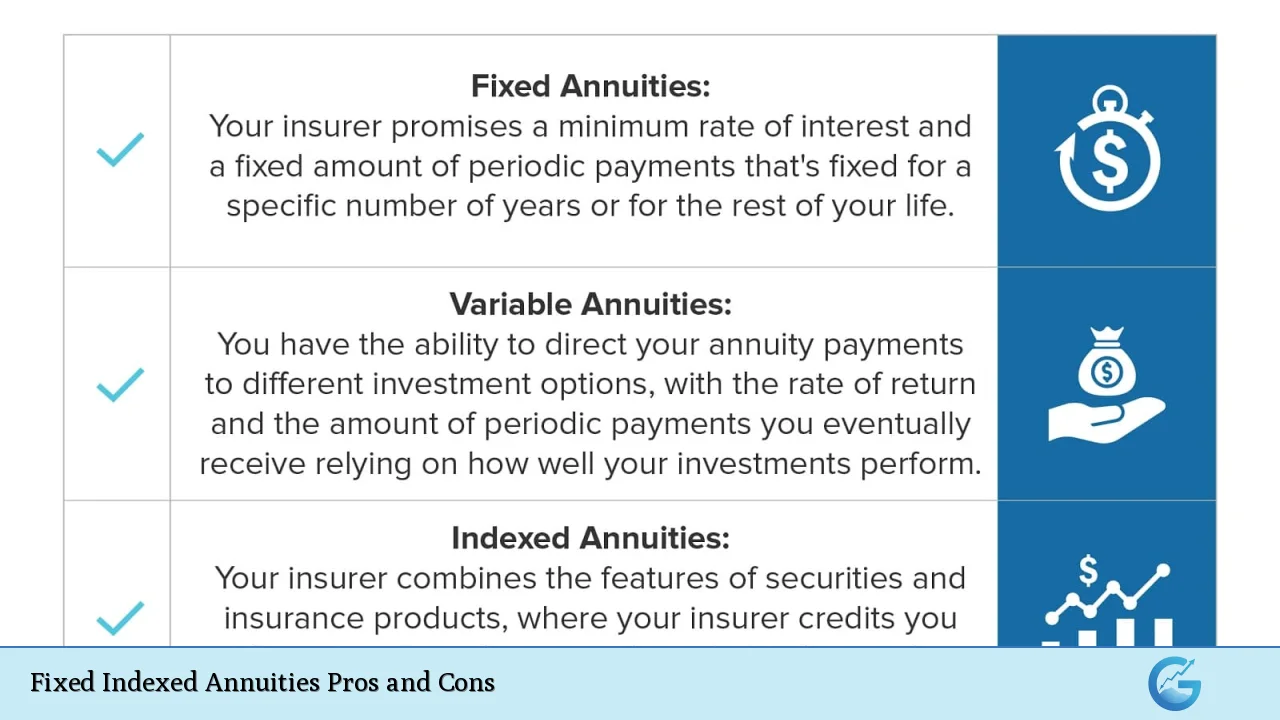

Fixed indexed annuities (FIAs) are a unique financial product that combines the features of both fixed and variable annuities. They offer the potential for growth based on a stock market index while providing a safety net against market losses. This makes them an attractive option for individuals looking to secure their retirement savings while still having the opportunity to benefit from market performance. However, like any investment, FIAs come with their own set of advantages and disadvantages that potential investors should carefully consider.

| Pros | Cons |

|---|---|

| Principal protection from market losses | Complexity of contracts and terms |

| Tax-deferred growth potential | Caps on maximum returns |

| Guaranteed minimum returns | Illiquidity and surrender charges |

| Higher potential returns than traditional fixed income products | Less certainty compared to direct market investments |

| Flexible payout options during retirement | Potentially high fees and expenses |

Principal Protection from Market Losses

One of the most significant advantages of fixed indexed annuities is their principal protection. This means that regardless of how the underlying index performs, the initial investment amount is safeguarded from losses.

- Safety Net: Investors can rest assured that their principal will not decrease due to market downturns.

- Market Upside Participation: While investors do not directly invest in stocks, they can still benefit from positive index performance, allowing for growth without the risk of losing initial capital.

Tax-Deferred Growth Potential

Another compelling feature of FIAs is their tax-deferred growth. This allows investors to accumulate earnings without immediate tax liabilities.

- Compounding Growth: Earnings grow without being taxed until withdrawal, which can significantly enhance the overall return on investment over time.

- Retirement Strategy: This characteristic makes FIAs particularly appealing for those planning for retirement, as they can defer taxes until they are likely in a lower tax bracket.

Guaranteed Minimum Returns

Fixed indexed annuities typically come with a guaranteed minimum return, which provides a level of security that many other investment vehicles do not offer.

- Predictable Income: This guarantee ensures that even in poor market conditions, investors will receive a minimum return on their investment.

- Financial Planning: This feature can be particularly beneficial for retirees who need predictable income streams.

Higher Potential Returns Than Traditional Fixed Income Products

FIAs often provide higher potential returns compared to traditional fixed income products like CDs or savings accounts.

- Market Index Linkage: The returns are linked to an index (e.g., S&P 500), which historically has outperformed fixed-income alternatives over the long term.

- Inflation Hedge: This potential for higher returns can help protect against inflation, making FIAs an attractive option for long-term savers.

Flexible Payout Options During Retirement

Fixed indexed annuities offer various payout options, allowing investors to tailor their income strategy according to their needs.

- Multiple Withdrawal Choices: Investors can choose to receive payments as a lump sum or through regular installments, providing flexibility based on individual financial situations.

- Lifetime Income Options: Many FIAs offer options for guaranteed lifetime income, ensuring financial security throughout retirement.

Complexity of Contracts and Terms

Despite their advantages, one major disadvantage of fixed indexed annuities is their complexity.

- Difficult to Understand: The contracts often contain intricate terms regarding how interest is credited, caps on returns, and withdrawal penalties.

- Need for Professional Guidance: Due to this complexity, potential investors may require assistance from financial advisors or agents to navigate the details effectively.

Caps on Maximum Returns

While FIAs provide opportunities for growth, they also impose caps on the maximum returns investors can earn.

- Limitations on Gains: Even if the underlying index performs exceptionally well, the FIA may limit how much interest is credited based on predetermined caps.

- Opportunity Cost: In strong bull markets, this cap could result in significantly lower returns compared to direct stock investments or mutual funds.

Illiquidity and Surrender Charges

Fixed indexed annuities are generally less liquid than other investment types, which can pose challenges for investors needing access to funds.

- Surrender Charges: If withdrawals are made before a specified period (often several years), investors may incur surrender charges that can diminish overall returns.

- Long-Term Commitment: Investors must be prepared to commit their funds for longer durations, which may not suit everyone’s financial situation.

Less Certainty Compared to Direct Market Investments

Although FIAs provide some level of security, they still carry more uncertainty than traditional fixed-income investments.

- Variable Returns Based on Index Performance: Unlike fixed annuities that guarantee a specific return, FIAs depend on market conditions that can fluctuate unpredictably.

- Potentially Lower Returns in Certain Conditions: In scenarios where market performance is robust but capped by contract terms, investors may find themselves earning less than they would have through direct investments in equities.

Potentially High Fees and Expenses

Investors should also be aware of the fees associated with fixed indexed annuities, which can impact overall profitability.

- Management Fees: Many FIAs come with ongoing management fees that can erode returns over time.

- Complex Fee Structures: Understanding all associated costs can be challenging due to the complexity of contracts.

In conclusion, fixed indexed annuities offer a blend of security and growth potential that appeals to many investors seeking retirement solutions. They provide principal protection and tax-deferred growth while allowing participation in market gains. However, prospective buyers must weigh these benefits against the complexities of contracts, potential caps on returns, illiquidity issues, and associated fees. As with any financial product, it is crucial for individuals considering FIAs to conduct thorough research and consult with financial professionals to ensure these products align with their long-term financial goals.

Frequently Asked Questions About Fixed Indexed Annuities

- What is a fixed indexed annuity?

A fixed indexed annuity is a type of deferred annuity that provides growth linked to a stock market index while guaranteeing principal protection. - How do I benefit from market performance with an FIA?

Your earnings are tied to an index’s performance; if the index rises, your contract value increases within certain limits defined by your contract. - Can I lose money with a fixed indexed annuity?

No; you cannot lose your principal due to market downturns as long as you adhere to the terms of your contract. - What are surrender charges?

Surrender charges are fees applied if you withdraw funds from your FIA before a specified period ends. - Are there tax benefits associated with FIAs?

Yes; earnings grow tax-deferred until withdrawal, allowing for potentially greater accumulation over time. - What happens if I die before receiving payments?

If you pass away before receiving payments, most contracts will allow your beneficiaries to receive your accumulated value or death benefit. - How do I choose an FIA?

Selecting an FIA involves considering factors like fees, caps on earnings, and your long-term financial goals; professional advice is often recommended. - Are fixed indexed annuities suitable for everyone?

No; they are best suited for individuals seeking stable income during retirement who do not require immediate access to their funds.