scale of charges over time (e.g., 7 years)

- Potential for substantial financial loss if circumstances change

Credit Risk

While fixed annuities are generally considered safe investments, they are not without risk.

The guarantees provided by fixed annuities are only as strong as the financial stability of the insurance company issuing the contract.

If the insurance company faces financial difficulties or becomes insolvent, annuity owners could potentially lose some or all of their investment. While rare, this credit risk is an important consideration when choosing an annuity provider.

- Dependence on the financial strength of the insurance company

- Limited protection from state guaranty associations

- Importance of researching and selecting reputable insurers

Loss of Control Over Principal

Once an annuity is annuitized (converted into a stream of payments), the owner typically loses control over the principal amount invested.

This loss of control means that the funds cannot be accessed in a lump sum or left as an inheritance in the same way as other investments might be.

For some investors, this lack of flexibility and control over their assets can be a significant drawback.

- Inability to access the full principal amount once payments begin

- Limited options for changing the payment structure

- Potential impact on estate planning and wealth transfer

In conclusion, fixed annuities offer a unique combination of guaranteed income, tax benefits, and principal protection that can be attractive to many investors, particularly those nearing or in retirement. However, they also come with limitations such as lower potential returns, lack of liquidity, and inflation risk.

The decision to invest in a fixed annuity should be made carefully, considering one’s overall financial situation, retirement goals, and risk tolerance.

It’s often advisable to consult with a financial advisor to determine if a fixed annuity is an appropriate component of a diversified retirement strategy.

Frequently Asked Questions About Fixed Annuities Pros And Cons

- What is the main advantage of a fixed annuity?

The primary advantage of a fixed annuity is the guaranteed income stream it provides, offering financial security and predictability in retirement. - Are fixed annuities a good investment for young people?

Fixed annuities are generally more suitable for older investors nearing retirement. Young investors might benefit more from growth-oriented investments that have the potential for higher returns over the long term. - How do taxes work with fixed annuities?

Fixed annuities grow tax-deferred, meaning you don’t pay taxes on the earnings until you withdraw the money. When you start receiving payments, a portion is considered a return of principal (tax-free) and a portion is taxable as ordinary income. - Can I lose money in a fixed annuity?

While fixed annuities are generally considered low-risk, you can lose money if you withdraw funds early and incur surrender charges, or if the insurance company becomes insolvent. However, your principal is typically protected from market losses. - What happens to my fixed annuity if I die?

Most fixed annuities offer a death benefit. If you die before the annuity starts paying out, your beneficiaries typically receive the account value or a guaranteed minimum. If payments have started, the disposition depends on the payout option you chose. - How do fixed annuities compare to other retirement savings options?

Fixed annuities offer guaranteed income and principal protection, which distinguishes them from options like 401(k)s or IRAs that are subject to market fluctuations. However, they generally offer lower potential returns and less flexibility than other retirement savings vehicles. - Can I add money to my fixed annuity after I purchase it?

Some fixed annuities allow additional contributions, particularly during an initial contribution period. However, many are single-premium products that don’t allow for ongoing contributions. - How does inflation affect fixed annuities?

Inflation can erode the purchasing power of fixed annuity payments over time. Some annuities offer inflation protection riders, but these typically come at an additional cost or result in lower initial payments.