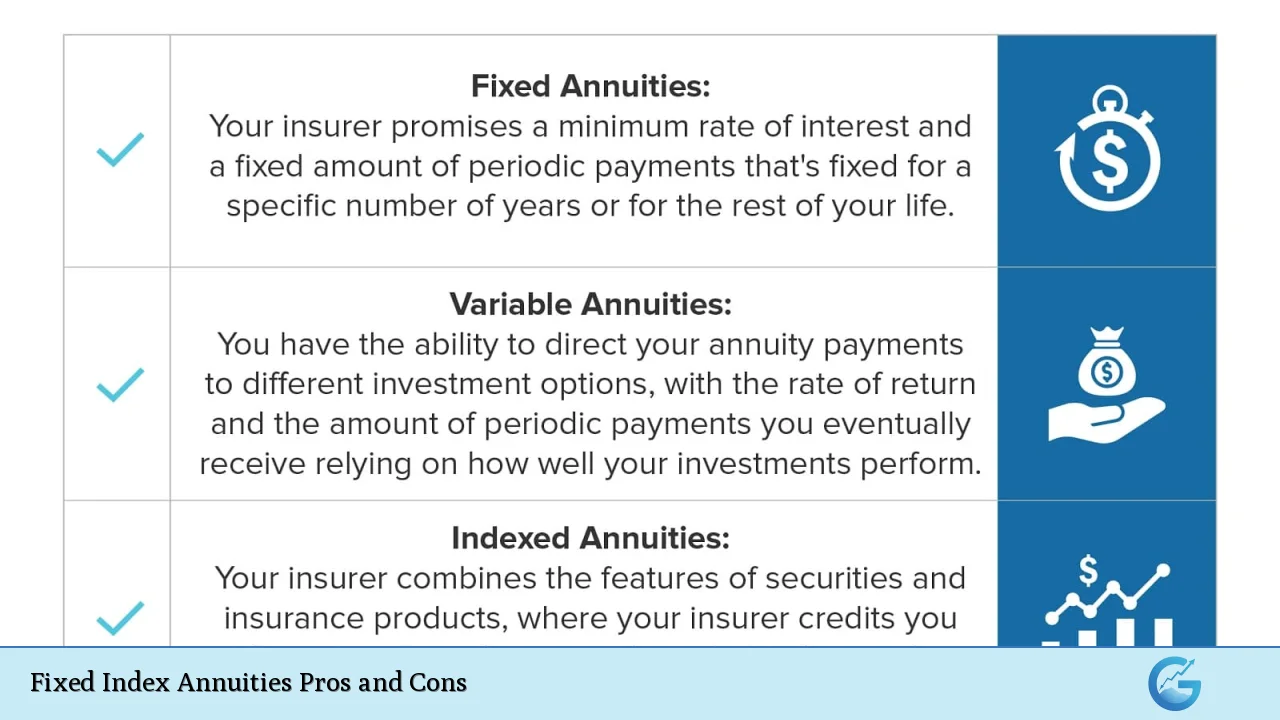

Fixed index annuities (FIAs) have gained popularity as a financial product that combines features of both fixed and variable annuities. They offer a unique investment opportunity, particularly for individuals looking to secure their retirement savings while still having the potential for growth linked to market performance. However, like any financial instrument, they come with their own set of advantages and disadvantages. This article aims to provide a comprehensive overview of the pros and cons of fixed index annuities, helping potential investors make informed decisions.

| Pros | Cons |

|---|---|

| Principal protection from market downturns | Limited growth potential due to caps and participation rates |

| Tax-deferred growth | Complex contracts can be difficult to understand |

| Minimum return guarantees | Illiquidity and potential surrender charges |

| Potential for higher returns compared to traditional fixed products | Dependence on market performance for returns |

| No management fees during the accumulation phase | Long crediting periods may delay returns |

| Lifetime income options available | May not suit all investment strategies or risk tolerances |

Principal Protection from Market Downturns

One of the most significant advantages of fixed index annuities is the protection they offer against market losses. Unlike direct stock market investments, FIAs ensure that your principal remains intact even during economic downturns. This feature is particularly appealing for conservative investors who prioritize capital preservation.

- Zero Loss Guarantee: In years when the linked index performs poorly, you won’t lose your initial investment.

- Safety Net: Insurance companies back these products with substantial reserves, providing a layer of financial security.

Tax-Deferred Growth

Fixed index annuities allow for tax-deferred growth, meaning you won’t owe taxes on earnings until you withdraw funds. This can significantly enhance your investment’s compounding potential.

- Compounding Benefits: By delaying taxes, your investment can grow more rapidly compared to taxable accounts.

- Lower Tax Bracket at Withdrawal: Many retirees find themselves in a lower tax bracket than during their working years, potentially reducing their overall tax burden upon withdrawal.

Minimum Return Guarantees

Many fixed index annuities come with a minimum return guarantee, ensuring that even if the linked index performs poorly, you will still receive some level of return.

- Safety Feature: This guarantee adds an extra layer of security, making FIAs a reliable option for risk-averse investors.

- Predictable Growth: Knowing that there is a minimum return helps in planning for future income needs.

Potential for Higher Returns Compared to Traditional Fixed Products

While fixed annuities offer guaranteed returns, FIAs provide the opportunity for potentially higher returns by linking growth to stock market indices.

- Market Participation: Investors can benefit from market upswings without directly investing in stocks.

- Higher Average Returns: Historically, FIAs have outperformed traditional fixed-income products like CDs over long periods.

No Management Fees During the Accumulation Phase

Unlike mutual funds or other investment vehicles that may charge annual management fees, fixed index annuities typically do not incur such costs during the accumulation phase.

- Cost Efficiency: This absence of management fees can lead to higher net returns over time.

- Simplified Investment: Investors do not need to worry about ongoing fees eating into their profits.

Lifetime Income Options Available

Many fixed index annuities offer options for lifetime income, which can be crucial for retirees concerned about outliving their savings.

- Guaranteed Income Stream: This feature ensures that you receive regular payments for life, regardless of how long you live.

- Flexibility in Payouts: Options may include single or joint life payouts, catering to individual needs.

Limited Growth Potential Due to Caps and Participation Rates

Despite their benefits, one major drawback of fixed index annuities is that they often come with caps on how much you can earn based on the performance of the underlying index.

- Earning Limitations: If the market performs exceptionally well, your gains may be capped at a predetermined rate.

- Participation Rates: You may only earn a fraction of the actual index gains, which can limit overall growth potential.

Complex Contracts Can Be Difficult to Understand

The complexity of fixed index annuity contracts can pose challenges for many investors.

- Confusing Terms: With various crediting methods and terms like “participation rates” and “caps,” understanding how returns are calculated can be daunting.

- Need for Professional Guidance: Many investors may require assistance from financial advisors to navigate these complexities effectively.

Illiquidity and Potential Surrender Charges

Fixed index annuities are generally less liquid than other investment options. Accessing funds before the end of the contract term often incurs penalties.

- Surrender Charges: Early withdrawals can lead to significant fees, which may deter investors from accessing their funds when needed.

- Long-Term Commitment: These products are designed as long-term investments; thus, they may not be suitable for those who require immediate access to cash.

Dependence on Market Performance for Returns

The returns on fixed index annuities are tied to the performance of specific market indices, which introduces an element of uncertainty.

- Market Volatility Impact: While you won’t lose principal, poor market performance can lead to minimal or no interest credits in certain years.

- Timing Risks: The timing of market fluctuations can affect your returns; gains are typically credited only once per year based on specific dates.

Long Crediting Periods May Delay Returns

Many FIAs have crediting periods that extend over several years before interest is calculated and credited to your account.

- Delayed Gratification: Investors may have to wait longer than expected to see any growth in their accounts.

- Market Conditions Change: Changes in market conditions during these periods can affect overall returns unpredictably.

May Not Suit All Investment Strategies or Risk Tolerances

While FIAs offer certain benefits, they may not align with every investor’s goals or risk tolerance levels.

- Not Suitable for Aggressive Investors: Those seeking high-risk investments with potentially high returns might find FIAs too conservative.

- Individual Financial Goals Matter: Each investor’s unique circumstances should dictate whether a fixed index annuity fits into their broader financial strategy.

In conclusion, fixed index annuities present both opportunities and challenges. They provide a unique blend of safety and potential growth that appeals particularly to conservative investors looking for retirement income solutions. However, understanding their complexities and limitations is crucial before committing funds. As with any financial product, it is essential to assess personal financial goals and consult with a qualified advisor when considering fixed index annuities as part of an investment strategy.

Frequently Asked Questions About Fixed Index Annuities

- What is a fixed index annuity?

A fixed index annuity is a type of insurance product that offers returns linked to a stock market index while providing principal protection against losses. - How do I benefit from a fixed index annuity?

You benefit through tax-deferred growth and potential earnings based on market performance without risking your principal. - Are there risks associated with fixed index annuities?

Yes, risks include limited growth potential due to caps on earnings and penalties for early withdrawals. - Can I lose money in a fixed index annuity?

No, you cannot lose your principal; however, your returns may be minimal if the market underperforms. - How are earnings calculated in a fixed index annuity?

Earnings are usually calculated based on the performance of an underlying stock market index using predetermined caps and participation rates. - What happens if I need my money before maturity?

If you withdraw funds before maturity, you may face surrender charges and tax implications. - Who should consider investing in a fixed index annuity?

This product is suitable for conservative investors looking for stable income streams during retirement. - Are there fees associated with fixed index annuities?

While there are typically no management fees during accumulation, surrender charges may apply if funds are withdrawn early.