Fixed annuities are a popular financial product designed to provide a stable income stream during retirement. They are contracts between an individual and an insurance company, where the individual makes a lump-sum payment or series of payments in exchange for regular disbursements in the future. Fixed annuities are often favored by risk-averse investors due to their guaranteed returns and predictable income. However, like any financial product, they come with both advantages and disadvantages that potential investors should carefully consider.

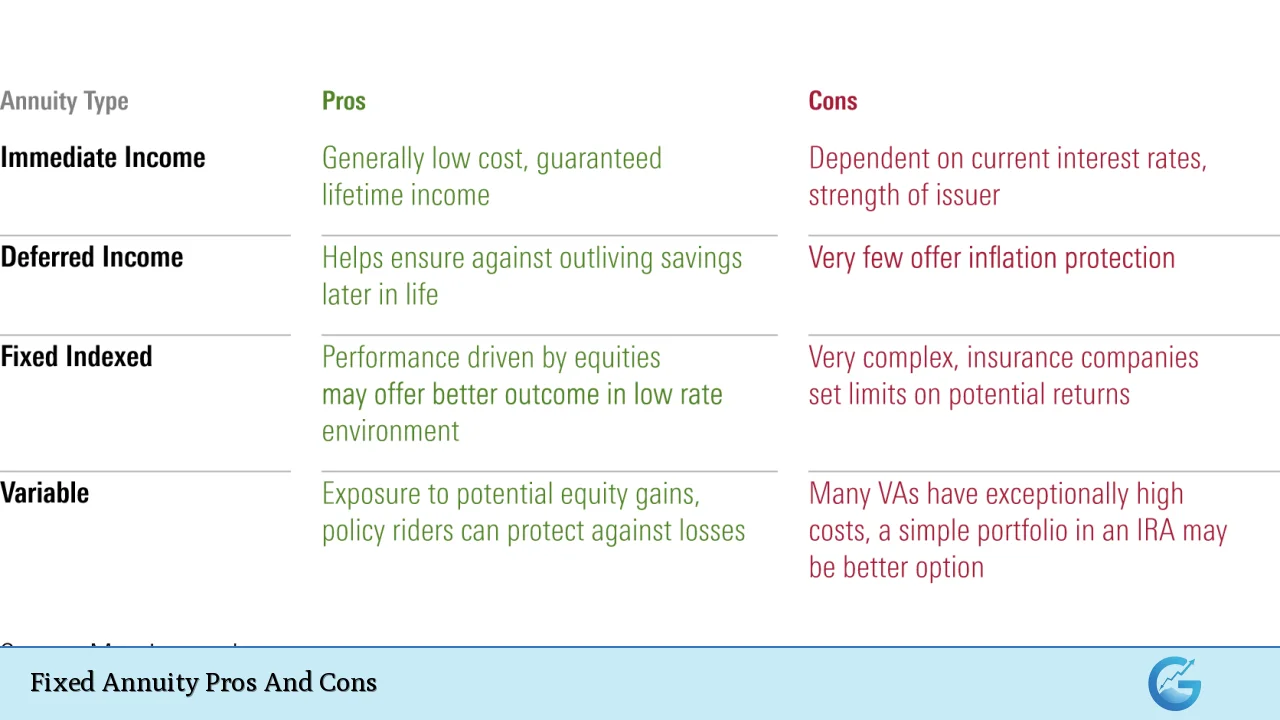

| Pros | Cons |

|---|---|

| Guaranteed returns on investment | Limited growth potential |

| Reliable income stream during retirement | Surrender charges for early withdrawal |

| Tax-deferred growth of earnings | No protection against inflation |

| Low minimum investment requirements | Complexity in understanding terms and conditions |

| Death benefit for beneficiaries | Potentially high fees and penalties |

Guaranteed Returns on Investment

One of the primary advantages of fixed annuities is that they offer guaranteed returns. This means that the interest rate is predetermined and will not fluctuate based on market conditions. Investors can expect a consistent return on their investment, providing peace of mind, especially for those nearing retirement who may be concerned about market volatility.

- Predictability: Fixed annuities provide a reliable way to plan for retirement income.

- Safety: The insurance company assumes the investment risk, ensuring that the principal amount is protected.

Reliable Income Stream During Retirement

Fixed annuities can provide a steady income stream throughout retirement. This feature is particularly appealing to retirees who want to ensure they have enough funds to cover their living expenses without worrying about market downturns.

- Lifetime Income Options: Many fixed annuities offer options for lifetime payouts, which can help mitigate the risk of outliving one’s savings.

- Supplemental Income: They can serve as a supplement to Social Security or other retirement accounts, enhancing overall financial security.

Tax-Deferred Growth of Earnings

Another significant benefit is that the earnings from fixed annuities grow on a tax-deferred basis. This means that investors do not pay taxes on the interest earned until they withdraw funds from the annuity.

- Compounding Growth: Tax deferral allows investments to grow faster since taxes are not deducted annually.

- Tax Efficiency: This feature can make fixed annuities an attractive option for those looking to maximize their retirement savings.

Low Minimum Investment Requirements

Fixed annuities often come with relatively low minimum investment thresholds, making them accessible to a broader range of investors.

- Affordability: Many fixed annuities require initial investments as low as $1,000 or $5,000.

- Entry Point: This accessibility allows individuals who may not have substantial savings to start building a secure retirement fund.

Death Benefit for Beneficiaries

Fixed annuities typically include a death benefit provision. If the annuitant passes away before receiving total payments equal to their premium, their beneficiaries will receive the remaining balance.

- Financial Security for Loved Ones: This feature ensures that the investment is not entirely lost upon death.

- Peace of Mind: Knowing that loved ones will receive financial support can be comforting for investors.

Limited Growth Potential

Despite their many advantages, fixed annuities have significant drawbacks, particularly regarding growth potential. The guaranteed returns often lag behind those available through other investment vehicles such as stocks or mutual funds.

- Opportunity Cost: Investors miss out on potentially higher returns available in more volatile markets.

- Stagnation: The fixed nature of returns means that during strong market performance, fixed annuity holders will not benefit from increased earnings.

Surrender Charges for Early Withdrawal

Another disadvantage is that many fixed annuities impose surrender charges if funds are withdrawn before a specified period. These charges can significantly reduce the amount an investor receives if they need access to their money early.

- Liquidity Issues: Investors may find themselves unable to access their funds without incurring penalties.

- Long-Term Commitment: Fixed annuities often require a long-term commitment, which may not suit everyone’s financial situation.

No Protection Against Inflation

Fixed annuities generally do not offer built-in protection against inflation. As prices rise over time, the purchasing power of fixed payments can diminish significantly.

- Cost of Living Concerns: Over time, fixed payments may not keep pace with rising costs, leading to reduced living standards in retirement.

- Inflation Risk: Without adjustments for inflation, retirees may find themselves struggling financially as their expenses increase.

Complexity in Understanding Terms and Conditions

While fixed annuities are simpler than some other financial products, they still come with complex terms and conditions that can be difficult for investors to fully understand.

- Contract Nuances: It’s essential for investors to read and comprehend all aspects of the contract before committing.

- Potential Misunderstandings: Misinterpretations can lead to dissatisfaction with the product or unexpected fees.

Potentially High Fees and Penalties

Fixed annuities can come with various fees that may eat into returns. These include management fees, surrender charges, and administrative costs that can accumulate over time.

- Cost Considerations: High fees can diminish overall returns and should be carefully evaluated before purchase.

- Transparency Issues: Some fees may not be clearly disclosed upfront, leading to unpleasant surprises later on.

In conclusion, fixed annuities present both compelling advantages and notable disadvantages. They offer guaranteed returns and reliable income streams that appeal particularly to risk-averse investors seeking stability during retirement. However, potential investors must weigh these benefits against limitations such as low growth potential and fees associated with early withdrawals.

Ultimately, understanding both sides of this financial product is crucial in making informed decisions about retirement planning and investment strategies.

Frequently Asked Questions About Fixed Annuity Pros And Cons

- What is a fixed annuity?

A fixed annuity is an insurance product that provides guaranteed returns on investments made by individuals in exchange for regular payouts during retirement. - What are the main benefits of a fixed annuity?

The main benefits include guaranteed returns, tax-deferred growth, reliable income during retirement, low minimum investment requirements, and death benefits for beneficiaries. - What are the risks associated with fixed annuities?

The risks include limited growth potential compared to other investments, surrender charges for early withdrawals, lack of inflation protection, complexity in understanding terms, and potentially high fees. - How do fixed annuities compare to variable annuities?

Fixed annuities offer guaranteed returns while variable annuities depend on market performance; thus, fixed annuities are generally less risky. - Can I access my money easily from a fixed annuity?

No; accessing funds from a fixed annuity before the surrender period typically incurs penalties. - Do fixed annuities provide inflation protection?

No; standard fixed annuities do not adjust payouts based on inflation unless specifically designed with inflation protection features. - What happens if I die before receiving full payments from my fixed annuity?

If you pass away before receiving total payments equal to your premium paid into the contract, your beneficiaries will receive any remaining balance. - Are there minimum investment amounts required for fixed annuities?

Yes; many fixed annuities require initial investments as low as $1,000 or $5,000.