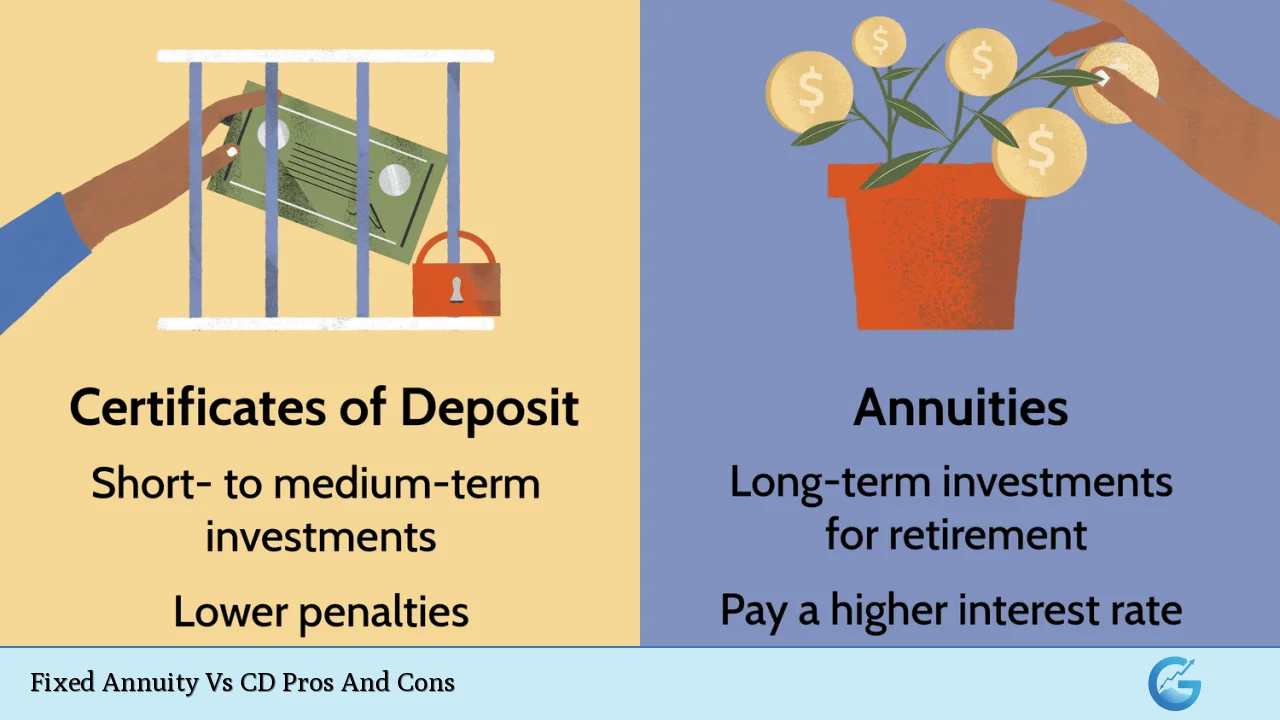

Investing is a critical component of financial planning, and understanding the options available is essential for making informed decisions. Among the various investment vehicles, fixed annuities and certificates of deposit (CDs) are popular choices for conservative investors seeking stability and predictable returns. Both options provide a means to grow savings with relatively low risk, but they come with distinct characteristics that cater to different financial goals and timelines. This article explores the advantages and disadvantages of fixed annuities versus CDs, helping you determine which might be the best fit for your investment strategy.

| Pros | Cons |

|---|---|

| Higher interest rates compared to CDs | Limited liquidity, especially during surrender periods |

| Tax-deferred growth until withdrawal | Not FDIC insured; relies on insurer’s financial strength |

| Flexible payout options, including lifetime income | Surrender charges may apply for early withdrawals |

| No annual taxes on interest earned while invested | Complexity in terms and conditions compared to CDs |

| Potential for higher returns in low-interest environments | Longer commitment periods may not suit all investors |

| Death benefit options for beneficiaries | Lower liquidity than CDs, especially in emergencies |

| No fees except for surrender charges on early withdrawals above free amounts | Interest rates may fluctuate after initial guarantee period ends |

| Can be part of a retirement income strategy | May have higher minimum investment requirements than CDs |

Higher Interest Rates Compared to CDs

Fixed annuities typically offer higher interest rates than CDs, making them an attractive option for long-term investors.

- Competitive Returns: Fixed annuities often provide better returns due to their longer investment horizons and the ability of insurance companies to invest in a broader range of assets.

- Market Adaptability: In low-interest-rate environments, fixed annuities can yield more competitive rates than traditional bank products like CDs.

Tax-Deferred Growth Until Withdrawal

One of the significant advantages of fixed annuities is the tax-deferral feature.

- Tax Benefits: Earnings on fixed annuities grow tax-deferred until withdrawal, allowing for potentially greater compound growth over time compared to taxable accounts.

- Control Over Taxation: Investors can choose when to withdraw funds, thus controlling when they incur tax liabilities.

Flexible Payout Options, Including Lifetime Income

Fixed annuities offer various payout options that can be tailored to individual needs.

- Lifetime Income Streams: Many fixed annuities provide options for guaranteed lifetime income, which can be particularly beneficial during retirement.

- Customizable Withdrawals: Investors can often choose between lump-sum payments or structured payouts based on their financial needs.

No Annual Taxes on Interest Earned While Invested

Unlike CDs, where interest is taxed annually, fixed annuities allow earnings to accumulate without immediate tax consequences.

- Tax Efficiency: This feature enhances the overall return on investment since taxes do not reduce the principal amount each year.

Potential for Higher Returns in Low-Interest Environments

In periods of low interest rates, fixed annuities can outperform CDs significantly.

- Long-Term Investment Strategy: Investors looking for stable returns over several years may find fixed annuities more beneficial than the often lower rates offered by CDs.

Death Benefit Options for Beneficiaries

Fixed annuities often include death benefits that can provide financial security for beneficiaries.

- Estate Planning Benefits: In the event of the investor’s death, the remaining account balance may be passed on to heirs without going through probate, simplifying estate management.

No Fees Except for Surrender Charges on Early Withdrawals Above Free Amounts

Fixed annuities generally do not have maintenance fees like some other investment products.

- Cost Efficiency: Aside from potential surrender charges for early withdrawals, investors typically do not face ongoing fees that could erode their investment returns.

Limited Liquidity, Especially During Surrender Periods

While fixed annuities have many advantages, they also come with significant liquidity constraints.

- Access Restrictions: Withdrawals may be limited during the surrender charge period (usually ranging from 3 to 10 years), which can hinder access to funds in emergencies.

- Surrender Charges: If funds are needed before the end of the surrender period, investors may incur penalties that reduce their overall returns.

Not FDIC Insured; Relies on Insurer’s Financial Strength

Unlike CDs, which are insured by the FDIC up to $250,000 per depositor, fixed annuities are not government-backed.

- Risk Exposure: The safety of a fixed annuity depends on the financial stability of the issuing insurance company. If an insurer faces financial difficulties or insolvency, policyholders may lose their investments.

Surrender Charges May Apply for Early Withdrawals

Investors must be cautious about early withdrawals from fixed annuities due to potential penalties.

- Costly Penalties: Surrender charges can significantly diminish returns if funds are accessed prematurely. These charges typically decrease over time but can still pose a challenge for those needing immediate access to cash.

Complexity in Terms and Conditions Compared to CDs

The structure and terms associated with fixed annuities can be more complex than those governing CDs.

- Understanding Terms: Investors must carefully review their contracts to understand withdrawal options, fees, and potential penalties fully. This complexity can deter some investors who prefer straightforward products like CDs.

Longer Commitment Periods May Not Suit All Investors

Fixed annuities often require longer investment commitments than CDs.

- Investment Horizon Considerations: For individuals seeking short-term savings or those who anticipate needing access to funds soon, a CD may be more appropriate due to its shorter terms and greater liquidity options.

Lower Liquidity Than CDs, Especially in Emergencies

The inherent design of fixed annuities can lead to lower liquidity compared to CDs.

- Emergency Access Issues: In situations requiring quick access to funds (e.g., medical emergencies), investors may find themselves limited by withdrawal restrictions and surrender charges associated with their annuity contracts.

Interest Rates May Fluctuate After Initial Guarantee Period Ends

While fixed annuities provide guaranteed rates initially, these rates may change after a set period.

- Potential Rate Changes: After the initial guarantee period (often 3-10 years), interest rates might adjust based on market conditions. This variability could impact long-term returns if market rates decline significantly after renewal.

May Have Higher Minimum Investment Requirements Than CDs

Investors should consider that fixed annuities often require larger minimum investments than typical CDs.

- Investment Thresholds: Many fixed annuity products require minimum investments ranging from $2,500 to $3 million, which might exclude small investors looking for lower entry points available with most CDs.

In summary, both fixed annuities and certificates of deposit offer unique advantages and disadvantages that cater to different financial goals. Fixed annuities typically provide higher interest rates and tax-deferred growth but come with limitations on liquidity and reliance on insurer stability. Conversely, CDs offer greater flexibility and FDIC insurance but usually yield lower returns.

When deciding between these two investment vehicles, it is crucial to assess your financial objectives, risk tolerance, and time horizon. Consulting with a financial advisor can further clarify which option aligns best with your overall investment strategy and retirement planning needs.

Frequently Asked Questions About Fixed Annuity Vs CD Pros And Cons

- What is a fixed annuity?

A fixed annuity is an insurance product that provides guaranteed interest over a specified period while allowing tax-deferred growth until withdrawal. - How does a certificate of deposit work?

A CD is a savings product offered by banks or credit unions that pays a fixed interest rate over a set term; it is typically insured by the FDIC. - Which offers better returns: fixed annuities or CDs?

Generally, fixed annuities offer higher interest rates compared to CDs due to their longer commitment periods. - Are there penalties for withdrawing money from a fixed annuity?

Yes, early withdrawals from a fixed annuity may incur surrender charges depending on the terms of the contract. - Is interest earned on a CD taxed annually?

Yes, interest earned on a CD is taxed as ordinary income each year it is earned. - What happens if I need my money before my CD matures?

If you withdraw money before maturity from a CD, you will typically incur an interest penalty. - Can I access my money easily from a fixed annuity?

No; accessing money from a fixed annuity can be challenging due to potential surrender charges and withdrawal restrictions. - Which option is better for retirement planning?

A fixed annuity may be more beneficial for retirement planning due to its potential for guaranteed income streams compared to a CD.

In conclusion, understanding both options’ pros and cons allows you to make informed decisions aligned with your financial goals. Whether you choose a fixed annuity or a certificate of deposit will depend largely on your specific needs regarding liquidity, risk tolerance, and investment horizon.