Fixed income annuities are a popular financial product designed to provide a steady stream of income, particularly during retirement. They are contracts offered by insurance companies that guarantee a fixed return on the initial investment, making them an attractive option for risk-averse investors. However, like any financial product, they come with their own set of advantages and disadvantages. This article delves into the pros and cons of fixed income annuities, helping potential investors make informed decisions.

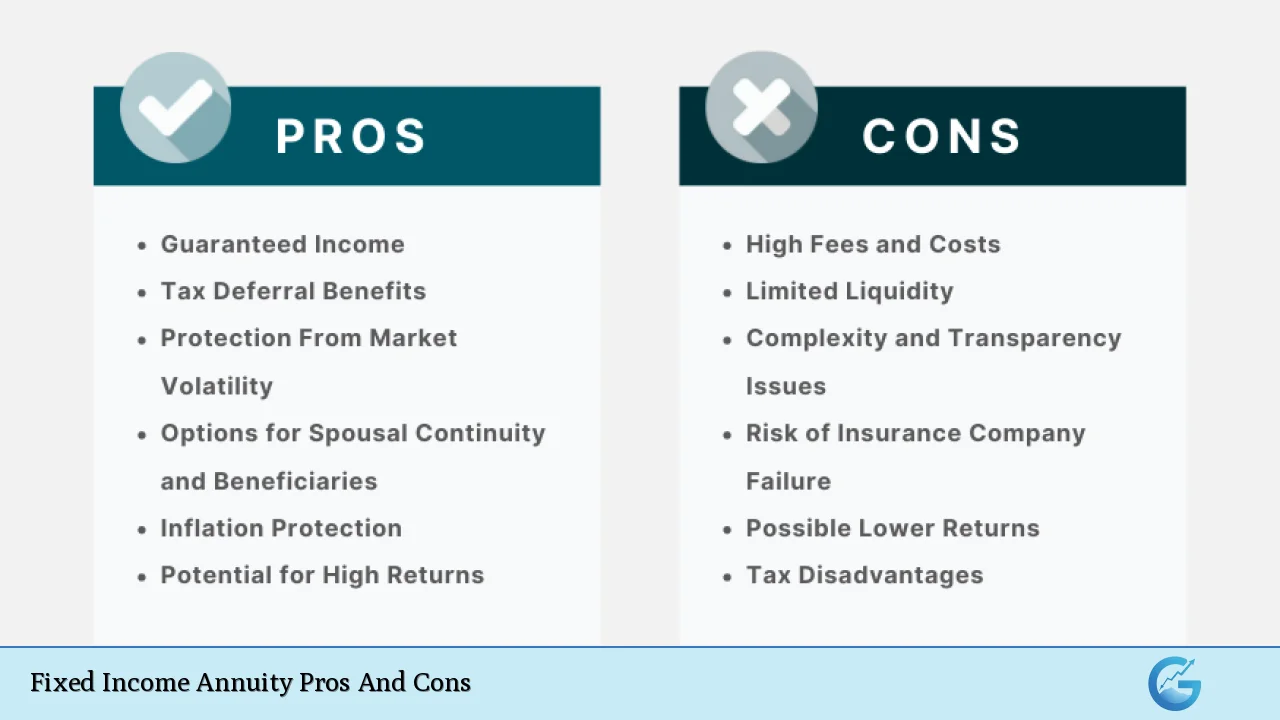

| Pros | Cons |

|---|---|

| Guaranteed Income for Life | Limited Liquidity |

| Tax-Deferred Growth | Inflation Risk |

| Predictable Returns | High Fees and Charges |

| Low Minimum Investment Requirements | Complexity of Terms and Conditions |

| Death Benefits for Beneficiaries | Potential for Lower Returns Compared to Other Investments |

Guaranteed Income for Life

One of the most significant advantages of fixed income annuities is their ability to provide guaranteed income for life. This feature is particularly appealing for retirees who wish to ensure a stable cash flow throughout their retirement years.

- Predictable Monthly Payments: Once the annuitant begins receiving payments, they can expect consistent monthly deposits for the rest of their life, regardless of market conditions.

- Financial Security: This predictability can help retirees manage their budgets more effectively, reducing the anxiety associated with fluctuating income sources.

Limited Liquidity

While guaranteed income is a strong selling point, fixed income annuities come with liquidity constraints.

- Withdrawal Restrictions: Most fixed annuities impose limits on how much money can be withdrawn each year without incurring penalties. This means that in emergencies, accessing funds can be challenging.

- Surrender Charges: If an investor needs to withdraw funds before a specified period (usually several years), they may face surrender charges that can significantly reduce their returns.

Tax-Deferred Growth

Another advantage is that earnings in fixed income annuities grow tax-deferred until withdrawals are made.

- Compounding Benefits: This allows the investment to compound over time without the immediate tax burden, potentially leading to greater accumulation of wealth.

- Tax Efficiency: For individuals in higher tax brackets, this feature can be particularly beneficial as it allows them to defer taxes until they are in a lower bracket during retirement.

Inflation Risk

Despite the benefits of tax-deferred growth, fixed income annuities expose investors to inflation risk.

- Fixed Payments: The payments received from fixed annuities do not typically increase with inflation. Over time, this can erode purchasing power, making it difficult for retirees to maintain their standard of living.

- Cost-of-Living Adjustments: While some products offer riders that adjust payments for inflation, these options usually come at an additional cost and may not fully offset inflation’s impact.

Predictable Returns

Fixed income annuities offer predictable returns that are not subject to market volatility.

- Stability: Investors looking for stability in their portfolios often favor fixed annuities because they provide a guaranteed interest rate over a specified period.

- Risk Mitigation: This makes them an appealing choice for conservative investors who prefer less risk compared to stocks or variable annuities.

High Fees and Charges

A notable disadvantage of fixed income annuities is the potential for high fees and charges associated with them.

- Surrender Charges: As mentioned earlier, early withdrawals can incur substantial surrender charges that diminish overall returns.

- Management Fees: Some contracts may also include ongoing management fees that could further reduce net gains. It’s essential for investors to read the fine print and understand all associated costs before committing.

Low Minimum Investment Requirements

Many fixed income annuities have relatively low minimum investment thresholds compared to other investment vehicles.

- Accessibility: This feature allows a broader range of individuals to invest in these products without needing significant upfront capital.

- Entry Point: Investors can often start with as little as $1,000 or $5,000, making it easier for those new to investing or those with limited funds to enter the market.

Complexity of Terms and Conditions

Fixed income annuities can be complex financial instruments with various terms and conditions that may confuse potential investors.

- Understanding Contracts: The intricacies of different products—such as payout options, surrender periods, and interest rates—can be overwhelming.

- Need for Professional Guidance: Investors may require assistance from financial advisors to navigate these complexities effectively and choose the right product suited to their needs.

Death Benefits for Beneficiaries

Many fixed income annuities offer death benefits that can provide financial security for beneficiaries after the annuitant’s death.

- Protection for Loved Ones: This feature ensures that if the investor passes away before fully utilizing their investment, their beneficiaries receive a payout, which can be crucial for family financial planning.

- Peace of Mind: Knowing that loved ones will benefit from the investment can provide additional peace of mind for investors planning their estate.

Potential for Lower Returns Compared to Other Investments

While fixed income annuities provide stability and predictability, they may not yield returns as high as other investment options like stocks or mutual funds.

- Opportunity Cost: Investors seeking growth may find better returns in diversified portfolios or higher-risk investments.

- Long-Term Commitment: Fixed annuities typically require long-term commitments, which can limit flexibility and growth potential compared to more dynamic investment strategies available in other markets such as crypto or forex trading.

In conclusion, fixed income annuities present both significant advantages and notable disadvantages. They offer guaranteed income and tax-deferred growth but come with limitations on liquidity and potential inflation risks. Understanding these factors is crucial for anyone considering investing in fixed income annuities as part of their financial strategy.

Frequently Asked Questions About Fixed Income Annuity Pros And Cons

- What are the main benefits of fixed income annuities?

The primary benefits include guaranteed lifetime income, tax-deferred growth on earnings, predictable returns, and low minimum investment requirements. - Are there any risks associated with fixed income annuities?

Yes, risks include limited liquidity due to withdrawal restrictions and surrender charges, inflation risk due to fixed payments not adjusting over time, and potentially high fees. - How do fixed income annuities compare to other investment options?

Fixed income annuities offer stability and predictability but may yield lower returns compared to more aggressive investments like stocks or mutual funds. - Can I access my money easily from a fixed income annuity?

No, accessing funds from a fixed income annuity can be challenging due to withdrawal restrictions and potential surrender charges. - What happens if I die before using my fixed income annuity?

Many contracts include death benefits that ensure your beneficiaries receive a payout if you pass away before fully utilizing your investment. - Do I have to pay taxes on my earnings from fixed income annuities?

Earnings grow tax-deferred until you withdraw funds; at that point, you will owe taxes on the amount withdrawn. - What should I consider before investing in a fixed income annuity?

You should evaluate your financial goals, risk tolerance, liquidity needs, and understand all fees associated with the product. - Are there alternatives to fixed income annuities?

Yes, alternatives include traditional savings accounts, CDs (Certificates of Deposit), bonds, or diversified stock portfolios depending on your risk appetite.

Understanding both sides of investing in fixed income annuities is essential for making informed decisions tailored to individual financial goals.