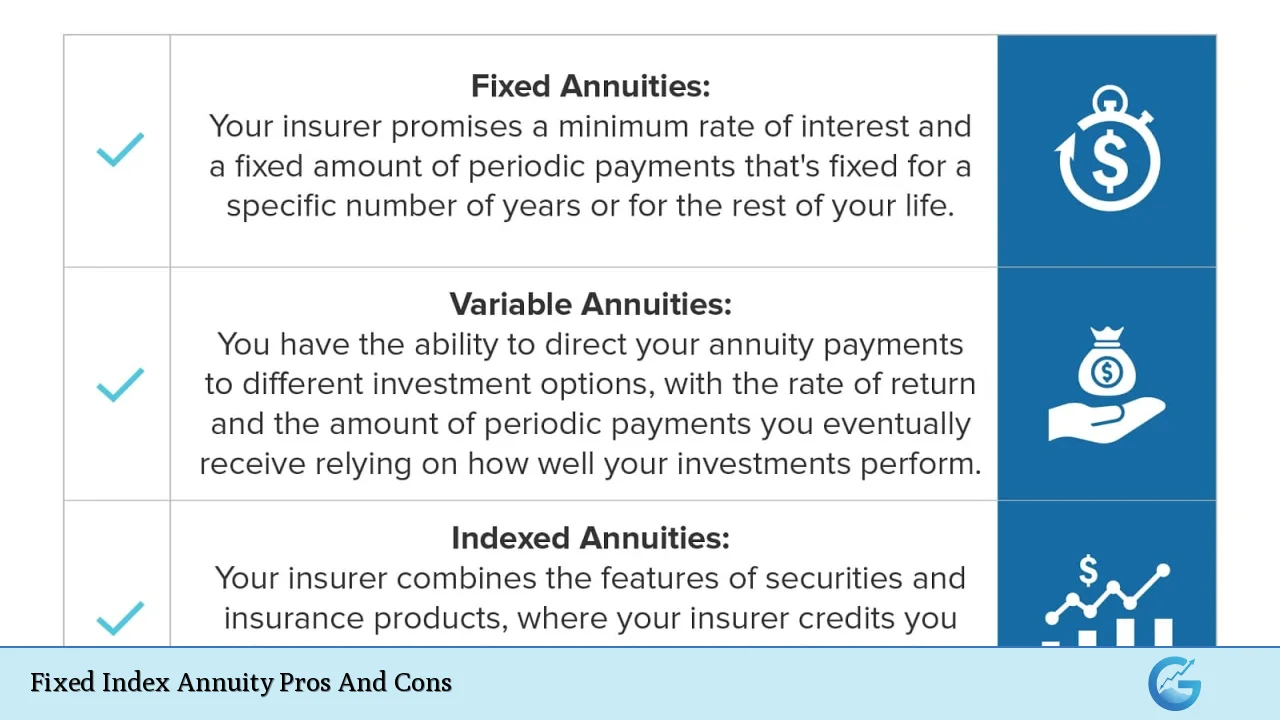

Fixed index annuities (FIAs) are complex financial products that blend elements of traditional fixed annuities with the potential for higher returns linked to market performance. These insurance contracts offer a unique combination of principal protection and the opportunity for growth based on the performance of a specified market index, such as the S&P 500. As retirement planning tools, FIAs have gained popularity among investors seeking a balance between security and growth potential.

| Pros | Cons |

|---|---|

| Principal protection | Limited upside potential |

| Tax-deferred growth | Complex product structure |

| Potential for higher returns than traditional fixed annuities | Surrender charges and illiquidity |

| Guaranteed minimum return | Caps on index-linked gains |

| No direct market risk | Potential for high fees |

| Lifetime income options | Opportunity cost compared to direct market investments |

| Death benefit provisions | Inflation risk |

| Creditor protection in some states | Complexity in understanding crediting methods |

Advantages of Fixed Index Annuities

Principal Protection

One of the most significant advantages of fixed index annuities is the guarantee of principal protection.

Unlike direct investments in the stock market or even variable annuities, FIAs ensure that the initial investment amount is safeguarded against market downturns. This feature is particularly appealing to risk-averse investors or those nearing retirement who cannot afford to lose their capital.

- Guaranteed return of principal regardless of market performance

- Protection against negative index returns

- Peace of mind for conservative investors

Tax-Deferred Growth

Fixed index annuities offer tax-deferred growth, which can be a powerful tool for long-term wealth accumulation. This means that any earnings within the annuity are not taxed until withdrawal, allowing for compound growth over time.

- Potential for faster accumulation of wealth

- Flexibility in timing withdrawals to optimize tax situations

- Particularly beneficial for high-income earners in higher tax brackets

Potential for Higher Returns

Compared to traditional fixed annuities or certificates of deposit (CDs), fixed index annuities offer the potential for higher returns. This is due to their link to market index performance, which can provide growth opportunities beyond what guaranteed fixed-rate products typically offer.

- Possibility to outperform traditional fixed-income investments

- Participation in market gains without direct market exposure

- Diversification tool for conservative portfolios seeking growth

Guaranteed Minimum Return

Many fixed index annuities come with a guaranteed minimum return, ensuring that even in periods of poor market performance, the annuity will still provide some level of growth.

This feature acts as a safety net, providing a floor for returns that can help in financial planning and retirement income projections.

- Assurance of some growth regardless of market conditions

- Helps in creating predictable retirement income streams

- Mitigates the risk of zero or negative returns over the contract period

No Direct Market Risk

Fixed index annuities shield investors from direct market risk. While the potential for returns is linked to market index performance, the annuity owner does not directly invest in the market, thus avoiding the volatility and potential losses associated with stock ownership.

- Protection from market crashes and bear markets

- Smoother performance curve compared to direct equity investments

- Reduced anxiety over market fluctuations

Lifetime Income Options

Many fixed index annuities offer the option to convert the accumulated value into a guaranteed lifetime income stream. This feature can be invaluable for retirees seeking a reliable source of income that cannot be outlived.

- Addresses longevity risk in retirement planning

- Provides a predictable income base for budgeting

- Can be structured to include inflation protection or survivor benefits

Death Benefit Provisions

Fixed index annuities often include death benefit provisions, ensuring that beneficiaries receive at least the principal amount invested, and in some cases, the highest contract value achieved. This can be an important estate planning tool.

- Protection for heirs against market downturns

- Potential to pass on accumulated gains

- Bypass probate process for faster distribution to beneficiaries

Creditor Protection

In some states, annuities, including fixed index annuities, offer a level of protection against creditors. This can be particularly valuable for professionals in high-liability fields or those concerned about potential legal judgments.

- Asset protection strategy for high-risk professionals

- Potential safeguard in bankruptcy scenarios

- Varies by state, so consultation with a legal professional is advised

Disadvantages of Fixed Index Annuities

Limited Upside Potential

While fixed index annuities offer the potential for higher returns than traditional fixed annuities, they typically cap or limit the upside.

This means that in years of exceptional market performance, FIA returns may significantly underperform direct market investments.

- Participation rates may limit the percentage of index gains credited

- Caps on annual returns can restrict growth in strong market years

- Spread fees can reduce the effective return credited to the account

Complex Product Structure

Fixed index annuities are often criticized for their complexity. The various crediting methods, participation rates, caps, and spreads can be difficult for the average investor to fully understand and compare across products.

- Challenging to accurately assess the potential returns

- Difficult to compare different FIA products

- May require professional guidance to fully comprehend terms and conditions

Surrender Charges and Illiquidity

Most fixed index annuities come with surrender periods during which withdrawals above a certain amount incur penalties. This lack of liquidity can be problematic for investors who may need access to their funds.

- Surrender periods can last up to 10-15 years

- Early withdrawals may be subject to substantial penalties

- Limited flexibility to respond to changing financial needs

Caps on Index-Linked Gains

Insurance companies typically impose caps on the amount of index-linked gains that can be credited to the annuity. These caps limit the potential upside, especially in years of strong market performance.

- Annual point-to-point caps often range from 3% to 7%

- Monthly sum caps can be even lower, sometimes 1-2% per month

- Caps may be adjusted downward by the insurer over time

Potential for High Fees

While fixed index annuities don’t have the same fee structure as variable annuities, they can still come with various charges that can erode returns. These may include administrative fees, rider charges for additional benefits, and spread fees.

- Mortality and expense charges may apply

- Optional riders for enhanced benefits often come at a cost

- Spread fees can reduce the effective interest credited

Opportunity Cost

By choosing a fixed index annuity over direct market investments, investors may miss out on potentially higher returns, especially during bull markets. The trade-off for downside protection is often a significant reduction in upside potential.

- Historical stock market returns have outpaced FIA returns over long periods

- Dividend income from stocks is not captured in index-linked gains

- Limited ability to benefit from compound growth of direct equity ownership

Inflation Risk

While some fixed index annuities offer inflation protection riders, many do not adequately address the risk of inflation eroding purchasing power over time. This can be particularly problematic for long-term contracts.

- Fixed guaranteed rates may not keep pace with inflation

- Caps and participation rates can limit the ability to outpace inflation

- The real value of the annuity may decrease over time in high-inflation environments

Complexity in Understanding Crediting Methods

The methods used to calculate and credit index-linked interest can be highly complex and vary significantly between products. This complexity can make it difficult for investors to accurately assess the potential performance of their annuity.

- Various crediting methods include annual point-to-point, monthly sum, and daily average

- Each method can produce dramatically different results under various market conditions

- Understanding the nuances of each crediting method requires significant financial literacy

In conclusion, fixed index annuities offer a unique blend of principal protection and potential for market-linked growth, making them an attractive option for certain investors, particularly those nearing or in retirement. However, the complexity of these products, combined with their limitations on upside potential and liquidity constraints, necessitates careful consideration and often professional guidance before investing.

As with any financial product, it’s crucial to align the features and limitations of fixed index annuities with your individual financial goals, risk tolerance, and overall retirement strategy.

Frequently Asked Questions About Fixed Index Annuities

- How do fixed index annuities differ from variable annuities?

Fixed index annuities offer principal protection and returns linked to an index, while variable annuities invest directly in the market. FIAs have no risk of loss due to market performance, whereas variable annuities can lose value. - Can I lose money in a fixed index annuity?

You cannot lose money due to market performance, but you may incur losses if you withdraw funds during the surrender period. Additionally, inflation can erode the purchasing power of your investment over time. - Are fixed index annuities FDIC insured?

No, fixed index annuities are not FDIC insured. They are backed by the financial strength of the issuing insurance company, so it’s important to choose a reputable, financially stable insurer. - How are returns calculated in a fixed index annuity?

Returns are typically calculated using a crediting method that measures index performance over a specific period, subject to caps, participation rates, or spreads. The exact calculation can vary significantly between products. - What happens to my fixed index annuity if I die?

Most fixed index annuities include a death benefit that pays out to your beneficiaries. This is often the contract value or a guaranteed minimum, whichever is higher. - Can I withdraw money from my fixed index annuity?

Yes, but withdrawals may be subject to surrender charges if taken during the surrender period. Many contracts allow for penalty-free withdrawals of up to 10% annually. - How are fixed index annuities taxed?

Growth in a fixed index annuity is tax-deferred. Withdrawals are taxed as ordinary income, and if taken before age 59½, may incur an additional 10% federal tax penalty. - Are fixed index annuities a good investment for everyone?

Fixed index annuities are not suitable for everyone. They are generally best for conservative investors seeking principal protection with some growth potential, particularly those nearing or in retirement.